Joanna LeFebvre

@joannalefebvre.bsky.social

290 followers

160 following

41 posts

State fiscal policy nerd @centeronbudget.bsky.social, former teacher, Duke Sanford and @washu.edu alum

Posts

Media

Videos

Starter Packs

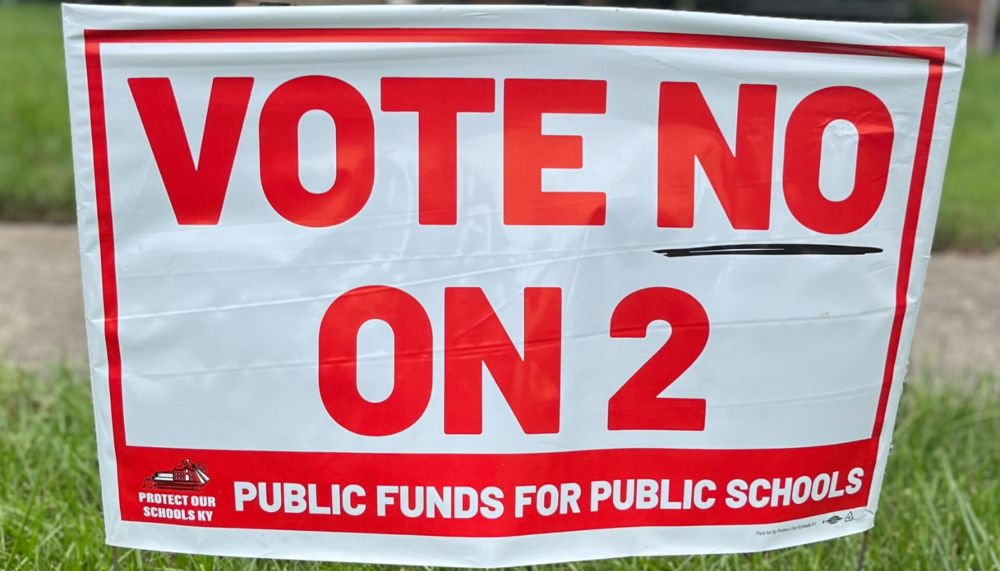

Reposted by Joanna LeFebvre

Whitney Tucker

@whitneytucker.bsky.social

· Jul 25

Reposted by Joanna LeFebvre

Economic Policy Institute

@epi.org

· Jun 30

State education funding falls short in too many states, even as they prosper: Southern states, in particular, are neglecting students

State spending on public education declined markedly in the dozen years prior to the COVID-19 pandemic. This decline in funding was a response to the Great Recession since many state governments prior...

www.epi.org

Reposted by Joanna LeFebvre