www.edinburghfinancialanalytics.com

Those decisions feed through to model performance quarter by quarter.

Over time, a disciplined process delivers consistent results.

Those decisions feed through to model performance quarter by quarter.

Over time, a disciplined process delivers consistent results.

Those decisions feed through to model performance quarter by quarter.

Over time, a disciplined process delivers consistent results.

We rank investable equity indices using behavioural signals (to improve your odds). Right now, Asia sits at the top of the rankings.

Passive exposure isn’t neutral when concentration is extreme. Time to diversify?

Link in reply.

We rank investable equity indices using behavioural signals (to improve your odds). Right now, Asia sits at the top of the rankings.

Passive exposure isn’t neutral when concentration is extreme. Time to diversify?

Link in reply.

What (yield curve) do you want for Christmas? 🎄

Views on the US economy in 2026 are diverging fast.

Capex boom? Or labour-market wobble?

A short thread with charts...

#YieldCurve #Macro #Banks #Markets #FixedIncome #Investing #USEconomy

What (yield curve) do you want for Christmas? 🎄

Views on the US economy in 2026 are diverging fast.

Capex boom? Or labour-market wobble?

A short thread with charts...

#YieldCurve #Macro #Banks #Markets #FixedIncome #Investing #USEconomy

Divergence is everywhere.

Plenty of stocks are rising, plenty are falling. Breadth is fractured across markets.

And searches for the Hindenburg Omen hit a 5-year high!

Divergence is everywhere.

Plenty of stocks are rising, plenty are falling. Breadth is fractured across markets.

And searches for the Hindenburg Omen hit a 5-year high!

Liquidity is drying up fast and that means it’s time to think about protecting portfolios against bad scenarios.

🧵[1/7]

Liquidity is drying up fast and that means it’s time to think about protecting portfolios against bad scenarios.

🧵[1/7]

🧵

[1/8]

#Investing #Volatility #OptionsTrading #BehavioralFinance

🧵

[1/8]

#Investing #Volatility #OptionsTrading #BehavioralFinance

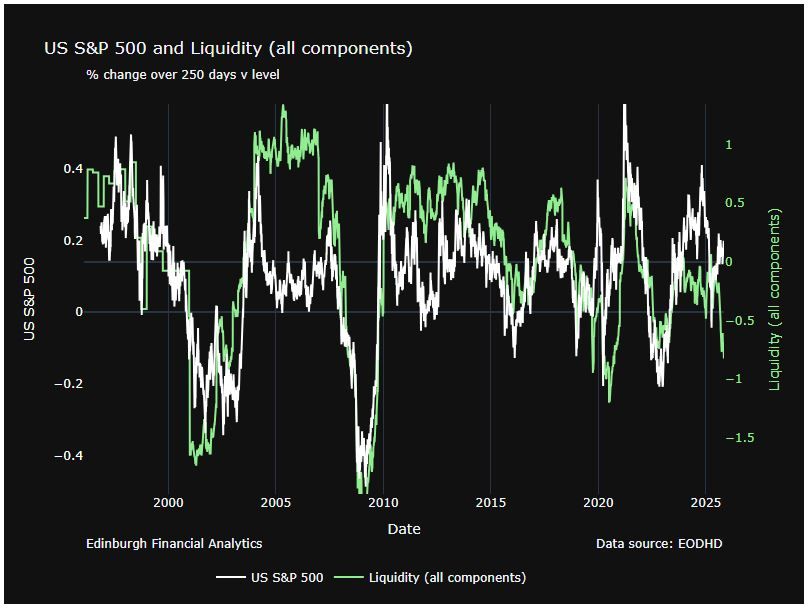

Liquidity is taking centre stage in markets right now.

A US shutdown hits in two key ways...

But first here's a chart of SPX (yoy) v our (falling) index of liquidity (green).

#Markets #USEconomy #Liquidity #AssetAllocation

[1/6]

Liquidity is taking centre stage in markets right now.

A US shutdown hits in two key ways...

But first here's a chart of SPX (yoy) v our (falling) index of liquidity (green).

#Markets #USEconomy #Liquidity #AssetAllocation

[1/6]

Our 𝐟𝐫𝐞𝐞 weekly Chart Pack distils behavioural & macro signals into a few key visuals, for investors who prefer signal to noise.

🔗https://edinburghfinancialanalytics.com/#sign_up

#BehaviouralFinance #MarketInsights #Investing #CatsOfBluesky

🧵[1/5]

Our 𝐟𝐫𝐞𝐞 weekly Chart Pack distils behavioural & macro signals into a few key visuals, for investors who prefer signal to noise.

🔗https://edinburghfinancialanalytics.com/#sign_up

#BehaviouralFinance #MarketInsights #Investing #CatsOfBluesky

🧵[1/5]

How did Edinburgh Financial Analytics’ models fare this quarter?

Here’s the breakdown ⬇️

#PerformanceReview #Investing

How did Edinburgh Financial Analytics’ models fare this quarter?

Here’s the breakdown ⬇️

#PerformanceReview #Investing

Our volatility model (using #VIX, #SKEW & #GAMMA) shows us where in the past conditions in #options activity are like today.

The most similar period is the end of 2021 closely followed by the pre-covid peak in early 2020.

#Markets #Equities #Volatility #QuantFinance

Our volatility model (using #VIX, #SKEW & #GAMMA) shows us where in the past conditions in #options activity are like today.

The most similar period is the end of 2021 closely followed by the pre-covid peak in early 2020.

#Markets #Equities #Volatility #QuantFinance

1/n

If you're heavily invested in equities you'll want to look through the charts that follow. Not investment advice but hopefully valuable information.

#equities #volatility #gamma #riskmanagement

1/n

If you're heavily invested in equities you'll want to look through the charts that follow. Not investment advice but hopefully valuable information.

#equities #volatility #gamma #riskmanagement

The bond market narrative and recent price action don't match.

Global financial headlines are dominated by talk of steeper yield curves, driven by fears of persistent inflation and unsustainable government debt.

[1/7]

The bond market narrative and recent price action don't match.

Global financial headlines are dominated by talk of steeper yield curves, driven by fears of persistent inflation and unsustainable government debt.

[1/7]

𝐇𝐨𝐰 𝐦𝐚𝐧𝐲 𝐦𝐨𝐫𝐞 𝐛𝐥𝐨𝐜𝐤𝐬 𝐜𝐚𝐧 𝐰𝐞 𝐫𝐞𝐦𝐨𝐯𝐞?

Two of the important drivers of global equity markets are #liquidity and #investorbehaviour.

In the last 2 weeks another block has been pulled from the 𝐉𝐞𝐧𝐠𝐚 𝐭𝐨𝐰𝐞𝐫.

#GlobalEquities #RiskManagement

𝐇𝐨𝐰 𝐦𝐚𝐧𝐲 𝐦𝐨𝐫𝐞 𝐛𝐥𝐨𝐜𝐤𝐬 𝐜𝐚𝐧 𝐰𝐞 𝐫𝐞𝐦𝐨𝐯𝐞?

Two of the important drivers of global equity markets are #liquidity and #investorbehaviour.

In the last 2 weeks another block has been pulled from the 𝐉𝐞𝐧𝐠𝐚 𝐭𝐨𝐰𝐞𝐫.

#GlobalEquities #RiskManagement

Market liquidity matters.

It drives risk-taking and shapes investor behaviour.

When liquidity is plentiful, leverage and FOMO often push prices higher.

When it’s scarce, caution dominates.

#MarketLiquidity #InvestorBehaviour #FOMC #USD #GlobalMarkets

Market liquidity matters.

It drives risk-taking and shapes investor behaviour.

When liquidity is plentiful, leverage and FOMO often push prices higher.

When it’s scarce, caution dominates.

#MarketLiquidity #InvestorBehaviour #FOMC #USD #GlobalMarkets

[1/4] We’ve just added a new trading model, built on commodity index ETFs and grounded in investor behaviour + chaos theory.

edinburghfinancialanalytics.com#alloc

Snapshot below ⬇️

#Commodities #QuantInvesting #MarketSignals

[1/4] We’ve just added a new trading model, built on commodity index ETFs and grounded in investor behaviour + chaos theory.

edinburghfinancialanalytics.com#alloc

Snapshot below ⬇️

#Commodities #QuantInvesting #MarketSignals

We held back this equity update after his 30% tariff bombshell …

But markets barely reacted.

Have we discounted the TACO follow-up already? Or is the Epstein fallout the beginning of the end for MAGA?

[🧵 More ⬇️]

We held back this equity update after his 30% tariff bombshell …

But markets barely reacted.

Have we discounted the TACO follow-up already? Or is the Epstein fallout the beginning of the end for MAGA?

[🧵 More ⬇️]

1/

The latest CFTC data gave us some food for thought (pun intended 😄).

Speculators who’ve consistently been profitable in Consumer Staples are now extremely short.

If they’re right again, the sector is in trouble.

#ConsumerStaples #CFTCdata

1/

The latest CFTC data gave us some food for thought (pun intended 😄).

Speculators who’ve consistently been profitable in Consumer Staples are now extremely short.

If they’re right again, the sector is in trouble.

#ConsumerStaples #CFTCdata

𝐁𝐞𝐰𝐚𝐫𝐞 𝐨𝐟 𝐠𝐨𝐨𝐝 𝐧𝐞𝐰𝐬 𝐨𝐧 𝐭𝐡𝐞 𝐃𝐨𝐥𝐥𝐚𝐫!

There hasn't been much of it lately. Uncertainty from the US administration has weighed on trading partners, companies, and households.

The result? Weaker growth expectations… and a weaker currency. 🧵

𝐁𝐞𝐰𝐚𝐫𝐞 𝐨𝐟 𝐠𝐨𝐨𝐝 𝐧𝐞𝐰𝐬 𝐨𝐧 𝐭𝐡𝐞 𝐃𝐨𝐥𝐥𝐚𝐫!

There hasn't been much of it lately. Uncertainty from the US administration has weighed on trading partners, companies, and households.

The result? Weaker growth expectations… and a weaker currency. 🧵

Only one of them saw it coming (it wasn't Bernanke).

Why are we so afraid of falling prices?

Time to question the 2% target.

#Macro #Deflation #CentralBanks #QE #InflationTargeting

www.linkedin.com/pulse/good-d...

Only one of them saw it coming (it wasn't Bernanke).

Why are we so afraid of falling prices?

Time to question the 2% target.

#Macro #Deflation #CentralBanks #QE #InflationTargeting

www.linkedin.com/pulse/good-d...

March revised down by 65,000, from +185,000 to +120,000.

April revised down by 30,000, from +177,000 to

+147,000.

In the past this has been the most useful component of the jobs release as new data corrects for birth / death model assumptions.

March revised down by 65,000, from +185,000 to +120,000.

April revised down by 30,000, from +177,000 to

+147,000.

In the past this has been the most useful component of the jobs release as new data corrects for birth / death model assumptions.

With VIX in the low 20s and market moves no longer headline news, we’ve got a 🧭 window of opportunity to reassess portfolios.

#markets #investing

With VIX in the low 20s and market moves no longer headline news, we’ve got a 🧭 window of opportunity to reassess portfolios.

#markets #investing