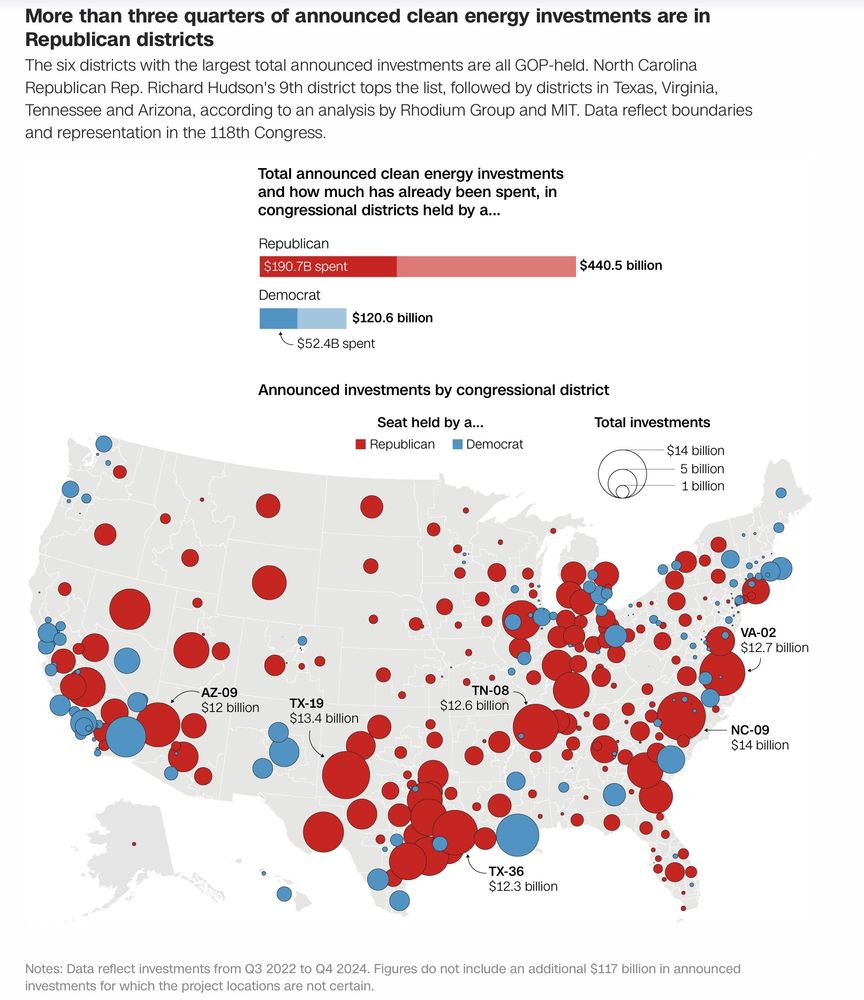

*New this quarter* - we present a breakdown of the past 2.5 years of clean investments mapped to the congressional district boundaries in effect for the 119th Congress.

www.cleaninvestmentmonitor.org/reports/clea...

*New this quarter* - we present a breakdown of the past 2.5 years of clean investments mapped to the congressional district boundaries in effect for the 119th Congress.

www.cleaninvestmentmonitor.org/reports/clea...

If you're interested in data-driven research in either of those fields, you'll find it here!

If you're interested in data-driven research in either of those fields, you'll find it here!

Clean investment is at an all time high in the US, with $71 billion invested in Q3 2024 across manufacturing, energy & industry, and retail segments.

Clean investment is at an all time high in the US, with $71 billion invested in Q3 2024 across manufacturing, energy & industry, and retail segments.

the focus now shifts to the fight over the inflation reduction act, which is the most important biden climate policy to preserve.

caveat lector, i wrote this at 3am! heatmap.news/politics/don...

the focus now shifts to the fight over the inflation reduction act, which is the most important biden climate policy to preserve.

caveat lector, i wrote this at 3am! heatmap.news/politics/don...