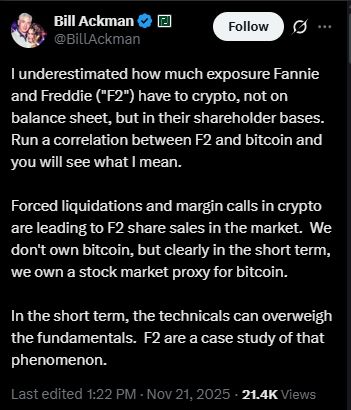

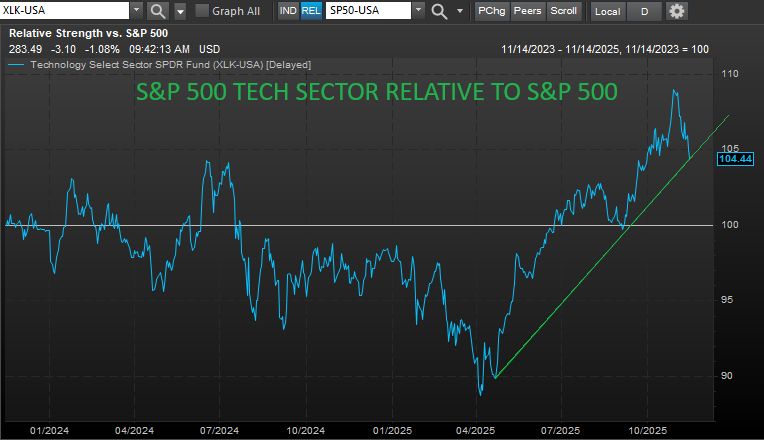

Varuious long-building imbalances now in the open: K-shaped/AI-centric growth, crypto as chaos agent.

New CNBC column, free with email registration.

Varuious long-building imbalances now in the open: K-shaped/AI-centric growth, crypto as chaos agent.

New CNBC column, free with email registration.

Still plenty to prove as the macro/Fed interplay shifts around, but worth watching...

Still plenty to prove as the macro/Fed interplay shifts around, but worth watching...

Maybe things will settle down after the Bitcoin close....

Maybe things will settle down after the Bitcoin close....

Watching for potential friction overhead: A purely mechanical oversold index bounce often stalls near the 20-day moving average...

Watching for potential friction overhead: A purely mechanical oversold index bounce often stalls near the 20-day moving average...

Stock-price correlation of "hyperscalers" MSFT, GOOGL, AMZN, META, ORCL collapsing as the market sorts winners vs. losers.

In particular, it seems investors are handing GOOGL the belt over MSFT (for now).

Stock-price correlation of "hyperscalers" MSFT, GOOGL, AMZN, META, ORCL collapsing as the market sorts winners vs. losers.

In particular, it seems investors are handing GOOGL the belt over MSFT (for now).

What would've been a smart way to set up for its last report in August? Typical beat-and-raise released Aug. 27 with the stock hovering just below a record high....

What would've been a smart way to set up for its last report in August? Typical beat-and-raise released Aug. 27 with the stock hovering just below a record high....

Today's flush is a stampede out of AI/Mag7, breadth not bad, defensive sectors trying to hold, equal-weight S&P 500 barely down.

Today's flush is a stampede out of AI/Mag7, breadth not bad, defensive sectors trying to hold, equal-weight S&P 500 barely down.

The original "jobless recovery" that got Clinton elected with "It's the economy, stupid."

The original "jobless recovery" that got Clinton elected with "It's the economy, stupid."

But the recent ructions offer a glimpse of its eventual demise - symptoms of underlying imbalances emerging, pre-chronic conditions threatining to go acute.

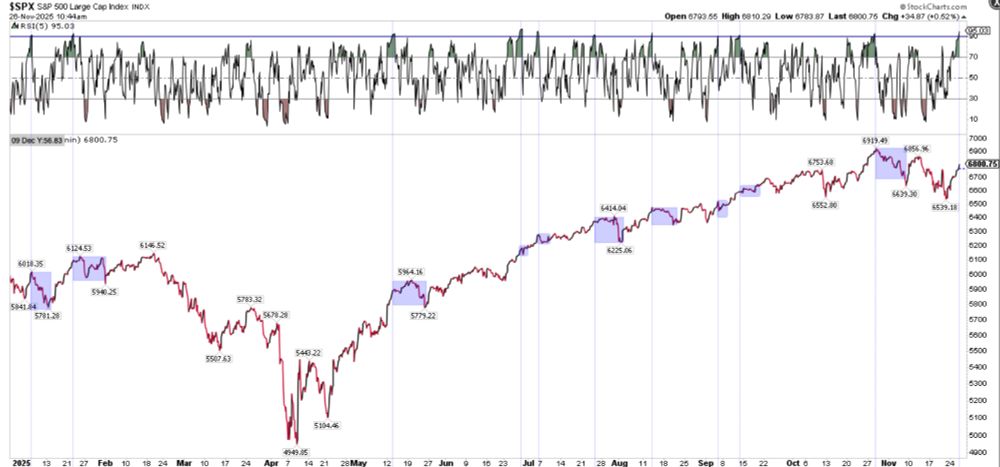

Still just a routine-looking choppy phase in an uptrend?

New column, free with email signup.

But the recent ructions offer a glimpse of its eventual demise - symptoms of underlying imbalances emerging, pre-chronic conditions threatining to go acute.

Still just a routine-looking choppy phase in an uptrend?

New column, free with email signup.

But the recent ructions offer a glimpse of its eventual demise - symptoms of underlying imbalances emerging, pre-chronic conditions threatining to go acute.

Still just a routine-looking choppy phase in an uptrend?

New column, free with email signup.

But the recent ructions offer a glimpse of its eventual demise - symptoms of underlying imbalances emerging, pre-chronic conditions threatining to go acute.

Still just a routine-looking choppy phase in an uptrend?

New column, free with email signup.

Softbank sold 32m NVDA shares worth $5.8B, you say?

The stock trades 180m shares a day and yesterday added $264B in value.

Softbank sold 32m NVDA shares worth $5.8B, you say?

The stock trades 180m shares a day and yesterday added $264B in value.

We hit stocks, macro, credit, Fed, memories of days gone by at Barron’s and why markets thrive on “just the right amount of wrong.”

urldefense.com/v3/__https:/...

We hit stocks, macro, credit, Fed, memories of days gone by at Barron’s and why markets thrive on “just the right amount of wrong.”

urldefense.com/v3/__https:/...

Still, it's an uneven rally and very few in history have gone much longer or stronger without a proper gut check.

Weekend column.

Still, it's an uneven rally and very few in history have gone much longer or stronger without a proper gut check.

Weekend column.

We hit stocks, macro, credit, Fed, memories of days gone by at Barron’s and why markets thrive on “just the right amount of wrong.”

urldefense.com/v3/__https:/...

We hit stocks, macro, credit, Fed, memories of days gone by at Barron’s and why markets thrive on “just the right amount of wrong.”

urldefense.com/v3/__https:/...

History says let it ride, wary investors ponder locking it in as 3-yr S&P 500 returns sit among the best ever.

New column, free to read with email signup.

History says let it ride, wary investors ponder locking it in as 3-yr S&P 500 returns sit among the best ever.

New column, free to read with email signup.

We're just in a mode where corporate managers are going after past over-hiring, padding margins, navigating big tech-spending commitments and conveying to investors they are forward-thinking and efficiency-minded.

We're just in a mode where corporate managers are going after past over-hiring, padding margins, navigating big tech-spending commitments and conveying to investors they are forward-thinking and efficiency-minded.