Course on Thinkific

learnbiotechinvesting.thinkific.com

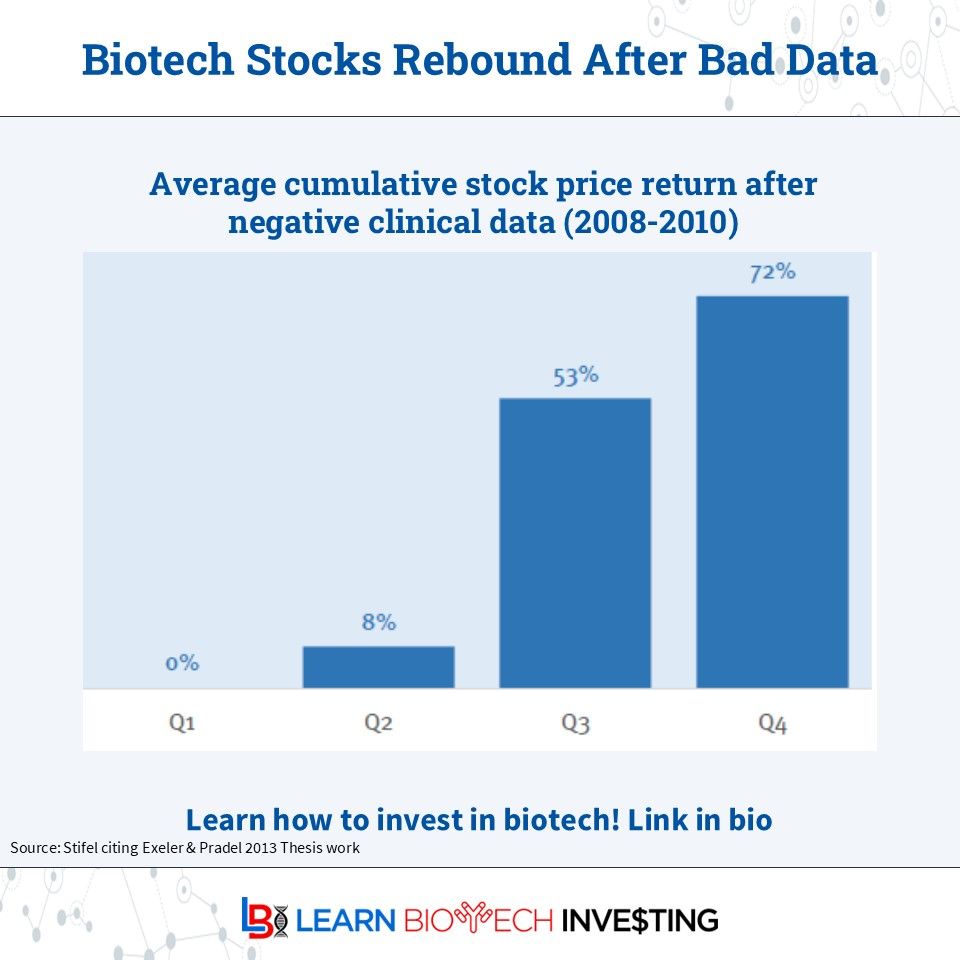

An interesting find but likely a dataset quirk

What do you think?

#learnbiotechinvesting #investing #BiotechPrometheus

An interesting find but likely a dataset quirk

What do you think?

#learnbiotechinvesting #investing #BiotechPrometheus

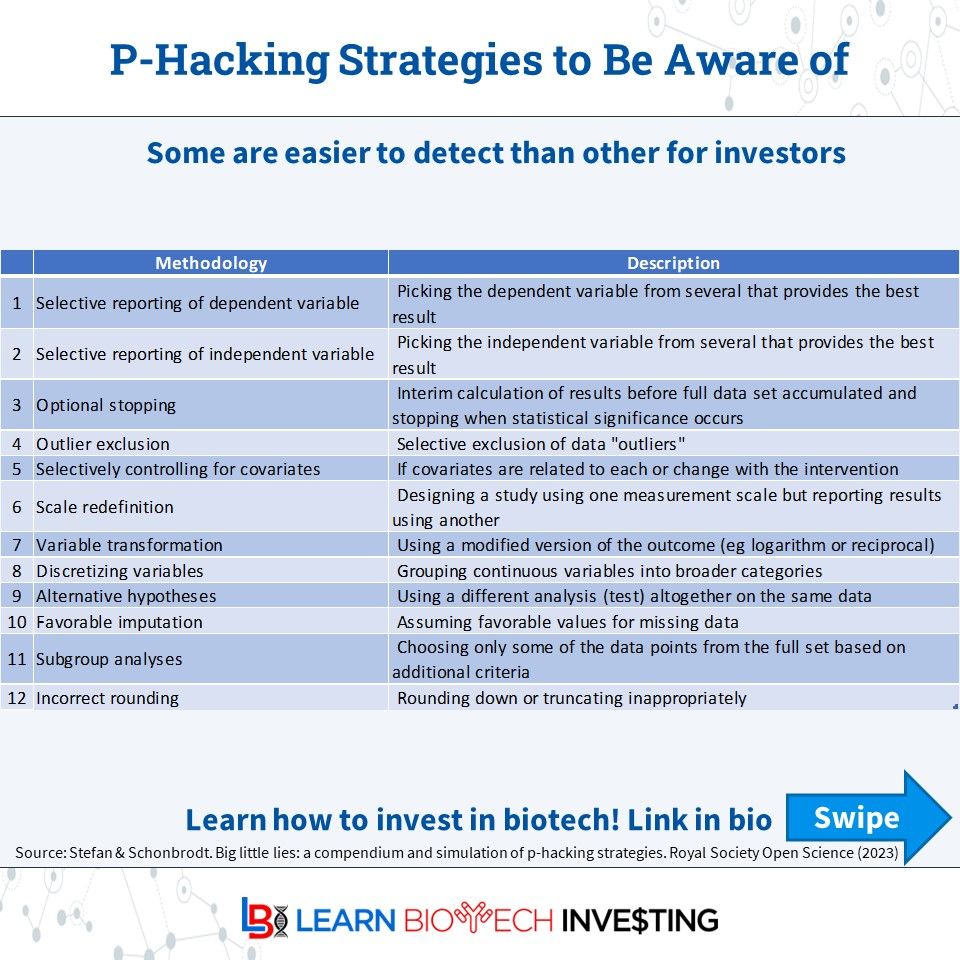

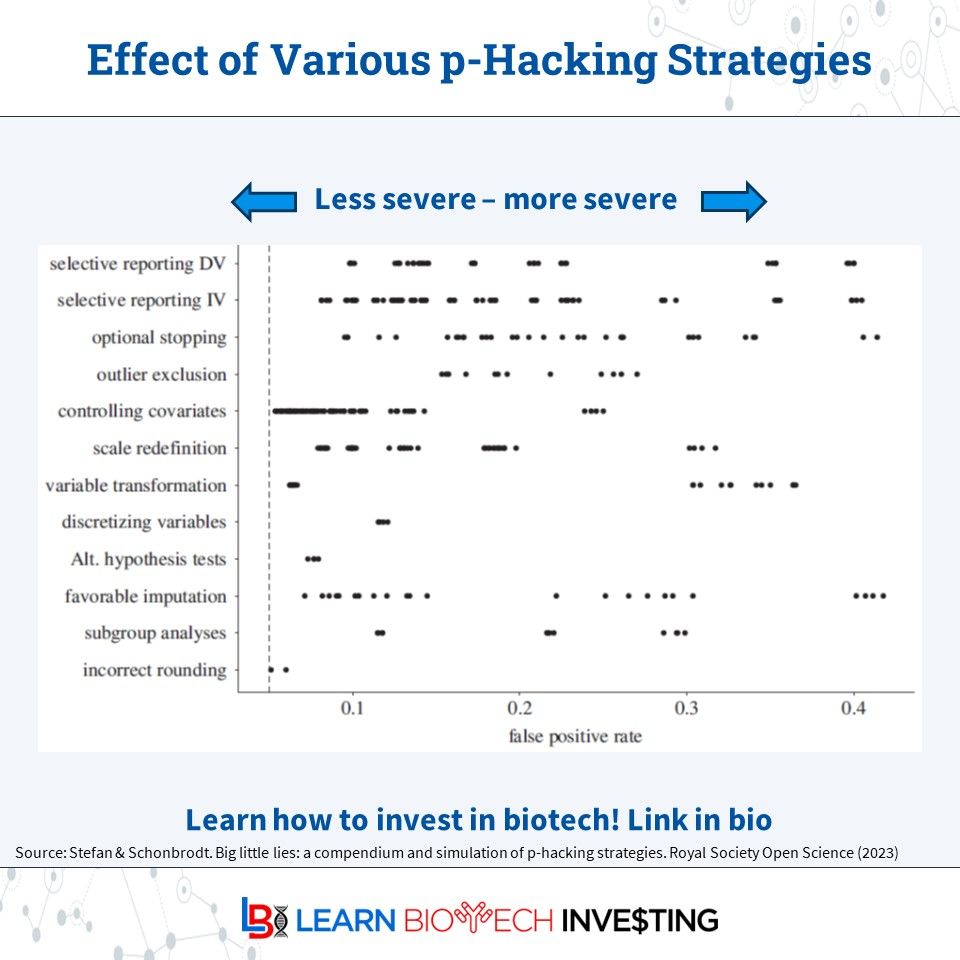

Hard to know without raw data but be prepared to ask & investigate where possible!

#learnbiotechinvesting #biotechinvesting #BiotechPrometheus

Hard to know without raw data but be prepared to ask & investigate where possible!

#learnbiotechinvesting #biotechinvesting #BiotechPrometheus

Here are the biopharma companies ranked by likelihood of first approval (LoA%) from 2006-2022

$AMGN, $NVO, #Eisai top the list

$GSK, #Astellas, $ABBV are at the bottom

#learnbiotechinvesting #BiotechPrometheus

Here are the biopharma companies ranked by likelihood of first approval (LoA%) from 2006-2022

$AMGN, $NVO, #Eisai top the list

$GSK, #Astellas, $ABBV are at the bottom

#learnbiotechinvesting #BiotechPrometheus

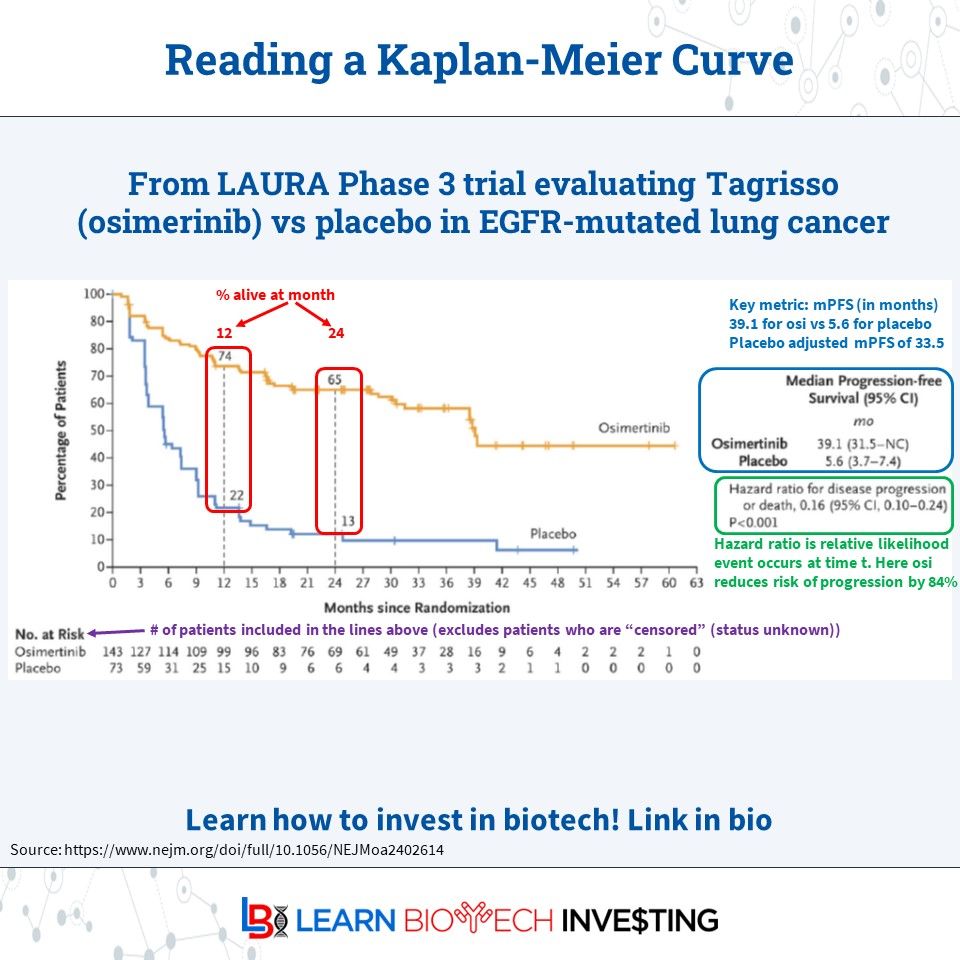

Its an important metric for patients since it gives them a better understanding of the risk they face over time rather than when the median patient will progress or die

#learnbiotechinvesting

Its an important metric for patients since it gives them a better understanding of the risk they face over time rather than when the median patient will progress or die

#learnbiotechinvesting

It covers #mPFS, 12 & 24-month survival, #HazardRatio, #atRisk.

These metrics give different views of a drug.

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

It covers #mPFS, 12 & 24-month survival, #HazardRatio, #atRisk.

These metrics give different views of a drug.

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

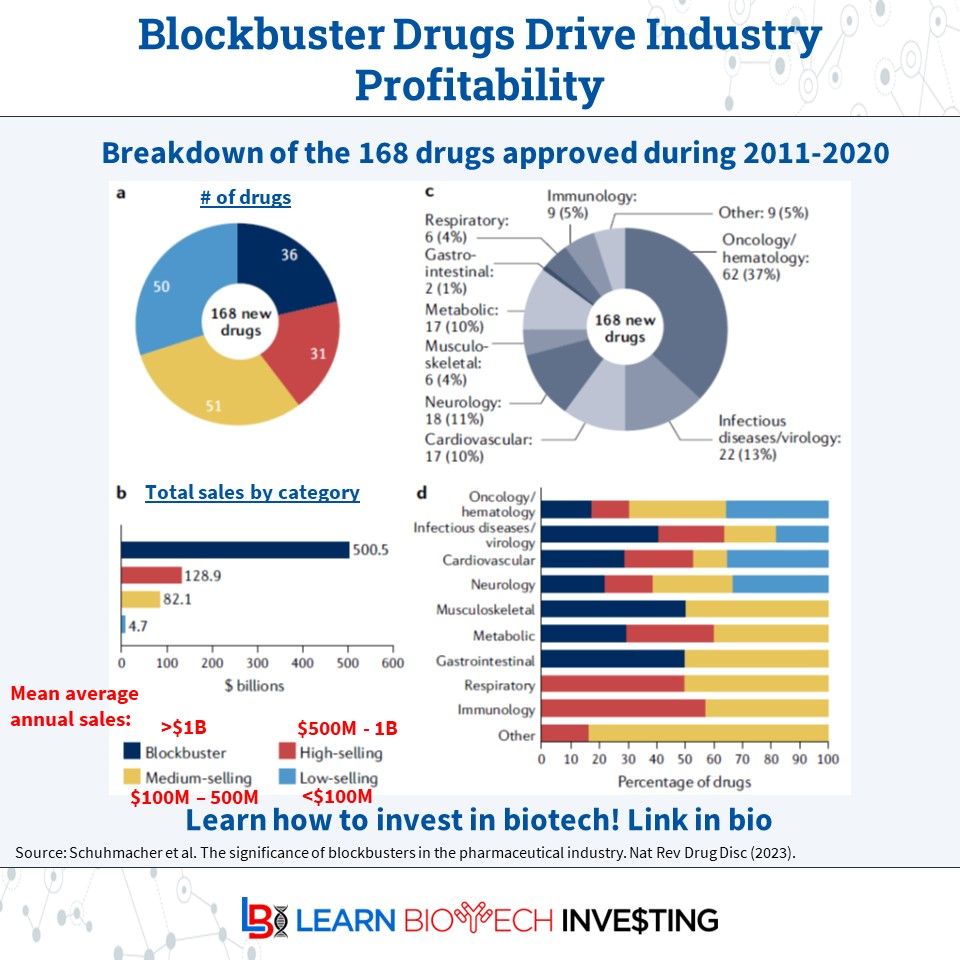

From 2011-2020, all blockbuster were profitable but no low selling drugs were

No immunology blockbusters in the time frame but there are now

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

From 2011-2020, all blockbuster were profitable but no low selling drugs were

No immunology blockbusters in the time frame but there are now

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

That will impact your analysis

This is from 2013. If there's more recent data, please cite the source below

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

That will impact your analysis

This is from 2013. If there's more recent data, please cite the source below

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

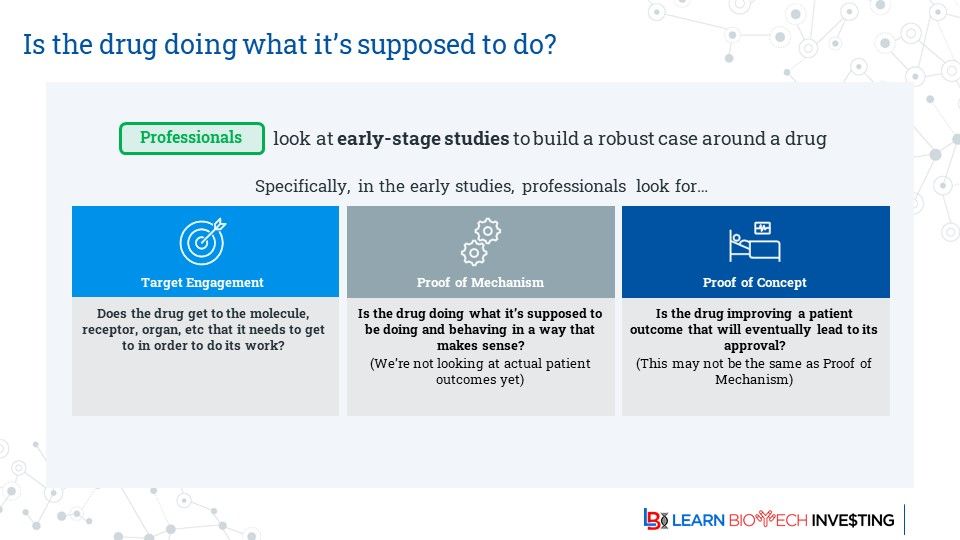

Look for: getting to right tissue, target engagement, proof of mechanism, and proof of concept

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Look for: getting to right tissue, target engagement, proof of mechanism, and proof of concept

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

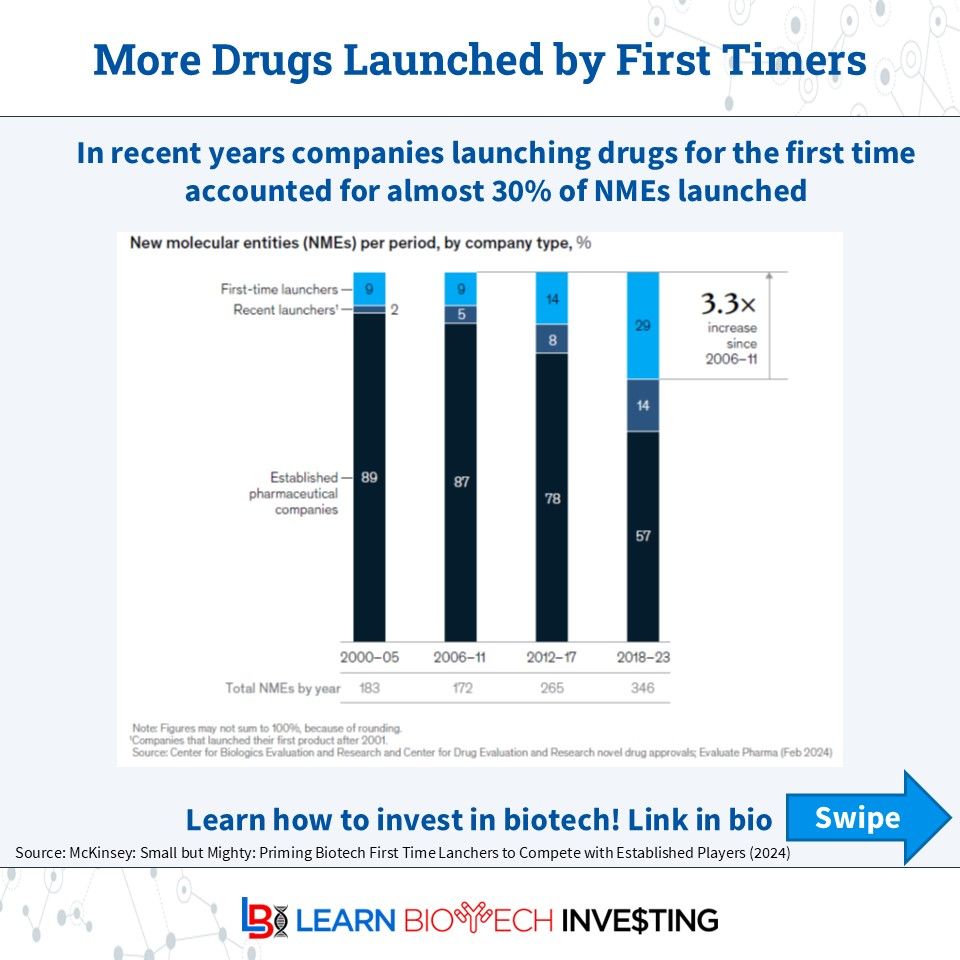

First timers underperform expectations vs experienced peers ~75% vs ~55% of the time

McKinsey correlates this to greater & earlier commercial investment from experience

Do you agree?

First timers underperform expectations vs experienced peers ~75% vs ~55% of the time

McKinsey correlates this to greater & earlier commercial investment from experience

Do you agree?

Here's what the CRs/PRs/SDs mean at a high level

These are assessed on scans

I'm using RECIST v1.1 definitions

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Here's what the CRs/PRs/SDs mean at a high level

These are assessed on scans

I'm using RECIST v1.1 definitions

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Accelerated approval and Breakthrough status save a statistically significant amount of time. But Fast track does not

Investors should keep this in mind

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Accelerated approval and Breakthrough status save a statistically significant amount of time. But Fast track does not

Investors should keep this in mind

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

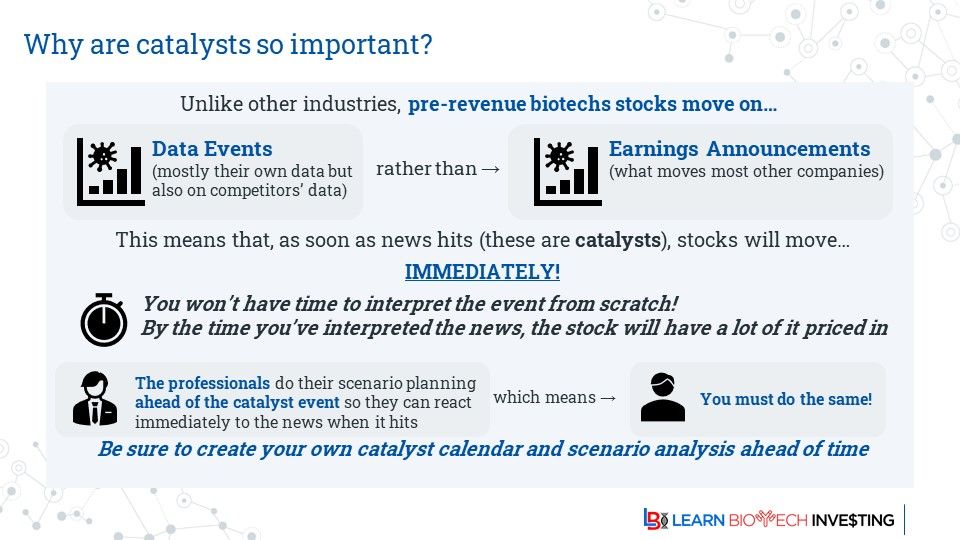

You won't have time to thoughtfully analyze the data when it hits

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

You won't have time to thoughtfully analyze the data when it hits

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

It tries to factor development risk into revenue and cost assumptions.

Here is a table of PoS values:

#learnbiotechinvesting #investing #BiotechPrometheus

It tries to factor development risk into revenue and cost assumptions.

Here is a table of PoS values:

#learnbiotechinvesting #investing #BiotechPrometheus

Though these deals are few & far between, here are some examples:

Who will be next?

#learnbiotechinvesting #investing #BiotechPrometheus

Though these deals are few & far between, here are some examples:

Who will be next?

#learnbiotechinvesting #investing #BiotechPrometheus

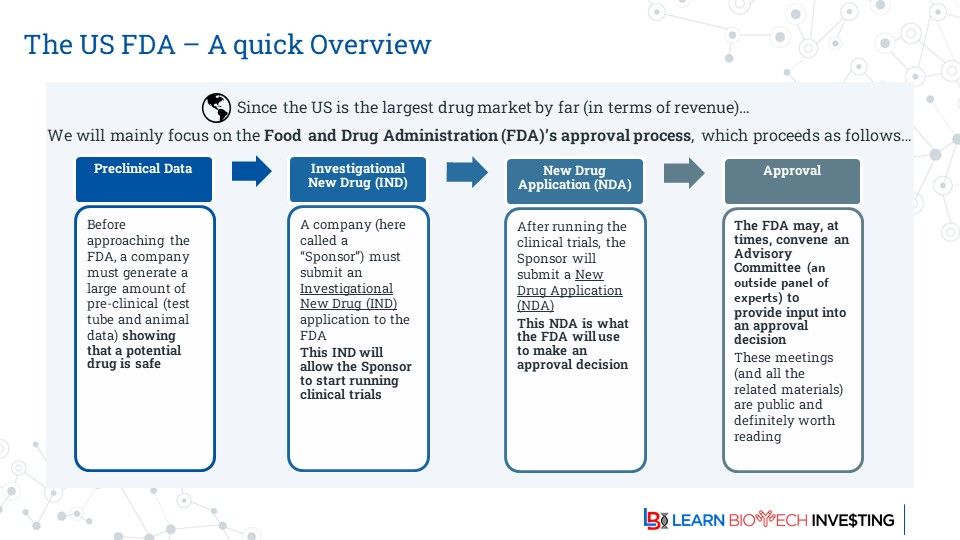

But what is it? Here's a quick overview for those new to the field

There will be lots of news to sift through. Enjoy!

#learnbiotechinvesting #BiotechPrometheus

But what is it? Here's a quick overview for those new to the field

There will be lots of news to sift through. Enjoy!

#learnbiotechinvesting #BiotechPrometheus

This framework will help investors organise their thoughts

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

This framework will help investors organise their thoughts

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

At each step investors should ask themselves if the company is developing things in a way that will satisfy the FDA

Until a drug is approved the FDA is the most important decision maker

#BiotechPrometheus

At each step investors should ask themselves if the company is developing things in a way that will satisfy the FDA

Until a drug is approved the FDA is the most important decision maker

#BiotechPrometheus

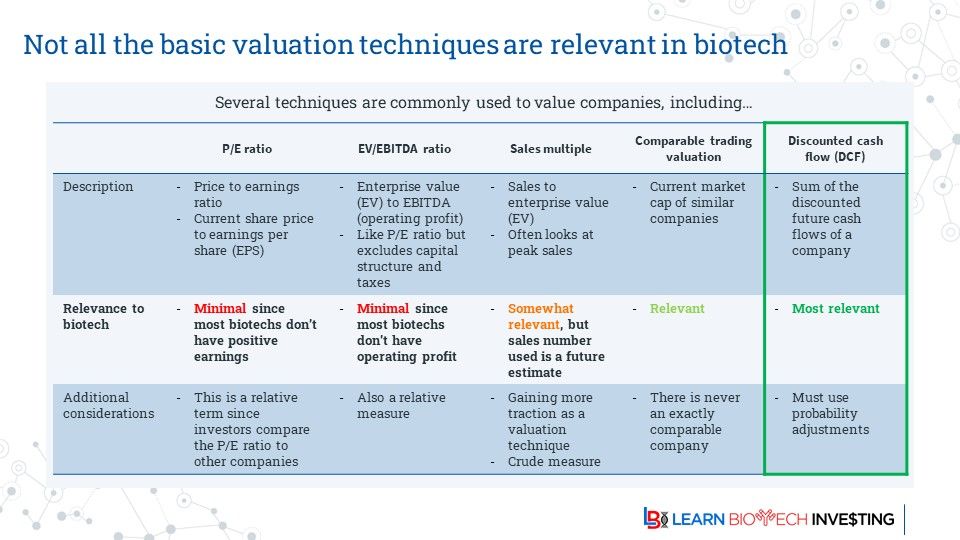

Though it too has drawbacks

#DCF #PoS #learnbiotechinvesting #investing #BiotechPrometheus

Though it too has drawbacks

#DCF #PoS #learnbiotechinvesting #investing #BiotechPrometheus

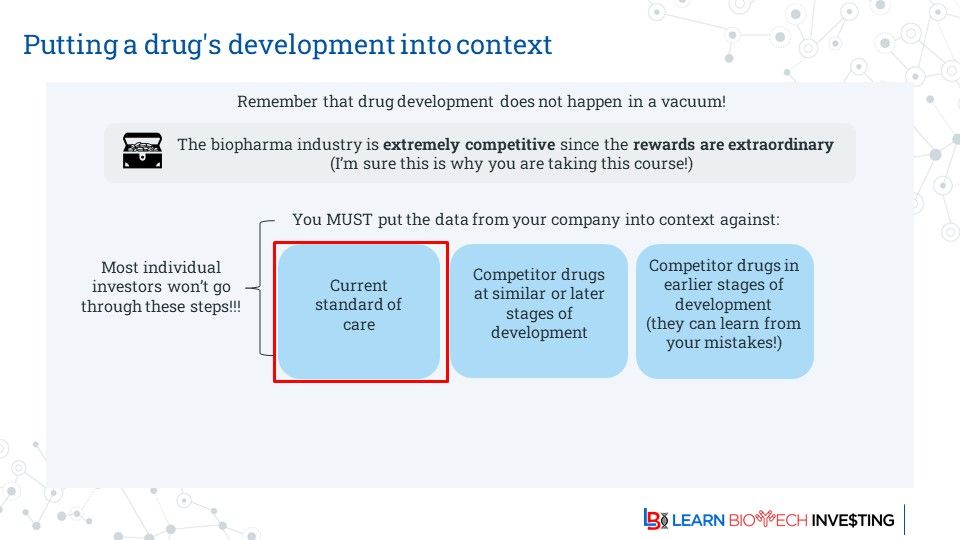

Also keep an eye on the competition

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Also keep an eye on the competition

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

What do you think?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

What do you think?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Usually applied to multiple drugs in the same class it can hamper revenue potential if alternatives exist

Investors should be aware

#learnbiotechinvesting

Usually applied to multiple drugs in the same class it can hamper revenue potential if alternatives exist

Investors should be aware

#learnbiotechinvesting

#learnbiotechinvesting #biotech#BiotechPrometheus

#learnbiotechinvesting #biotech#BiotechPrometheus

First-in-class will retain larger share if later entrants are not differentiated while a differentiated drug will gain outsized share even if a later entrant

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

First-in-class will retain larger share if later entrants are not differentiated while a differentiated drug will gain outsized share even if a later entrant

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

In many cases a biotech's drug will be sold by pharma so understanding what they look for is important to know

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

In many cases a biotech's drug will be sold by pharma so understanding what they look for is important to know

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Take the free course. It focuses on the basics

What other topics should we cover?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Take the free course. It focuses on the basics

What other topics should we cover?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus