The underemployment rate jumped to 6.2% (from 5.7% last month), which pushed the underutilisation rate to 10.5% (from 10.1%) #ausbiz #auspol

It's also the cause of softer job gains this year, with the industry growing just +34k jobs over the past year (down from +176k)

It's also the cause of softer job gains this year, with the industry growing just +34k jobs over the past year (down from +176k)

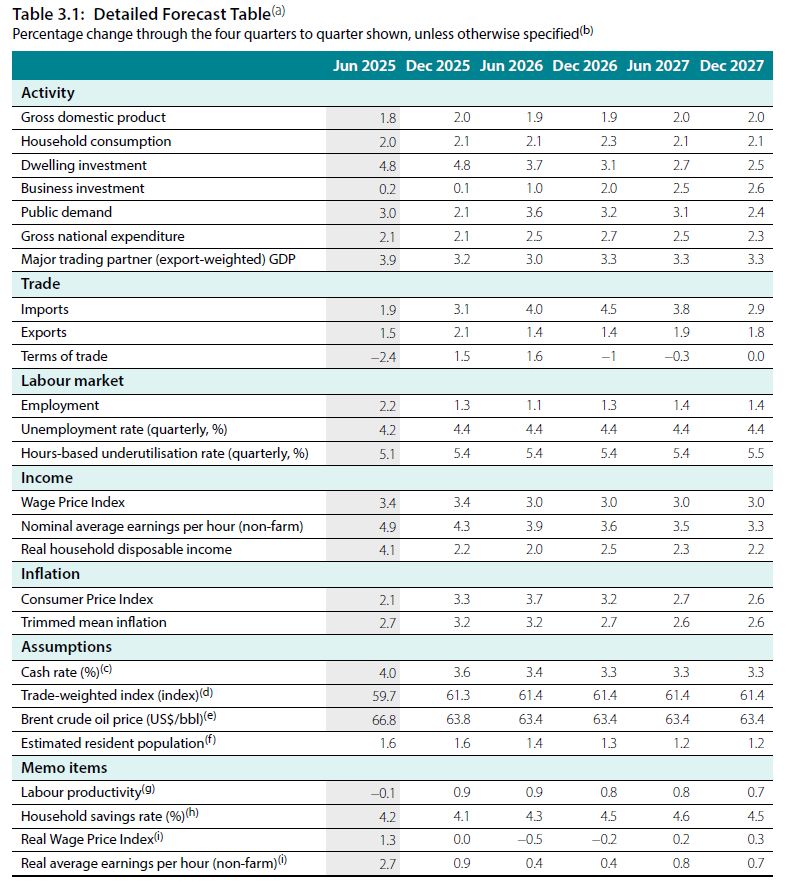

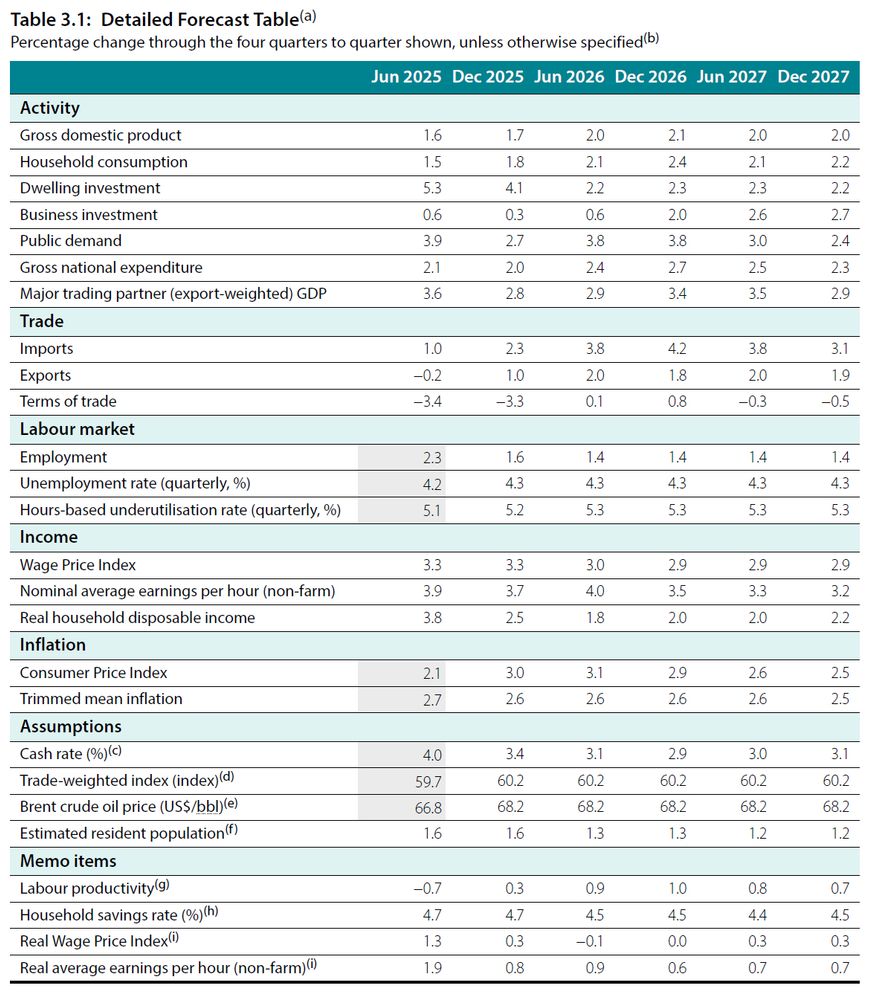

Trimmed mean inflation revised higher (3.2% in Dec-25 compared to 2.6% previously).

Unemployment rate revised higher (4.4% in Dec-25 compared to 4.3% previously). This one seems too optimistic to me!

Trimmed mean inflation revised higher (3.2% in Dec-25 compared to 2.6% previously).

Unemployment rate revised higher (4.4% in Dec-25 compared to 4.3% previously). This one seems too optimistic to me!

And if you are wondering why it's because employment growth has slowed significantly. Up 116k from January to September this year, compared to 323k over the same period last year #ausbiz #auspol

Employment is up just 103k this year, compared to +282k over the same period last year.

If that doesn't pick up soon, a spike in the unemployment rate is inevitable #ausbiz #auspol

And based on the latest RBA forecasts - released yesterday - we aren't expecting any further improvement this year or next.

And based on the latest RBA forecasts - released yesterday - we aren't expecting any further improvement this year or next.

By comparison, consumer prices have increased by 2% over the past year.

By comparison, consumer prices have increased by 2% over the past year.

Interestingly, US merchandise imports are pretty much in line with 2024 levels; fewer imports from China but more from other countries.

Interestingly, US merchandise imports are pretty much in line with 2024 levels; fewer imports from China but more from other countries.

And yet the debate is dominated by tweaks to tax policy #auspol

And yet the debate is dominated by tweaks to tax policy #auspol

Unemployment and inflation forecasts unchanged from 3 months ago.

GDP growth 1.7% in Dec 2025 (vs 2.1% previously) and 2.1% in Dec 2026 (vs 2.2%).

Cash rate is assumed to drop to 2.9% in the Dec quarter next year, compared to 3.6% as of today #ausbiz

Unemployment and inflation forecasts unchanged from 3 months ago.

GDP growth 1.7% in Dec 2025 (vs 2.1% previously) and 2.1% in Dec 2026 (vs 2.2%).

Cash rate is assumed to drop to 2.9% in the Dec quarter next year, compared to 3.6% as of today #ausbiz

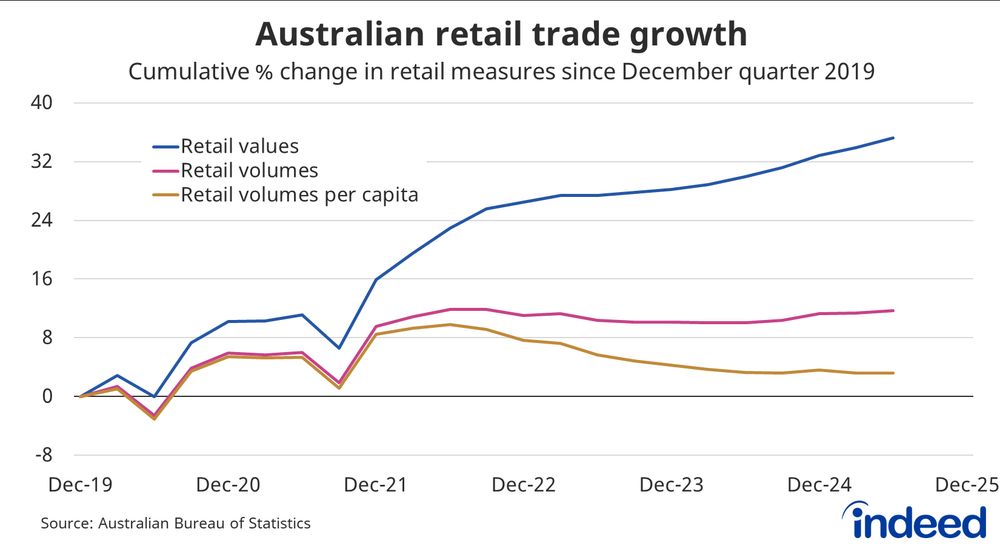

But the volume of goods sold has been broadly unchanged in recent years, due to higher prices.

And volume per capita is almost 6% below its peak.

So we are spending more, but consuming less #ausbiz

But the volume of goods sold has been broadly unchanged in recent years, due to higher prices.

And volume per capita is almost 6% below its peak.

So we are spending more, but consuming less #ausbiz

That's a good sign that domestic price pressures have eased.

That's a good sign that domestic price pressures have eased.

The RBA has achieved its inflation target over the past decade and they've achieved it by pretty consistently missing the target most years.

Undershooting in the years before the pandemic and then overshooting during the cost-of-living crisis.

The RBA has achieved its inflation target over the past decade and they've achieved it by pretty consistently missing the target most years.

Undershooting in the years before the pandemic and then overshooting during the cost-of-living crisis.