#personal #finance #loans #debt #credit #data #savings #shopping #lottery #networth #data #automobile #balance #transfer #lottery #lotto #budget #independence

loan.alyzer.com/instant-insp...

#ZigZiglarWisdom

#results #choice #action #change #journey #forward #growth #Quotes #Progress #experience #Life #Lessons #wisdom

#Monday #Timeless #Advice #quote #tshirt #inspiration #joy #lessons #MondayMotivation

It's a K-shaped economy

Young ppl are screwed

Only the rich are thriving

I get it but think we're taking this too far

What if things are better than they seem on social media?

Some facts, figures and thoughts on this:

awealthofcommonsense.com/2025/11/what...

It's a K-shaped economy

Young ppl are screwed

Only the rich are thriving

I get it but think we're taking this too far

What if things are better than they seem on social media?

Some facts, figures and thoughts on this:

awealthofcommonsense.com/2025/11/what...

1. 50 year mortgages (not that helpful)

2. One time 3% mortgage for anyone who missed out (not bad)

3. Build more housing (we're deregulating everything else but not this for some reason)

awealthofcommonsense.com/2025/11/the-...

1. 50 year mortgages (not that helpful)

2. One time 3% mortgage for anyone who missed out (not bad)

3. Build more housing (we're deregulating everything else but not this for some reason)

awealthofcommonsense.com/2025/11/the-...

1. There are more rules in place (no SEC, FDIC back then)

2. The stock market is way more important (1-2% of households owned stocks in 1929)

3. Policymakers have learned from past crises

awealthofcommonsense.com/2025/11/why-...

1. There are more rules in place (no SEC, FDIC back then)

2. The stock market is way more important (1-2% of households owned stocks in 1929)

3. Policymakers have learned from past crises

awealthofcommonsense.com/2025/11/why-...

#investing

#investing

thecollegeinvestor.com/32275/hsa-an...

thecollegeinvestor.com/32275/hsa-an...

After the crash from 1929-1932 the $2.5 million turned into just $375k

In his memoir Graham wrote about how hubris was the cause of his losses

Some thoughts on bull market brain:

awealthofcommonsense.com/2025/11/ben-...

After the crash from 1929-1932 the $2.5 million turned into just $375k

In his memoir Graham wrote about how hubris was the cause of his losses

Some thoughts on bull market brain:

awealthofcommonsense.com/2025/11/ben-...

AI is taking entry level jobs

Housing is too expensive

Social media is rotting brains

I don't buy it. Young ppl are more educated & tech savvy than ever

They'll figure it out

awealthofcommonsense.com/2025/11/are-...

AI is taking entry level jobs

Housing is too expensive

Social media is rotting brains

I don't buy it. Young ppl are more educated & tech savvy than ever

They'll figure it out

awealthofcommonsense.com/2025/11/are-...

Should young ppl care about bubbles?

Is now the time to increase your tech exposure?

I have thoughts:

awealthofcommonsense.com/2025/11/is-n...

Should young ppl care about bubbles?

Is now the time to increase your tech exposure?

I have thoughts:

awealthofcommonsense.com/2025/11/is-n...

It's the only mega bull market to end w/a whimper not a bang

There was no crash in the aftermath

The 1960s saw 8% annual returns

Not all good things end badly

awealthofcommonsense.com/2025/11/the-...

It's the only mega bull market to end w/a whimper not a bang

There was no crash in the aftermath

The 1960s saw 8% annual returns

Not all good things end badly

awealthofcommonsense.com/2025/11/the-...

The Dow in the Roaring 20s: +489%

Japn in the 1980s: +510%

The Nasdaq in the 1990s +795%

The Nasdaq 100 over the past 10 years: +512%

awealthofcommonsense.com/2025/11/the-...

The Dow in the Roaring 20s: +489%

Japn in the 1980s: +510%

The Nasdaq in the 1990s +795%

The Nasdaq 100 over the past 10 years: +512%

awealthofcommonsense.com/2025/11/the-...

A closer look at the pros and cons of a trend following strategy:

awealthofcommonsense.com/2025/10/tren...

A closer look at the pros and cons of a trend following strategy:

awealthofcommonsense.com/2025/10/tren...

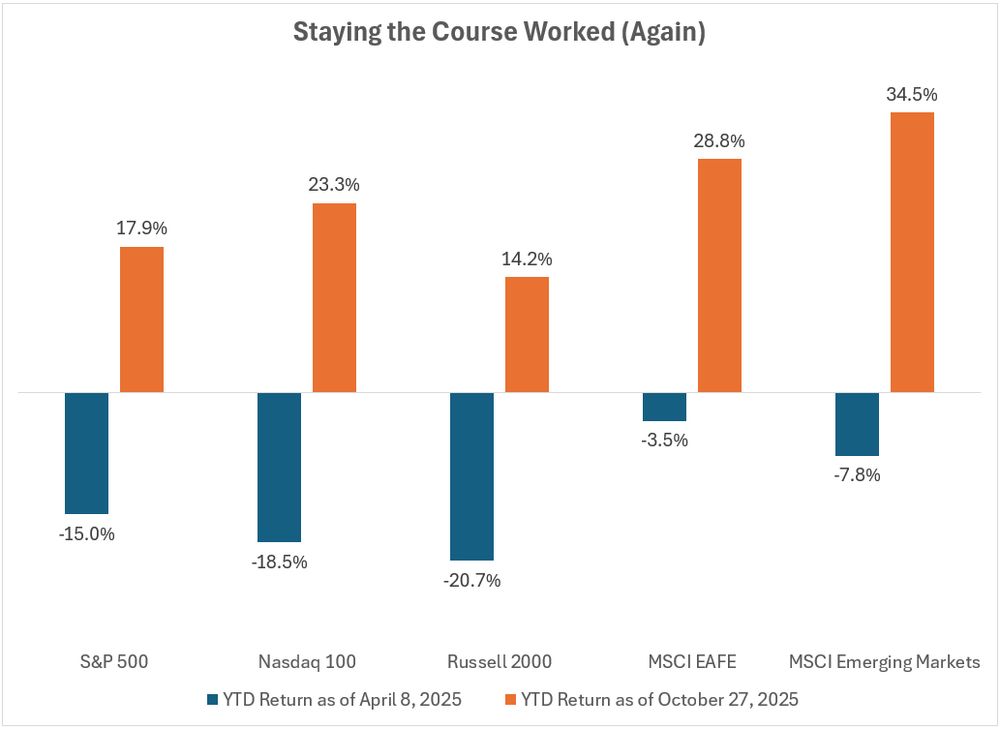

S&P 500 -15.0%

Nasdaq 100 -18.5%

R2000 -20.7%

EAFE -3.5%

EM -7.8%

Now the 2025 YTD returns thru Monday:

S&P 500 +17.9%

Nasdaq 100 +23.3%

R2000 +14.2%

EAFE +28.8%

EM +34.5%

Staying the course worked (again):

awealthofcommonsense.com/2025/10/stay...

S&P 500 -15.0%

Nasdaq 100 -18.5%

R2000 -20.7%

EAFE -3.5%

EM -7.8%

Now the 2025 YTD returns thru Monday:

S&P 500 +17.9%

Nasdaq 100 +23.3%

R2000 +14.2%

EAFE +28.8%

EM +34.5%

Staying the course worked (again):

awealthofcommonsense.com/2025/10/stay...

Some questions for the next one:

Will the wealth effect make things worse?

Will young ppl stay invested?

What will happen to illiquid private investments?

Will households ramp up their borrowing?

awealthofcommonsense.com/2025/10/what...

Some questions for the next one:

Will the wealth effect make things worse?

Will young ppl stay invested?

What will happen to illiquid private investments?

Will households ramp up their borrowing?

awealthofcommonsense.com/2025/10/what...

(more than you think)

awealthofcommonsense.com/2025/10/how-...

(more than you think)

awealthofcommonsense.com/2025/10/how-...

1. New vehicles are really expensive now

2. People under 40 are all in on the stock market

3. Wealth inequality is turning into health inequality

awealthofcommonsense.com/2025/10/3-ch...

1. New vehicles are really expensive now

2. People under 40 are all in on the stock market

3. Wealth inequality is turning into health inequality

awealthofcommonsense.com/2025/10/3-ch...

It's beating the stock market since 2000 (and in the 2020s)

It's one of the more unique financial assets out there

But I don't own any gold

Here are some of my reasons:

awealthofcommonsense.com/2025/10/why-...

It's beating the stock market since 2000 (and in the 2020s)

It's one of the more unique financial assets out there

But I don't own any gold

Here are some of my reasons:

awealthofcommonsense.com/2025/10/why-...

For many that wealth is mostly tied up in their home and retirement accts

Some thoughts on the pros and cons of being house/retirement acct rich:

awealthofcommonsense.com/2025/10/hous...

For many that wealth is mostly tied up in their home and retirement accts

Some thoughts on the pros and cons of being house/retirement acct rich:

awealthofcommonsense.com/2025/10/hous...

The rich are getting richer

But low income Americans now own more stocks than ever before

Housing is more expensive

But that has made more young ppl invest in the stock market

Two positive trends in household wealth:

awealthofcommonsense.com/2025/10/two-...

The rich are getting richer

But low income Americans now own more stocks than ever before

Housing is more expensive

But that has made more young ppl invest in the stock market

Two positive trends in household wealth:

awealthofcommonsense.com/2025/10/two-...

It happens

Stocks go down too

awealthofcommonsense.com/2025/10/stoc...

It happens

Stocks go down too

awealthofcommonsense.com/2025/10/stoc...

Are we in for a melt-up?

How do you make forecasts in a bubble?

What's the worst-case AI scenario?

Would an AI bust lead to a recession?

Will anyone call the eventual top?

awealthofcommonsense.com/2025/10/some...

Are we in for a melt-up?

How do you make forecasts in a bubble?

What's the worst-case AI scenario?

Would an AI bust lead to a recession?

Will anyone call the eventual top?

awealthofcommonsense.com/2025/10/some...