Job postings: data.indeed.com#/postings

Remote work: data.indeed.com#/remote

AI and GenAI: data.indeed.com#/ai

Wage growth: data.indeed.com#/wages (not available in Australia)

Check it out!

The underemployment rate jumped to 6.2% (from 5.7% last month), which pushed the underutilisation rate to 10.5% (from 10.1%) #ausbiz #auspol

It's also the cause of softer job gains this year, with the industry growing just +34k jobs over the past year (down from +176k)

It's also the cause of softer job gains this year, with the industry growing just +34k jobs over the past year (down from +176k)

But it is concerning, particularly because we'd enter this hiking cycle with a softer job market and mediocre economy.

But it is concerning, particularly because we'd enter this hiking cycle with a softer job market and mediocre economy.

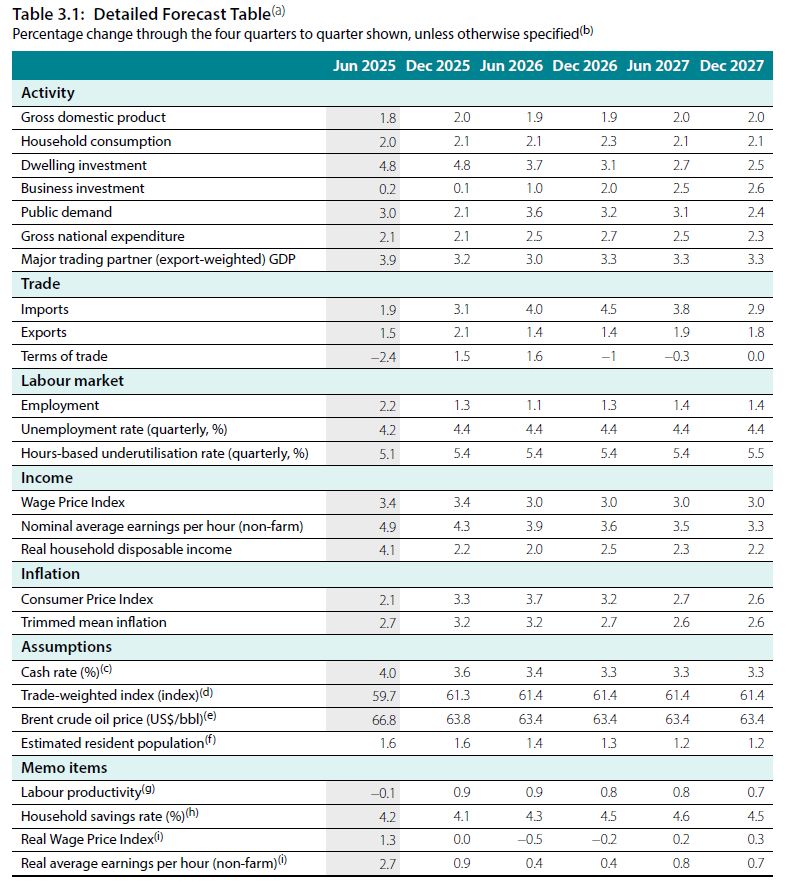

Trimmed mean inflation revised higher (3.2% in Dec-25 compared to 2.6% previously).

Unemployment rate revised higher (4.4% in Dec-25 compared to 4.3% previously). This one seems too optimistic to me!

Trimmed mean inflation revised higher (3.2% in Dec-25 compared to 2.6% previously).

Unemployment rate revised higher (4.4% in Dec-25 compared to 4.3% previously). This one seems too optimistic to me!

And if you are wondering why it's because employment growth has slowed significantly. Up 116k from January to September this year, compared to 323k over the same period last year #ausbiz #auspol

Employment is up just 103k this year, compared to +282k over the same period last year.

If that doesn't pick up soon, a spike in the unemployment rate is inevitable #ausbiz #auspol

Employment is up just 103k this year, compared to +282k over the same period last year.

If that doesn't pick up soon, a spike in the unemployment rate is inevitable #ausbiz #auspol

By comparison, consumer prices have increased by 2% over the past year.

By comparison, consumer prices have increased by 2% over the past year.

And yet the debate is dominated by tweaks to tax policy #auspol

And yet the debate is dominated by tweaks to tax policy #auspol

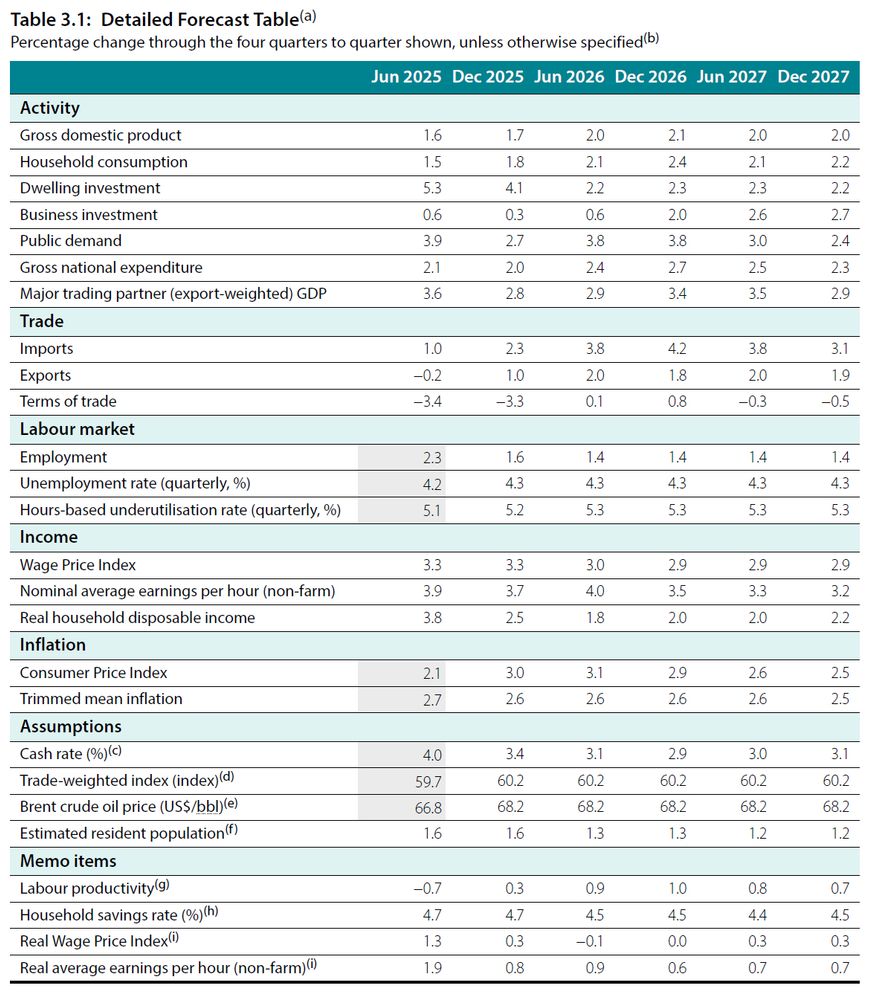

Unemployment and inflation forecasts unchanged from 3 months ago.

GDP growth 1.7% in Dec 2025 (vs 2.1% previously) and 2.1% in Dec 2026 (vs 2.2%).

Cash rate is assumed to drop to 2.9% in the Dec quarter next year, compared to 3.6% as of today #ausbiz

Unemployment and inflation forecasts unchanged from 3 months ago.

GDP growth 1.7% in Dec 2025 (vs 2.1% previously) and 2.1% in Dec 2026 (vs 2.2%).

Cash rate is assumed to drop to 2.9% in the Dec quarter next year, compared to 3.6% as of today #ausbiz