Lily Batchelder

@lilybatch.bsky.social

1.3K followers

110 following

67 posts

Kopple Family Professor, NYU Law. Faculty Director @taxlawcenter.org. Former Assistant Secretary for Tax Policy at Treasury; Deputy Director, National Economic Council; Chief Tax Counsel, Senate Finance Committee.

Posts

Media

Videos

Starter Packs

Reposted by Lily Batchelder

Chye-Ching Huang

@dashching.bsky.social

· Jun 24

Reposted by Lily Batchelder

Lily Batchelder

@lilybatch.bsky.social

· May 31

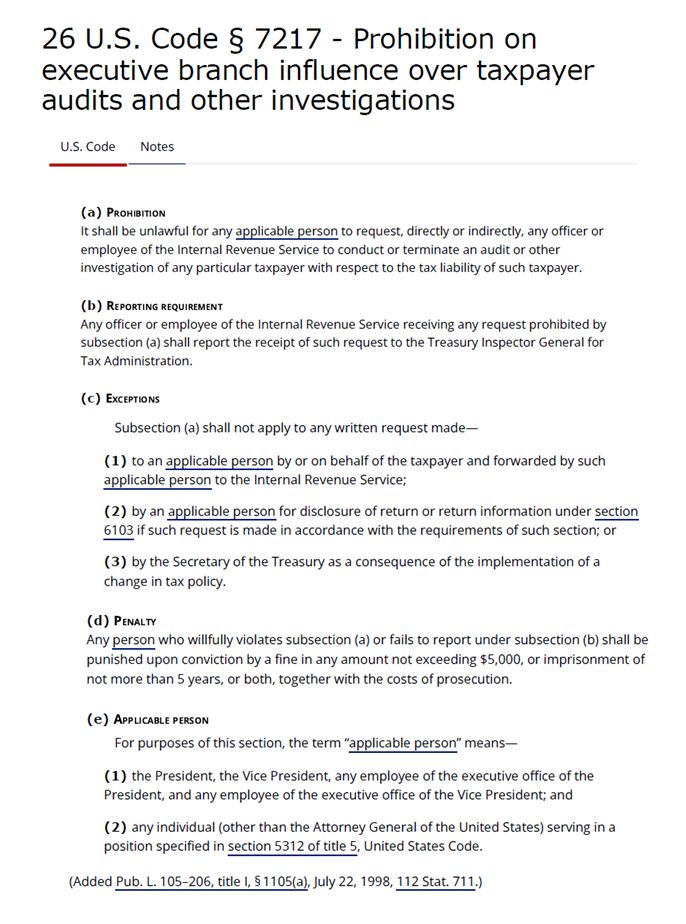

Register for Webinar: Understanding Risks to Taxpayer Privacy

Please join the Tax Law Center for a virtual discussion of the legal, privacy, and cybersecurity risks of unprecedented efforts to access, use, and share taxpayer data across government for purposes f...

nyu.zoom.us

Reposted by Lily Batchelder

Lily Batchelder

@lilybatch.bsky.social

· Apr 20

Lily Batchelder

@lilybatch.bsky.social

· Apr 20

Lily Batchelder

@lilybatch.bsky.social

· Apr 20