Available at: rdcu.be/eZfQl

Available at: rdcu.be/eZfQl

Available at: rdcu.be/eY6JW

Available at: rdcu.be/eY6JW

Available at: rdcu.be/eYVQm

Available at: rdcu.be/eYVQm

Available at: rdcu.be/eYKVH

Available at: rdcu.be/eYKVH

Available at: rdcu.be/eYmdR

Available at: rdcu.be/eYmdR

Available at: rdcu.be/eYdMe

Available at: rdcu.be/eYdMe

Available at: rdcu.be/eJnj8

Available at: rdcu.be/eJnj8

Available at: rdcu.be/eJaAZ

Available at: rdcu.be/eJaAZ

"Taxpayer response to greater progressivity: evidence from personal income tax reform in Uganda" by Maria Jouste, Tina Kaidu Barugahara, Joseph Ayo Okello, Jukka Pirttilä & Pia Rattenhuber

Available at: rdcu.be/eI3rM

"Taxpayer response to greater progressivity: evidence from personal income tax reform in Uganda" by Maria Jouste, Tina Kaidu Barugahara, Joseph Ayo Okello, Jukka Pirttilä & Pia Rattenhuber

Available at: rdcu.be/eI3rM

"Digitalization of tax collection and enterprises’ social security compliance" by Changlin Yu & Yanming Li

Available at: rdcu.be/eITit

"Digitalization of tax collection and enterprises’ social security compliance" by Changlin Yu & Yanming Li

Available at: rdcu.be/eITit

"The marginal value of public funds: a brief guide and application to tax policy" by Spencer Bastani

Available at: rdcu.be/eIl3e

"The marginal value of public funds: a brief guide and application to tax policy" by Spencer Bastani

Available at: rdcu.be/eIl3e

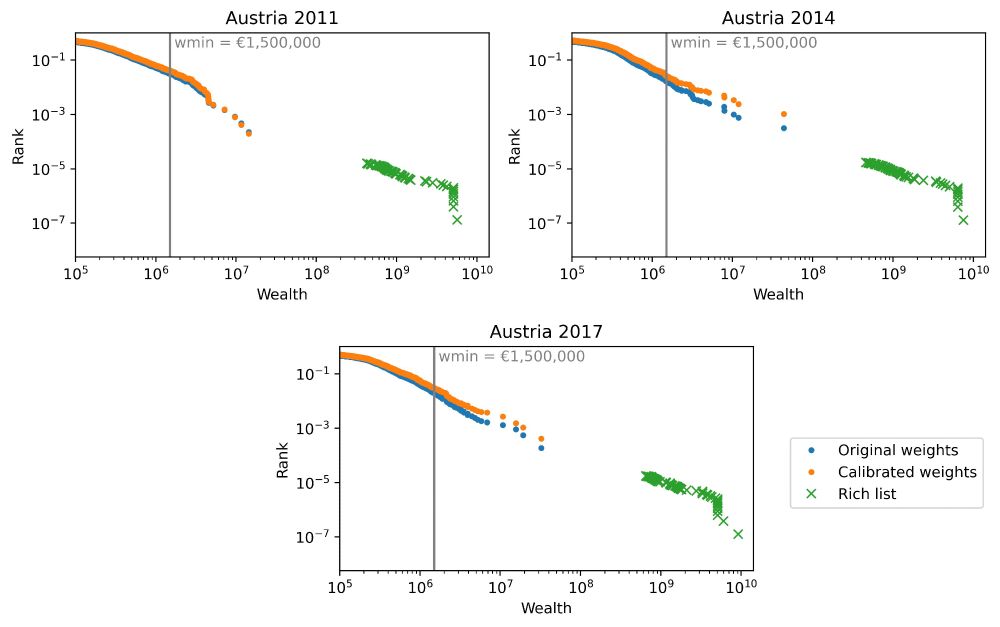

"Wealth survey calibration using income tax data" by Daniel Kolář

Available at: rdcu.be/evkMu

"Wealth survey calibration using income tax data" by Daniel Kolář

Available at: rdcu.be/evkMu