Gerard DiPippo

@gdp1985.bsky.social

2.5K followers

430 following

100 posts

RAND China Research Center. Former Senior Geo-Economics Analyst at Bloomberg, CSIS Economics Program, DNIO for Economic Issues at NIC, and CIA. All views my own.

Posts

Media

Videos

Starter Packs

Gerard DiPippo

@gdp1985.bsky.social

· Sep 1

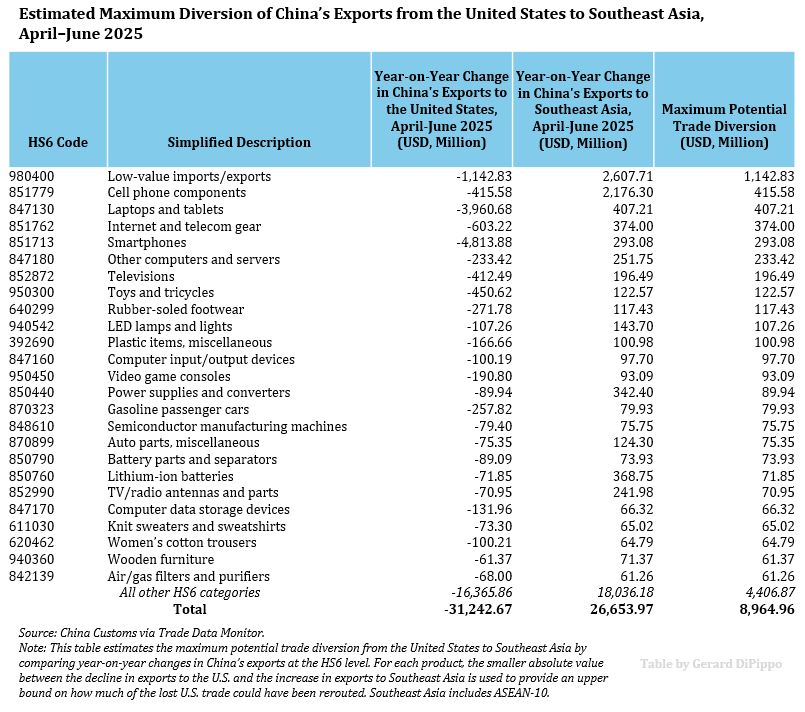

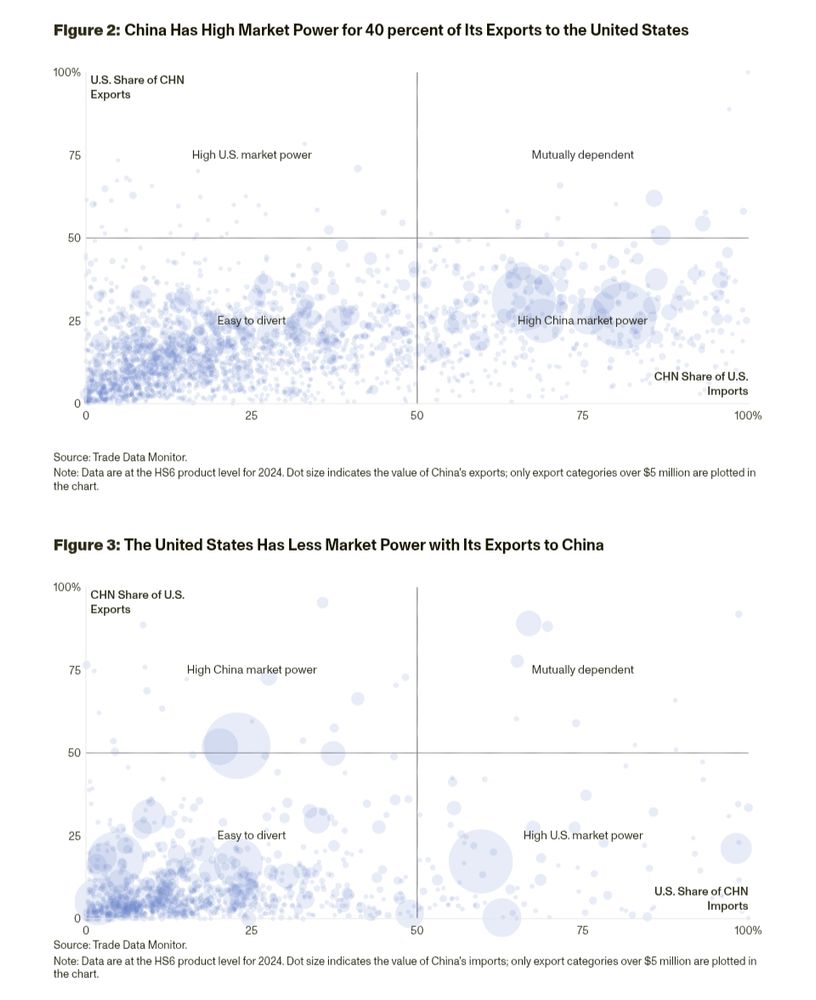

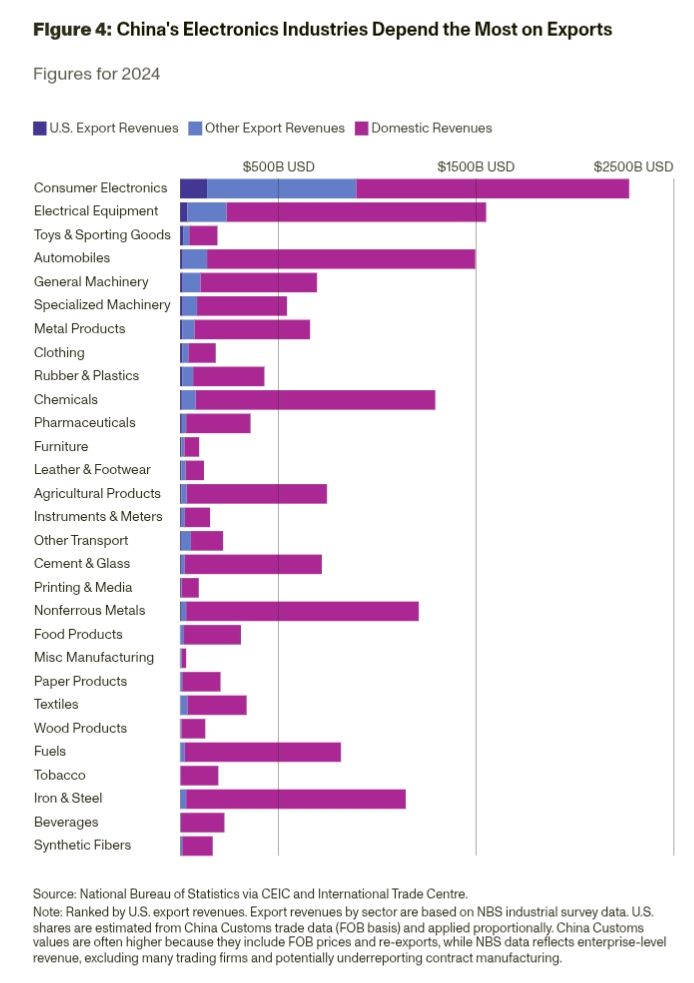

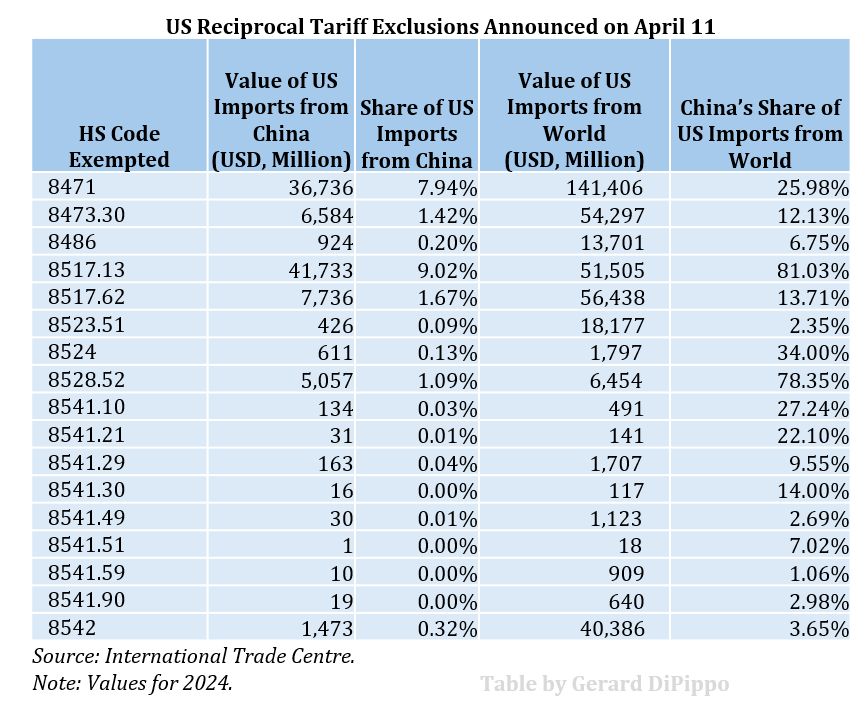

Changing Course in a Storm: China’s Economy in the Trade War | China Leadership Monitor

China is weathering deflation, a property-sector collapse, and renewed trade tensions with the United States through calculated restraint rather than panic. Exports remain resilient via market diversi...

www.prcleader.org

Gerard DiPippo

@gdp1985.bsky.social

· Aug 1

Gerard DiPippo

@gdp1985.bsky.social

· Apr 8

Gerard DiPippo

@gdp1985.bsky.social

· Mar 4

Reposted by Gerard DiPippo

Simon Lester

@simonlester.com

· Mar 1

Gerard DiPippo

@gdp1985.bsky.social

· Feb 22

Gerard DiPippo

@gdp1985.bsky.social

· Feb 22

Gerard DiPippo

@gdp1985.bsky.social

· Feb 6