https://trade2infinity.com/

⚠️ None of our content should be considered financial advice.

⚠️ Trading involves significant risk.

⚠️ Trading leveraged products can lead to financial ruin.

👉 Have a plan.

👉 Follow your plan.

👉 Control risk always.

And

👉 Trade small to survive.

oversightdemocrats.house.gov/trump-family...

Gold and silver are the ultimate hedge against the international system going to shit. Gold & silver = up more.

Is this a short-term spike, or the start of a bigger move in metals?

Gold and silver are the ultimate hedge against the international system going to shit. Gold & silver = up more.

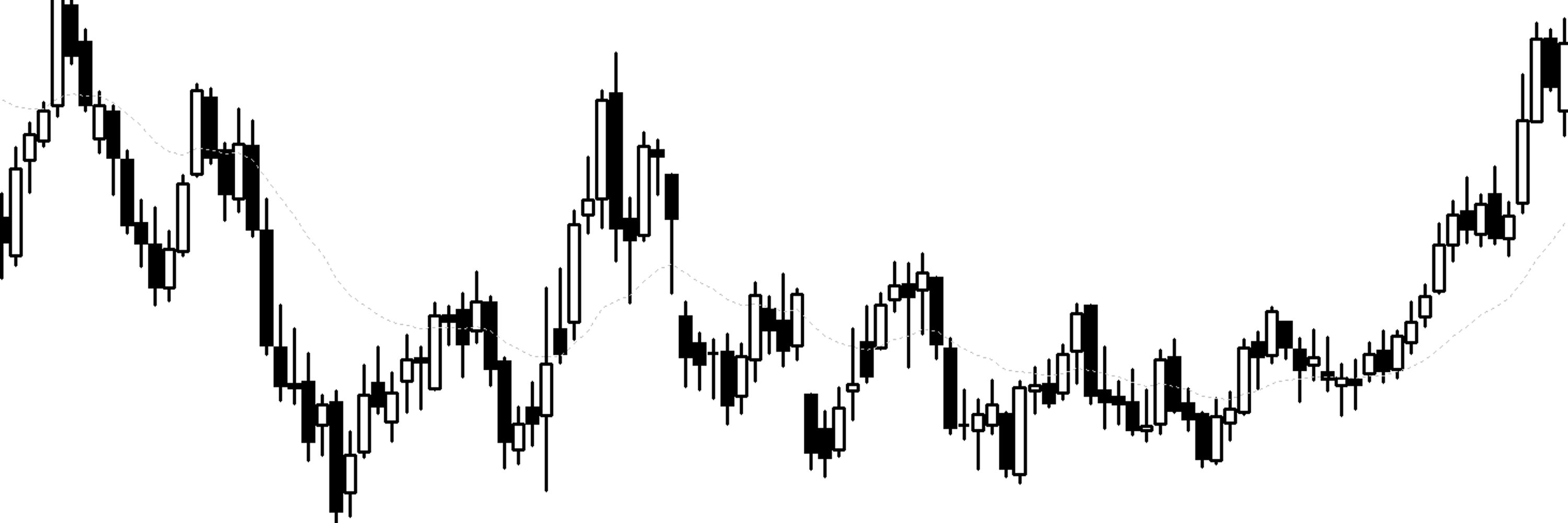

The market. The traders. The institutions. All of them buying and selling the Aussie dollar.

Markets move based on traders' and institutions' beliefs about most of the events listed...?

See the events that steered the Australian dollar in 2025.

The market. The traders. The institutions. All of them buying and selling the Aussie dollar.

Markets move based on traders' and institutions' beliefs about most of the events listed...?

www.citationneeded.news/issue-99/

@punterspolitics.bsky.social

youtu.be/JAOtx5Ki_D0?...

@punterspolitics.bsky.social

youtu.be/JAOtx5Ki_D0?...

Join me in signing the @australiainstitute.org.au petition demanding more scrutiny nb.australiainstitute.org.au/aukus_parlia...

Join me in signing the @australiainstitute.org.au petition demanding more scrutiny nb.australiainstitute.org.au/aukus_parlia...

How do wars get started?

Australia has two USA manned bases here on OUR land:

🌟 Pine Gap, NT

🌟 the Naval Communication Station Harold E. Holt, Exmouth, WA

Australia needs to close both.

No alliance w' USA

www.abc.net.au/news/2026-01...

How do wars get started?

Australia has two USA manned bases here on OUR land:

🌟 Pine Gap, NT

🌟 the Naval Communication Station Harold E. Holt, Exmouth, WA

Australia needs to close both.

No alliance w' USA

www.abc.net.au/news/2026-01...

It applies to trading too.

It applies to trading too.

Use a stop always......

Use a stop always......

Trading takes "decision making under uncertainty" to a new level. NO exposure to the clowns in the media is the way to go.

Trading takes "decision making under uncertainty" to a new level. NO exposure to the clowns in the media is the way to go.

"Cheaper and safer"

"Cheaper and safer"

That is what moved GBP in 2025.

That is what moved GBP in 2025.

Read the full piece here: thepoint.com.au/opinions/260...

Read the full piece here: thepoint.com.au/opinions/260...

Have you written down all your rules in your own trading plan?

Have you written down all your rules in your own trading plan?

Policy shifts, growth data, and energy prices all played a role.

Fed signals, US data strength, and energy prices led the way.

Fed signals, US data strength, and energy prices led the way.

Contains an ominous warning:

"When the economy they’ve hollowed out seizes up, when the markets they’ve destabilized implode, when the legitimacy of the institutions they’ve captured evaporates......"

Check it out 👇

Contains an ominous warning:

"When the economy they’ve hollowed out seizes up, when the markets they’ve destabilized implode, when the legitimacy of the institutions they’ve captured evaporates......"

Check it out 👇

Our 2025 FX Power Rankings break it down, from the strongest movers to the weakest performers.

Our 2025 FX Power Rankings break it down, from the strongest movers to the weakest performers.