💭 Making & learning from money mistakes

🏠 Midwest | Writing about real money experiences

💡 No guru stuff, just honest money talks

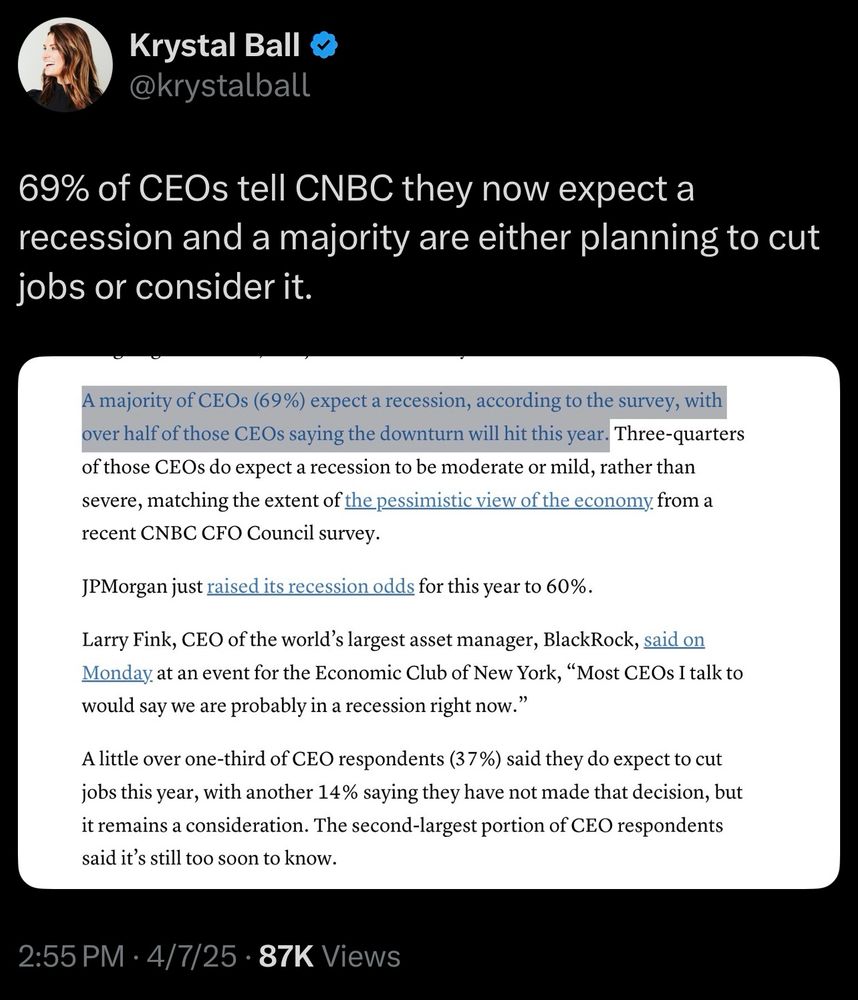

Might be a good reference for tomorrow.

Might be a good reference for tomorrow.

#personalfinance

#personalfinance

Patience pays!

#InvestingWisely #StayTheCourse

Patience pays!

#InvestingWisely #StayTheCourse

But you don’t need to play the chaos.

Play the macro trend:

📈 Rising inflation

📉 Slower growth

🛡️ Safer sectors, smarter moves

Tariffs are the storm. You’re the umbrella ☂️

But you don’t need to play the chaos.

Play the macro trend:

📈 Rising inflation

📉 Slower growth

🛡️ Safer sectors, smarter moves

Tariffs are the storm. You’re the umbrella ☂️

But not yours—

Because you:

✅ Rebalanced for inflation

✅ Cut risky overexposure

✅ Held through the noise

Investing is 80% mindset, 20% moves. 🧘♂️📊

But not yours—

Because you:

✅ Rebalanced for inflation

✅ Cut risky overexposure

✅ Held through the noise

Investing is 80% mindset, 20% moves. 🧘♂️📊

But instead of panic-selling, zoom out.

🧠 Think:

1. U.S.-centric ETFs

2. Dividend stocks

3. Inflation hedges

But instead of panic-selling, zoom out.

🧠 Think:

1. U.S.-centric ETFs

2. Dividend stocks

3. Inflation hedges

High prices = high inflation

High inflation = Fed says “LOL no rate cuts”

👀 Translation: stocks stay shaky

➡️ ETF and CHILL

The real flex? Long-term conviction.

High prices = high inflation

High inflation = Fed says “LOL no rate cuts”

👀 Translation: stocks stay shaky

➡️ ETF and CHILL

The real flex? Long-term conviction.

#powell #recession

#powell #recession

Visit DirectFile.irs.gov to check eligibility and learn more.

Visit DirectFile.irs.gov to check eligibility and learn more.

Did you know a library card can unlock a world of free resources? Most library cards are FREE for residents, offering access to books, audiobooks, eBooks, music, movies, and more! #LibraryCard #FreeResources #finsky #personalfinance

Did you know a library card can unlock a world of free resources? Most library cards are FREE for residents, offering access to books, audiobooks, eBooks, music, movies, and more! #LibraryCard #FreeResources #finsky #personalfinance

#TaxHelp #AffordableTaxes

#TaxHelp #AffordableTaxes

1) Your Statement

2) Your Benefit Verification Letter

3) Your Tax Form from SSA

4) Your Earnings Record.

ALSO take a Snapshot of your Benefits & Payments which shows the DATE/AMOUNT of your NEXT PAYMENT (DO THIS PART 1x MONTH).🚨

1) Your Statement

2) Your Benefit Verification Letter

3) Your Tax Form from SSA

4) Your Earnings Record.

ALSO take a Snapshot of your Benefits & Payments which shows the DATE/AMOUNT of your NEXT PAYMENT (DO THIS PART 1x MONTH).🚨

#finsky #personalfinance

#finsky #personalfinance

#finsky

#finsky