Bad news: we're still facing a budget shortfall

Solution: Disconnect from tax cuts mainly for corporations and the wealthy that Congress enacted earlier this year, protecting the services Oregonians rely on

#ORleg #ORpol

While causing millions to lose health insurance and nutrition assistance, it would also accelerate growth of the federal debt.

WTF are we doing here?

While causing millions to lose health insurance and nutrition assistance, it would also accelerate growth of the federal debt.

WTF are we doing here?

By a lot.

And it does so to pay for tax cuts for the rich #orpol

By a lot.

And it does so to pay for tax cuts for the rich #orpol

Read CBO analysis --> bit.ly/4jZQud3

Read CBO analysis --> bit.ly/4jZQud3

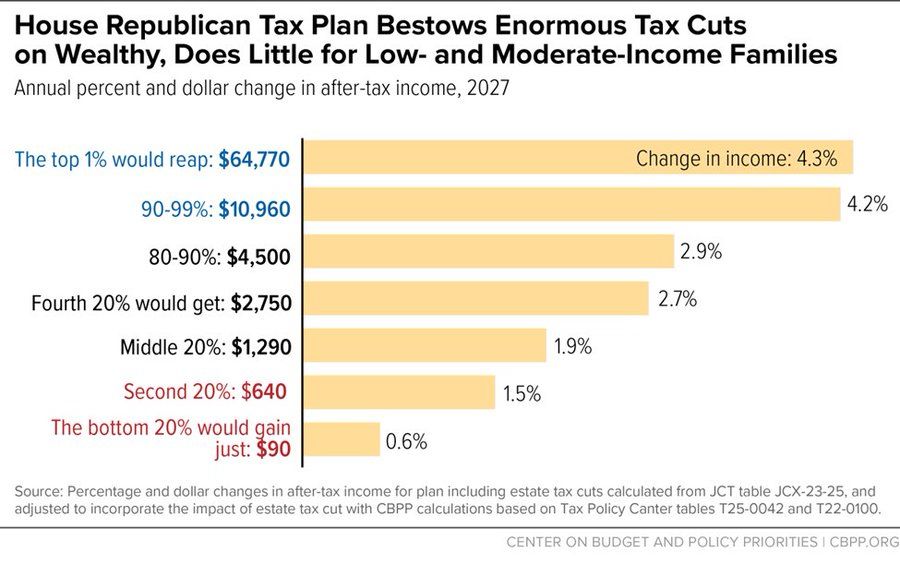

Unsurprisingly, it provides enormous tax cuts for the wealthy—including an average annual $65k cut for the top 1%—while doing little for low- and moderate-income families in 2027 (and even less by 2029).

#orpol #orleg

oregoncapitalchronicle.com/2025/05/06/e...

#orpol #orleg

oregoncapitalchronicle.com/2025/05/06/e...

Visit DirectFile.irs.gov to check eligibility and learn more.

Visit DirectFile.irs.gov to check eligibility and learn more.