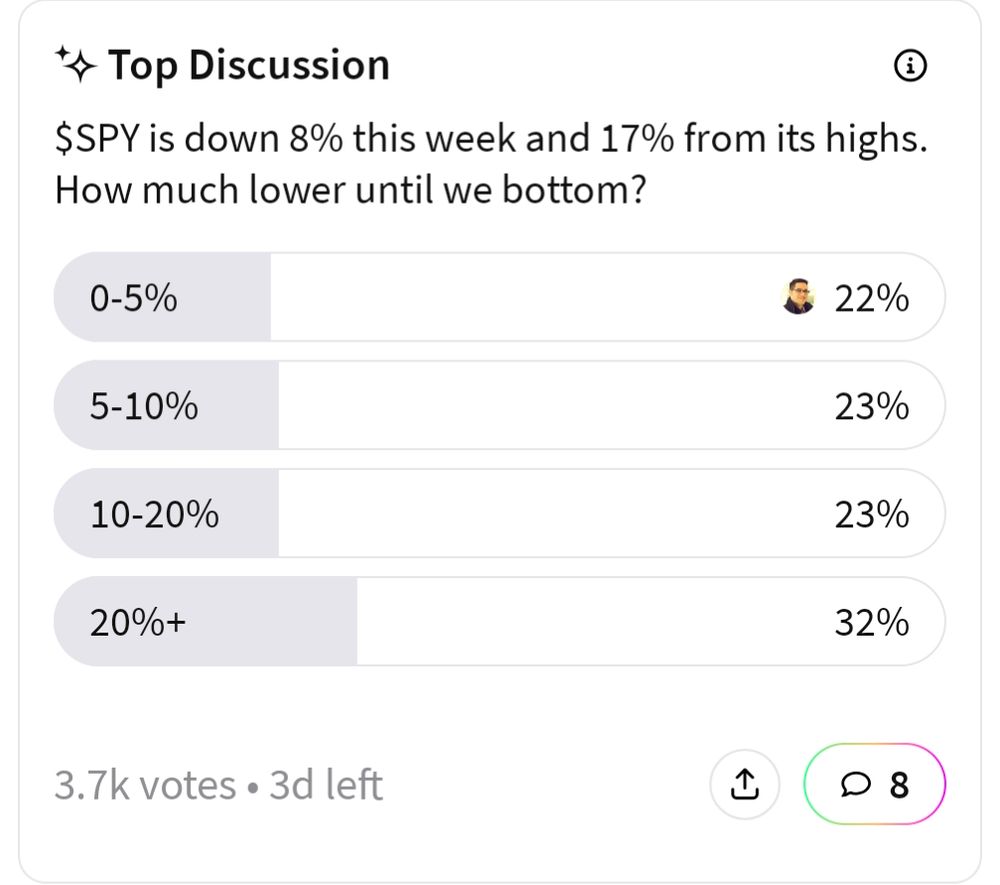

Remember if someone thinks the market is going down, and they put their money where their mouth is, they would have already sold their stocks.

If folks are done selling, the market goes back up.

Remember if someone thinks the market is going down, and they put their money where their mouth is, they would have already sold their stocks.

If folks are done selling, the market goes back up.

Hoping Trump and co work things out over the weekend. Weeeee!

Hoping Trump and co work things out over the weekend. Weeeee!

If you have a similar mindset and strategy, I will keep making posts like this you might be interested in.

If you have a similar mindset and strategy, I will keep making posts like this you might be interested in.

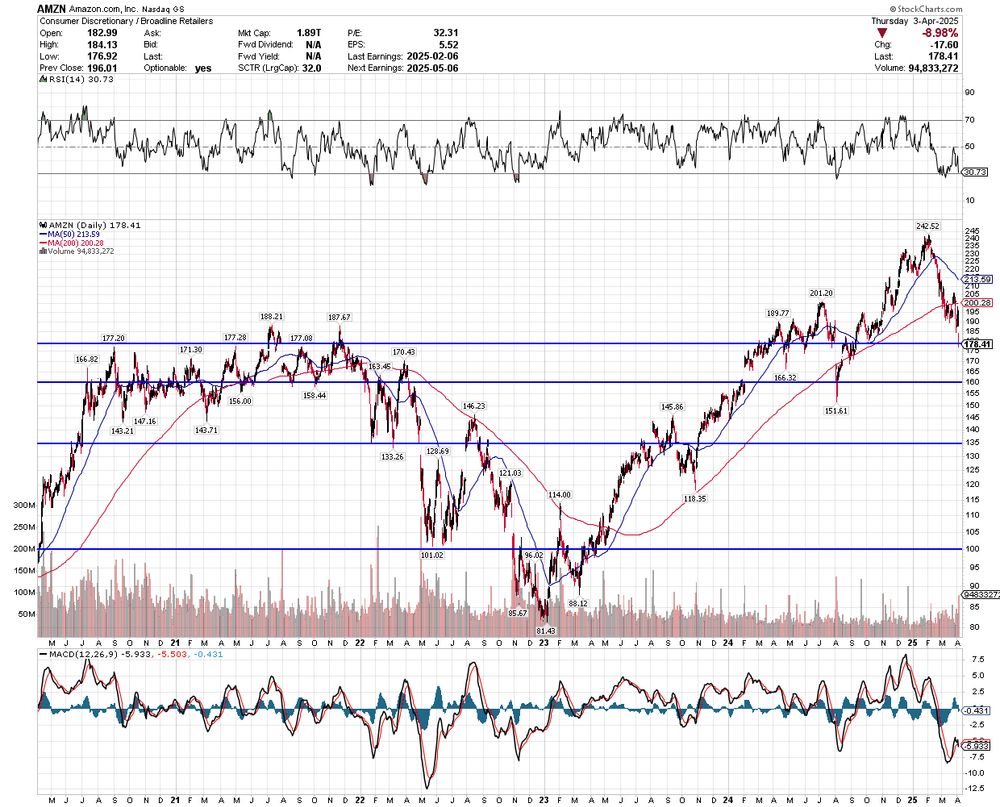

I personally would not try to trade that. Policy can change. Many of those same companies sell over seas too and will be hurt by reciprocal tariffs.

I personally would not try to trade that. Policy can change. Many of those same companies sell over seas too and will be hurt by reciprocal tariffs.

If all tariffs go off again, we potentially shoot much higher.

If not, I think we trade sideways through earnings until the recession is super clear...

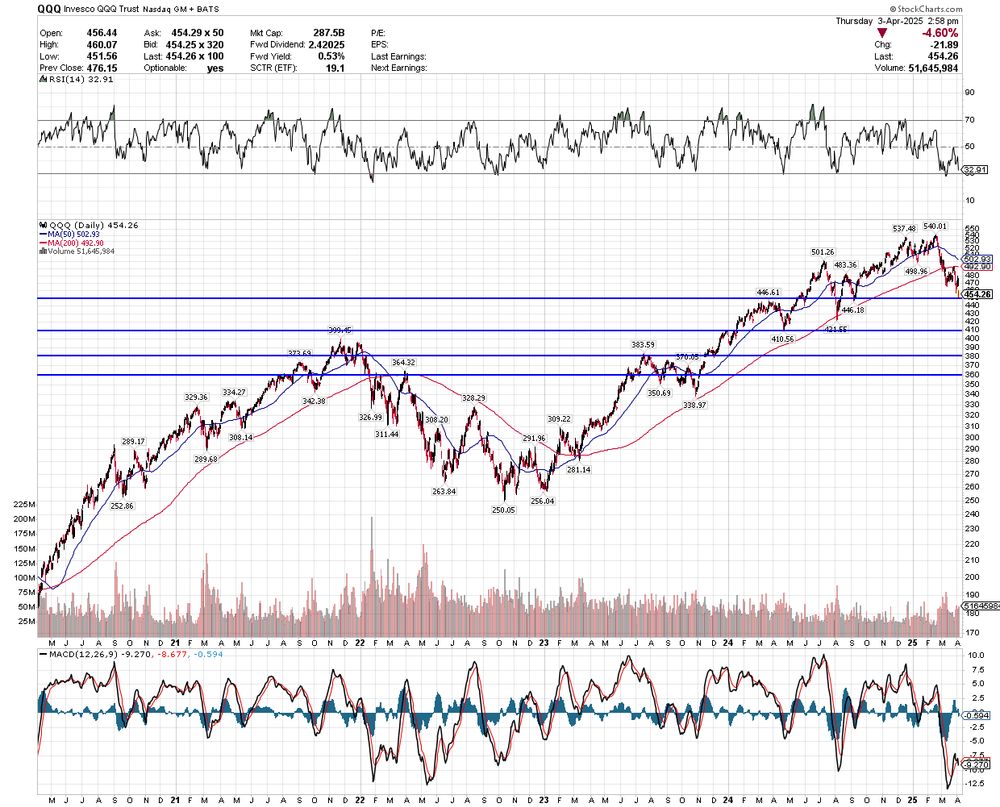

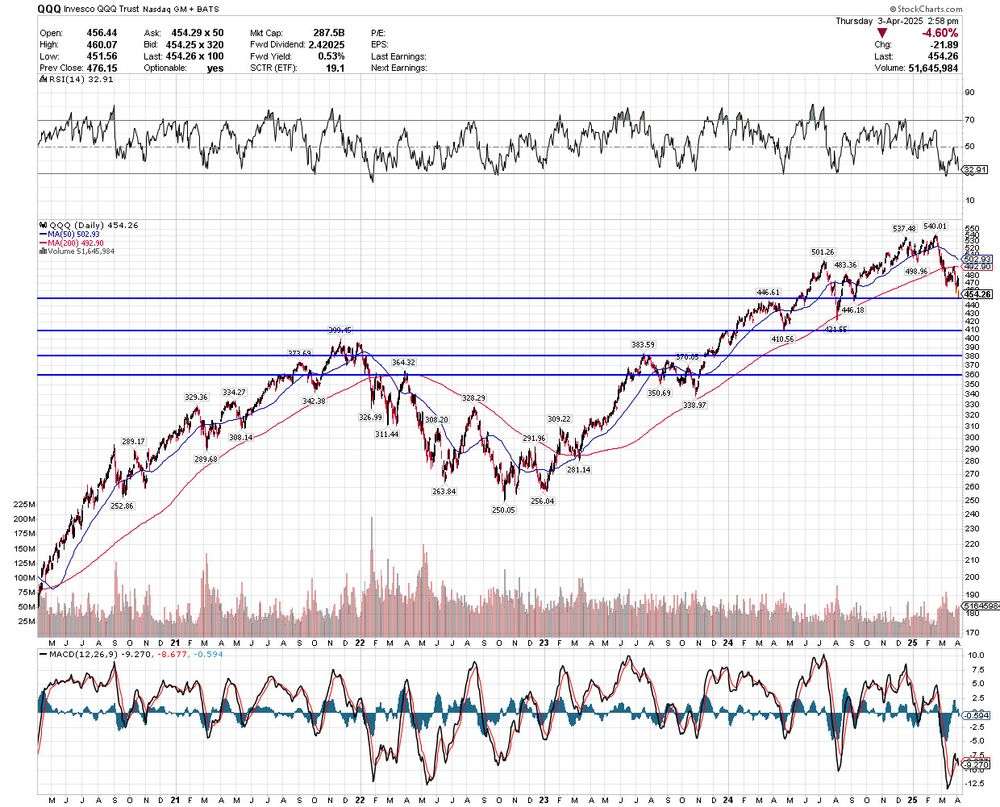

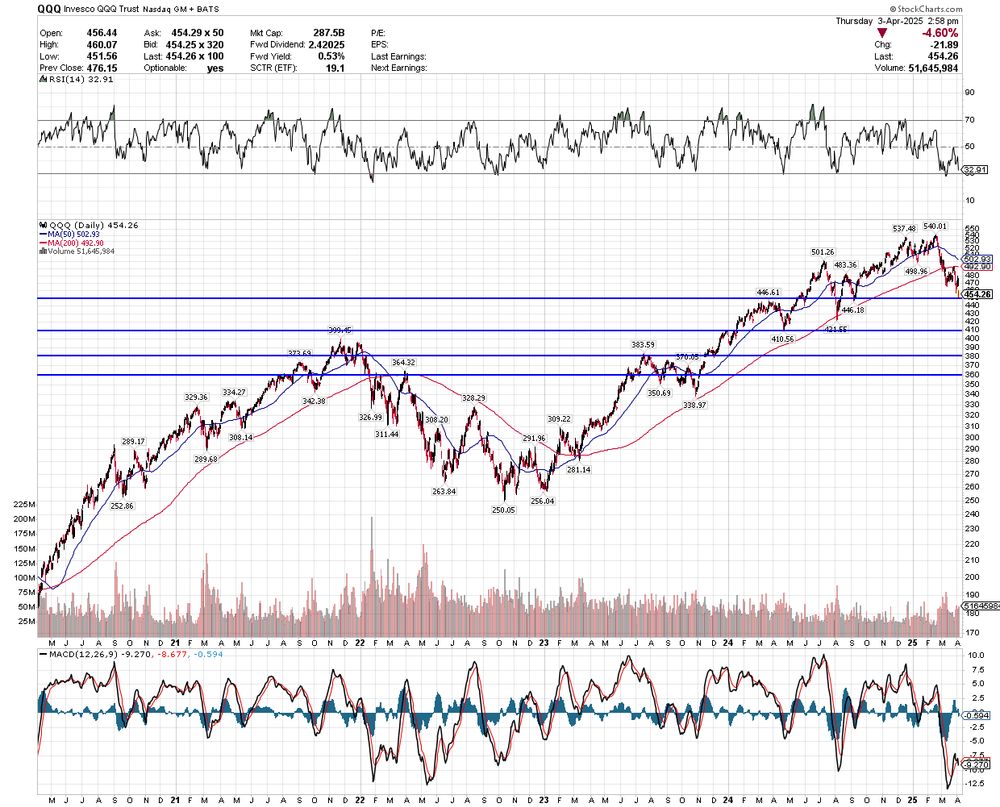

For the QQQ, there is nice support in this ~$450 range. So maybe a bounce coming.

After that, the ~$400 level (conveniently another 10% or so drop) is strong support at the pre-COVID top.

If all tariffs go off again, we potentially shoot much higher.

If not, I think we trade sideways through earnings until the recession is super clear...

The stock whipsawed as they stopped being able to sell GLP-1 drugs, but they've now worked out a deal with $LLY.

Could be a Netflix-like moment here. HIMS and the other online drugstores are easier to use than Lilly's new site.

The stock whipsawed as they stopped being able to sell GLP-1 drugs, but they've now worked out a deal with $LLY.

Could be a Netflix-like moment here. HIMS and the other online drugstores are easier to use than Lilly's new site.

Support at $100, $75, $50.

Support at $100, $75, $50.

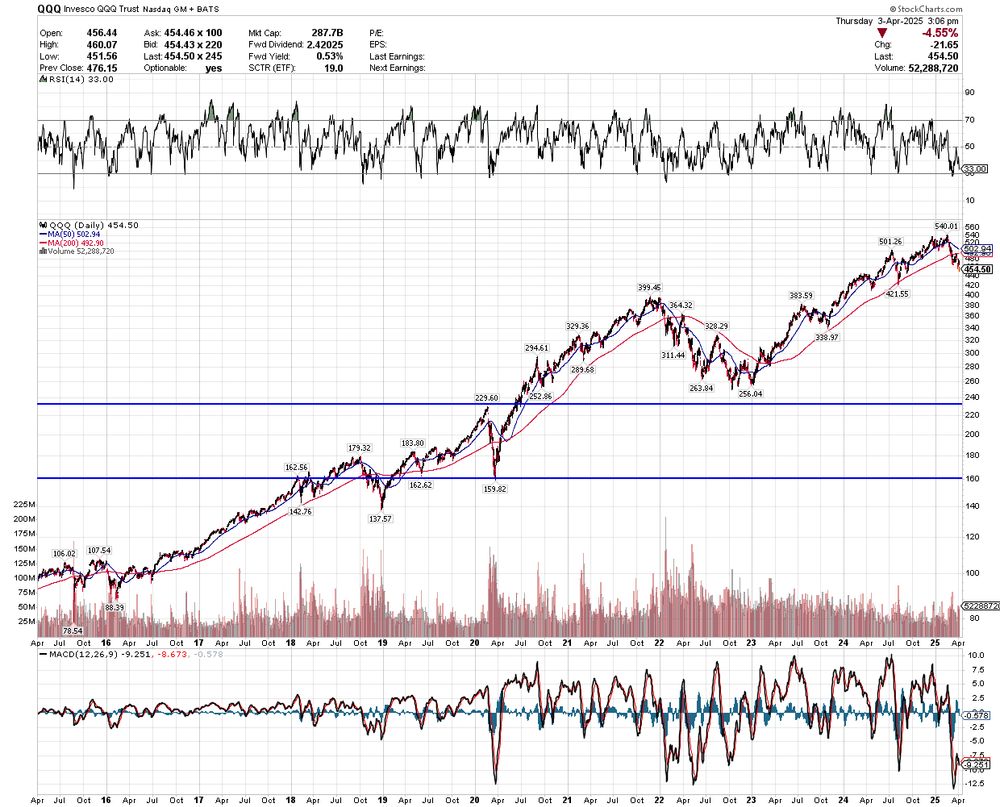

FWIW, the pre-COVID QQQ high was ~$230. The COVID low was ~$160.

FWIW, the pre-COVID QQQ high was ~$230. The COVID low was ~$160.

For the QQQ, there is nice support in this ~$450 range. So maybe a bounce coming.

After that, the ~$400 level (conveniently another 10% or so drop) is strong support at the pre-COVID top.

For the QQQ, there is nice support in this ~$450 range. So maybe a bounce coming.

After that, the ~$400 level (conveniently another 10% or so drop) is strong support at the pre-COVID top.

The answer? Piece-by-piece. One page at a time. There's no need for expensive migrations.

The answer? Piece-by-piece. One page at a time. There's no need for expensive migrations.

Do you run a WordPress business? Have you left X and moved to BlueSky?

That wouldn't be the only topic of the episode, but I'm interested in how people are navigating the new fragmentation.

Do you run a WordPress business? Have you left X and moved to BlueSky?

That wouldn't be the only topic of the episode, but I'm interested in how people are navigating the new fragmentation.

Originally released in 2000! The 2013 revision updates the examples, but changes relatively little of the advice.

It holds up extremely well. I reference it all the time.

sensible.com/dont-make-me...

Originally released in 2000! The 2013 revision updates the examples, but changes relatively little of the advice.

It holds up extremely well. I reference it all the time.

sensible.com/dont-make-me...

Is there anyone out there from Asia, Africa, the Middle East, or Australia who wants to join us to talk about WordPress news, perhaps once a month?

Is there anyone out there from Asia, Africa, the Middle East, or Australia who wants to join us to talk about WordPress news, perhaps once a month?