Course on Thinkific

learnbiotechinvesting.thinkific.com

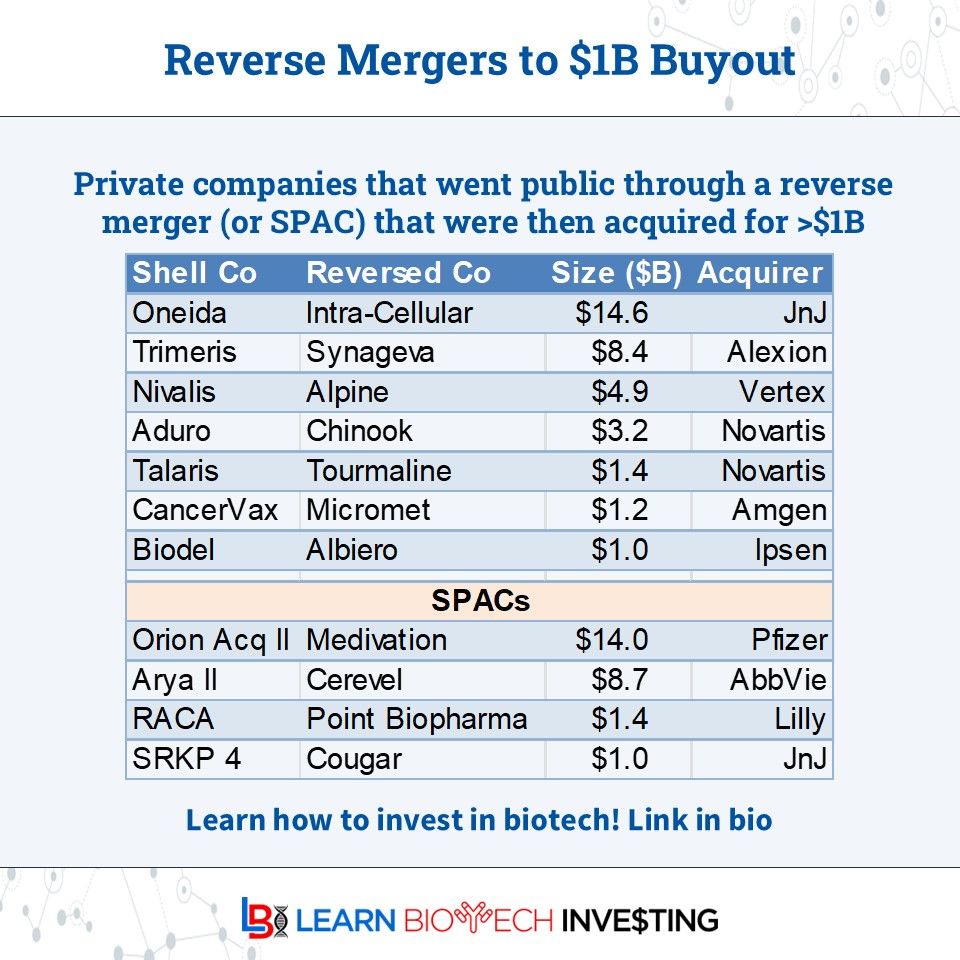

Though these deals are few & far between, here are some examples:

Who will be next?

#learnbiotechinvesting #investing #BiotechPrometheus

Though these deals are few & far between, here are some examples:

Who will be next?

#learnbiotechinvesting #investing #BiotechPrometheus

But what is it? Here's a quick overview for those new to the field

There will be lots of news to sift through. Enjoy!

#learnbiotechinvesting #BiotechPrometheus

But what is it? Here's a quick overview for those new to the field

There will be lots of news to sift through. Enjoy!

#learnbiotechinvesting #BiotechPrometheus

This framework will help investors organise their thoughts

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

This framework will help investors organise their thoughts

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

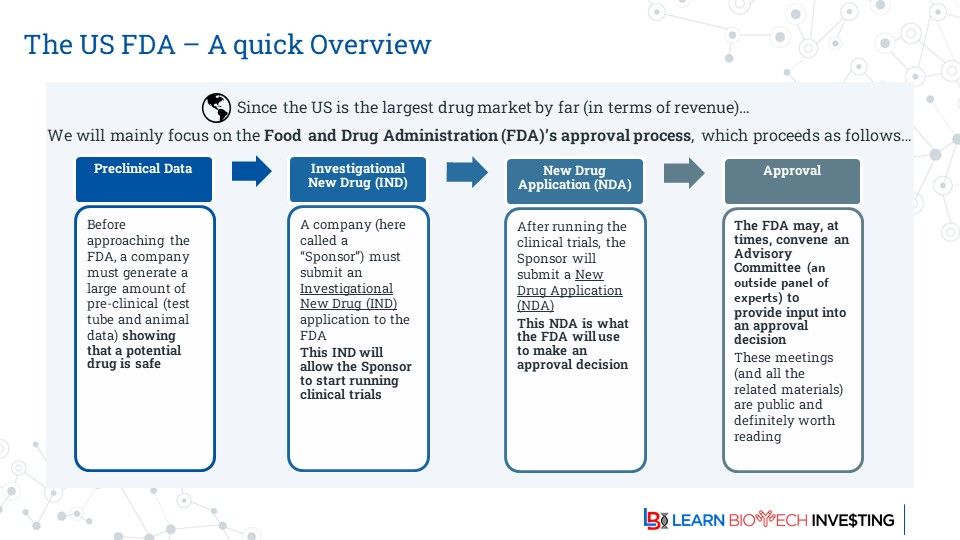

At each step investors should ask themselves if the company is developing things in a way that will satisfy the FDA

Until a drug is approved the FDA is the most important decision maker

#BiotechPrometheus

At each step investors should ask themselves if the company is developing things in a way that will satisfy the FDA

Until a drug is approved the FDA is the most important decision maker

#BiotechPrometheus

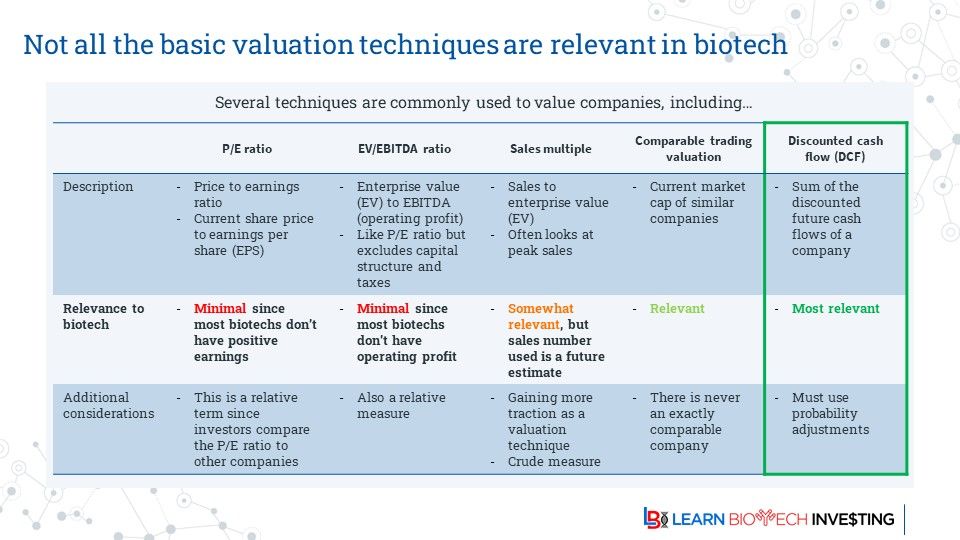

Though it too has drawbacks

#DCF #PoS #learnbiotechinvesting #investing #BiotechPrometheus

Though it too has drawbacks

#DCF #PoS #learnbiotechinvesting #investing #BiotechPrometheus

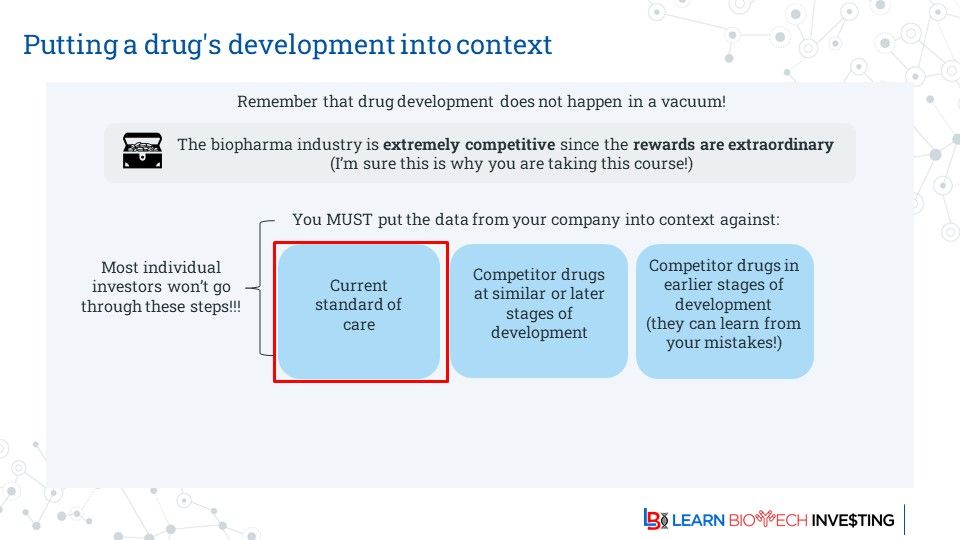

Also keep an eye on the competition

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Also keep an eye on the competition

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

What do you think?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

What do you think?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Usually applied to multiple drugs in the same class it can hamper revenue potential if alternatives exist

Investors should be aware

#learnbiotechinvesting

Usually applied to multiple drugs in the same class it can hamper revenue potential if alternatives exist

Investors should be aware

#learnbiotechinvesting

#learnbiotechinvesting #biotech#BiotechPrometheus

#learnbiotechinvesting #biotech#BiotechPrometheus

First-in-class will retain larger share if later entrants are not differentiated while a differentiated drug will gain outsized share even if a later entrant

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

First-in-class will retain larger share if later entrants are not differentiated while a differentiated drug will gain outsized share even if a later entrant

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

In many cases a biotech's drug will be sold by pharma so understanding what they look for is important to know

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

In many cases a biotech's drug will be sold by pharma so understanding what they look for is important to know

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Take the free course. It focuses on the basics

What other topics should we cover?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Take the free course. It focuses on the basics

What other topics should we cover?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

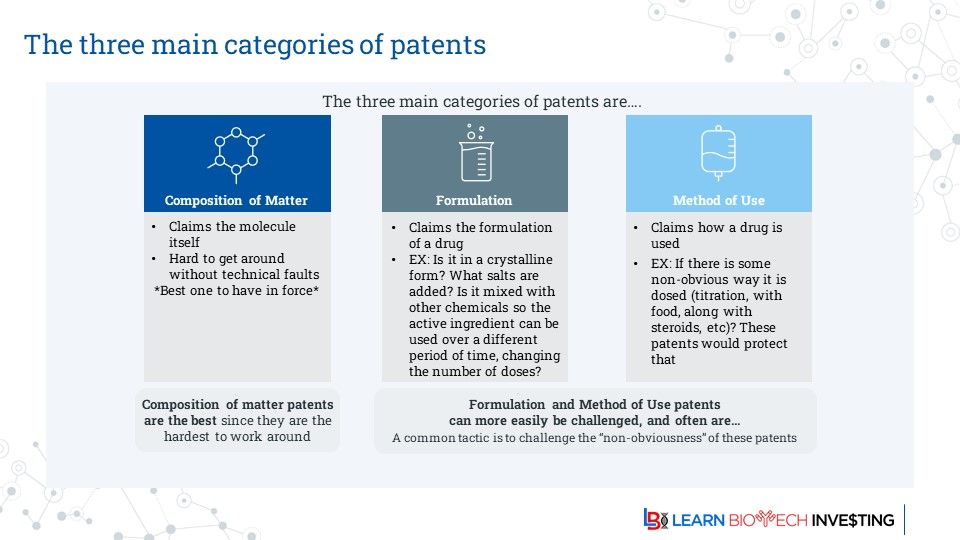

There are 3 main types, with composition of matter being the most important.

But remember that not all patents are equal; some are stronger than others

There are 3 main types, with composition of matter being the most important.

But remember that not all patents are equal; some are stronger than others

Here's a selected list:

Any others I'm missing?

Who will be next?

#learnbiotechinvesting #investing #BiotechPrometheus

Here's a selected list:

Any others I'm missing?

Who will be next?

#learnbiotechinvesting #investing #BiotechPrometheus

Here are schematics of what most people think, what it is in reality, & modifications for small or large molecules

Investors take note: all must work to MAKE a drug, but almost any step can BREAK a drug!

Here are schematics of what most people think, what it is in reality, & modifications for small or large molecules

Investors take note: all must work to MAKE a drug, but almost any step can BREAK a drug!

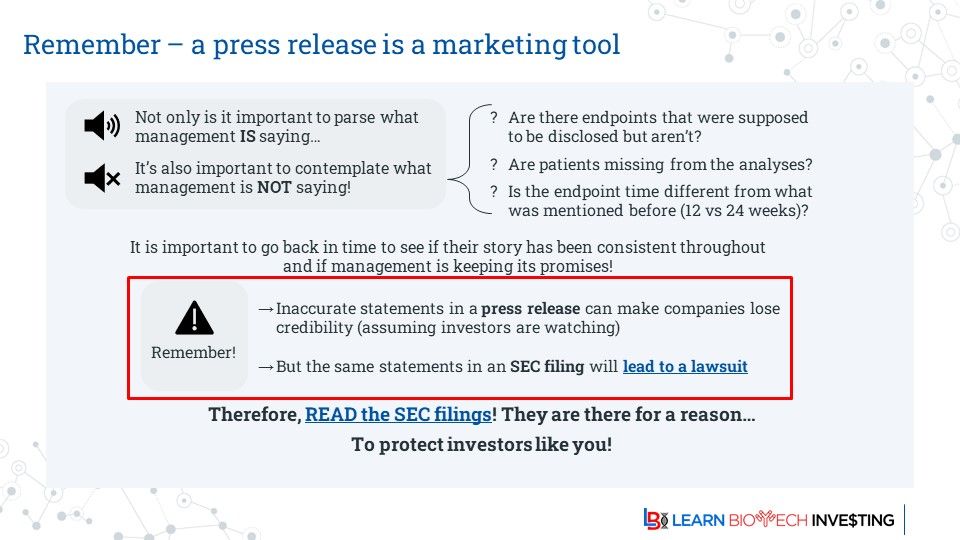

Read the SEC filings! They exist to help #investors! And they are freely available, often on the company website

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Read the SEC filings! They exist to help #investors! And they are freely available, often on the company website

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

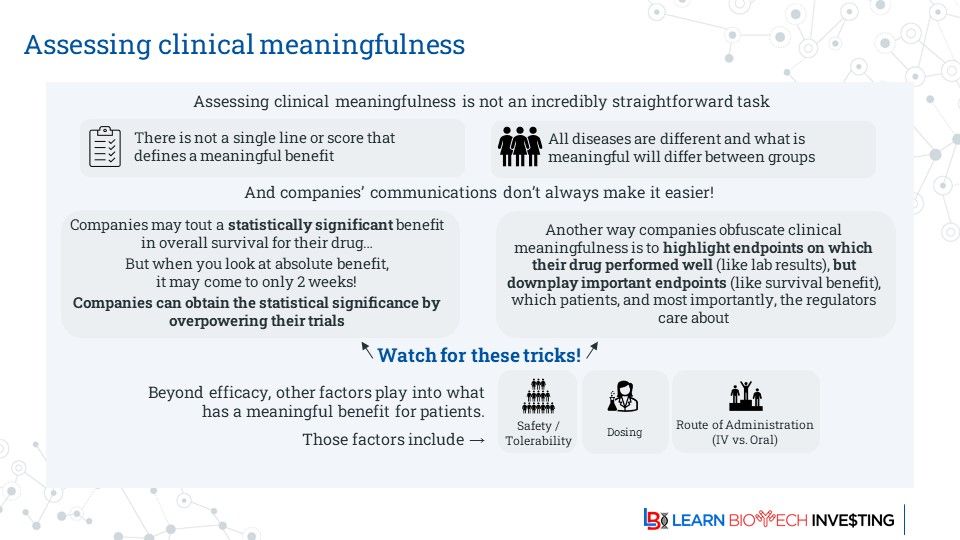

A "positive" result sometimes isn't enough if it doesn't significantly change the treatment landscape. But this can be subjective

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

A "positive" result sometimes isn't enough if it doesn't significantly change the treatment landscape. But this can be subjective

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

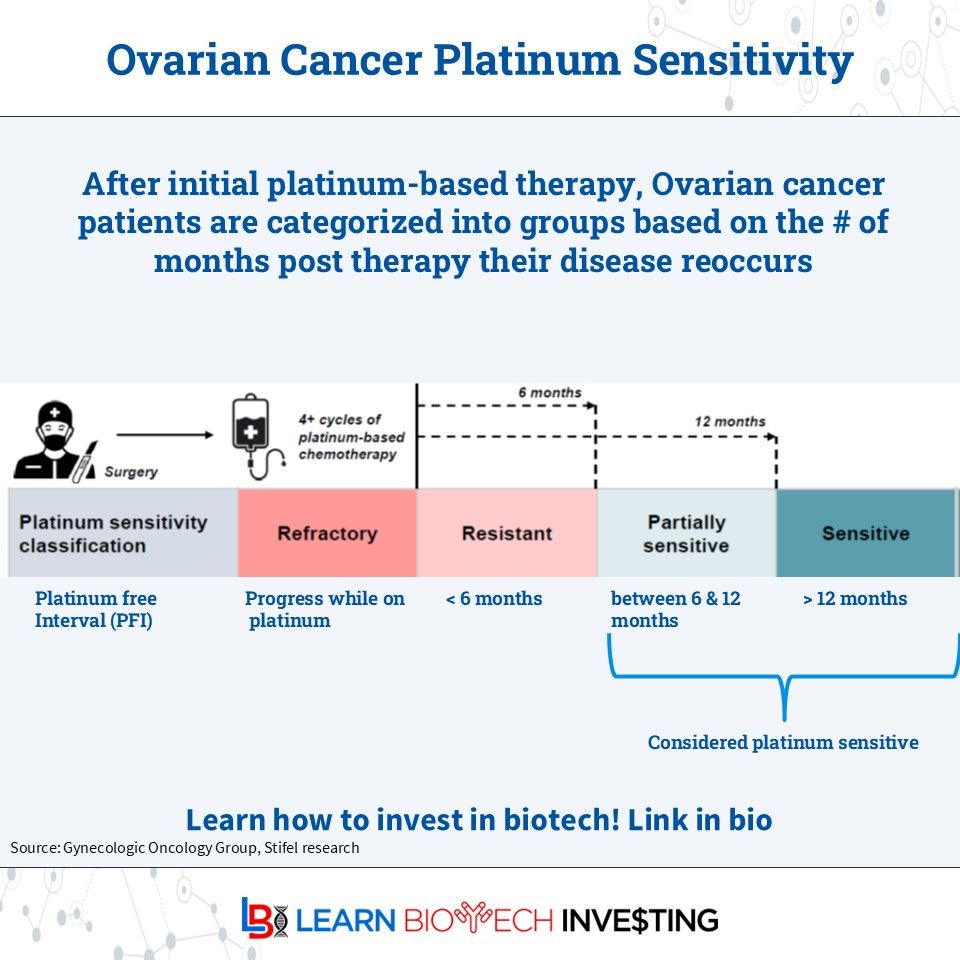

Probability of response to 2L Pt is low for refractory (~0%) or resistant (~10%)

#learnbiotechinvesting

Probability of response to 2L Pt is low for refractory (~0%) or resistant (~10%)

#learnbiotechinvesting

This is a drastic simplification but useful to know

Be aware of the perverse incentives #PBM

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

This is a drastic simplification but useful to know

Be aware of the perverse incentives #PBM

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

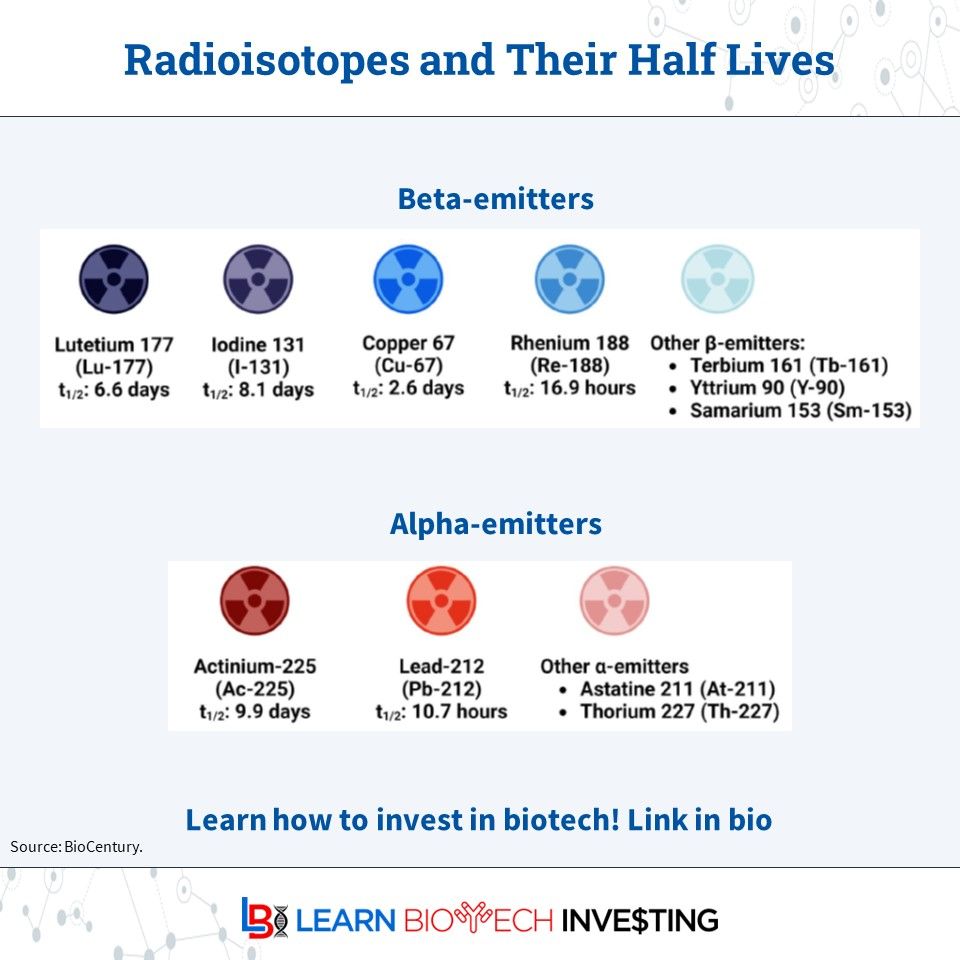

It has implications for manufacturing, ligand residence time, and dosing frequency

Beta-emitters (especially Lu-177) are more common due to approved infrastructure, but alpha-emitters (especially Ac-225) are growing fast

It has implications for manufacturing, ligand residence time, and dosing frequency

Beta-emitters (especially Lu-177) are more common due to approved infrastructure, but alpha-emitters (especially Ac-225) are growing fast

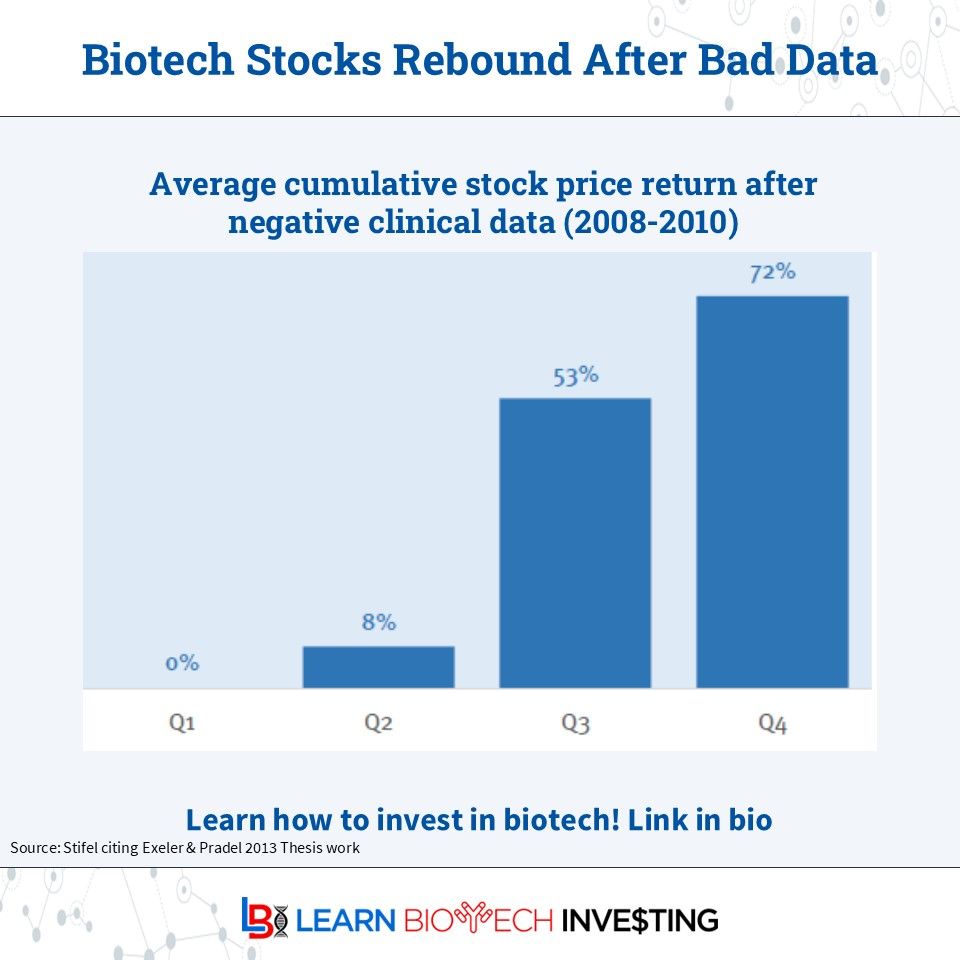

An interesting find but likely a dataset quirk

What do you think?

#learnbiotechinvesting #investing #BiotechPrometheus

An interesting find but likely a dataset quirk

What do you think?

#learnbiotechinvesting #investing #BiotechPrometheus

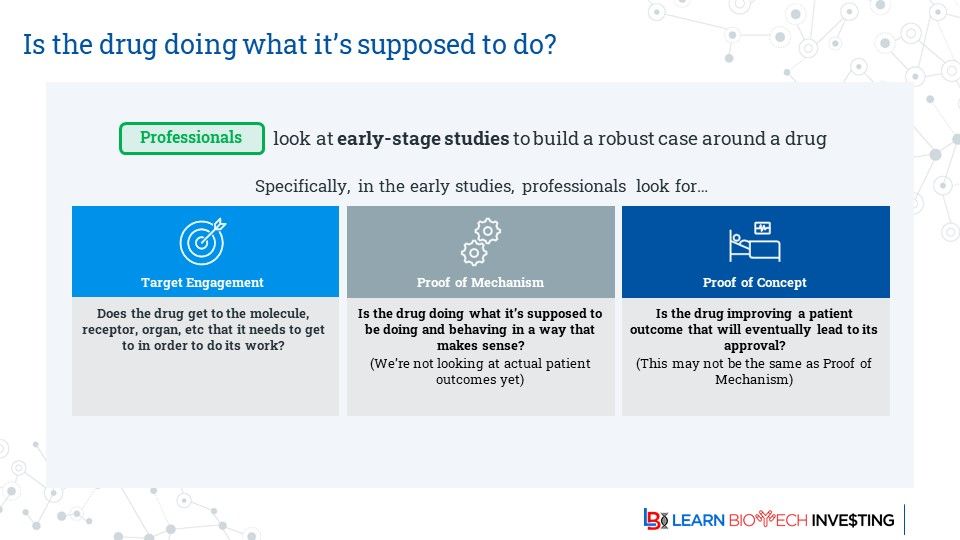

Look for: getting to right tissue, target engagement, proof of mechanism, and proof of concept

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Look for: getting to right tissue, target engagement, proof of mechanism, and proof of concept

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

That will impact your analysis

This is from 2013. If there's more recent data, please cite the source below

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

That will impact your analysis

This is from 2013. If there's more recent data, please cite the source below

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

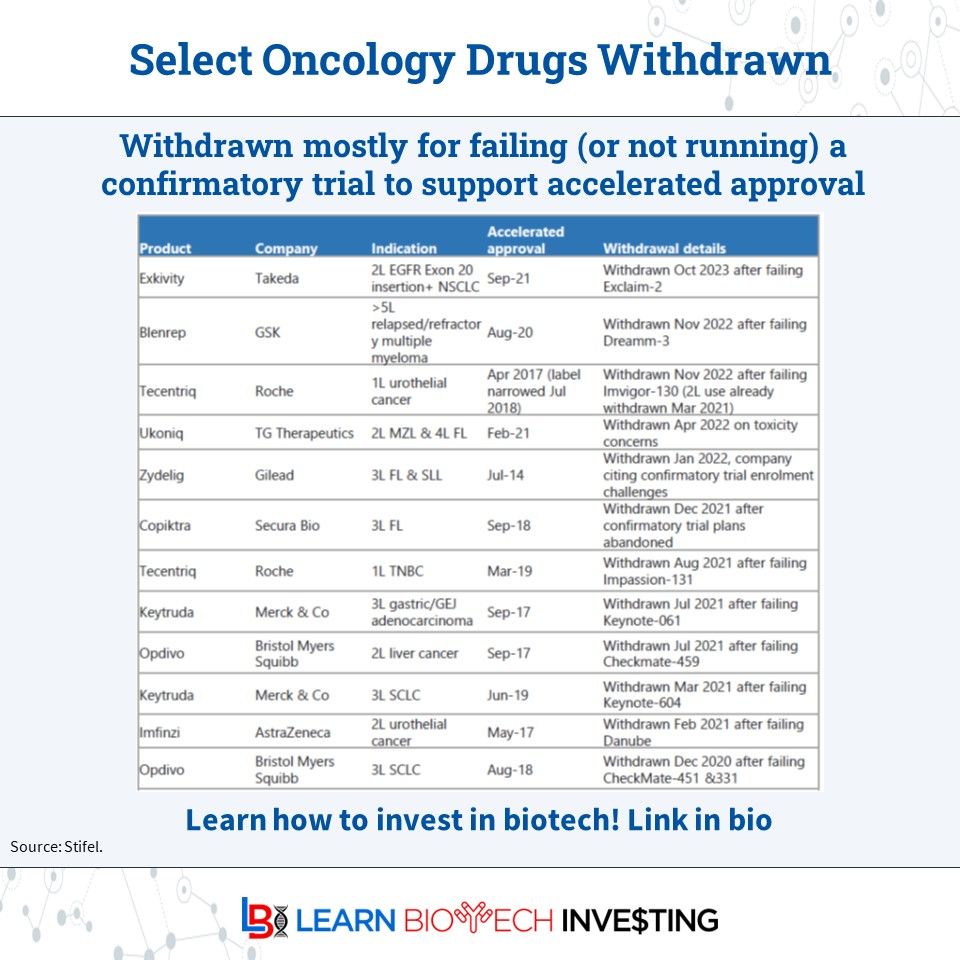

Here are recent oncology examples but it also happens in other TAs (women's health)

Here are recent oncology examples but it also happens in other TAs (women's health)

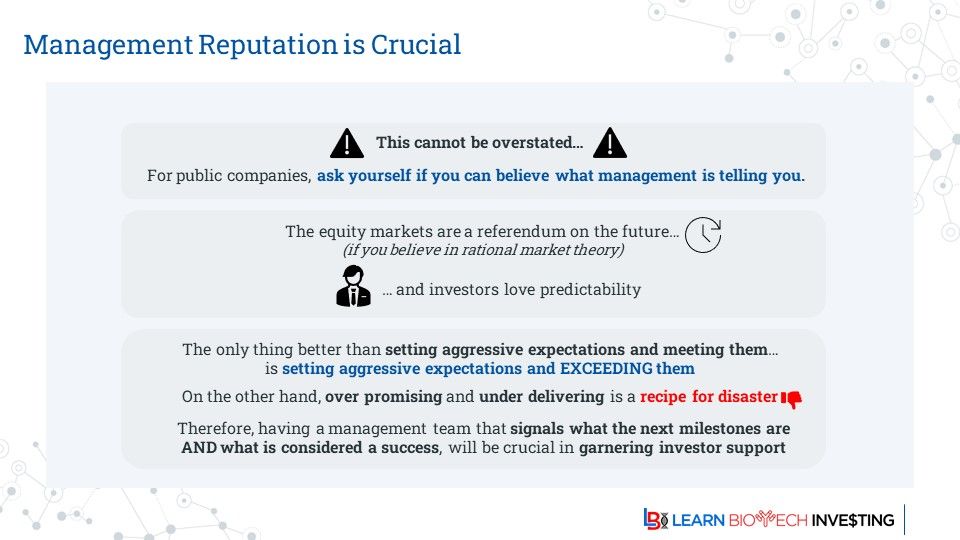

A lot that happens inside a company that is critical for success is outside of public view

Investors must ask themselves if they believe management is giving an accurate assessment, both good & bad

#learnbiotechinvesting #BiotechPrometheus

A lot that happens inside a company that is critical for success is outside of public view

Investors must ask themselves if they believe management is giving an accurate assessment, both good & bad

#learnbiotechinvesting #BiotechPrometheus