Chaos & Order

@chaosorderinsight.bsky.social

Where geopolitics meets market intelligence.

Tracking the seismic shifts in water, energy, metals, and power structures—beyond the headlines.

chaosandorderinsight.substack.com

Tracking the seismic shifts in water, energy, metals, and power structures—beyond the headlines.

chaosandorderinsight.substack.com

🧬 Big Pharma's $200B patent problem can't be solved internally. Drug development: 10-15 years. Patent expiries: 2026-2027.

The math doesn't work. So they're buying innovation instead.

But not everyone can buy from everywhere. Here's why that matters: 🧵 (1/8)

The math doesn't work. So they're buying innovation instead.

But not everyone can buy from everywhere. Here's why that matters: 🧵 (1/8)

October 31, 2025 at 10:31 AM

🧬 Big Pharma's $200B patent problem can't be solved internally. Drug development: 10-15 years. Patent expiries: 2026-2027.

The math doesn't work. So they're buying innovation instead.

But not everyone can buy from everywhere. Here's why that matters: 🧵 (1/8)

The math doesn't work. So they're buying innovation instead.

But not everyone can buy from everywhere. Here's why that matters: 🧵 (1/8)

An ECB official warned this week that stablecoins threaten European banks.

He's right to panic.

While Europe debates CBDCs, US regulators designed a system where private companies earn $7B annually paying depositors 0%.

Thread on The Triple Lock: 🧵 1/10

He's right to panic.

While Europe debates CBDCs, US regulators designed a system where private companies earn $7B annually paying depositors 0%.

Thread on The Triple Lock: 🧵 1/10

October 21, 2025 at 8:42 AM

An ECB official warned this week that stablecoins threaten European banks.

He's right to panic.

While Europe debates CBDCs, US regulators designed a system where private companies earn $7B annually paying depositors 0%.

Thread on The Triple Lock: 🧵 1/10

He's right to panic.

While Europe debates CBDCs, US regulators designed a system where private companies earn $7B annually paying depositors 0%.

Thread on The Triple Lock: 🧵 1/10

In June 2025, Apollo committed £4.5B to EDF's nuclear projects—largest sterling private credit deal ever.

That same month, they closed a $2.7B insurance acquisition nobody noticed.

The second deal matters more. Here's why: (1/8)

That same month, they closed a $2.7B insurance acquisition nobody noticed.

The second deal matters more. Here's why: (1/8)

October 16, 2025 at 12:21 PM

In June 2025, Apollo committed £4.5B to EDF's nuclear projects—largest sterling private credit deal ever.

That same month, they closed a $2.7B insurance acquisition nobody noticed.

The second deal matters more. Here's why: (1/8)

That same month, they closed a $2.7B insurance acquisition nobody noticed.

The second deal matters more. Here's why: (1/8)

Reposted by Chaos & Order

Hell no! 🚨 That old nugget...

FT: "Central banks should sell gold bubble"

Reality: CBs are net buyers for 14th consecutive year. China, Russia, India, Poland, Turkey actively accumulating in 2025.

Not thoughtless—strategic. Monetary fragmentation. Zero counterparty risk.

on.ft.com/3KHEm3D

FT: "Central banks should sell gold bubble"

Reality: CBs are net buyers for 14th consecutive year. China, Russia, India, Poland, Turkey actively accumulating in 2025.

Not thoughtless—strategic. Monetary fragmentation. Zero counterparty risk.

on.ft.com/3KHEm3D

Gold bubble should prompt central banks to sell the metal

The world is a thoughtless prisoner of history when it treats bullion as a desirable store of value

on.ft.com

October 10, 2025 at 6:35 PM

Hell no! 🚨 That old nugget...

FT: "Central banks should sell gold bubble"

Reality: CBs are net buyers for 14th consecutive year. China, Russia, India, Poland, Turkey actively accumulating in 2025.

Not thoughtless—strategic. Monetary fragmentation. Zero counterparty risk.

on.ft.com/3KHEm3D

FT: "Central banks should sell gold bubble"

Reality: CBs are net buyers for 14th consecutive year. China, Russia, India, Poland, Turkey actively accumulating in 2025.

Not thoughtless—strategic. Monetary fragmentation. Zero counterparty risk.

on.ft.com/3KHEm3D

1/8 Headlines scream: "India buying oil in rupees—dollar dominance ending!"

Reality: Currency origami. The barrel is still priced in Brent before converting to rupees.

Payment rail changed. Pricing power didn't.

New edition breaks down what's actually happening 🧵

Reality: Currency origami. The barrel is still priced in Brent before converting to rupees.

Payment rail changed. Pricing power didn't.

New edition breaks down what's actually happening 🧵

October 2, 2025 at 6:41 PM

1/8 Headlines scream: "India buying oil in rupees—dollar dominance ending!"

Reality: Currency origami. The barrel is still priced in Brent before converting to rupees.

Payment rail changed. Pricing power didn't.

New edition breaks down what's actually happening 🧵

Reality: Currency origami. The barrel is still priced in Brent before converting to rupees.

Payment rail changed. Pricing power didn't.

New edition breaks down what's actually happening 🧵

1/8 🚨 MARINE INSURANCE REALITY CHECK: When Houthis targeted Red Sea shipping, war risk premiums spiked 2,700% in 6 weeks. 80% of container ships abandoned the route when insurance became uneconomical.

The lesson: trade routes die when insurance disappears.

The lesson: trade routes die when insurance disappears.

September 24, 2025 at 12:05 PM

1/8 🚨 MARINE INSURANCE REALITY CHECK: When Houthis targeted Red Sea shipping, war risk premiums spiked 2,700% in 6 weeks. 80% of container ships abandoned the route when insurance became uneconomical.

The lesson: trade routes die when insurance disappears.

The lesson: trade routes die when insurance disappears.

🧵1/3 The monetary architecture war nobody talks about: CBDCs vs private stablecoins

The competition is already over.

In 2025:

🇺🇸 Trump: Halted retail CBDCs, signed GENIUS Act

🇨🇳 China: Digital yuan across millions of wallets

🇪🇺 Europe: Hedging with both CBDCs and stablecoin regulation

The competition is already over.

In 2025:

🇺🇸 Trump: Halted retail CBDCs, signed GENIUS Act

🇨🇳 China: Digital yuan across millions of wallets

🇪🇺 Europe: Hedging with both CBDCs and stablecoin regulation

September 19, 2025 at 12:38 PM

🧵1/3 The monetary architecture war nobody talks about: CBDCs vs private stablecoins

The competition is already over.

In 2025:

🇺🇸 Trump: Halted retail CBDCs, signed GENIUS Act

🇨🇳 China: Digital yuan across millions of wallets

🇪🇺 Europe: Hedging with both CBDCs and stablecoin regulation

The competition is already over.

In 2025:

🇺🇸 Trump: Halted retail CBDCs, signed GENIUS Act

🇨🇳 China: Digital yuan across millions of wallets

🇪🇺 Europe: Hedging with both CBDCs and stablecoin regulation

1/8 European renewable targets assume battery storage capacity that won't exist by deadlines. The arithmetic is brutal.

September 19, 2025 at 12:28 PM

1/8 European renewable targets assume battery storage capacity that won't exist by deadlines. The arithmetic is brutal.

🧵 1/8 When Russia was cut from SWIFT in 2022, $300 billion in trade flows pivoted to alternative systems within months. Treasury teams assumed this was temporary. They were wrong.

September 11, 2025 at 10:29 AM

🧵 1/8 When Russia was cut from SWIFT in 2022, $300 billion in trade flows pivoted to alternative systems within months. Treasury teams assumed this was temporary. They were wrong.

🧵 1/9 THREAD: The Corporate Bond Rollover Wall Crisis

$10 trillion in corporate debt must refinance by 2027. The math is impossible. 🧮

$10 trillion in corporate debt must refinance by 2027. The math is impossible. 🧮

August 22, 2025 at 8:47 PM

🧵 1/9 THREAD: The Corporate Bond Rollover Wall Crisis

$10 trillion in corporate debt must refinance by 2027. The math is impossible. 🧮

$10 trillion in corporate debt must refinance by 2027. The math is impossible. 🧮

🚨 Currency Debasement & Monetary Realities 🚨

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

Currency Debasement: The Art of Quietly Robbing Creditors (While Rewarding Debtors)

How to spoliate bondholders and retirees without sacrificing the rich or your economy

chaosandorderinsight.substack.com

August 7, 2025 at 9:35 PM

🚨 Currency Debasement & Monetary Realities 🚨

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

🚨 Europe’s €500BN dilemma—who really runs fiscal policy, who wins from complexity, and why the “integration” story hides deeper risks.

Full strategic breakdown (no paywall): open.substack.com/pub/chaosand...

Quick thread 👇

Full strategic breakdown (no paywall): open.substack.com/pub/chaosand...

Quick thread 👇

August 7, 2025 at 1:19 PM

🚨 Europe’s €500BN dilemma—who really runs fiscal policy, who wins from complexity, and why the “integration” story hides deeper risks.

Full strategic breakdown (no paywall): open.substack.com/pub/chaosand...

Quick thread 👇

Full strategic breakdown (no paywall): open.substack.com/pub/chaosand...

Quick thread 👇

🚨 STRATEGIC BRIEF: Multipolar Finance Risk Assessment

Russia-China trade: 95% in national currencies

Dollar reserves: 71% → 59% decline

Central banks: Fastest gold accumulation since 1971

Timeline: 24-36 months to structural fragmentation

🧵

Russia-China trade: 95% in national currencies

Dollar reserves: 71% → 59% decline

Central banks: Fastest gold accumulation since 1971

Timeline: 24-36 months to structural fragmentation

🧵

July 24, 2025 at 10:16 PM

🚨 STRATEGIC BRIEF: Multipolar Finance Risk Assessment

Russia-China trade: 95% in national currencies

Dollar reserves: 71% → 59% decline

Central banks: Fastest gold accumulation since 1971

Timeline: 24-36 months to structural fragmentation

🧵

Russia-China trade: 95% in national currencies

Dollar reserves: 71% → 59% decline

Central banks: Fastest gold accumulation since 1971

Timeline: 24-36 months to structural fragmentation

🧵

Everyone's celebrating Europe's defence awakening. I'm watching commodity flows instead.

After 20+ years trading, I've noticed copper spikes 3-6 months before conflicts. Industrial metals don't lie about military preparations.

🧵 Thread: Europe's defence reality

After 20+ years trading, I've noticed copper spikes 3-6 months before conflicts. Industrial metals don't lie about military preparations.

🧵 Thread: Europe's defence reality

July 24, 2025 at 10:05 PM

Everyone's celebrating Europe's defence awakening. I'm watching commodity flows instead.

After 20+ years trading, I've noticed copper spikes 3-6 months before conflicts. Industrial metals don't lie about military preparations.

🧵 Thread: Europe's defence reality

After 20+ years trading, I've noticed copper spikes 3-6 months before conflicts. Industrial metals don't lie about military preparations.

🧵 Thread: Europe's defence reality

💧 What If Wednesday #3: "What If Ultra-Pure Water Becomes the New Oil?"

The scenario: While French regions ban PFAS-contaminated tap water, AI data centres compete for ultra-pure supplies (2M litres daily per facility).

The scenario: While French regions ban PFAS-contaminated tap water, AI data centres compete for ultra-pure supplies (2M litres daily per facility).

July 9, 2025 at 6:23 PM

💧 What If Wednesday #3: "What If Ultra-Pure Water Becomes the New Oil?"

The scenario: While French regions ban PFAS-contaminated tap water, AI data centres compete for ultra-pure supplies (2M litres daily per facility).

The scenario: While French regions ban PFAS-contaminated tap water, AI data centres compete for ultra-pure supplies (2M litres daily per facility).

💧 What If Wednesday #3: "What If Ultra-Pure Water Becomes the New Oil?"

The scenario: While French regions ban PFAS-contaminated tap water, AI data centers compete for ultra-pure supplies (2M liters daily per facility).

🧵

The scenario: While French regions ban PFAS-contaminated tap water, AI data centers compete for ultra-pure supplies (2M liters daily per facility).

🧵

July 9, 2025 at 6:21 PM

💧 What If Wednesday #3: "What If Ultra-Pure Water Becomes the New Oil?"

The scenario: While French regions ban PFAS-contaminated tap water, AI data centers compete for ultra-pure supplies (2M liters daily per facility).

🧵

The scenario: While French regions ban PFAS-contaminated tap water, AI data centers compete for ultra-pure supplies (2M liters daily per facility).

🧵

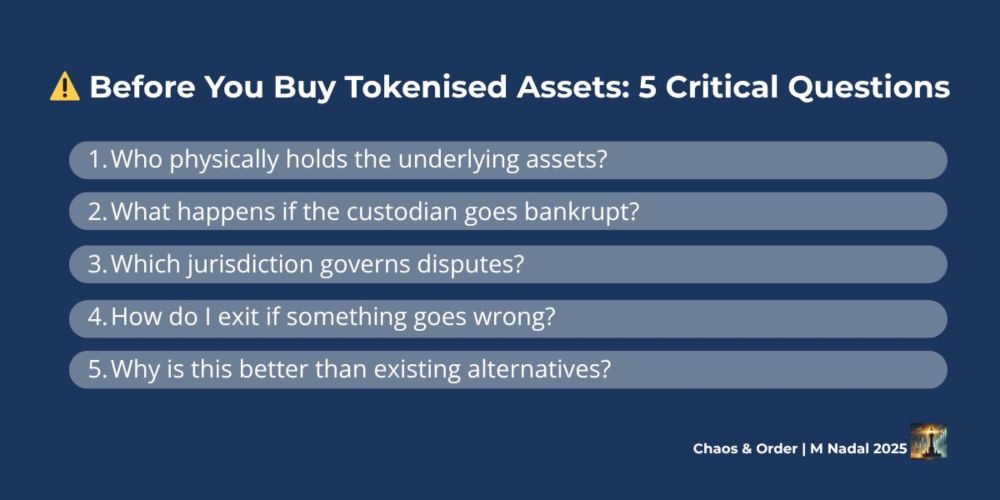

Hot take: Tokenised stocks solve problems we already fixed.

ETFs = fractional ownership. ADRs = cross-border access. Both with regulatory protection.

Why rebuild with more complexity, fewer protections?

chaosandorderinsight.substack.com/p/before-you...

#Fintech #TokenisedAssets

ETFs = fractional ownership. ADRs = cross-border access. Both with regulatory protection.

Why rebuild with more complexity, fewer protections?

chaosandorderinsight.substack.com/p/before-you...

#Fintech #TokenisedAssets

Before You Buy That Tokenised Tesla: What Kraken's New Product Actually Means

Chaos & Order – Advisory Brief

chaosandorderinsight.substack.com

July 2, 2025 at 6:33 PM

Hot take: Tokenised stocks solve problems we already fixed.

ETFs = fractional ownership. ADRs = cross-border access. Both with regulatory protection.

Why rebuild with more complexity, fewer protections?

chaosandorderinsight.substack.com/p/before-you...

#Fintech #TokenisedAssets

ETFs = fractional ownership. ADRs = cross-border access. Both with regulatory protection.

Why rebuild with more complexity, fewer protections?

chaosandorderinsight.substack.com/p/before-you...

#Fintech #TokenisedAssets

Quantum computing arriving 5 years early = competitive advantage reset overnight.

Are you ready when 'impossible' becomes solvable?

chaosandorderinsight.substack.com/p/what-if-qu...

#QuantumComputing #Strategy #Leadership #TechTrends #Innovation

Are you ready when 'impossible' becomes solvable?

chaosandorderinsight.substack.com/p/what-if-qu...

#QuantumComputing #Strategy #Leadership #TechTrends #Innovation

What If Quantum Computing Arrives 5 Years Early?

What If Wednesday #2

chaosandorderinsight.substack.com

July 2, 2025 at 6:25 PM

Quantum computing arriving 5 years early = competitive advantage reset overnight.

Are you ready when 'impossible' becomes solvable?

chaosandorderinsight.substack.com/p/what-if-qu...

#QuantumComputing #Strategy #Leadership #TechTrends #Innovation

Are you ready when 'impossible' becomes solvable?

chaosandorderinsight.substack.com/p/what-if-qu...

#QuantumComputing #Strategy #Leadership #TechTrends #Innovation

Lithuania discovers Europe's largest lithium deposit (2021). Politicians cheer "strategic autonomy!"

Reality: No EU company can process it. Ore ships to China, returns as "processed lithium."

We outsourced the value-add. 🧵

Reality: No EU company can process it. Ore ships to China, returns as "processed lithium."

We outsourced the value-add. 🧵

June 26, 2025 at 9:36 AM

Lithuania discovers Europe's largest lithium deposit (2021). Politicians cheer "strategic autonomy!"

Reality: No EU company can process it. Ore ships to China, returns as "processed lithium."

We outsourced the value-add. 🧵

Reality: No EU company can process it. Ore ships to China, returns as "processed lithium."

We outsourced the value-add. 🧵

🚨 The brutal math of European manufacturing:

Robot: €4.20/hour, 24/7

EU worker: €22.60/hour, 8hrs

5:1 cost advantage = human labor obsolete

China: 470 robots/10K workers (+68 in 1 year!)

EU: 219 robots/10K workers

Full read: chaosandorderinsight.substack.com/p/the-roboti...

#Automation #Europe

Robot: €4.20/hour, 24/7

EU worker: €22.60/hour, 8hrs

5:1 cost advantage = human labor obsolete

China: 470 robots/10K workers (+68 in 1 year!)

EU: 219 robots/10K workers

Full read: chaosandorderinsight.substack.com/p/the-roboti...

#Automation #Europe

June 12, 2025 at 9:51 AM

🚨 The brutal math of European manufacturing:

Robot: €4.20/hour, 24/7

EU worker: €22.60/hour, 8hrs

5:1 cost advantage = human labor obsolete

China: 470 robots/10K workers (+68 in 1 year!)

EU: 219 robots/10K workers

Full read: chaosandorderinsight.substack.com/p/the-roboti...

#Automation #Europe

Robot: €4.20/hour, 24/7

EU worker: €22.60/hour, 8hrs

5:1 cost advantage = human labor obsolete

China: 470 robots/10K workers (+68 in 1 year!)

EU: 219 robots/10K workers

Full read: chaosandorderinsight.substack.com/p/the-roboti...

#Automation #Europe

Reposted by Chaos & Order

The best women aren't in boardrooms. They were eliminated years ago by systems that punish competence wrapped in motherhood. Thread 🧵

June 10, 2025 at 8:49 AM

The best women aren't in boardrooms. They were eliminated years ago by systems that punish competence wrapped in motherhood. Thread 🧵

Reposted by Chaos & Order

Read the full analysis here:

👉 chaosandorderinsight.substack.com

And get ready:

🔜 June 12 → The Robotics Revolution: Europe’s Productivity Lifeline

#ChaosAndOrder #Geopolitics #StrategicAutonomy #Commodities #Robotics #Europe

👉 chaosandorderinsight.substack.com

And get ready:

🔜 June 12 → The Robotics Revolution: Europe’s Productivity Lifeline

#ChaosAndOrder #Geopolitics #StrategicAutonomy #Commodities #Robotics #Europe

June 6, 2025 at 4:44 PM

Read the full analysis here:

👉 chaosandorderinsight.substack.com

And get ready:

🔜 June 12 → The Robotics Revolution: Europe’s Productivity Lifeline

#ChaosAndOrder #Geopolitics #StrategicAutonomy #Commodities #Robotics #Europe

👉 chaosandorderinsight.substack.com

And get ready:

🔜 June 12 → The Robotics Revolution: Europe’s Productivity Lifeline

#ChaosAndOrder #Geopolitics #StrategicAutonomy #Commodities #Robotics #Europe

Reposted by Chaos & Order

The ECB printed €1.85 trillion.

But somehow €800bn/year for industrial survival is “too much”?

This isn’t an economic constraint.

It’s a political choice.

But somehow €800bn/year for industrial survival is “too much”?

This isn’t an economic constraint.

It’s a political choice.

June 6, 2025 at 4:44 PM

The ECB printed €1.85 trillion.

But somehow €800bn/year for industrial survival is “too much”?

This isn’t an economic constraint.

It’s a political choice.

But somehow €800bn/year for industrial survival is “too much”?

This isn’t an economic constraint.

It’s a political choice.

Reposted by Chaos & Order

Meanwhile, Brussels negotiates Mercosur—trading food security for short-term exports.

Products banned in Europe get a free pass in trade deals. That’s not strategy.

It’s self-inflicted dependency.

Products banned in Europe get a free pass in trade deals. That’s not strategy.

It’s self-inflicted dependency.

June 6, 2025 at 4:44 PM

Meanwhile, Brussels negotiates Mercosur—trading food security for short-term exports.

Products banned in Europe get a free pass in trade deals. That’s not strategy.

It’s self-inflicted dependency.

Products banned in Europe get a free pass in trade deals. That’s not strategy.

It’s self-inflicted dependency.

Reposted by Chaos & Order

Germany broke its own debt rules to inject €200bn.

→ €10bn for Intel

→ €10bn+ for TSMC

→ Fast-track permitting

France’s nuclear edge? Sidelined.

→ €10bn for Intel

→ €10bn+ for TSMC

→ Fast-track permitting

France’s nuclear edge? Sidelined.

June 6, 2025 at 4:44 PM

Germany broke its own debt rules to inject €200bn.

→ €10bn for Intel

→ €10bn+ for TSMC

→ Fast-track permitting

France’s nuclear edge? Sidelined.

→ €10bn for Intel

→ €10bn+ for TSMC

→ Fast-track permitting

France’s nuclear edge? Sidelined.