CBI Economics

@cbieconomics.bsky.social

Posts from the economics directorate of the CBI. Follow us for updates and analysis on the UK economy, tax & fiscal policy, our business surveys, and consulting projects.

Here are the key UK economic data releases for this week

November 10, 2025 at 9:01 AM

Here are the key UK economic data releases for this week

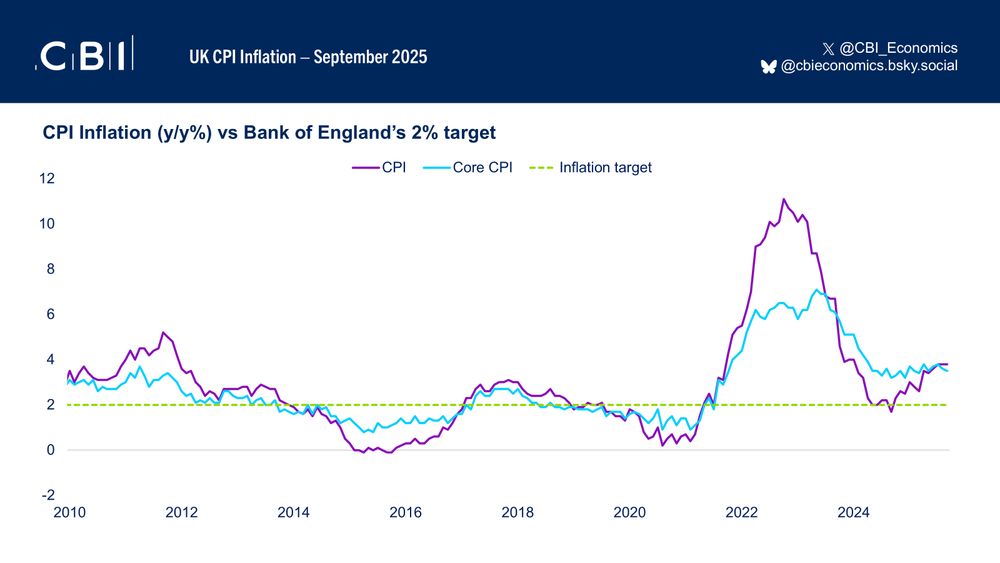

The Bank expects CPI inflation to have peaked (at 3.8% in September). Looking ahead, inflation is projected to slow over the forecast, gradually returning to 2% in mid-2027.

November 6, 2025 at 1:10 PM

The Bank expects CPI inflation to have peaked (at 3.8% in September). Looking ahead, inflation is projected to slow over the forecast, gradually returning to 2% in mid-2027.

The Bank of England’s latest forecast expects economic activity to remain subdued, with GDP growth projected to be 1.5% in 2025, 1.2% in 2026, picking up to 1.6% in 2027 and 1.8% in 2028.

November 6, 2025 at 1:10 PM

The Bank of England’s latest forecast expects economic activity to remain subdued, with GDP growth projected to be 1.5% in 2025, 1.2% in 2026, picking up to 1.6% in 2027 and 1.8% in 2028.

The Bank of England’s Monetary Policy Committee (MPC) voted 5-4 to leave Bank Rate at 4%. The majority bloc voted to keep rates on hold due to concerns over inflation persistence, driven by higher inflation expectations and structural shifts which may have led to greater inflation persistence .

November 6, 2025 at 1:10 PM

The Bank of England’s Monetary Policy Committee (MPC) voted 5-4 to leave Bank Rate at 4%. The majority bloc voted to keep rates on hold due to concerns over inflation persistence, driven by higher inflation expectations and structural shifts which may have led to greater inflation persistence .

Here are the key UK economic data releases and events for this week

November 3, 2025 at 9:06 AM

Here are the key UK economic data releases and events for this week

📊Firms expect to see further declines into early 2026:

• Business & professional services: -12%

• Consumer services: -28%

• Distribution: -34%

• Manufacturing: -19%

[Figures shown are net balances – the percentage of firms expecting an increase minus those expecting a decrease]

• Business & professional services: -12%

• Consumer services: -28%

• Distribution: -34%

• Manufacturing: -19%

[Figures shown are net balances – the percentage of firms expecting an increase minus those expecting a decrease]

October 29, 2025 at 9:06 AM

📊Firms expect to see further declines into early 2026:

• Business & professional services: -12%

• Consumer services: -28%

• Distribution: -34%

• Manufacturing: -19%

[Figures shown are net balances – the percentage of firms expecting an increase minus those expecting a decrease]

• Business & professional services: -12%

• Consumer services: -28%

• Distribution: -34%

• Manufacturing: -19%

[Figures shown are net balances – the percentage of firms expecting an increase minus those expecting a decrease]

📉 PRIVATE SECTOR DOWNTURN SET TO PERSIST INTO 2026

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

October 29, 2025 at 9:06 AM

📉 PRIVATE SECTOR DOWNTURN SET TO PERSIST INTO 2026

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Total distribution sales volumes (including retail, wholesale, and motor trades) continued to fall at a firm rate in the year to October. Firms expect the downturn to deepen next month.

October 27, 2025 at 11:06 AM

Total distribution sales volumes (including retail, wholesale, and motor trades) continued to fall at a firm rate in the year to October. Firms expect the downturn to deepen next month.

Wholesalers reported another difficult trading month, with annual sales volumes falling at a fast rate in October. Sales are expected to decline at a slightly quicker pace next month.

October 27, 2025 at 11:06 AM

Wholesalers reported another difficult trading month, with annual sales volumes falling at a fast rate in October. Sales are expected to decline at a slightly quicker pace next month.

Internet sales volumes grew slightly in the year to October but are expected to contract at a modest pace next month.

October 27, 2025 at 11:06 AM

Internet sales volumes grew slightly in the year to October but are expected to contract at a modest pace next month.

Retail sales for the time of year were seen as “poor” in October, to a similar extent as last month. Retailers expect sales to remain below seasonal norms in November.

October 27, 2025 at 11:06 AM

Retail sales for the time of year were seen as “poor” in October, to a similar extent as last month. Retailers expect sales to remain below seasonal norms in November.

Year-on-year retail sales volumes fell at a strong rate in October amid weak consumer confidence and Budget concerns - according to the latest CBI DTS. Retailers expect the 13-month-long downturn to extend into November.

October 27, 2025 at 11:06 AM

Year-on-year retail sales volumes fell at a strong rate in October amid weak consumer confidence and Budget concerns - according to the latest CBI DTS. Retailers expect the 13-month-long downturn to extend into November.

September’s growth was largely driven by non-store retailers’ sales volumes, with sales volumes at a three-year-high. In particular, online jewellers reported strong demand for gold, while computer and telecoms sales also rose firmly, possibly boosted by new tech launches.

October 24, 2025 at 9:42 AM

September’s growth was largely driven by non-store retailers’ sales volumes, with sales volumes at a three-year-high. In particular, online jewellers reported strong demand for gold, while computer and telecoms sales also rose firmly, possibly boosted by new tech launches.

Retail sales volumes rose by 0.5% m/m in September (from 0.6% in August), marking a fourth consecutive month of growth. Over Q3 as a whole, sales rose to their highest level in three years (by 0.9%), boosted in part by the good weather seen over the summer.

October 24, 2025 at 9:42 AM

Retail sales volumes rose by 0.5% m/m in September (from 0.6% in August), marking a fourth consecutive month of growth. Over Q3 as a whole, sales rose to their highest level in three years (by 0.9%), boosted in part by the good weather seen over the summer.

Numbers employed fell in the quarter to October, at the fastest pace in five years. Manufacturers expect another fall in employment in the quarter to January.

October 23, 2025 at 10:08 AM

Numbers employed fell in the quarter to October, at the fastest pace in five years. Manufacturers expect another fall in employment in the quarter to January.

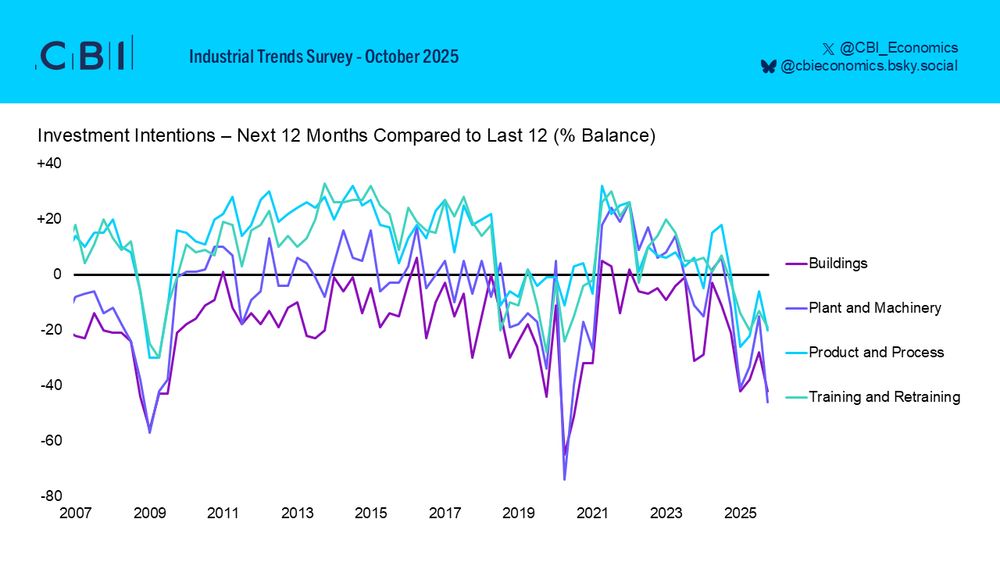

The main constraint on investment was uncertainty about demand, followed by inadequate net return, and a shortage of internal finance.

October 23, 2025 at 10:08 AM

The main constraint on investment was uncertainty about demand, followed by inadequate net return, and a shortage of internal finance.

Investment intentions for the year ahead have deteriorated. Manufacturers expect to reduce investment in plant & machinery, in buildings, in product & process innovation, and in training & retraining.

October 23, 2025 at 10:08 AM

Investment intentions for the year ahead have deteriorated. Manufacturers expect to reduce investment in plant & machinery, in buildings, in product & process innovation, and in training & retraining.

Average costs rose in the quarter to October at an elevated pace. Costs growth is expected to remain historically strong in the quarter to January. Both domestic and export prices are anticipated to rise in the next three months at an above average pace.

October 23, 2025 at 10:08 AM

Average costs rose in the quarter to October at an elevated pace. Costs growth is expected to remain historically strong in the quarter to January. Both domestic and export prices are anticipated to rise in the next three months at an above average pace.

Business sentiment deteriorated in October. Export optimism for the year ahead also declined further.

October 23, 2025 at 10:08 AM

Business sentiment deteriorated in October. Export optimism for the year ahead also declined further.

Manufacturing competitiveness deteriorated across all major markets in the three months to October. Competitiveness is expected to worsen again in the three months to January.

October 23, 2025 at 10:08 AM

Manufacturing competitiveness deteriorated across all major markets in the three months to October. Competitiveness is expected to worsen again in the three months to January.

Total new orders fell through the quarter, reflecting the fastest pace of decline since July 2020 for both domestic and export orders. Manufacturers expect the total volume of new orders to decline again in the three months to January.

October 23, 2025 at 10:08 AM

Total new orders fell through the quarter, reflecting the fastest pace of decline since July 2020 for both domestic and export orders. Manufacturers expect the total volume of new orders to decline again in the three months to January.

The latest CBI Industrial Trends Survey found that output volumes fell in the quarter to October, at a similar pace to the quarter to September. Firms expect volumes to fall again in the three months to January.

October 23, 2025 at 10:08 AM

The latest CBI Industrial Trends Survey found that output volumes fell in the quarter to October, at a similar pace to the quarter to September. Firms expect volumes to fall again in the three months to January.

Unchanged #inflation in September reflected a large upward contribution from transport being offset by downward contributions from other categories, including recreation & culture and food & drink

October 22, 2025 at 9:19 AM

Unchanged #inflation in September reflected a large upward contribution from transport being offset by downward contributions from other categories, including recreation & culture and food & drink

UK #CPI inflation held steady at 3.8% in the year to September, undershooting consensus expectations (of 4.0%). Core CPI inflation (excl. energy, food, alcohol, and tobacco) eased slightly to 3.5% (from 3.6% in August)

October 22, 2025 at 9:19 AM

UK #CPI inflation held steady at 3.8% in the year to September, undershooting consensus expectations (of 4.0%). Core CPI inflation (excl. energy, food, alcohol, and tobacco) eased slightly to 3.5% (from 3.6% in August)

Here are the key UK economic data releases for this week

October 20, 2025 at 8:07 AM

Here are the key UK economic data releases for this week