Marjorie Nadal

@marjorienadal.bsky.social

Writer of Chaos & Order.

Former Trading MD decoding markets, power plays & the forces reshaping our world.

http://linkedin.com/in/commodity

chaosandorderinsight.substack.com

www.mnadalandco.com

Former Trading MD decoding markets, power plays & the forces reshaping our world.

http://linkedin.com/in/commodity

chaosandorderinsight.substack.com

www.mnadalandco.com

Reposted by Marjorie Nadal

In June 2025, Apollo committed £4.5B to EDF's nuclear projects—largest sterling private credit deal ever.

That same month, they closed a $2.7B insurance acquisition nobody noticed.

The second deal matters more. Here's why: (1/8)

That same month, they closed a $2.7B insurance acquisition nobody noticed.

The second deal matters more. Here's why: (1/8)

October 16, 2025 at 12:21 PM

In June 2025, Apollo committed £4.5B to EDF's nuclear projects—largest sterling private credit deal ever.

That same month, they closed a $2.7B insurance acquisition nobody noticed.

The second deal matters more. Here's why: (1/8)

That same month, they closed a $2.7B insurance acquisition nobody noticed.

The second deal matters more. Here's why: (1/8)

Hell no! 🚨 That old nugget...

FT: "Central banks should sell gold bubble"

Reality: CBs are net buyers for 14th consecutive year. China, Russia, India, Poland, Turkey actively accumulating in 2025.

Not thoughtless—strategic. Monetary fragmentation. Zero counterparty risk.

on.ft.com/3KHEm3D

FT: "Central banks should sell gold bubble"

Reality: CBs are net buyers for 14th consecutive year. China, Russia, India, Poland, Turkey actively accumulating in 2025.

Not thoughtless—strategic. Monetary fragmentation. Zero counterparty risk.

on.ft.com/3KHEm3D

Gold bubble should prompt central banks to sell the metal

The world is a thoughtless prisoner of history when it treats bullion as a desirable store of value

on.ft.com

October 10, 2025 at 6:35 PM

Hell no! 🚨 That old nugget...

FT: "Central banks should sell gold bubble"

Reality: CBs are net buyers for 14th consecutive year. China, Russia, India, Poland, Turkey actively accumulating in 2025.

Not thoughtless—strategic. Monetary fragmentation. Zero counterparty risk.

on.ft.com/3KHEm3D

FT: "Central banks should sell gold bubble"

Reality: CBs are net buyers for 14th consecutive year. China, Russia, India, Poland, Turkey actively accumulating in 2025.

Not thoughtless—strategic. Monetary fragmentation. Zero counterparty risk.

on.ft.com/3KHEm3D

Reposted by Marjorie Nadal

8/8 Bottom line: Position for parallel benchmark development, not dollar collapse.

Anyone selling you dollar-collapse headlines is talking politics. Anyone showing you basis spreads is talking money.

Full analysis: open.substack.com/pub/chaosand...

Anyone selling you dollar-collapse headlines is talking politics. Anyone showing you basis spreads is talking money.

Full analysis: open.substack.com/pub/chaosand...

Chaos & Order Edition 19: Commodity Origami

Third in “The New Money Architecture” series

open.substack.com

October 2, 2025 at 6:41 PM

8/8 Bottom line: Position for parallel benchmark development, not dollar collapse.

Anyone selling you dollar-collapse headlines is talking politics. Anyone showing you basis spreads is talking money.

Full analysis: open.substack.com/pub/chaosand...

Anyone selling you dollar-collapse headlines is talking politics. Anyone showing you basis spreads is talking money.

Full analysis: open.substack.com/pub/chaosand...

If you're allocating capital in commodities, you need to understand the difference between payment rails and pricing power. One is theatre. The other determines where the money is. Check out my latest analysis: Commodity Origami open.substack.com/pub/chaosand...

October 2, 2025 at 6:45 PM

If you're allocating capital in commodities, you need to understand the difference between payment rails and pricing power. One is theatre. The other determines where the money is. Check out my latest analysis: Commodity Origami open.substack.com/pub/chaosand...

Reposted by Marjorie Nadal

🧵1/3 The monetary architecture war nobody talks about: CBDCs vs private stablecoins

The competition is already over.

In 2025:

🇺🇸 Trump: Halted retail CBDCs, signed GENIUS Act

🇨🇳 China: Digital yuan across millions of wallets

🇪🇺 Europe: Hedging with both CBDCs and stablecoin regulation

The competition is already over.

In 2025:

🇺🇸 Trump: Halted retail CBDCs, signed GENIUS Act

🇨🇳 China: Digital yuan across millions of wallets

🇪🇺 Europe: Hedging with both CBDCs and stablecoin regulation

September 19, 2025 at 12:38 PM

🧵1/3 The monetary architecture war nobody talks about: CBDCs vs private stablecoins

The competition is already over.

In 2025:

🇺🇸 Trump: Halted retail CBDCs, signed GENIUS Act

🇨🇳 China: Digital yuan across millions of wallets

🇪🇺 Europe: Hedging with both CBDCs and stablecoin regulation

The competition is already over.

In 2025:

🇺🇸 Trump: Halted retail CBDCs, signed GENIUS Act

🇨🇳 China: Digital yuan across millions of wallets

🇪🇺 Europe: Hedging with both CBDCs and stablecoin regulation

Reposted by Marjorie Nadal

🚨 Currency Debasement & Monetary Realities 🚨

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

Currency Debasement: The Art of Quietly Robbing Creditors (While Rewarding Debtors)

How to spoliate bondholders and retirees without sacrificing the rich or your economy

chaosandorderinsight.substack.com

August 7, 2025 at 9:35 PM

🚨 Currency Debasement & Monetary Realities 🚨

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

Reposted by Marjorie Nadal

9/9 This isn't doom-mongering. It's arithmetic. The maturity wall is locked in. The rate shock is structural. The only question is positioning.

Full analysis: chaosandorderinsight.substack.com/p/strategic-...

Full analysis: chaosandorderinsight.substack.com/p/strategic-...

Strategic Intelligence Brief: The Corporate Bond Rollover Wall Crisis

When Mathematical Inevitability Meets Market Reality

chaosandorderinsight.substack.com

August 22, 2025 at 8:47 PM

9/9 This isn't doom-mongering. It's arithmetic. The maturity wall is locked in. The rate shock is structural. The only question is positioning.

Full analysis: chaosandorderinsight.substack.com/p/strategic-...

Full analysis: chaosandorderinsight.substack.com/p/strategic-...

Reposted by Marjorie Nadal

1/8 European renewable targets assume battery storage capacity that won't exist by deadlines. The arithmetic is brutal.

September 19, 2025 at 12:28 PM

1/8 European renewable targets assume battery storage capacity that won't exist by deadlines. The arithmetic is brutal.

Reposted by Marjorie Nadal

3/3 China's counter: mBridge network for direct settlement, bypassing dollars entirely.Investment thesis:

Position for parallel systems, not winner-take-all outcomes.

Full analysis: chaosandorderinsight.substack.com/p/chaos-and-...

Position for parallel systems, not winner-take-all outcomes.

Full analysis: chaosandorderinsight.substack.com/p/chaos-and-...

Chaos & Order Edition 18: Central Bank Digital Currencies vs. Private Money

Second in "The New Money Architecture" series

chaosandorderinsight.substack.com

September 19, 2025 at 12:38 PM

3/3 China's counter: mBridge network for direct settlement, bypassing dollars entirely.Investment thesis:

Position for parallel systems, not winner-take-all outcomes.

Full analysis: chaosandorderinsight.substack.com/p/chaos-and-...

Position for parallel systems, not winner-take-all outcomes.

Full analysis: chaosandorderinsight.substack.com/p/chaos-and-...

Reposted by Marjorie Nadal

🧵 1/9 THREAD: The Corporate Bond Rollover Wall Crisis

$10 trillion in corporate debt must refinance by 2027. The math is impossible. 🧮

$10 trillion in corporate debt must refinance by 2027. The math is impossible. 🧮

August 22, 2025 at 8:47 PM

🧵 1/9 THREAD: The Corporate Bond Rollover Wall Crisis

$10 trillion in corporate debt must refinance by 2027. The math is impossible. 🧮

$10 trillion in corporate debt must refinance by 2027. The math is impossible. 🧮

1/4 🌊 Water Wars - Episode 1 live now!

The moment water diplomacy died: April 23rd, 2025. How India's suspension of the Indus Waters Treaty reveals the weaponisation of resources in the 21st century.

🎵Spotify: open.spotify.com/show/6ThViVt...

The moment water diplomacy died: April 23rd, 2025. How India's suspension of the Indus Waters Treaty reveals the weaponisation of resources in the 21st century.

🎵Spotify: open.spotify.com/show/6ThViVt...

Water Wars

Podcast · Marjorie F. Nadal · Strategic analysis of how water is becoming a weapon in global conflicts. From the Indus Basin crisis and Turkey’s Euphrates dams to the geopolitics of the Nile, Russia’s...

open.spotify.com

August 20, 2025 at 7:33 PM

1/4 🌊 Water Wars - Episode 1 live now!

The moment water diplomacy died: April 23rd, 2025. How India's suspension of the Indus Waters Treaty reveals the weaponisation of resources in the 21st century.

🎵Spotify: open.spotify.com/show/6ThViVt...

The moment water diplomacy died: April 23rd, 2025. How India's suspension of the Indus Waters Treaty reveals the weaponisation of resources in the 21st century.

🎵Spotify: open.spotify.com/show/6ThViVt...

🧵 1/8 THREAD: The Corporate Bond Rollover Wall Crisis

While everyone debates Fed cuts, $10 trillion in corporate debt must refinance by 2027. The math is brutal. 🧮

While everyone debates Fed cuts, $10 trillion in corporate debt must refinance by 2027. The math is brutal. 🧮

August 20, 2025 at 2:54 PM

🧵 1/8 THREAD: The Corporate Bond Rollover Wall Crisis

While everyone debates Fed cuts, $10 trillion in corporate debt must refinance by 2027. The math is brutal. 🧮

While everyone debates Fed cuts, $10 trillion in corporate debt must refinance by 2027. The math is brutal. 🧮

🧵 How a terrorist attack in Kashmir broke 65 years of water diplomacy—and exposed the new reality of resource weaponisation (1/8)

August 19, 2025 at 11:16 AM

🧵 How a terrorist attack in Kashmir broke 65 years of water diplomacy—and exposed the new reality of resource weaponisation (1/8)

🚨 Just dropped a deep dive thread on Currency Debasement & Monetary Realities 🚨

How do governments quietly shift wealth from bondholders and retirees to debtors without crashing the economy?

Spoiler: It’s not by “revaluing gold.” (🧵1/3)

How do governments quietly shift wealth from bondholders and retirees to debtors without crashing the economy?

Spoiler: It’s not by “revaluing gold.” (🧵1/3)

🚨 Currency Debasement & Monetary Realities 🚨

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

1/9 Recent buzz claims “revaluing Treasury’s gold” can fix fiscal woes. Gold prices fluctuate freely; the statutory $42.22/oz price is outdated accounting theatre. It doesn’t create real spending power. Official Fed analysis agrees.

Currency Debasement: The Art of Quietly Robbing Creditors (While Rewarding Debtors)

How to spoliate bondholders and retirees without sacrificing the rich or your economy

chaosandorderinsight.substack.com

August 7, 2025 at 9:40 PM

🚨 Just dropped a deep dive thread on Currency Debasement & Monetary Realities 🚨

How do governments quietly shift wealth from bondholders and retirees to debtors without crashing the economy?

Spoiler: It’s not by “revaluing gold.” (🧵1/3)

How do governments quietly shift wealth from bondholders and retirees to debtors without crashing the economy?

Spoiler: It’s not by “revaluing gold.” (🧵1/3)

My latest on European fiscal architecture & global capital allocation.

The patterns are clear: institutional design shapes who wins & who pays.

The €500BN question? Not whether Europe needs the money, but whether the system can deliver it.

Worth a read for anyone positioning capital in 2025-2026. 🧵

The patterns are clear: institutional design shapes who wins & who pays.

The €500BN question? Not whether Europe needs the money, but whether the system can deliver it.

Worth a read for anyone positioning capital in 2025-2026. 🧵

🚨 Europe’s €500BN dilemma—who really runs fiscal policy, who wins from complexity, and why the “integration” story hides deeper risks.

Full strategic breakdown (no paywall): open.substack.com/pub/chaosand...

Quick thread 👇

Full strategic breakdown (no paywall): open.substack.com/pub/chaosand...

Quick thread 👇

August 7, 2025 at 1:24 PM

My latest on European fiscal architecture & global capital allocation.

The patterns are clear: institutional design shapes who wins & who pays.

The €500BN question? Not whether Europe needs the money, but whether the system can deliver it.

Worth a read for anyone positioning capital in 2025-2026. 🧵

The patterns are clear: institutional design shapes who wins & who pays.

The €500BN question? Not whether Europe needs the money, but whether the system can deliver it.

Worth a read for anyone positioning capital in 2025-2026. 🧵

The Insurance Availability Crisis

My Lexus went from £1,000 insurance to "no coverage available" in 18 months. Even the manufacturer couldn't arrange coverage. This isn't about one car. It's a systematic pattern I'm tracking globally.

Full strategic assessment: open.substack.com/pub/chaosand...

My Lexus went from £1,000 insurance to "no coverage available" in 18 months. Even the manufacturer couldn't arrange coverage. This isn't about one car. It's a systematic pattern I'm tracking globally.

Full strategic assessment: open.substack.com/pub/chaosand...

Strategic Intelligence Brief: The Insurance Availability Crisis

When Risk Becomes Uninsurable, It Becomes Uninvestable

open.substack.com

August 4, 2025 at 9:15 PM

The Insurance Availability Crisis

My Lexus went from £1,000 insurance to "no coverage available" in 18 months. Even the manufacturer couldn't arrange coverage. This isn't about one car. It's a systematic pattern I'm tracking globally.

Full strategic assessment: open.substack.com/pub/chaosand...

My Lexus went from £1,000 insurance to "no coverage available" in 18 months. Even the manufacturer couldn't arrange coverage. This isn't about one car. It's a systematic pattern I'm tracking globally.

Full strategic assessment: open.substack.com/pub/chaosand...

Russia-China trade: 95% in national currencies.

Dollar reserves declining from 71% to 59%.

Central banks accumulating gold at fastest pace since 1971.

Timeline: 24-36 months to structural fragmentation.

Dollar reserves declining from 71% to 59%.

Central banks accumulating gold at fastest pace since 1971.

Timeline: 24-36 months to structural fragmentation.

July 24, 2025 at 10:19 PM

Russia-China trade: 95% in national currencies.

Dollar reserves declining from 71% to 59%.

Central banks accumulating gold at fastest pace since 1971.

Timeline: 24-36 months to structural fragmentation.

Dollar reserves declining from 71% to 59%.

Central banks accumulating gold at fastest pace since 1971.

Timeline: 24-36 months to structural fragmentation.

Sharing some strategic intelligence I've been working on.

After 20+ years in commodity trading, I've learned that industrial metals reveal military preparations months before official announcements.

What I'm seeing in European defence capacity is concerning.

After 20+ years in commodity trading, I've learned that industrial metals reveal military preparations months before official announcements.

What I'm seeing in European defence capacity is concerning.

July 24, 2025 at 10:12 PM

Sharing some strategic intelligence I've been working on.

After 20+ years in commodity trading, I've learned that industrial metals reveal military preparations months before official announcements.

What I'm seeing in European defence capacity is concerning.

After 20+ years in commodity trading, I've learned that industrial metals reveal military preparations months before official announcements.

What I'm seeing in European defence capacity is concerning.

This kind of scenario analysis is what I use with executives to stress-test critical assumptions before market disruption becomes obvious.

Ultra-pure water demand vs. contaminated supply = the next strategic resource bottleneck.

Ultra-pure water demand vs. contaminated supply = the next strategic resource bottleneck.

The strategic shock: Water supply bifurcates into contaminated (for humans) and ultra-pure (for industry).

Early signals:

→ Tech companies buying water rights in American West

→ Premium water shipping routes emerging

→ Moody's factoring water stress into municipal ratings

Early signals:

→ Tech companies buying water rights in American West

→ Premium water shipping routes emerging

→ Moody's factoring water stress into municipal ratings

July 9, 2025 at 6:26 PM

This kind of scenario analysis is what I use with executives to stress-test critical assumptions before market disruption becomes obvious.

Ultra-pure water demand vs. contaminated supply = the next strategic resource bottleneck.

Ultra-pure water demand vs. contaminated supply = the next strategic resource bottleneck.

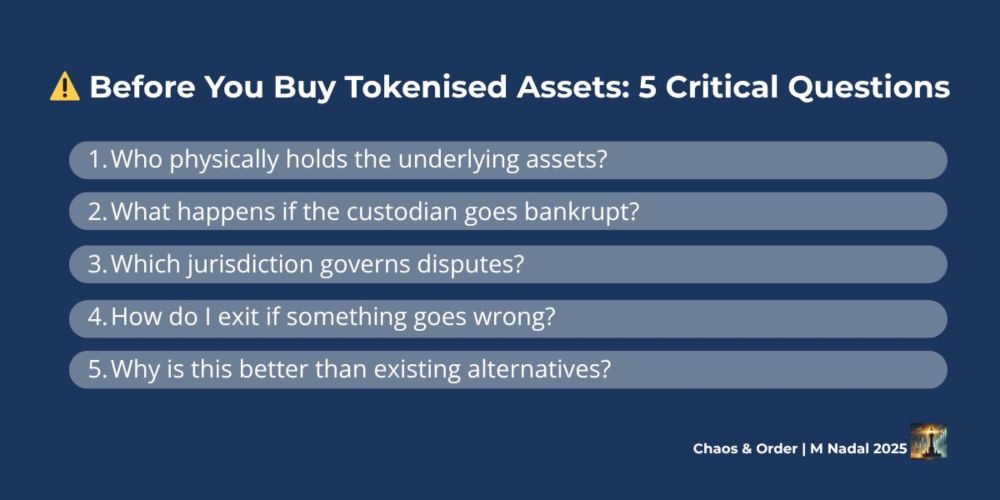

Tokenised Tesla isn't Tesla stock—it's a digital IOU with Swiss custody, zero US approval, and 2%+ spreads.

Every similar platform has failed or been shut down within months.

Why rebuild equity markets with more complexity, fewer protections?

My analysis in latest Advisory Brief 👇

Every similar platform has failed or been shut down within months.

Why rebuild equity markets with more complexity, fewer protections?

My analysis in latest Advisory Brief 👇

Hot take: Tokenised stocks solve problems we already fixed.

ETFs = fractional ownership. ADRs = cross-border access. Both with regulatory protection.

Why rebuild with more complexity, fewer protections?

chaosandorderinsight.substack.com/p/before-you...

#Fintech #TokenisedAssets

ETFs = fractional ownership. ADRs = cross-border access. Both with regulatory protection.

Why rebuild with more complexity, fewer protections?

chaosandorderinsight.substack.com/p/before-you...

#Fintech #TokenisedAssets

Before You Buy That Tokenised Tesla: What Kraken's New Product Actually Means

Chaos & Order – Advisory Brief

chaosandorderinsight.substack.com

July 2, 2025 at 6:53 PM

Tokenised Tesla isn't Tesla stock—it's a digital IOU with Swiss custody, zero US approval, and 2%+ spreads.

Every similar platform has failed or been shut down within months.

Why rebuild equity markets with more complexity, fewer protections?

My analysis in latest Advisory Brief 👇

Every similar platform has failed or been shut down within months.

Why rebuild equity markets with more complexity, fewer protections?

My analysis in latest Advisory Brief 👇

The hidden risk: quantum computing makes 'impossible' problems solvable.

Supply chains hit theoretical optimisation.

Drug discovery: decades to months.

Financial modelling approaches perfection.

Who's reimagining their business model?

My take in What if Wednesday #2

#QuantumComputing #Strategy

Supply chains hit theoretical optimisation.

Drug discovery: decades to months.

Financial modelling approaches perfection.

Who's reimagining their business model?

My take in What if Wednesday #2

#QuantumComputing #Strategy

Quantum computing arriving 5 years early = competitive advantage reset overnight.

Are you ready when 'impossible' becomes solvable?

chaosandorderinsight.substack.com/p/what-if-qu...

#QuantumComputing #Strategy #Leadership #TechTrends #Innovation

Are you ready when 'impossible' becomes solvable?

chaosandorderinsight.substack.com/p/what-if-qu...

#QuantumComputing #Strategy #Leadership #TechTrends #Innovation

What If Quantum Computing Arrives 5 Years Early?

What If Wednesday #2

chaosandorderinsight.substack.com

July 2, 2025 at 6:50 PM

The hidden risk: quantum computing makes 'impossible' problems solvable.

Supply chains hit theoretical optimisation.

Drug discovery: decades to months.

Financial modelling approaches perfection.

Who's reimagining their business model?

My take in What if Wednesday #2

#QuantumComputing #Strategy

Supply chains hit theoretical optimisation.

Drug discovery: decades to months.

Financial modelling approaches perfection.

Who's reimagining their business model?

My take in What if Wednesday #2

#QuantumComputing #Strategy

My latest analysis: Europe's critical materials dependency.

100% of anode-grade graphite flows through China.

Even Lithuania's "strategic" lithium ships to China for processing.

But there's a path forward - and three asymmetric plays.

Thread below 👇

100% of anode-grade graphite flows through China.

Even Lithuania's "strategic" lithium ships to China for processing.

But there's a path forward - and three asymmetric plays.

Thread below 👇

Lithuania discovers Europe's largest lithium deposit (2021). Politicians cheer "strategic autonomy!"

Reality: No EU company can process it. Ore ships to China, returns as "processed lithium."

We outsourced the value-add. 🧵

Reality: No EU company can process it. Ore ships to China, returns as "processed lithium."

We outsourced the value-add. 🧵

June 26, 2025 at 9:40 AM

My latest analysis: Europe's critical materials dependency.

100% of anode-grade graphite flows through China.

Even Lithuania's "strategic" lithium ships to China for processing.

But there's a path forward - and three asymmetric plays.

Thread below 👇

100% of anode-grade graphite flows through China.

Even Lithuania's "strategic" lithium ships to China for processing.

But there's a path forward - and three asymmetric plays.

Thread below 👇

Essential reading on Europe's automation imperative!👇

🚨 The brutal math of European manufacturing:

Robot: €4.20/hour, 24/7

EU worker: €22.60/hour, 8hrs

5:1 cost advantage = human labor obsolete

China: 470 robots/10K workers (+68 in 1 year!)

EU: 219 robots/10K workers

Full read: chaosandorderinsight.substack.com/p/the-roboti...

#Automation #Europe

Robot: €4.20/hour, 24/7

EU worker: €22.60/hour, 8hrs

5:1 cost advantage = human labor obsolete

China: 470 robots/10K workers (+68 in 1 year!)

EU: 219 robots/10K workers

Full read: chaosandorderinsight.substack.com/p/the-roboti...

#Automation #Europe

June 12, 2025 at 9:52 AM

Essential reading on Europe's automation imperative!👇

The best women aren't in boardrooms. They were eliminated years ago by systems that punish competence wrapped in motherhood. Thread 🧵

June 10, 2025 at 8:49 AM

The best women aren't in boardrooms. They were eliminated years ago by systems that punish competence wrapped in motherhood. Thread 🧵

📉 Europe needs €800bn/year to avoid industrial decline.

But nothing’s moving.

Chaos & Order #10 breaks down why Draghi’s report landed with a thud.

🧵Thread: Europe's Strategic Paralysis

But nothing’s moving.

Chaos & Order #10 breaks down why Draghi’s report landed with a thud.

🧵Thread: Europe's Strategic Paralysis

June 6, 2025 at 4:44 PM

📉 Europe needs €800bn/year to avoid industrial decline.

But nothing’s moving.

Chaos & Order #10 breaks down why Draghi’s report landed with a thud.

🧵Thread: Europe's Strategic Paralysis

But nothing’s moving.

Chaos & Order #10 breaks down why Draghi’s report landed with a thud.

🧵Thread: Europe's Strategic Paralysis