2. The Fed has been hated for 110 years

3. High probabilities do not imply certainty

4. It can always be different this time

5. Things go up over time

6. We’re not all going to agree

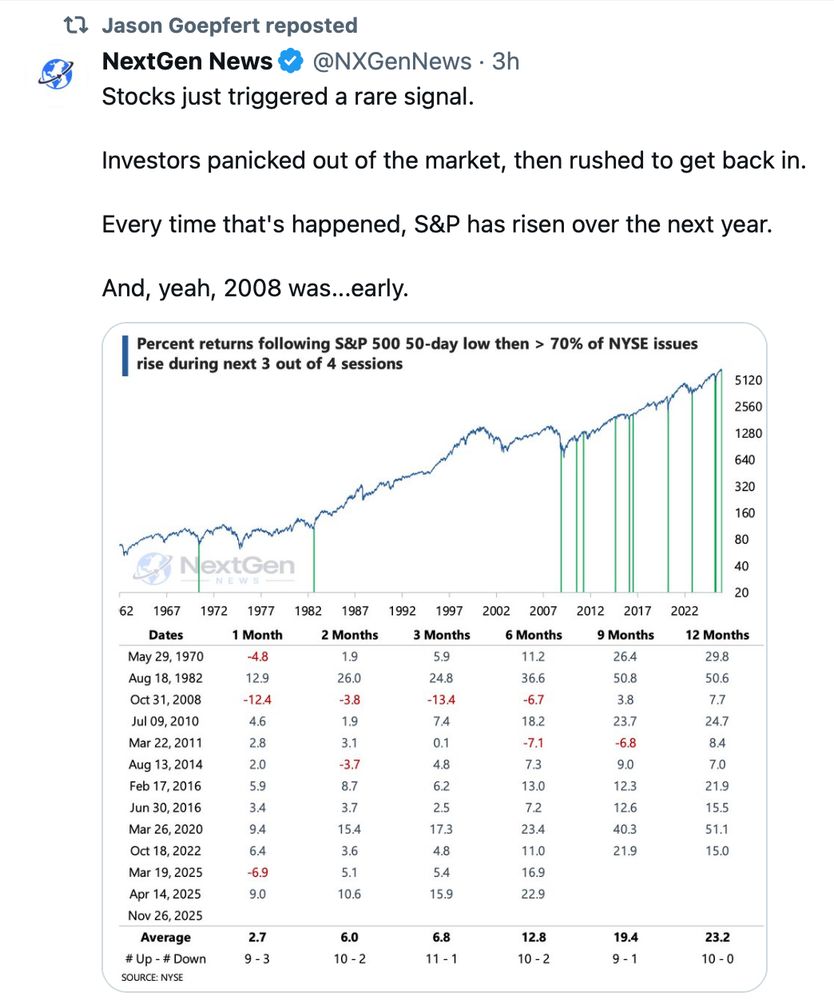

And then a screamer into year end

Interesting.

Was far worse in the first half of the '80s @yardeni.

2011-2013 was the golden age to be a buyer.

yardeni.com/charts/h...

www.calculatedriskblog.com/2025/12/heav...

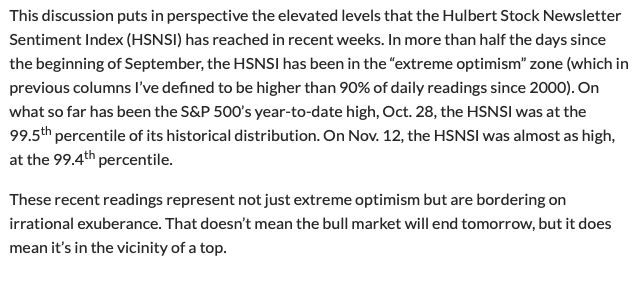

"So while there are plenty of signs of irrational exuberance in the stock market, contrarians don’t know if the top will occur in the next several weeks, in 2026 or if it already happened in October." www.marketwatch.com/story/goodby...

"So while there are plenty of signs of irrational exuberance in the stock market, contrarians don’t know if the top will occur in the next several weeks, in 2026 or if it already happened in October." www.marketwatch.com/story/goodby...

bsky.app/profile/carl...

I found the December column interesting …”

- B of A desk

bsky.app/profile/carl...

Investing go.bsky.app/Qn6r8WD

Econ go.bsky.app/Q3Vt4ef

Ritholtz All Stars go.bsky.app/K7pijeB