econofact.org/podcast/the-...

econofact.org/podcast/the-...

@scottlincicome.bsky.social of @cato.org, Ramesh Ponnuru, @natasharsarin.bsky.social, @michaelrstrain.bsky.social, @justinwolfers.bsky.social and @markzandi.bsky.social weigh in:

@scottlincicome.bsky.social of @cato.org, Ramesh Ponnuru, @natasharsarin.bsky.social, @michaelrstrain.bsky.social, @justinwolfers.bsky.social and @markzandi.bsky.social weigh in:

Listen here: econofact.org/podcast/thro...

Listen here: econofact.org/podcast/thro...

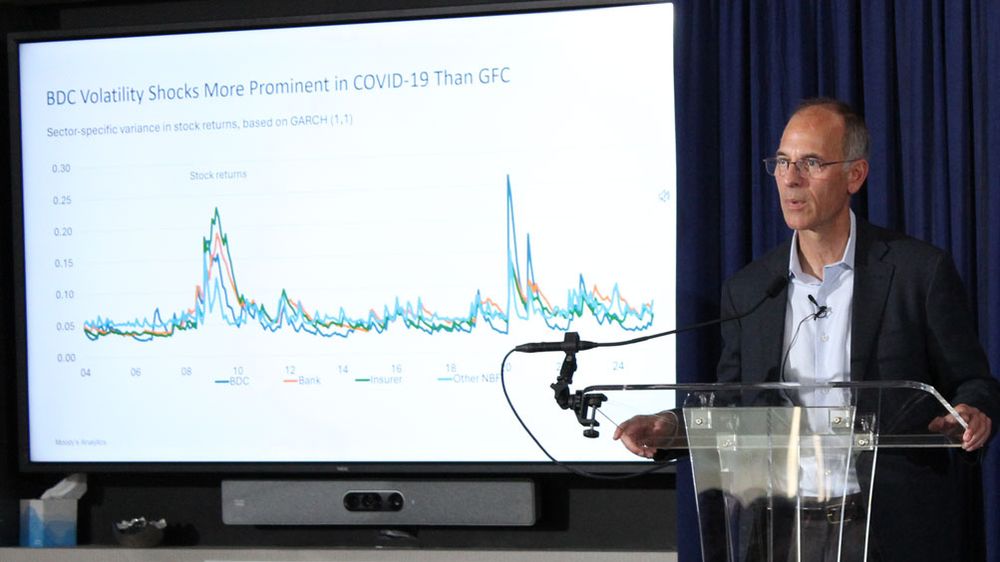

Chuck Todd is joined by @markzandi.bsky.social, chief economist at Moody’s Analytics, to discuss the damaging effects of President Donald Trump’s tariffs and trade war on the U.S. economy.

opiniontoday.substack.com/i/162029400/...

Chuck Todd is joined by @markzandi.bsky.social, chief economist at Moody’s Analytics, to discuss the damaging effects of President Donald Trump’s tariffs and trade war on the U.S. economy.

opiniontoday.substack.com/i/162029400/...

#tariffs #econsky

podcasts.apple.com/us/podcast/m...

#tariffs #econsky

podcasts.apple.com/us/podcast/m...

@markzandi.bsky.social on the #Tariffs impact on US-China relations.

podcasts.apple.com/us/podcast/t...

@markzandi.bsky.social on the #Tariffs impact on US-China relations.

podcasts.apple.com/us/podcast/t...