Posting about politics, poverty, housing, benefits and work.

Northern Irish, views my own.

Too many families face unthinkable choices between feeding their children or keeping their homes warm.

18 months out from the next Assembly election, our Poverty in NI report looks at the action that's needed 🔽

Too many families face unthinkable choices between feeding their children or keeping their homes warm.

18 months out from the next Assembly election, our Poverty in NI report looks at the action that's needed 🔽

> That's £3.945m more than if it had just increased with inflation

> Her house has effectively gained £72k in value every year in today's prices

> Her house earned around double what the average UK earner did each year

> That's £3.945m more than if it had just increased with inflation

> Her house has effectively gained £72k in value every year in today's prices

> Her house earned around double what the average UK earner did each year

Yesterday the OBR reported cost of TA to local authorities increased 20% *a year* between 2022-23 and 2024-25.

Yesterday the OBR reported cost of TA to local authorities increased 20% *a year* between 2022-23 and 2024-25.

Yesterday the OBR reported cost of TA to local authorities increased 20% *a year* between 2022-23 and 2024-25.

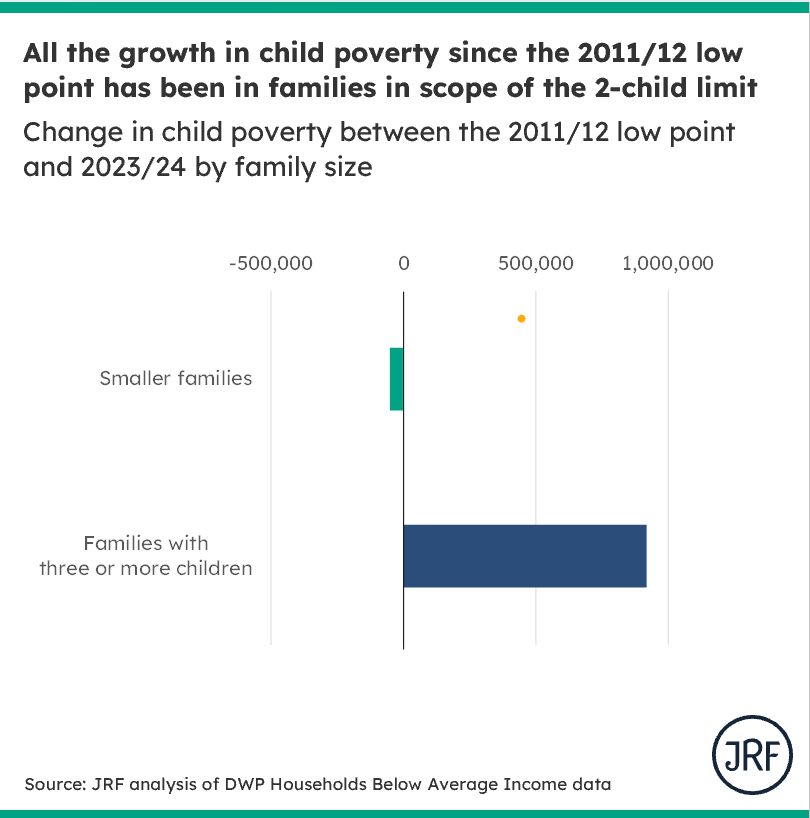

Scrapping this cruel policy to lift 450000 children out of poverty is a huge win!

Scrapping this cruel policy to lift 450000 children out of poverty is a huge win!

🔥🔥🔥

🔥🔥🔥

Hear from our Chief Economist @chrisbelfield.bsky.social on three key policies that will make a lasting impact on reducing poverty. 🔽

Hear from our Chief Economist @chrisbelfield.bsky.social on three key policies that will make a lasting impact on reducing poverty. 🔽

A quick thread on what the latest Annual Survey of Hours and Earnings (ASHE) tells us 👇

A quick thread on what the latest Annual Survey of Hours and Earnings (ASHE) tells us 👇

The strain of this freeze on private renters is immense; in April around 40% of private renters in receipt of LHA said they didn't have enough to cover rent.

The strain of this freeze on private renters is immense; in April around 40% of private renters in receipt of LHA said they didn't have enough to cover rent.

Apply at the link below! Budget up to £40k including vat.

Please reshare!!

Apply at the link below! Budget up to £40k including vat.

Please reshare!!

Apply at the link below! Budget up to £40k including vat.

Please reshare!!

Apply at the link below! Budget up to £40k including vat.

Please reshare!!

Since 2016, tax reforms helped slash the growth of the private rented sector and boosted first-time buyers—without hurting existing tenants.

A big housing story hiding in plain sight? ⬇️

Since 2016, tax reforms helped slash the growth of the private rented sector and boosted first-time buyers—without hurting existing tenants.

A big housing story hiding in plain sight? ⬇️

Ratios of rents to incomes dipped in 2022/23 as incomes climbed faster than rents.

Rents have been catching up so affordability has worsened again and seems likely it will continue to worsen through 2025...

Ratios of rents to incomes dipped in 2022/23 as incomes climbed faster than rents.

Rents have been catching up so affordability has worsened again and seems likely it will continue to worsen through 2025...

Can you identify compelling news stories that resonate with the mainstream media and political debates?

Do you thrive in shaping strategy and working with colleagues to turn policy ideas into media successes?

Apply: jrf.octo-firstclass.co.uk/candidates/c....

Can you identify compelling news stories that resonate with the mainstream media and political debates?

Do you thrive in shaping strategy and working with colleagues to turn policy ideas into media successes?

Apply: jrf.octo-firstclass.co.uk/candidates/c....

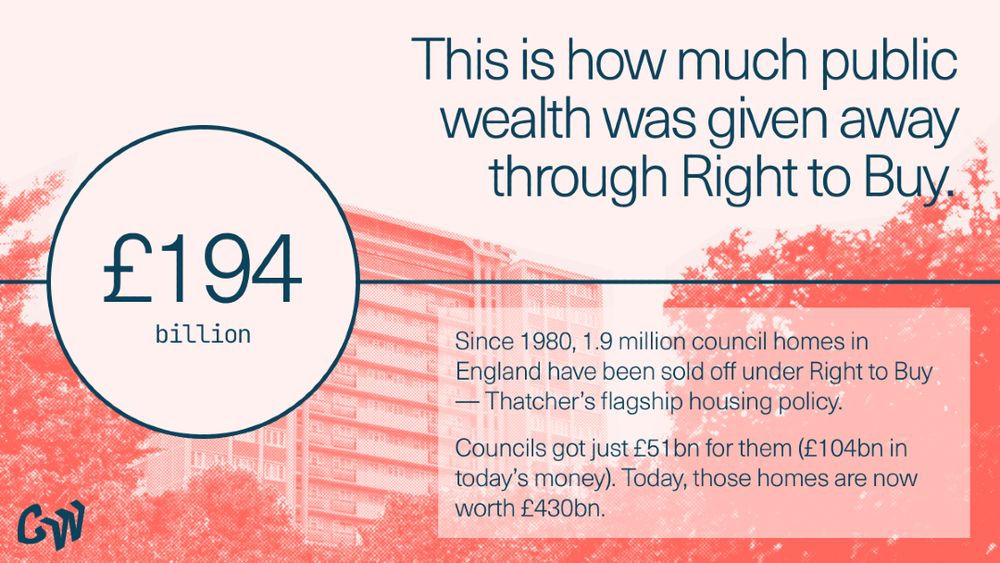

1bn? 10bn? 100bn?

Try 200 BILLION pounds.

🧵 Here's how Britain’s most infamous housing policy became its biggest housing disaster — and near the largest privatisation in British history.

1bn? 10bn? 100bn?

Try 200 BILLION pounds.

🧵 Here's how Britain’s most infamous housing policy became its biggest housing disaster — and near the largest privatisation in British history.

www.theguardian.com/politics/202...

www.theguardian.com/politics/202...

We're hiring a Senior Policy Advisor for our Scotland office.

If you believe as passionately as we do that we can deliver a fairer Scotland free from poverty then this job could be for you. 🔽 1/3

We're hiring a Senior Policy Advisor for our Scotland office.

If you believe as passionately as we do that we can deliver a fairer Scotland free from poverty then this job could be for you. 🔽 1/3

Arresting this escalating crisis needs to be a key priority for Government.

Arresting this escalating crisis needs to be a key priority for Government.

'Vulnerable' families, those receiving a disability benefit or other means-tested benefits, were much more likely to be living in poorer quality and damp homes.

'Vulnerable' families, those receiving a disability benefit or other means-tested benefits, were much more likely to be living in poorer quality and damp homes.