Previous bills sets 10 year periods. And every 10 years the carbon price crashes because of reauthorization uncertainty (as happening now).

Decarbonization investments are made over longer horizons and need more durable policy.

AB 1207 extends C&T from 2030-2045. 4/

Previous bills sets 10 year periods. And every 10 years the carbon price crashes because of reauthorization uncertainty (as happening now).

Decarbonization investments are made over longer horizons and need more durable policy.

AB 1207 extends C&T from 2030-2045. 4/

GHGs, air pollution & their disparities have fallen because of C&T, as my research shows.

Moving forward, it is crucial to reaffirm C&T's foundational elements that ensure affordable GHG reductions and environmental integrity.

This bill reauthorizes those pieces. 3/

GHGs, air pollution & their disparities have fallen because of C&T, as my research shows.

Moving forward, it is crucial to reaffirm C&T's foundational elements that ensure affordable GHG reductions and environmental integrity.

This bill reauthorizes those pieces. 3/

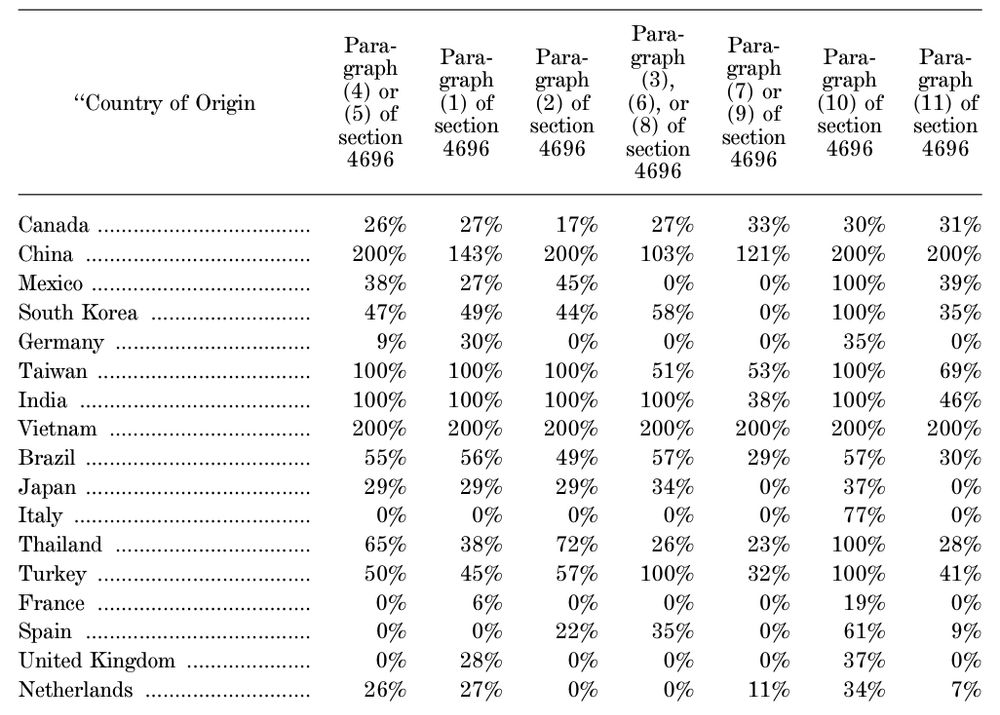

Authors' cite their calculation that FPFA raises $198B over 5 years.

But their accounting exercise makes a crucial assumption: trade volumes don't change under carbon tariffs.

FPFA increase tariffs on some goods by 100%!

Will imports really not fall? 4/

Authors' cite their calculation that FPFA raises $198B over 5 years.

But their accounting exercise makes a crucial assumption: trade volumes don't change under carbon tariffs.

FPFA increase tariffs on some goods by 100%!

Will imports really not fall? 4/

PRC imports serves <2% of U.S. consumption. And PRC consumes 94% of own iron/steel.

So trade too little for U.S. carbon tariffs to have much leverage. 3/

PRC imports serves <2% of U.S. consumption. And PRC consumes 94% of own iron/steel.

So trade too little for U.S. carbon tariffs to have much leverage. 3/

Climate policy costs itself plays a small role. Much of increased prices are from higher distribution costs, such as from wildfires. 2/

Climate policy costs itself plays a small role. Much of increased prices are from higher distribution costs, such as from wildfires. 2/

funding, either from additional C&T permit revenue or

other state funds.

Figure shows reductions for any funding amount.

Subsidies can also target

different populations and times of year. 5/

funding, either from additional C&T permit revenue or

other state funds.

Figure shows reductions for any funding amount.

Subsidies can also target

different populations and times of year. 5/

For a sense of magnitude, adaptation-induced GHG cuts lower what these countries must do to meet Paris GHG commitments by 20%.

This "free" abatement suggests Paris commitments need to be more stringent. 4/

For a sense of magnitude, adaptation-induced GHG cuts lower what these countries must do to meet Paris GHG commitments by 20%.

This "free" abatement suggests Paris commitments need to be more stringent. 4/

Depending on a place's energy mix, GHGs can go up or down.

After summing local impacts across the planet using high resolution data, we find total energy-based adaptation lowers GHGs. 3/

Depending on a place's energy mix, GHGs can go up or down.

After summing local impacts across the planet using high resolution data, we find total energy-based adaptation lowers GHGs. 3/

Energy-based adaptation around the planet lowers global temperatures by 0.07 to 0.12C in 2099.

This adaptation-induced cooling avoids $0.6 to $1.8 trillion in damages between 2020-2099. 2/

Energy-based adaptation around the planet lowers global temperatures by 0.07 to 0.12C in 2099.

This adaptation-induced cooling avoids $0.6 to $1.8 trillion in damages between 2020-2099. 2/

US and Mexico GDP fall by 0.8%, followed by drop of 0.5% in Canada and 0.3% in PRC. 2/

US and Mexico GDP fall by 0.8%, followed by drop of 0.5% in Canada and 0.3% in PRC. 2/

Headline: US GDP falls 0.8%, US prices rise 5%, $220B revenue

How are other countries affected? Which sectors see highest US price increases? 🧵 1/

#econsky

Headline: US GDP falls 0.8%, US prices rise 5%, $220B revenue

How are other countries affected? Which sectors see highest US price increases? 🧵 1/

#econsky

Left fig. shows distribution of US price increases by sector. Right fig. shows sectors with the highest increases. Note lots of intermediate goods which will translate onto higher final good prices (we don't model input-output linkages).

Left fig. shows distribution of US price increases by sector. Right fig. shows sectors with the highest increases. Note lots of intermediate goods which will translate onto higher final good prices (we don't model input-output linkages).

Prices fall everywhere except for the US, where the average price increase is 9.6%.

GDP falls in most places with US GDP decreasing by 1%.

Prices fall everywhere except for the US, where the average price increase is 9.6%.

GDP falls in most places with US GDP decreasing by 1%.

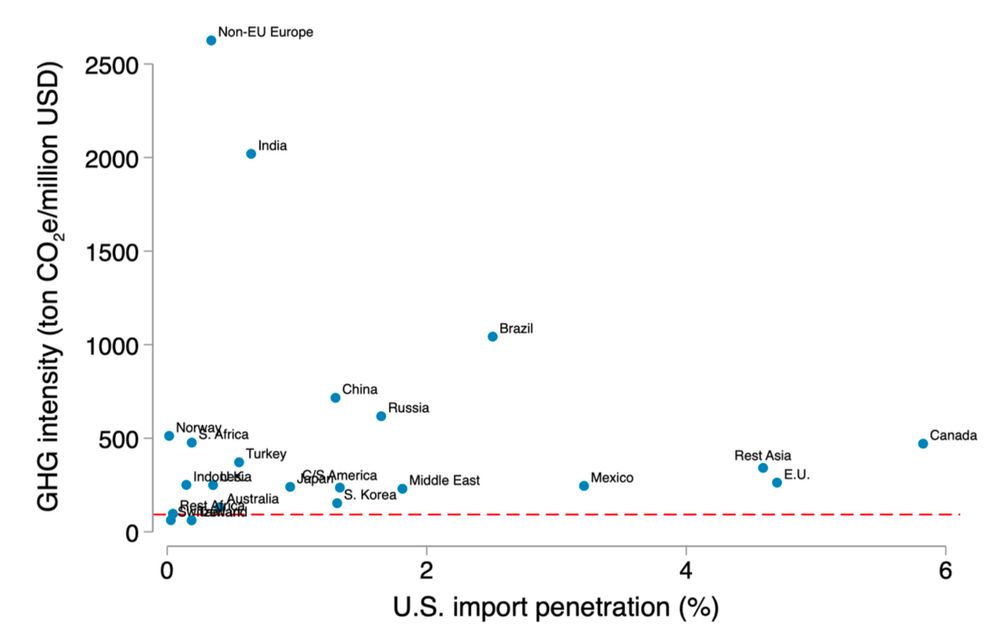

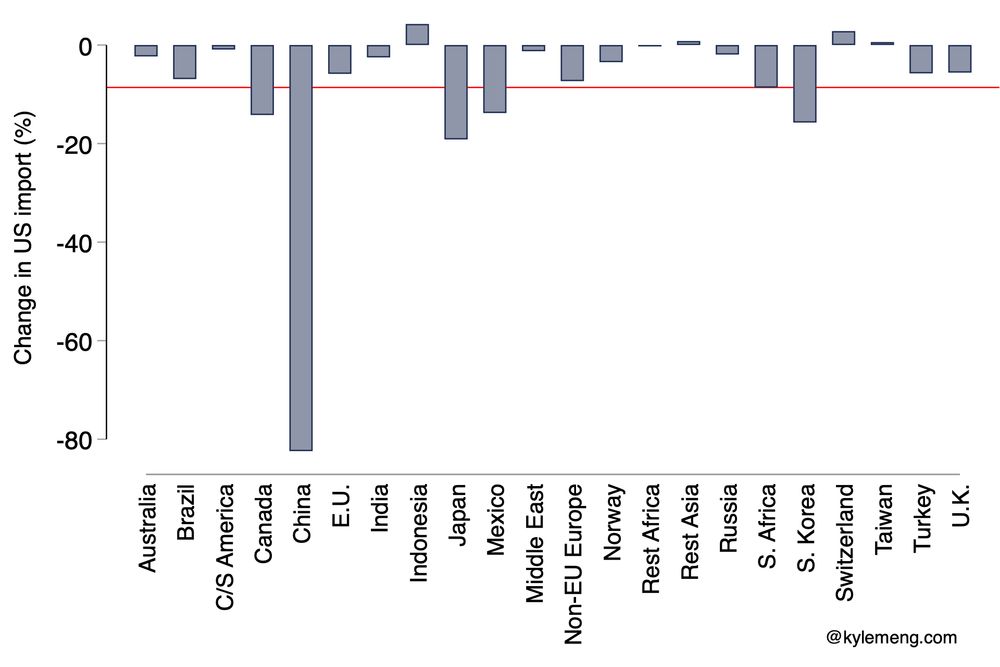

Country-level change in US imports correlated with tariff. We see large 20-40% drops. But some countries/regions with low or zero tariffs (e.g., Russia) will import more to the US.

Country-level change in US imports correlated with tariff. We see large 20-40% drops. But some countries/regions with low or zero tariffs (e.g., Russia) will import more to the US.

We model: April 2nd tariffs + 25% on CAN/MEX imports + 20% on PRC imports + 25% on iron/steel/alum/cars.

Fig. shows total tariff by country. Avg. is 20.4%, about 10X pre-Trump rates.

What are US and foreign country impacts?

We model: April 2nd tariffs + 25% on CAN/MEX imports + 20% on PRC imports + 25% on iron/steel/alum/cars.

Fig. shows total tariff by country. Avg. is 20.4%, about 10X pre-Trump rates.

What are US and foreign country impacts?

Actual rates are an order of magnitude smaller than Trump claims. Adding other trade barriers and manipulation won't increase much. 2/

Actual rates are an order of magnitude smaller than Trump claims. Adding other trade barriers and manipulation won't increase much. 2/

Do they seem oddly high? Especially given all this talk about how trade is too liberalized?

What are actual tariffs charged on US exports? 1/

@econsky

Do they seem oddly high? Especially given all this talk about how trade is too liberalized?

What are actual tariffs charged on US exports? 1/

@econsky

It introduced income-varying fixed charges!

Fixed charges, which economists have long argued for efficiency reasons, led to more equal cost sharing after the drought. 9/

It introduced income-varying fixed charges!

Fixed charges, which economists have long argued for efficiency reasons, led to more equal cost sharing after the drought. 9/

We also see groundwater tables falling much faster during the drought in richer neighborhoods.

This drop of about 1 meter/year in groundwater levels rivals that of some of the fastest depleting aquifers in the world. 8/

We also see groundwater tables falling much faster during the drought in richer neighborhoods.

This drop of about 1 meter/year in groundwater levels rivals that of some of the fastest depleting aquifers in the world. 8/