https://trade2infinity.com/

⚠️ None of our content should be considered financial advice.

⚠️ Trading involves significant risk.

⚠️ Trading leveraged products can lead to financial ruin.

👉 Have a plan.

👉 Follow your plan.

👉 Control risk always.

And

👉 Trade small to survive.

Few markets seem to be trending, silver and the yen being the exceptions?

Not a forecast - do your own research.

Prices are still sticky, tariffs are creeping through, and the Fed isn’t ready to blink yet.

Few markets seem to be trending, silver and the yen being the exceptions?

Not a forecast - do your own research.

Use Monte Carlo to investigate your future trading career range of outcomes - especially use it for how you approach risk management.

The universe of your potential future outcomes will surprise you. It did for us.

Use Monte Carlo to investigate your future trading career range of outcomes - especially use it for how you approach risk management.

The universe of your potential future outcomes will surprise you. It did for us.

They are always worth checking out👇

www.citationneeded.news/issue-98/

They are always worth checking out👇

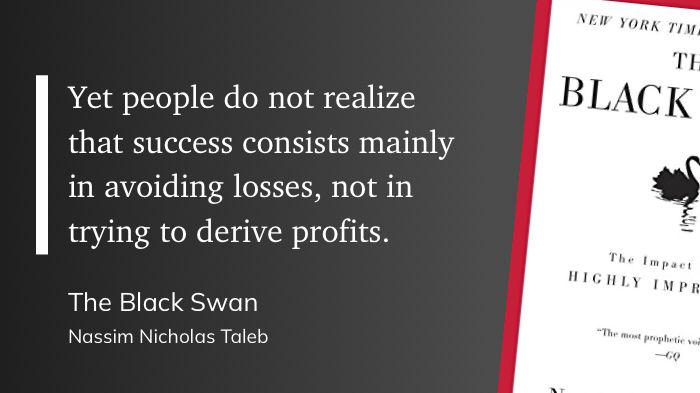

Most of trading consists of risk management and trade management and NOT entries.

Our top ranked would be:

Dr Howard Bandy

Al Brooks

Chris Shea

Akram Najjar

Benoit Mandelbrot

Nassim Taleb

Who's on your list?

Most of trading consists of risk management and trade management and NOT entries.

Our top ranked would be:

Dr Howard Bandy

Al Brooks

Chris Shea

Akram Najjar

Benoit Mandelbrot

Nassim Taleb

Who's on your list?

Our top ranked would be:

Dr Howard Bandy

Al Brooks

Chris Shea

Akram Najjar

Benoit Mandelbrot

Nassim Taleb

Who's on your list?

Will this push markets higher or trigger more uncertainty?

Will this push markets higher or trigger more uncertainty?

Let's have a look at have major FX pairs performed.

Let's have a look at have major FX pairs performed.

Comment below

Comment below

Ed Seykota had some good advice in "Market Wizards" by Jack Schwager on this.

You should pay it some heed. Perhaps it'd be best to model it using Monte Carlo to define how much.

Ed Seykota had some good advice in "Market Wizards" by Jack Schwager on this.

You should pay it some heed. Perhaps it'd be best to model it using Monte Carlo to define how much.

From the Trading Coach, Chris Shea.

From the Trading Coach, Chris Shea.

Use Monte Carlo.

The population of your future trades can tell you a lot of what TO do, and NOT to do.

Use Monte Carlo.

The population of your future trades can tell you a lot of what TO do, and NOT to do.

Let's have a look at have major FX pairs performed.

Let's have a look at have major FX pairs performed.

Stay ahead with the key news events to watch this month.

Stay ahead with the key news events to watch this month.

"I try to keep very conscious of the idea that I have to listen to myself".

Good advice.

"I try to keep very conscious of the idea that I have to listen to myself".

Good advice.

Fortunately Forex Factory does.

Eg if you were day trading the Aussie 200 index yesterday the 10:30 am bar when the CPI was announced was a wild one.

A comprehensive option for report times:

www.forexfactory.com

Fortunately Forex Factory does.

Eg if you were day trading the Aussie 200 index yesterday the 10:30 am bar when the CPI was announced was a wild one.

A comprehensive option for report times:

www.forexfactory.com

Molly is worth following for crypto, financial regulation and USA Govt corruption. ✅

Molly is worth following for crypto, financial regulation and USA Govt corruption. ✅

Perhaps the pullback will test the bottom of the channel / moving average and maybe go again?

Read the full article here https://bit.ly/49FjJQ1

Perhaps the pullback will test the bottom of the channel / moving average and maybe go again?

And don't stay on the wrong side of them. Without a protective stop financial ruin may result.

And don't stay on the wrong side of them. Without a protective stop financial ruin may result.

Stay informed. Stay ahead.

Stay informed. Stay ahead.