Alpesh Paleja

@alpeshpaleja.bsky.social

Deputy Chief Economist at the CBI. All views my own. 🌈

Pinned

Alpesh Paleja

@alpeshpaleja.bsky.social

· May 14

Hello! We’re the economics team at the Confederation of British Industry (CBI). Follow us for posts on UK macroeconomics, our business surveys, tax & fiscal policy, and updates on our consulting work.

We have arrived!

That was a pretty dovish hold by the Monetary Policy Committee, with Andrew Bailey (the deciding vote) particularly more sanguine on upside inflation risks.

December rate cut definitely back on the table.

www.bankofengland.co.uk/monetary-pol...

December rate cut definitely back on the table.

www.bankofengland.co.uk/monetary-pol...

Bank Rate maintained at 4% - November 2025 Monetary Policy Summary and Minutes

Find out more about the Monetary Policy Committee’s latest decision

www.bankofengland.co.uk

November 6, 2025 at 1:48 PM

That was a pretty dovish hold by the Monetary Policy Committee, with Andrew Bailey (the deciding vote) particularly more sanguine on upside inflation risks.

December rate cut definitely back on the table.

www.bankofengland.co.uk/monetary-pol...

December rate cut definitely back on the table.

www.bankofengland.co.uk/monetary-pol...

Reposted by Alpesh Paleja

Some good news for the UK economy: inflation has likely peaked and the labour market shows signs of stabilising.

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

Economy in brief: October 2025 | CBI

Your monthly overview of the major trends impacting the UK’s main business sectors.

www.cbi.org.uk

November 6, 2025 at 11:41 AM

Some good news for the UK economy: inflation has likely peaked and the labour market shows signs of stabilising.

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

Thrilled to join the first episode of The CBI Exchange - our brand new podcast!

Tune in as we unpack the state of the economy ahead of the Budget, speculate on what we might expect from the Chancellor, and outline what business needs to thrive

audioboom.com/posts/880055...

Tune in as we unpack the state of the economy ahead of the Budget, speculate on what we might expect from the Chancellor, and outline what business needs to thrive

audioboom.com/posts/880055...

The CBI Exchange: The Budget Briefing

Join us for a seat at the table with the people shaping the UK economy - from business leaders and economists to the policymakers behind the headlines.

audioboom.com

November 4, 2025 at 4:51 PM

Thrilled to join the first episode of The CBI Exchange - our brand new podcast!

Tune in as we unpack the state of the economy ahead of the Budget, speculate on what we might expect from the Chancellor, and outline what business needs to thrive

audioboom.com/posts/880055...

Tune in as we unpack the state of the economy ahead of the Budget, speculate on what we might expect from the Chancellor, and outline what business needs to thrive

audioboom.com/posts/880055...

Reposted by Alpesh Paleja

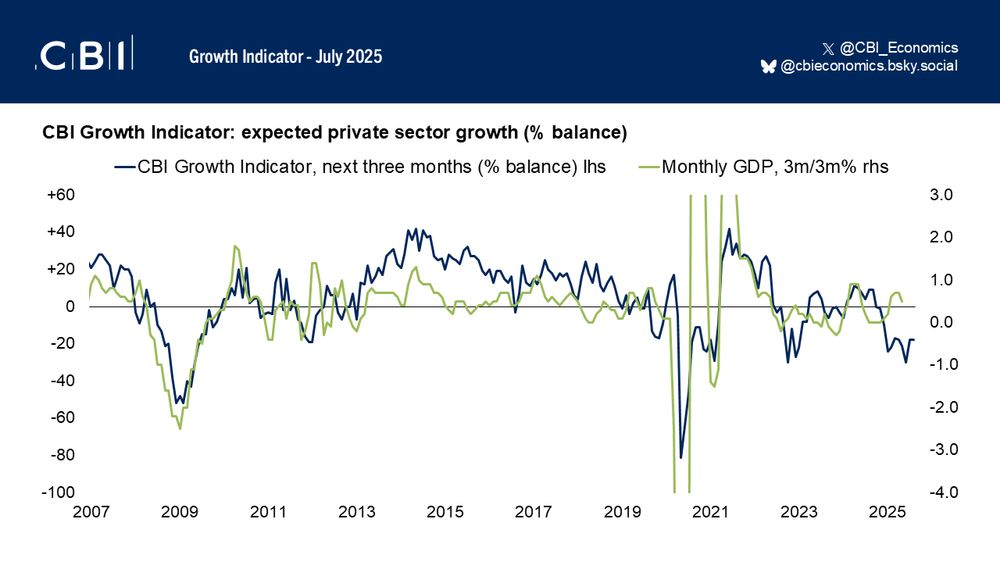

📉 PRIVATE SECTOR DOWNTURN SET TO PERSIST INTO 2026

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

October 29, 2025 at 9:06 AM

📉 PRIVATE SECTOR DOWNTURN SET TO PERSIST INTO 2026

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Reposted by Alpesh Paleja

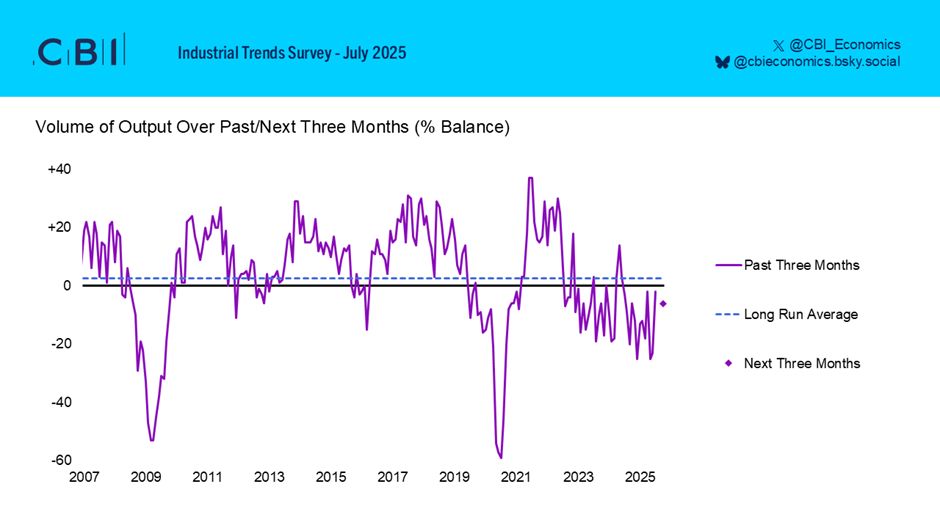

The latest CBI Industrial Trends Survey found that output volumes fell in the quarter to October, at a similar pace to the quarter to September. Firms expect volumes to fall again in the three months to January.

October 23, 2025 at 10:08 AM

The latest CBI Industrial Trends Survey found that output volumes fell in the quarter to October, at a similar pace to the quarter to September. Firms expect volumes to fall again in the three months to January.

Really pleased to be able to host Jon Hall of the Bank of England's FPC this week, for his upcoming speech on the balance between financial stability and long-term economic growth. Link to register below 👇

This Thursday, we're pleased to be hosting Jon Hall, External Member of the Bank of England's Financial Policy Committee, for a discussion on safeguarding UK financial stability while supporting long-term growth.

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

Home - CBI Member Discussion with Jon Hall, External Member of the Bank of England's Financial Policy Committee (FPC)

events.cbi.org.uk

October 20, 2025 at 9:56 AM

Really pleased to be able to host Jon Hall of the Bank of England's FPC this week, for his upcoming speech on the balance between financial stability and long-term economic growth. Link to register below 👇

Reposted by Alpesh Paleja

With weak underlying economic momentum and sticky #inflation, the #MPC is set to tread cautiously. In our September’s Economy in Brief, @alpeshpaleja.bsky.social explores the Bank Rate decision, UK outlook and jittery bond markets.

Read more🔒: www.cbi.org.uk/articles/eco...

Read more🔒: www.cbi.org.uk/articles/eco...

Economy in brief: September 2025 | CBI

Your monthly overview of the major trends impacting the UK’s main business sectors.

www.cbi.org.uk

September 30, 2025 at 9:03 AM

With weak underlying economic momentum and sticky #inflation, the #MPC is set to tread cautiously. In our September’s Economy in Brief, @alpeshpaleja.bsky.social explores the Bank Rate decision, UK outlook and jittery bond markets.

Read more🔒: www.cbi.org.uk/articles/eco...

Read more🔒: www.cbi.org.uk/articles/eco...

A little overshadowed by the GDP data this morning, but worth noting that households' inflation expectations have crept up again in the latest BoE Inflation Attitudes Survey.

Hhs now expect the CPI rate to be 3.4% in two years time, the highest such expectation since end-2022

Hhs now expect the CPI rate to be 3.4% in two years time, the highest such expectation since end-2022

September 12, 2025 at 9:49 AM

A little overshadowed by the GDP data this morning, but worth noting that households' inflation expectations have crept up again in the latest BoE Inflation Attitudes Survey.

Hhs now expect the CPI rate to be 3.4% in two years time, the highest such expectation since end-2022

Hhs now expect the CPI rate to be 3.4% in two years time, the highest such expectation since end-2022

Reposted by Alpesh Paleja

The last week saw a rise in bond yields across advanced economies, reflecting concern in markets about the state of public finances across the G7

Why did yields spike, and why have they remained higher in the UK than elsewhere? Check out our latest note:

www.cbi.org.uk/articles/unp...

Why did yields spike, and why have they remained higher in the UK than elsewhere? Check out our latest note:

www.cbi.org.uk/articles/unp...

Unpacking recent moves in global bond markets | CBI

Bond yields surged across major economies, with Japan’s 30-year hitting a record and UK gilts peaking at 5.75%—the highest since 1998. Turbulence continues.

www.cbi.org.uk

September 5, 2025 at 9:54 AM

The last week saw a rise in bond yields across advanced economies, reflecting concern in markets about the state of public finances across the G7

Why did yields spike, and why have they remained higher in the UK than elsewhere? Check out our latest note:

www.cbi.org.uk/articles/unp...

Why did yields spike, and why have they remained higher in the UK than elsewhere? Check out our latest note:

www.cbi.org.uk/articles/unp...

Reposted by Alpesh Paleja

📈 I've been critical of the ONS in the past, but this is a refreshingly honest account of how they've started to fix issues with retail sales in the past few weeks. Let's hope they can adopt this approach across other published statistics: blog.ons.gov.uk/2025/09/05/c...

Correcting the record on retail sales, improving quality across economic statistics

Under new senior leadership the ONS is urgently focusing its resources on core economic statistics as part of a wider strategic recovery plan. In this post, incoming Director General for economic soci

blog.ons.gov.uk

September 5, 2025 at 7:11 AM

📈 I've been critical of the ONS in the past, but this is a refreshingly honest account of how they've started to fix issues with retail sales in the past few weeks. Let's hope they can adopt this approach across other published statistics: blog.ons.gov.uk/2025/09/05/c...

Reposted by Alpesh Paleja

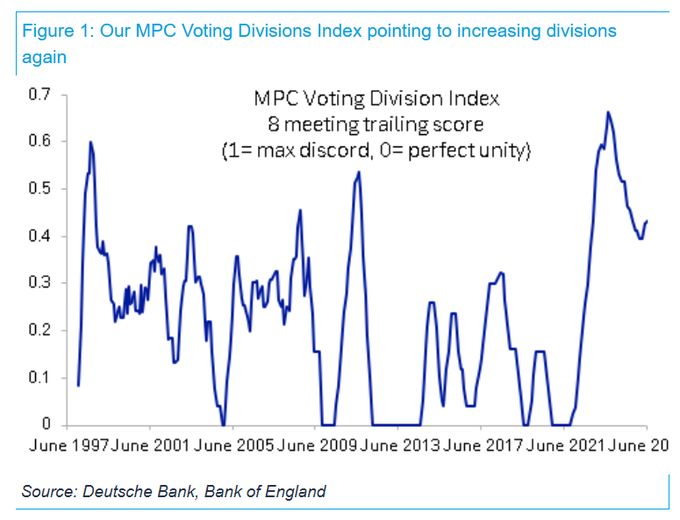

Sticky inflation vs a cooling labour market — a tough trade-off for the MPC.

In our latest Economy in Brief, @alpeshpaleja.bsky.social unpacks:

· Why the MPC is so divided

· Mixed signals on UK growth

· What’s next for private sector activity

Read more: www.cbi.org.uk/articles/eco...

In our latest Economy in Brief, @alpeshpaleja.bsky.social unpacks:

· Why the MPC is so divided

· Mixed signals on UK growth

· What’s next for private sector activity

Read more: www.cbi.org.uk/articles/eco...

Economy in brief: August 2025 | CBI

Your monthly guide to the UK economy, giving you a monthly overview of the major trends impacting the UK's main business sectors.

www.cbi.org.uk

September 2, 2025 at 11:28 AM

Sticky inflation vs a cooling labour market — a tough trade-off for the MPC.

In our latest Economy in Brief, @alpeshpaleja.bsky.social unpacks:

· Why the MPC is so divided

· Mixed signals on UK growth

· What’s next for private sector activity

Read more: www.cbi.org.uk/articles/eco...

In our latest Economy in Brief, @alpeshpaleja.bsky.social unpacks:

· Why the MPC is so divided

· Mixed signals on UK growth

· What’s next for private sector activity

Read more: www.cbi.org.uk/articles/eco...

Reposted by Alpesh Paleja

This week is the #NobelPrize meeting 🎓

Since the Economics prize was introduced in 1969, over half of all laureates have been US–born.

Last year’s laureates: Daron Acemoglu 🇹🇷, James Robinson 🇺🇸🇬🇧 & Simon Johnson 🇬🇧, won for their research on institutions, growth & inequality.

#ChartOfTheDay

Since the Economics prize was introduced in 1969, over half of all laureates have been US–born.

Last year’s laureates: Daron Acemoglu 🇹🇷, James Robinson 🇺🇸🇬🇧 & Simon Johnson 🇬🇧, won for their research on institutions, growth & inequality.

#ChartOfTheDay

August 27, 2025 at 9:02 AM

This week is the #NobelPrize meeting 🎓

Since the Economics prize was introduced in 1969, over half of all laureates have been US–born.

Last year’s laureates: Daron Acemoglu 🇹🇷, James Robinson 🇺🇸🇬🇧 & Simon Johnson 🇬🇧, won for their research on institutions, growth & inequality.

#ChartOfTheDay

Since the Economics prize was introduced in 1969, over half of all laureates have been US–born.

Last year’s laureates: Daron Acemoglu 🇹🇷, James Robinson 🇺🇸🇬🇧 & Simon Johnson 🇬🇧, won for their research on institutions, growth & inequality.

#ChartOfTheDay

A characteristically hawkish speech from Catherine Mann, mostly focusing on the dangers of inflation persistence. But she leaves the door open to voting for "forceful policy action" if downside risks to growth materialise:

www.bankofengland.co.uk/speech/2025/...

www.bankofengland.co.uk/speech/2025/...

Five ‘C’s for Central Bank Research − speech by Catherine L. Mann

Given at The Future of Central Banking conference on the occasion of the 100th Anniversary, Banco de México

www.bankofengland.co.uk

August 26, 2025 at 4:34 PM

A characteristically hawkish speech from Catherine Mann, mostly focusing on the dangers of inflation persistence. But she leaves the door open to voting for "forceful policy action" if downside risks to growth materialise:

www.bankofengland.co.uk/speech/2025/...

www.bankofengland.co.uk/speech/2025/...

Our latest #manufacturing survey continues to paint an un-pretty picture of activity, chiming with the weakness in this morning's flash manufacturing PMI. More below 👇

The latest CBI Industrial Trends Survey found that manufacturing output volumes fell in the three months to August, after being broadly unchanged in the three months to July. Manufacturers expect output volumes to decline again in the next three months.

August 21, 2025 at 1:33 PM

Our latest #manufacturing survey continues to paint an un-pretty picture of activity, chiming with the weakness in this morning's flash manufacturing PMI. More below 👇

To note that the ONS' 2025 Blue Book GDP estimates show a much stronger picture for business investment, largely due to higher R&D spending

Capex now estimated to have consistently recovered its COVID decline in Q3 2021 - two years earlier than in the current vintage of data

Capex now estimated to have consistently recovered its COVID decline in Q3 2021 - two years earlier than in the current vintage of data

August 20, 2025 at 1:27 PM

To note that the ONS' 2025 Blue Book GDP estimates show a much stronger picture for business investment, largely due to higher R&D spending

Capex now estimated to have consistently recovered its COVID decline in Q3 2021 - two years earlier than in the current vintage of data

Capex now estimated to have consistently recovered its COVID decline in Q3 2021 - two years earlier than in the current vintage of data

Reposted by Alpesh Paleja

Slightly worrying that the publication of the ONS' retail sales statistics has been delayed with such little notice.

August 19, 2025 at 9:44 AM

Slightly worrying that the publication of the ONS' retail sales statistics has been delayed with such little notice.

Reposted by Alpesh Paleja

Weak growth, stubborn inflation

The Bank of England faces a tough trade-off, with cautious rate cuts amid a loosening jobs market. Wage pressures are easing slowly, but risks remain.

This month's Economy in Brief from @alpeshpaleja.bsky.social breaks it down: t.co/0RouuL0j4W 🔒

The Bank of England faces a tough trade-off, with cautious rate cuts amid a loosening jobs market. Wage pressures are easing slowly, but risks remain.

This month's Economy in Brief from @alpeshpaleja.bsky.social breaks it down: t.co/0RouuL0j4W 🔒

https://www.cbi.org.uk/articles/economy-in-brief-july-2025/

t.co

July 31, 2025 at 9:29 AM

Weak growth, stubborn inflation

The Bank of England faces a tough trade-off, with cautious rate cuts amid a loosening jobs market. Wage pressures are easing slowly, but risks remain.

This month's Economy in Brief from @alpeshpaleja.bsky.social breaks it down: t.co/0RouuL0j4W 🔒

The Bank of England faces a tough trade-off, with cautious rate cuts amid a loosening jobs market. Wage pressures are easing slowly, but risks remain.

This month's Economy in Brief from @alpeshpaleja.bsky.social breaks it down: t.co/0RouuL0j4W 🔒

Good chart from Deutsche Bank, showing just how long the BoE's latest easing cycle has been. Assuming a few more rate cuts, it's set to be the longest in post-war history.

August 5, 2025 at 11:51 AM

Good chart from Deutsche Bank, showing just how long the BoE's latest easing cycle has been. Assuming a few more rate cuts, it's set to be the longest in post-war history.

Reposted by Alpesh Paleja

Today marks a milestone! 🎉 The CBI is proud to celebrate 60 years of championing business growth, driving change, and influencing policy.

Find out more about becoming a member: orlo.uk/Lu9zw

Here’s to the next 60 years! 💼

#CBI60 #VoiceOfBusiness #BusinessGrowth

Find out more about becoming a member: orlo.uk/Lu9zw

Here’s to the next 60 years! 💼

#CBI60 #VoiceOfBusiness #BusinessGrowth

July 30, 2025 at 9:16 AM

Today marks a milestone! 🎉 The CBI is proud to celebrate 60 years of championing business growth, driving change, and influencing policy.

Find out more about becoming a member: orlo.uk/Lu9zw

Here’s to the next 60 years! 💼

#CBI60 #VoiceOfBusiness #BusinessGrowth

Find out more about becoming a member: orlo.uk/Lu9zw

Here’s to the next 60 years! 💼

#CBI60 #VoiceOfBusiness #BusinessGrowth

Growth momentum remained weak going into Q3, according to our latest surveys. Continued headwinds from higher employment costs, energy prices and global volatility. Businesses cite a growing focus on managing costs and streamlining processes

Read our full take below 👇

Read our full take below 👇

📉 Private sector firms expect activity to fall again through October.

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

July 30, 2025 at 9:14 AM

Growth momentum remained weak going into Q3, according to our latest surveys. Continued headwinds from higher employment costs, energy prices and global volatility. Businesses cite a growing focus on managing costs and streamlining processes

Read our full take below 👇

Read our full take below 👇

Little movement in the UK GfK consumer #confidence index this month, BUT - the "now is a good time to save index" jumped by 7 points, to its highest since late 2007.

Further illustrates continued caution among households, and focus on rebuilding finances after a tough few years.

Further illustrates continued caution among households, and focus on rebuilding finances after a tough few years.

July 25, 2025 at 10:10 AM

Little movement in the UK GfK consumer #confidence index this month, BUT - the "now is a good time to save index" jumped by 7 points, to its highest since late 2007.

Further illustrates continued caution among households, and focus on rebuilding finances after a tough few years.

Further illustrates continued caution among households, and focus on rebuilding finances after a tough few years.

"Economics today resembles Catholic theology in medieval Europe: a rigid doctrine guarded by a modern priesthood who claim to possess the sole truth"

Great piece by Ha-Joon Chang, referencing the ongoing work of @rethinkecon.bsky.social

www.ft.com/content/9aab...

Great piece by Ha-Joon Chang, referencing the ongoing work of @rethinkecon.bsky.social

www.ft.com/content/9aab...

Economics teaching has become the Aeroflot of ideas

The discipline is failing students by ignoring the biggest social, political and ecological challenges facing the world today

www.ft.com

July 24, 2025 at 3:46 PM

"Economics today resembles Catholic theology in medieval Europe: a rigid doctrine guarded by a modern priesthood who claim to possess the sole truth"

Great piece by Ha-Joon Chang, referencing the ongoing work of @rethinkecon.bsky.social

www.ft.com/content/9aab...

Great piece by Ha-Joon Chang, referencing the ongoing work of @rethinkecon.bsky.social

www.ft.com/content/9aab...

Reposted by Alpesh Paleja

The latest CBI Industrial Trends Survey found that output volumes were broadly unchanged in the quarter to July. Firms expect volumes to fall slightly in the three months to October. #ITS

July 24, 2025 at 10:07 AM

The latest CBI Industrial Trends Survey found that output volumes were broadly unchanged in the quarter to July. Firms expect volumes to fall slightly in the three months to October. #ITS

Great chart from Deutsche Bank, showing just how divided the Bank of England's MPC are at the moment. And split views seem to be picking up, as the labour market loosens.

Though divisions within the Committee aren't necessarily a bad thing, of course.

Though divisions within the Committee aren't necessarily a bad thing, of course.

July 22, 2025 at 9:23 AM

Great chart from Deutsche Bank, showing just how divided the Bank of England's MPC are at the moment. And split views seem to be picking up, as the labour market loosens.

Though divisions within the Committee aren't necessarily a bad thing, of course.

Though divisions within the Committee aren't necessarily a bad thing, of course.

London waking up this morning #heatwave2025

a woman is standing in the rain with her head in her hands .

ALT: a woman is standing in the rain with her head in her hands .

media.tenor.com

July 2, 2025 at 5:59 AM

London waking up this morning #heatwave2025