www.alexandermackay.org

@andreyfradkin.bsky.social , is now available as an NBER working paper.

@nber.org link: nber.org/papers/w34135

@ssrn.bsky.social link: ssrn.com/abstract=538...

#EconSky

@andreyfradkin.bsky.social , is now available as an NBER working paper.

@nber.org link: nber.org/papers/w34135

@ssrn.bsky.social link: ssrn.com/abstract=538...

#EconSky

Even corrections for self-preferencing can reduce consumer welfare, as we show in the paper.

Even corrections for self-preferencing can reduce consumer welfare, as we show in the paper.

This effect varies a lot across categories. We found the largest benefits in acid reducers and batteries.

This effect varies a lot across categories. We found the largest benefits in acid reducers and batteries.

1. Consumers select similar products when Amazon brands are not available

2. No evidence for changes in search behavior

3. No evidence for shifts to other retailers

Despite these findings, we still found that consumers valued Amazon brands!

1. Consumers select similar products when Amazon brands are not available

2. No evidence for changes in search behavior

3. No evidence for shifts to other retailers

Despite these findings, we still found that consumers valued Amazon brands!

We then looked at:

- What products were selected in their absence

- If consumer search behavior changed

- If consumers went to other retail websites more often

We then looked at:

- What products were selected in their absence

- If consumer search behavior changed

- If consumers went to other retail websites more often

@nberpubs

link here: nber.org/papers/w34110

Also available on SSRN: dx.doi.org/10.2139/ssrn...

Joint with Santiago Alvarez-Blaser, Alberto Cavallo, and Paolo Mengano

#econsky

@nberpubs

link here: nber.org/papers/w34110

Also available on SSRN: dx.doi.org/10.2139/ssrn...

Joint with Santiago Alvarez-Blaser, Alberto Cavallo, and Paolo Mengano

#econsky

We evaluate the drivers of this leverage. The manufacturer gets a higher split with (e.g.) lower costs and greater market penetration.

We evaluate the drivers of this leverage. The manufacturer gets a higher split with (e.g.) lower costs and greater market penetration.

1. The manufacturer proposes downstream retail prices.

2. The manufacturer and retailers bargain over the wholesale price (and/or lump sum transfers).

1. The manufacturer proposes downstream retail prices.

2. The manufacturer and retailers bargain over the wholesale price (and/or lump sum transfers).

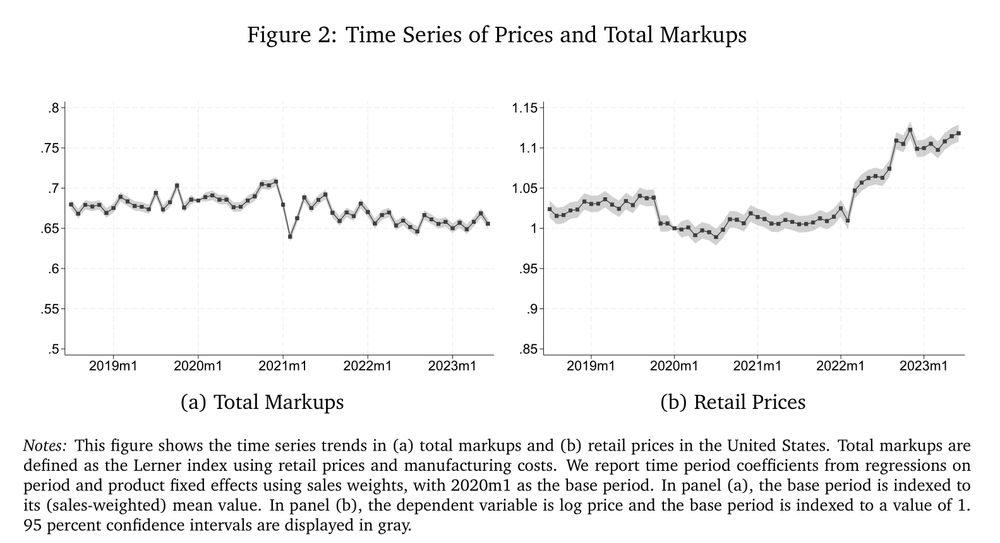

The movements offset each other, leading to stable total markups.

The movements offset each other, leading to stable total markups.

Retail prices increase starting in 2022, coinciding with general inflation.

But there is no increase in total markups, i.e., no evidence for "greedflation."

Retail prices increase starting in 2022, coinciding with general inflation.

But there is no increase in total markups, i.e., no evidence for "greedflation."

This is joint work with Zach Brown. Comments welcome.

I'll wrap up this thread with a question:

What are some examples where you think pricing speed matters?

This is joint work with Zach Brown. Comments welcome.

I'll wrap up this thread with a question:

What are some examples where you think pricing speed matters?