www.trucking.org/sites/defaul...

www.trucking.org/sites/defaul...

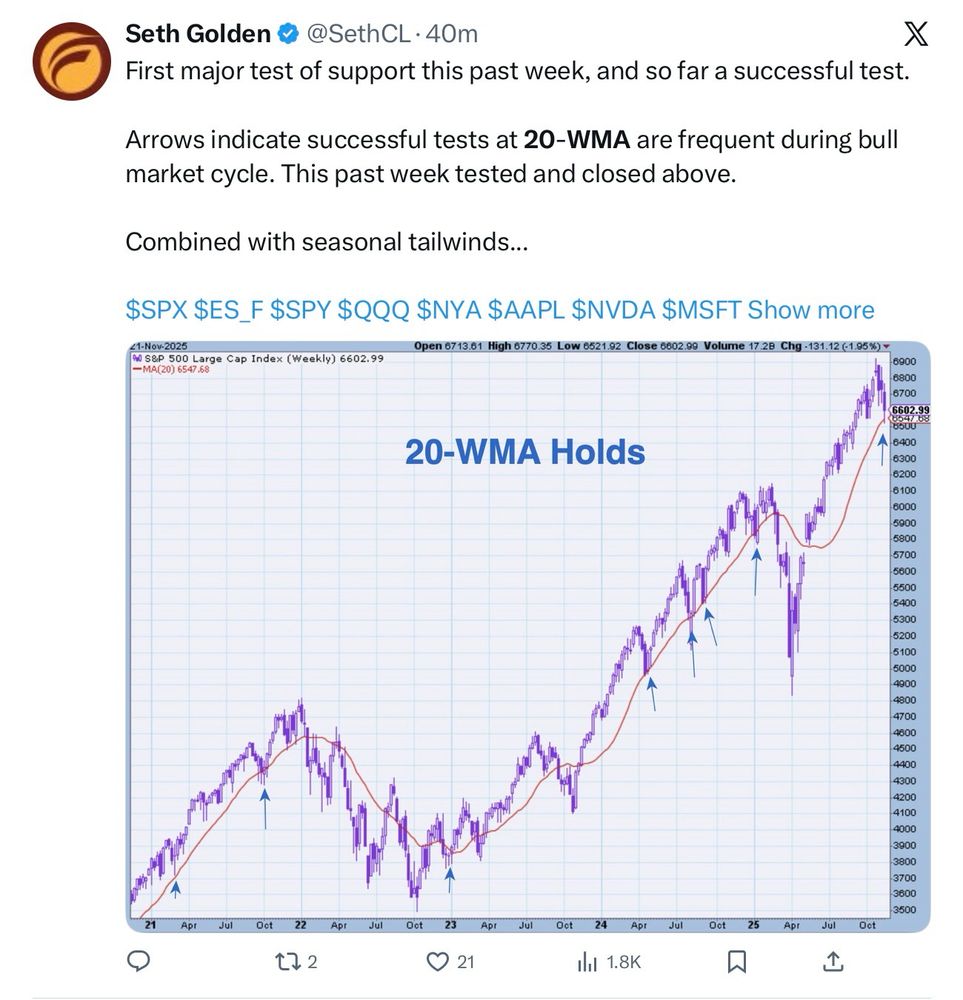

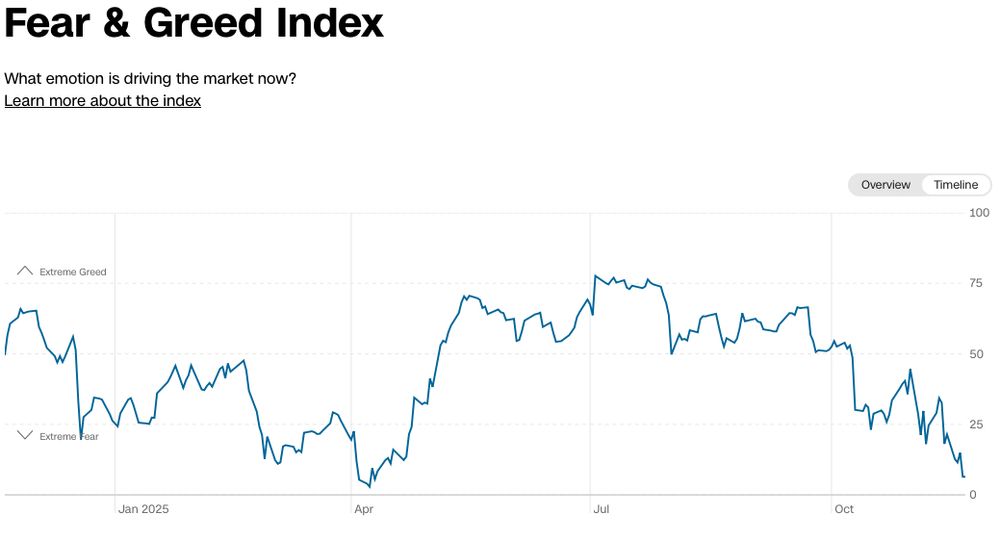

"So while there are plenty of signs of irrational exuberance in the stock market, contrarians don’t know if the top will occur in the next several weeks, in 2026 or if it already happened in October." www.marketwatch.com/story/goodby...

"So while there are plenty of signs of irrational exuberance in the stock market, contrarians don’t know if the top will occur in the next several weeks, in 2026 or if it already happened in October." www.marketwatch.com/story/goodby...

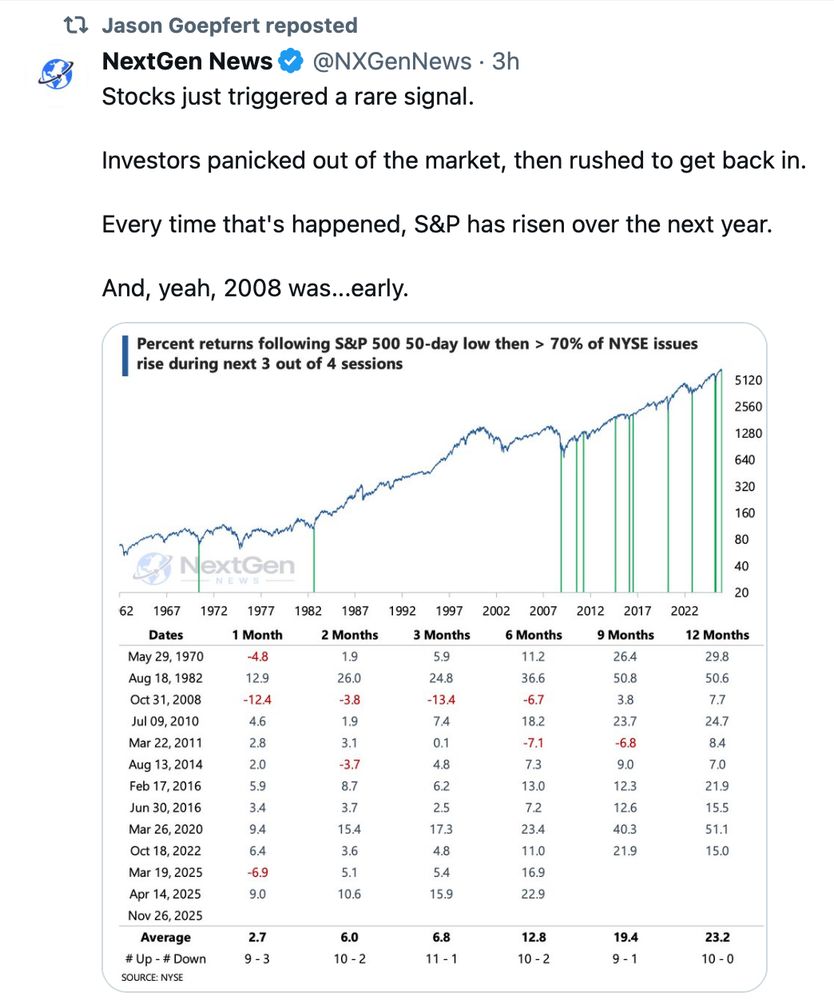

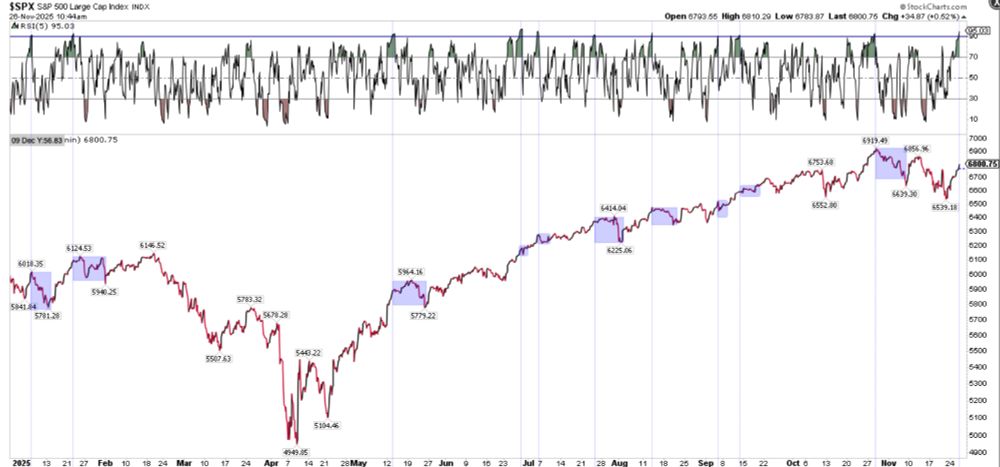

Sentiment buy signals are solid because investors panic all at once. Assuming a tidy symmetry with sentiment sell signals doesn't work

Sentiment buy signals are solid because investors panic all at once. Assuming a tidy symmetry with sentiment sell signals doesn't work