CBI Economics

@cbieconomics.bsky.social

Posts from the economics directorate of the CBI. Follow us for updates and analysis on the UK economy, tax & fiscal policy, our business surveys, and consulting projects.

Reposted by CBI Economics

A surprisingly bad set of labour market stats this morning. The story I was prepared for was "some weakening, but the shake out from the early part of the year is behind us". But it's worse than that - payroll jobs falling again, unemployment now up at 5%.

Here is our PN

Here is our PN

November 11, 2025 at 7:55 AM

A surprisingly bad set of labour market stats this morning. The story I was prepared for was "some weakening, but the shake out from the early part of the year is behind us". But it's worse than that - payroll jobs falling again, unemployment now up at 5%.

Here is our PN

Here is our PN

Here are the key UK economic data releases for this week

November 10, 2025 at 9:01 AM

Here are the key UK economic data releases for this week

Reposted by CBI Economics

The BoE's MPC kept Bank Rate at 4% today, as it waits to see further disinflationary progress.

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

The Bank of England’s Monetary Policy Committee (MPC) voted 5-4 to leave Bank Rate at 4%. The majority bloc voted to keep rates on hold due to concerns over inflation persistence, driven by higher inflation expectations and structural shifts which may have led to greater inflation persistence .

November 6, 2025 at 3:53 PM

The BoE's MPC kept Bank Rate at 4% today, as it waits to see further disinflationary progress.

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

The Bank of England’s Monetary Policy Committee (MPC) voted 5-4 to leave Bank Rate at 4%. The majority bloc voted to keep rates on hold due to concerns over inflation persistence, driven by higher inflation expectations and structural shifts which may have led to greater inflation persistence .

November 6, 2025 at 1:10 PM

The Bank of England’s Monetary Policy Committee (MPC) voted 5-4 to leave Bank Rate at 4%. The majority bloc voted to keep rates on hold due to concerns over inflation persistence, driven by higher inflation expectations and structural shifts which may have led to greater inflation persistence .

Some good news for the UK economy: inflation has likely peaked and the labour market shows signs of stabilising.

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

Economy in brief: October 2025 | CBI

Your monthly overview of the major trends impacting the UK’s main business sectors.

www.cbi.org.uk

November 6, 2025 at 11:41 AM

Some good news for the UK economy: inflation has likely peaked and the labour market shows signs of stabilising.

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

In our latest Economy in Brief, @alpeshpaleja.bsky.social explores what this means for monetary policy and the wider economic outlook.

Read more🔒: www.cbi.org.uk/articles/eco...

Here are the key UK economic data releases and events for this week

November 3, 2025 at 9:06 AM

Here are the key UK economic data releases and events for this week

📉 PRIVATE SECTOR DOWNTURN SET TO PERSIST INTO 2026

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

October 29, 2025 at 9:06 AM

📉 PRIVATE SECTOR DOWNTURN SET TO PERSIST INTO 2026

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Firms once again expect activity to fall over the next three months, with weakness across the board mirroring subdued GDP growth.

Year-on-year retail sales volumes fell at a strong rate in October amid weak consumer confidence and Budget concerns - according to the latest CBI DTS. Retailers expect the 13-month-long downturn to extend into November.

October 27, 2025 at 11:06 AM

Year-on-year retail sales volumes fell at a strong rate in October amid weak consumer confidence and Budget concerns - according to the latest CBI DTS. Retailers expect the 13-month-long downturn to extend into November.

Retail sales volumes rose by 0.5% m/m in September (from 0.6% in August), marking a fourth consecutive month of growth. Over Q3 as a whole, sales rose to their highest level in three years (by 0.9%), boosted in part by the good weather seen over the summer.

October 24, 2025 at 9:42 AM

Retail sales volumes rose by 0.5% m/m in September (from 0.6% in August), marking a fourth consecutive month of growth. Over Q3 as a whole, sales rose to their highest level in three years (by 0.9%), boosted in part by the good weather seen over the summer.

The latest CBI Industrial Trends Survey found that output volumes fell in the quarter to October, at a similar pace to the quarter to September. Firms expect volumes to fall again in the three months to January.

October 23, 2025 at 10:08 AM

The latest CBI Industrial Trends Survey found that output volumes fell in the quarter to October, at a similar pace to the quarter to September. Firms expect volumes to fall again in the three months to January.

Reposted by CBI Economics

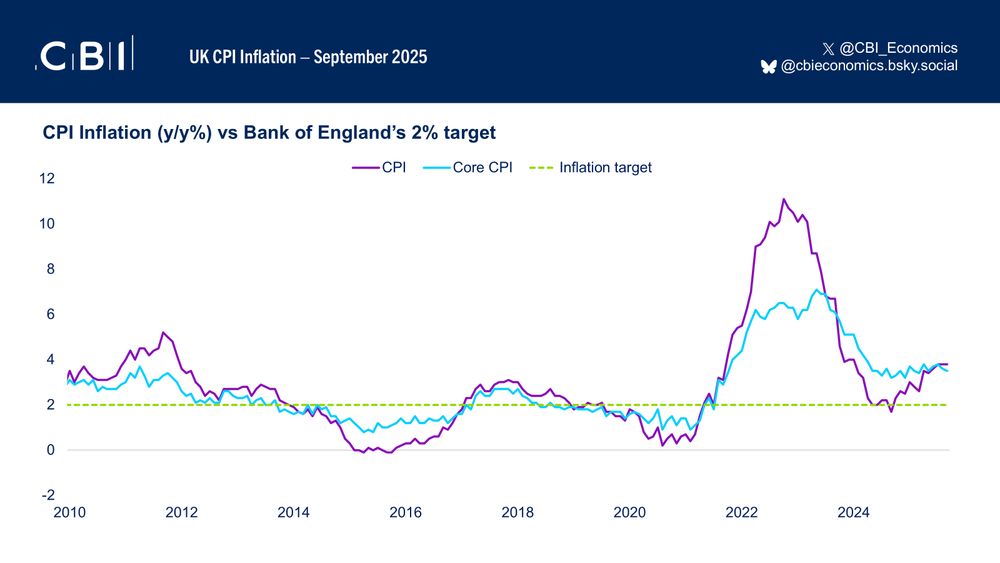

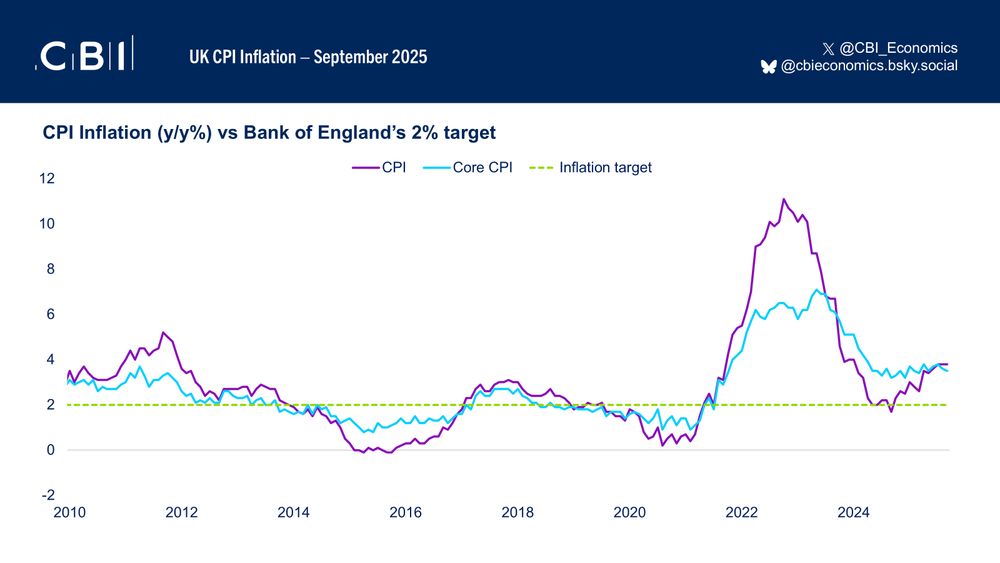

UK inflation came in lower than expected in September (at 3.8%), though it remains well above the BoE's 2% target. We expect inflation to slowly ease in the coming months, but we are unlikely to see a more substantial downshift until the first half of next year

UK #CPI inflation held steady at 3.8% in the year to September, undershooting consensus expectations (of 4.0%). Core CPI inflation (excl. energy, food, alcohol, and tobacco) eased slightly to 3.5% (from 3.6% in August)

October 22, 2025 at 9:25 AM

UK inflation came in lower than expected in September (at 3.8%), though it remains well above the BoE's 2% target. We expect inflation to slowly ease in the coming months, but we are unlikely to see a more substantial downshift until the first half of next year

UK #CPI inflation held steady at 3.8% in the year to September, undershooting consensus expectations (of 4.0%). Core CPI inflation (excl. energy, food, alcohol, and tobacco) eased slightly to 3.5% (from 3.6% in August)

October 22, 2025 at 9:19 AM

UK #CPI inflation held steady at 3.8% in the year to September, undershooting consensus expectations (of 4.0%). Core CPI inflation (excl. energy, food, alcohol, and tobacco) eased slightly to 3.5% (from 3.6% in August)

This Thursday, we're pleased to be hosting Jon Hall, External Member of the Bank of England's Financial Policy Committee, for a discussion on safeguarding UK financial stability while supporting long-term growth.

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

Home - CBI Member Discussion with Jon Hall, External Member of the Bank of England's Financial Policy Committee (FPC)

events.cbi.org.uk

October 20, 2025 at 9:42 AM

This Thursday, we're pleased to be hosting Jon Hall, External Member of the Bank of England's Financial Policy Committee, for a discussion on safeguarding UK financial stability while supporting long-term growth.

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

Here are the key UK economic data releases for this week

October 20, 2025 at 8:07 AM

Here are the key UK economic data releases for this week

Reposted by CBI Economics

This morning's data show UK GDP growth was 0.3% in the three months to August, with output expanding 0.1% on the month, in line with market expectations. Worrying thing in this release is the flatlining of the all-important service sector in July and August. A short thread on this to follow...

October 16, 2025 at 6:17 AM

This morning's data show UK GDP growth was 0.3% in the three months to August, with output expanding 0.1% on the month, in line with market expectations. Worrying thing in this release is the flatlining of the all-important service sector in July and August. A short thread on this to follow...

Reposted by CBI Economics

Today’s data show that a weakening jobs market is feeding through into pay. Depressing stat of the day: real weekly wages have increased by just £1.50 since Sep 2024. Here is our thread (from me and @hannahslaughter.bsky.social).

October 14, 2025 at 8:47 AM

Today’s data show that a weakening jobs market is feeding through into pay. Depressing stat of the day: real weekly wages have increased by just £1.50 since Sep 2024. Here is our thread (from me and @hannahslaughter.bsky.social).

Reposted by CBI Economics

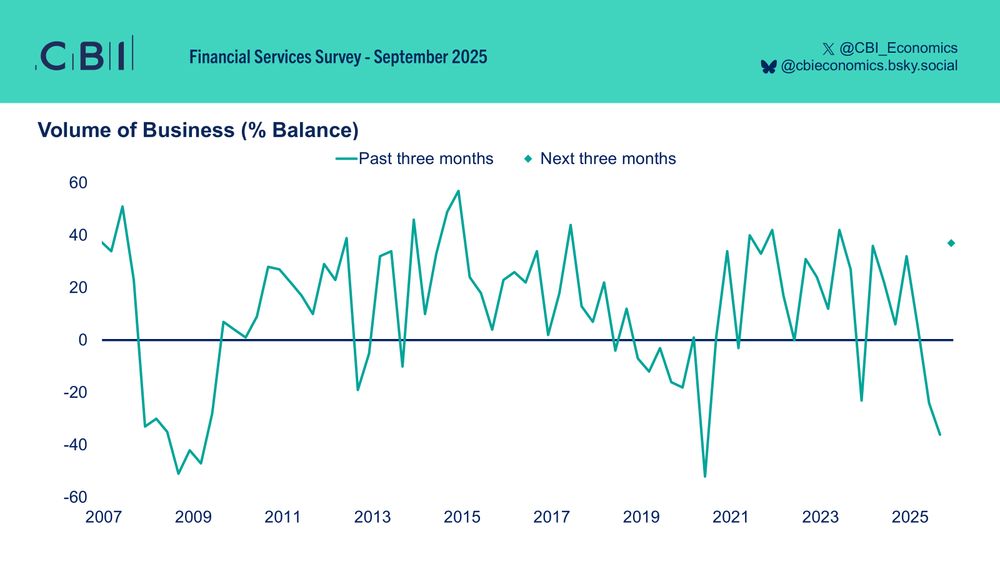

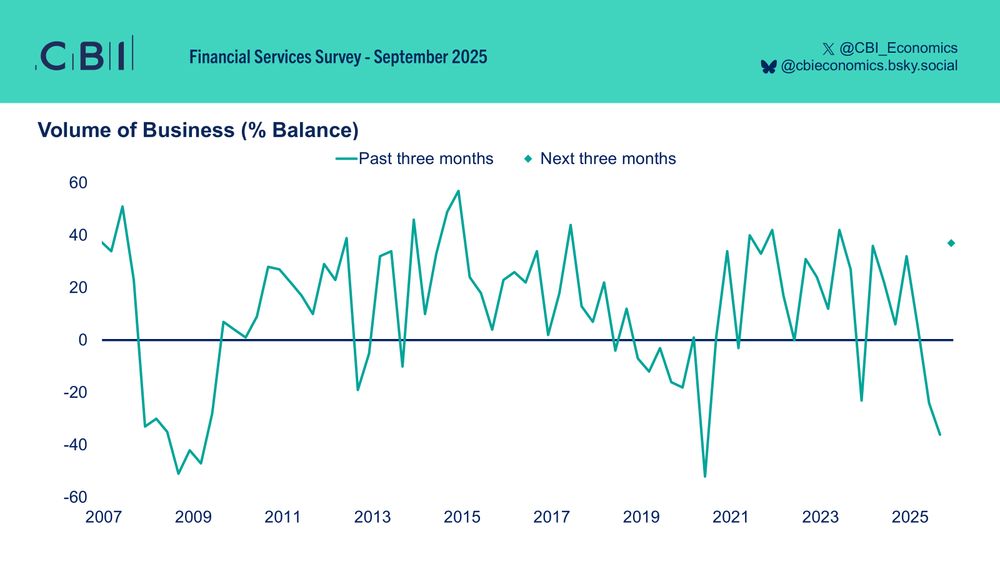

Activity in the FS sector dropped at its quickest rate in five years in Q3, but firms expect a strong rebound next quarter.

Check out the findings from the survey 👇🧵

Check out the findings from the survey 👇🧵

Business volumes in the financial services sector fell at the fastest rate since June 2020 in Q3 2025. However, firms expect volumes growth to make a strong recovery next quarter, according to the latest CBI Financial Services Survey.

October 2, 2025 at 9:06 AM

Activity in the FS sector dropped at its quickest rate in five years in Q3, but firms expect a strong rebound next quarter.

Check out the findings from the survey 👇🧵

Check out the findings from the survey 👇🧵

Business volumes in the financial services sector fell at the fastest rate since June 2020 in Q3 2025. However, firms expect volumes growth to make a strong recovery next quarter, according to the latest CBI Financial Services Survey.

October 2, 2025 at 8:10 AM

Business volumes in the financial services sector fell at the fastest rate since June 2020 in Q3 2025. However, firms expect volumes growth to make a strong recovery next quarter, according to the latest CBI Financial Services Survey.

Private sector activity is weak, hiring plans remain soft, and the investment appetite is muted. 📊

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

Economic deep dive Q3 2025 | CBI

Your quarterly guide to the UK economy; making sense of the key trends and what's driving them.

www.cbi.org.uk

October 1, 2025 at 8:32 AM

Private sector activity is weak, hiring plans remain soft, and the investment appetite is muted. 📊

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

With weak underlying economic momentum and sticky #inflation, the #MPC is set to tread cautiously. In our September’s Economy in Brief, @alpeshpaleja.bsky.social explores the Bank Rate decision, UK outlook and jittery bond markets.

Read more🔒: www.cbi.org.uk/articles/eco...

Read more🔒: www.cbi.org.uk/articles/eco...

Economy in brief: September 2025 | CBI

Your monthly overview of the major trends impacting the UK’s main business sectors.

www.cbi.org.uk

September 30, 2025 at 9:03 AM

With weak underlying economic momentum and sticky #inflation, the #MPC is set to tread cautiously. In our September’s Economy in Brief, @alpeshpaleja.bsky.social explores the Bank Rate decision, UK outlook and jittery bond markets.

Read more🔒: www.cbi.org.uk/articles/eco...

Read more🔒: www.cbi.org.uk/articles/eco...

📉 Private sector activity is expected to fall in the next quarter, with expectations weakening on August

All major sectors remain in negative territory, underlying persistent weakness in demand.

🧵 More on the outlook for services, manufacturing, and distributive trades below.

All major sectors remain in negative territory, underlying persistent weakness in demand.

🧵 More on the outlook for services, manufacturing, and distributive trades below.

September 29, 2025 at 8:30 AM

📉 Private sector activity is expected to fall in the next quarter, with expectations weakening on August

All major sectors remain in negative territory, underlying persistent weakness in demand.

🧵 More on the outlook for services, manufacturing, and distributive trades below.

All major sectors remain in negative territory, underlying persistent weakness in demand.

🧵 More on the outlook for services, manufacturing, and distributive trades below.

Here are the key UK economic data releases for this week

September 29, 2025 at 8:06 AM

Here are the key UK economic data releases for this week

Reposted by CBI Economics

September marked the twelfth straight month of falling annual retail sales, according to our latest DTS. Weak demand conditions are weighing on sales, while US tariffs are adding pressure for some retailers.

Check out the results of the survey 👇

Check out the results of the survey 👇

#Retail sales volumes fell year-on-year for the 12th month in a row in September, highlighting persistently weak demand conditions in the sector, according to the latest CBI DTS. Sales are expected to decline at a slightly faster rate next month.

September 25, 2025 at 10:09 AM

September marked the twelfth straight month of falling annual retail sales, according to our latest DTS. Weak demand conditions are weighing on sales, while US tariffs are adding pressure for some retailers.

Check out the results of the survey 👇

Check out the results of the survey 👇

#Retail sales volumes fell year-on-year for the 12th month in a row in September, highlighting persistently weak demand conditions in the sector, according to the latest CBI DTS. Sales are expected to decline at a slightly faster rate next month.

September 25, 2025 at 10:03 AM

#Retail sales volumes fell year-on-year for the 12th month in a row in September, highlighting persistently weak demand conditions in the sector, according to the latest CBI DTS. Sales are expected to decline at a slightly faster rate next month.

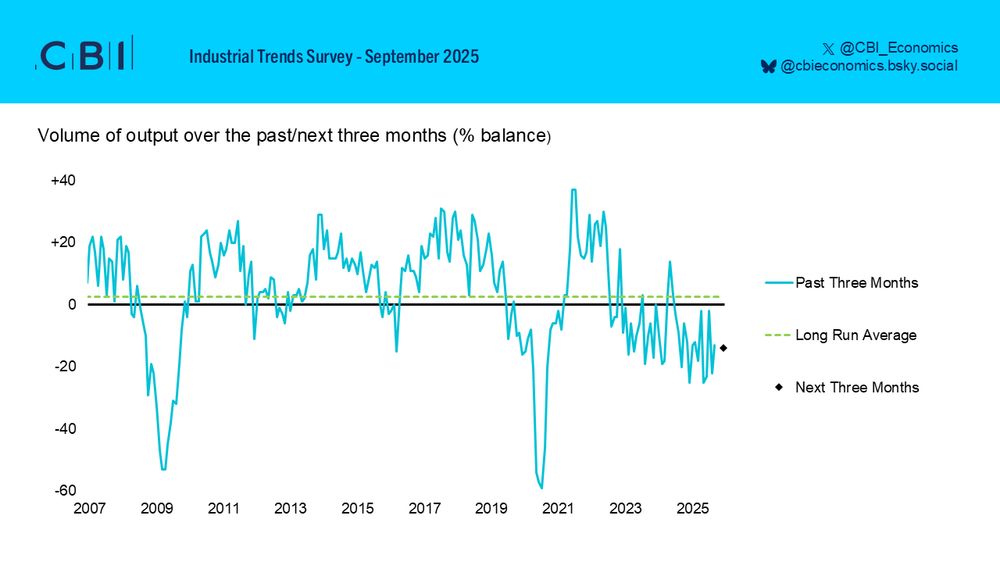

The latest CBI Industrial Trends Survey found that manufacturing output volumes fell in the three months to September, at a slower pace to the three months to August. Manufacturers expect output volumes to decline again in the next three months.

September 23, 2025 at 10:26 AM

The latest CBI Industrial Trends Survey found that manufacturing output volumes fell in the three months to September, at a slower pace to the three months to August. Manufacturers expect output volumes to decline again in the next three months.