David R. Agrawal

@davidragrawal.bsky.social

880 followers

500 following

86 posts

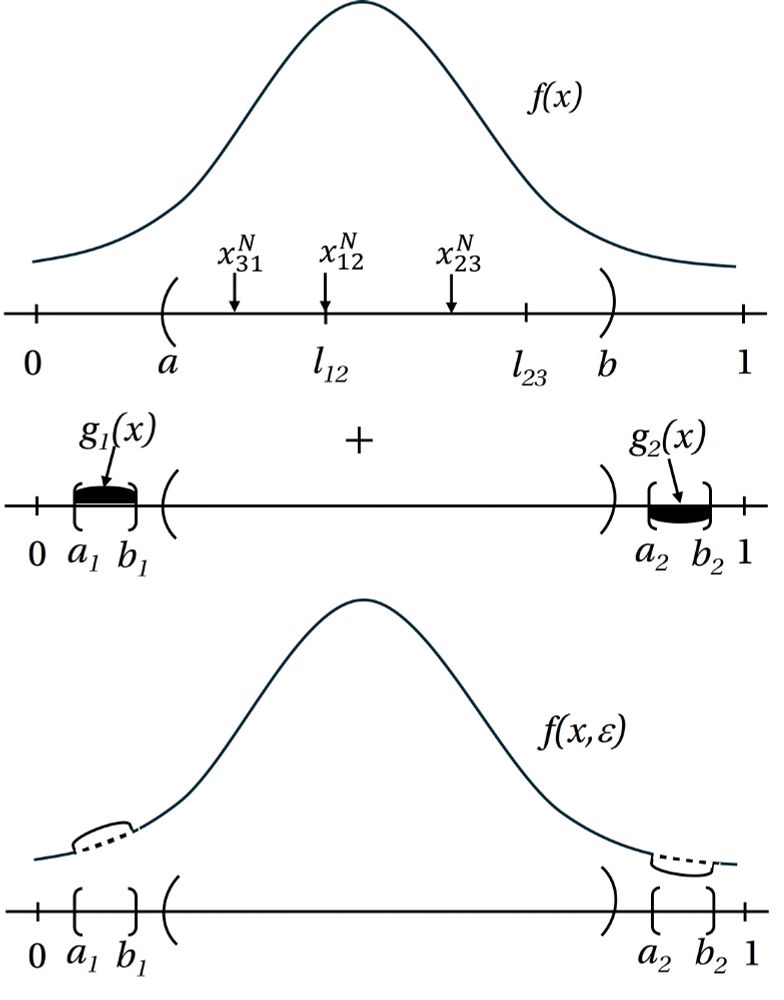

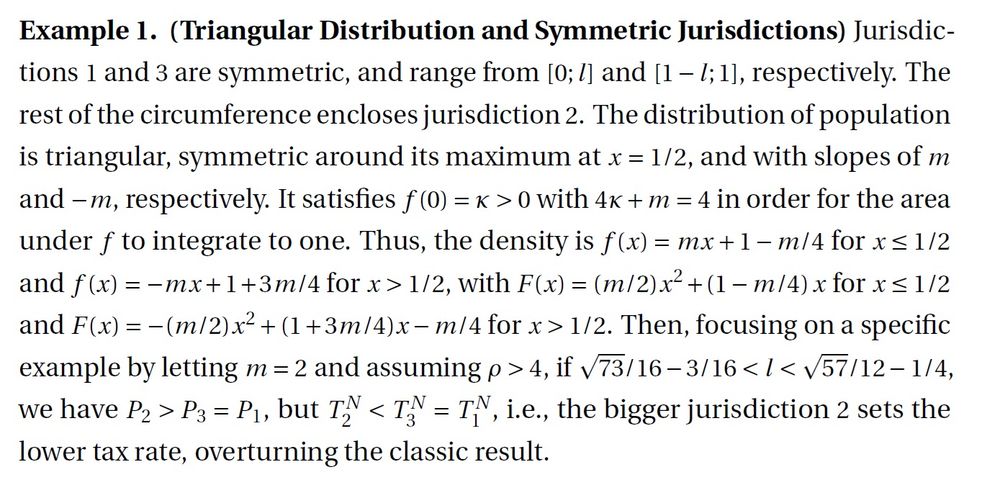

Professor UC Irvine Economics; Editor-in-Chief ITAX; Research on tax, fiscal competition, local policy, RST/VAT, inequality & mobility

https://sites.socsci.uci.edu/~dagrawa4/

Posts

Media

Videos

Starter Packs

Reposted by David R. Agrawal

Reposted by David R. Agrawal

Matt Pierson

@matthewcpierson.bsky.social

· Jan 29