There’s a raging debate in markets about the sustainability of today’s high stock valuations, and it starts with this chart👇

Shiller P/E has a strong track record of flagging bubbles, and it's flashing red.

(link below)

There’s a raging debate in markets about the sustainability of today’s high stock valuations, and it starts with this chart👇

Shiller P/E has a strong track record of flagging bubbles, and it's flashing red.

(link below)

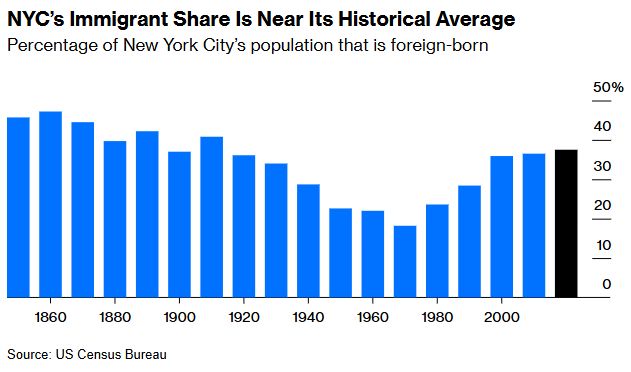

"Their insinuation that this is something new is, however, ridiculous." - @byjustinfox.bsky.social

www.bloomberg.com/opinion/arti...

"Their insinuation that this is something new is, however, ridiculous." - @byjustinfox.bsky.social

www.bloomberg.com/opinion/arti...

@byjustinfox.bsky.social

www.bloomberg.com/opinion/arti...

@byjustinfox.bsky.social

www.bloomberg.com/opinion/arti...

Dollar Extends Drop to Fresh 2025 Lows as Tariff Saga Rolls On

Dollar Extends Drop to Fresh 2025 Lows as Tariff Saga Rolls On

But why again are we tariffing textiles and toys?

But why again are we tariffing textiles and toys?

Trump on 4/4: "CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!"

Trump on 4/4: "CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!"

Peter Navarro's goal of $700b in tariff revenue "would put the US between Senegal and Mongolia" in terms of customs revenue relative to GDP - @byjustinfox.bsky.social

www.bloomberg.com/opinion/arti...

Peter Navarro's goal of $700b in tariff revenue "would put the US between Senegal and Mongolia" in terms of customs revenue relative to GDP - @byjustinfox.bsky.social

www.bloomberg.com/opinion/arti...

"Tariff revenue hasn’t surpassed 2% of GDP since the early 1870s, and hasn’t surpassed it on a sustained basis since the 1820s and 1830s." @byjustinfox.bsky.social

www.bloomberg.com/opinion/arti...

"Tariff revenue hasn’t surpassed 2% of GDP since the early 1870s, and hasn’t surpassed it on a sustained basis since the 1820s and 1830s." @byjustinfox.bsky.social

www.bloomberg.com/opinion/arti...

www.bloomberg.com/opinion/news...

www.bloomberg.com/opinion/news...

Eye-opening graphics from @markgongloff.bsky.social & Elaine He

www.bloomberg.com/opinion/feat...

Eye-opening graphics from @markgongloff.bsky.social & Elaine He

www.bloomberg.com/opinion/feat...

It's down from nosebleed levels in December, but it's hardly screaming "the bottom is in" 🤷♂️

It's down from nosebleed levels in December, but it's hardly screaming "the bottom is in" 🤷♂️

Eye-opening dataviz column from @davelee.me

www.bloomberg.com/opinion/feat...

Eye-opening dataviz column from @davelee.me

www.bloomberg.com/opinion/feat...

Tension today between the Chicago Fed tracker and the Bloomberg economist survey 🤔

Bloomberg survey: +0.6% m/m and +0.3% ex-auto

Chicago Fed CARTS: -0.8% m/m ex-auto

www.chicagofed.org/research/dat...

Tension today between the Chicago Fed tracker and the Bloomberg economist survey 🤔

Bloomberg survey: +0.6% m/m and +0.3% ex-auto

Chicago Fed CARTS: -0.8% m/m ex-auto

www.chicagofed.org/research/dat...