Alpesh Paleja

@alpeshpaleja.bsky.social

Deputy Chief Economist at the CBI. All views my own. 🌈

A little overshadowed by the GDP data this morning, but worth noting that households' inflation expectations have crept up again in the latest BoE Inflation Attitudes Survey.

Hhs now expect the CPI rate to be 3.4% in two years time, the highest such expectation since end-2022

Hhs now expect the CPI rate to be 3.4% in two years time, the highest such expectation since end-2022

September 12, 2025 at 9:49 AM

A little overshadowed by the GDP data this morning, but worth noting that households' inflation expectations have crept up again in the latest BoE Inflation Attitudes Survey.

Hhs now expect the CPI rate to be 3.4% in two years time, the highest such expectation since end-2022

Hhs now expect the CPI rate to be 3.4% in two years time, the highest such expectation since end-2022

To note that the ONS' 2025 Blue Book GDP estimates show a much stronger picture for business investment, largely due to higher R&D spending

Capex now estimated to have consistently recovered its COVID decline in Q3 2021 - two years earlier than in the current vintage of data

Capex now estimated to have consistently recovered its COVID decline in Q3 2021 - two years earlier than in the current vintage of data

August 20, 2025 at 1:27 PM

To note that the ONS' 2025 Blue Book GDP estimates show a much stronger picture for business investment, largely due to higher R&D spending

Capex now estimated to have consistently recovered its COVID decline in Q3 2021 - two years earlier than in the current vintage of data

Capex now estimated to have consistently recovered its COVID decline in Q3 2021 - two years earlier than in the current vintage of data

Good chart from Deutsche Bank, showing just how long the BoE's latest easing cycle has been. Assuming a few more rate cuts, it's set to be the longest in post-war history.

August 5, 2025 at 11:51 AM

Good chart from Deutsche Bank, showing just how long the BoE's latest easing cycle has been. Assuming a few more rate cuts, it's set to be the longest in post-war history.

Little movement in the UK GfK consumer #confidence index this month, BUT - the "now is a good time to save index" jumped by 7 points, to its highest since late 2007.

Further illustrates continued caution among households, and focus on rebuilding finances after a tough few years.

Further illustrates continued caution among households, and focus on rebuilding finances after a tough few years.

July 25, 2025 at 10:10 AM

Little movement in the UK GfK consumer #confidence index this month, BUT - the "now is a good time to save index" jumped by 7 points, to its highest since late 2007.

Further illustrates continued caution among households, and focus on rebuilding finances after a tough few years.

Further illustrates continued caution among households, and focus on rebuilding finances after a tough few years.

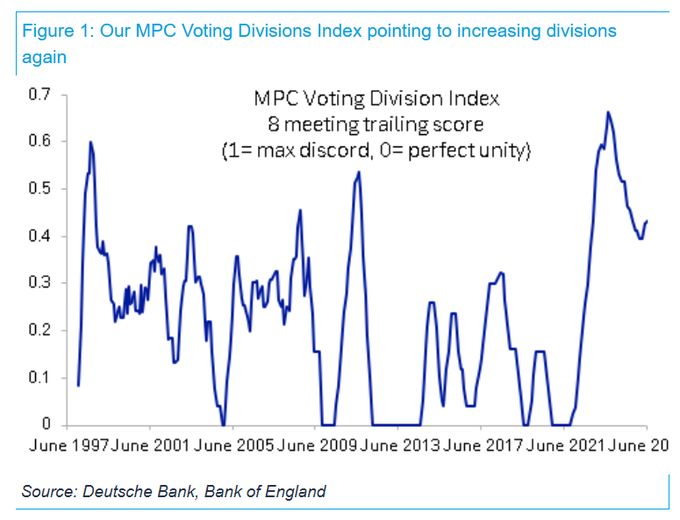

Great chart from Deutsche Bank, showing just how divided the Bank of England's MPC are at the moment. And split views seem to be picking up, as the labour market loosens.

Though divisions within the Committee aren't necessarily a bad thing, of course.

Though divisions within the Committee aren't necessarily a bad thing, of course.

July 22, 2025 at 9:23 AM

Great chart from Deutsche Bank, showing just how divided the Bank of England's MPC are at the moment. And split views seem to be picking up, as the labour market loosens.

Though divisions within the Committee aren't necessarily a bad thing, of course.

Though divisions within the Committee aren't necessarily a bad thing, of course.

Great chart from Goldman Sachs showing the key markets for Iran's oil exports. This is one reason why a full-blown closure of the Strait of Hormuz is a low-likelihood scenario: Iran wouldn't want to impact its top customer (i.e. China) #IranIsraelConflict

June 20, 2025 at 2:46 PM

Great chart from Goldman Sachs showing the key markets for Iran's oil exports. This is one reason why a full-blown closure of the Strait of Hormuz is a low-likelihood scenario: Iran wouldn't want to impact its top customer (i.e. China) #IranIsraelConflict

Households' near-term inflation expectations nudged down a touch in Q2, according to the Bank of England's latest Inflation Attitudes Survey.

But at 3.2%, they remain well above the 2% inflation target, so will likely remain a concern for the MPC.

But at 3.2%, they remain well above the 2% inflation target, so will likely remain a concern for the MPC.

June 13, 2025 at 9:16 AM

Households' near-term inflation expectations nudged down a touch in Q2, according to the Bank of England's latest Inflation Attitudes Survey.

But at 3.2%, they remain well above the 2% inflation target, so will likely remain a concern for the MPC.

But at 3.2%, they remain well above the 2% inflation target, so will likely remain a concern for the MPC.

Our latest #manufacturing survey doesn’t exactly paint a picture of strength – output flat, cost pressures strong and hiring falling.

Also early signs of tariff-related concerns seeping in – big spike in worries over pol-econ conditions abroad, and weakening competitiveness in non-EU markets.

Also early signs of tariff-related concerns seeping in – big spike in worries over pol-econ conditions abroad, and weakening competitiveness in non-EU markets.

April 24, 2025 at 11:02 AM

Our latest #manufacturing survey doesn’t exactly paint a picture of strength – output flat, cost pressures strong and hiring falling.

Also early signs of tariff-related concerns seeping in – big spike in worries over pol-econ conditions abroad, and weakening competitiveness in non-EU markets.

Also early signs of tariff-related concerns seeping in – big spike in worries over pol-econ conditions abroad, and weakening competitiveness in non-EU markets.

Near-term momentum remains weak, according to our latest business surveys. Continued feedback that NICs increase, NLW uprating and concerns over the Employment Rights Bill are hitting activity. And more citations of tariffs uncertainty leading to a pause in some projects

March 28, 2025 at 12:01 PM

Near-term momentum remains weak, according to our latest business surveys. Continued feedback that NICs increase, NLW uprating and concerns over the Employment Rights Bill are hitting activity. And more citations of tariffs uncertainty leading to a pause in some projects

Though growth has actually been revised up further ahead (OBR's own chart below) #SpringStatement

March 26, 2025 at 1:06 PM

Though growth has actually been revised up further ahead (OBR's own chart below) #SpringStatement

Inflation is also expected to be higher this year too, but only minimal changes to the OBR's numbers further ahead. Suggests an assumption of no (or very small) second-round effects (similar to the BoE) #SpringStatement

March 26, 2025 at 1:00 PM

Inflation is also expected to be higher this year too, but only minimal changes to the OBR's numbers further ahead. Suggests an assumption of no (or very small) second-round effects (similar to the BoE) #SpringStatement