MTS Insights

@mtsinsights.bsky.social

Economic commentary, data, and reports with topics ranging from #macro to financial #markets. Tweets are not financial advice.

🎄 Consumption has been resilient so far this year, but several macro factors are compounding to make for a weak 2025 holiday sales outlook.

Here's what it means for the consumer discretionary sector and retailers.

seekingalpha.com/article/4840...

Here's what it means for the consumer discretionary sector and retailers.

seekingalpha.com/article/4840...

2025 Holiday Sales Outlook And XLY: Consumer Resilience To Be Tested By The Labor Market

Consumer Discretionary Select Sector SPDR® Fund ETF is rated a Sell due to elevated valuations and macro headwinds. Learn more about XLY ETF here.

seekingalpha.com

November 7, 2025 at 6:17 PM

🎄 Consumption has been resilient so far this year, but several macro factors are compounding to make for a weak 2025 holiday sales outlook.

Here's what it means for the consumer discretionary sector and retailers.

seekingalpha.com/article/4840...

Here's what it means for the consumer discretionary sector and retailers.

seekingalpha.com/article/4840...

💼 The ADP National Employment Report showed private sector job growth of 42,000 in October, beating expectations but highlighting ongoing labor market softening, especially for cyclically sensitive firms.

seekingalpha.com/article/4838... #jobsreport

seekingalpha.com/article/4838... #jobsreport

October ADP Employment: ADP Steps Up With A Mixed Labor Reading

ADP jobs data shows large firms driving hiring gains while small businesses struggle. Click here to read what investors need to know.

seekingalpha.com

November 5, 2025 at 5:38 PM

💼 The ADP National Employment Report showed private sector job growth of 42,000 in October, beating expectations but highlighting ongoing labor market softening, especially for cyclically sensitive firms.

seekingalpha.com/article/4838... #jobsreport

seekingalpha.com/article/4838... #jobsreport

🇺🇸 September CPI data showed headline and core inflation below expectations, reinforcing the view that price growth is normalizing.

With rate cuts in October and December nearly fully priced in, investors should expect the Fed to stay the course.

seekingalpha.com/article/4833... #CPI

With rate cuts in October and December nearly fully priced in, investors should expect the Fed to stay the course.

seekingalpha.com/article/4833... #CPI

September U.S. CPI: Soft CPI Keeps Fed On Course For Rate Cuts (SPX)

September CPI shows cooling inflation and rising equities as Fed rate cuts loom. Click for my look at the latest data and what it may mean for markets.

seekingalpha.com

October 24, 2025 at 5:31 PM

🇺🇸 September CPI data showed headline and core inflation below expectations, reinforcing the view that price growth is normalizing.

With rate cuts in October and December nearly fully priced in, investors should expect the Fed to stay the course.

seekingalpha.com/article/4833... #CPI

With rate cuts in October and December nearly fully priced in, investors should expect the Fed to stay the course.

seekingalpha.com/article/4833... #CPI

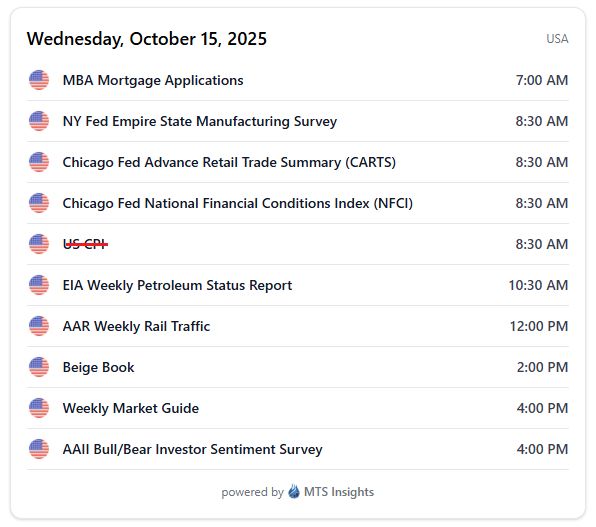

The CPI release that was originally due today has been rescheduled for October 24th, so the morning will be dominated by Fed data instead.

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

October 15, 2025 at 11:07 AM

The CPI release that was originally due today has been rescheduled for October 24th, so the morning will be dominated by Fed data instead.

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

A quiet start to a mid-October week. No major data updates are due today, just some recurring reports.

Full economic calendar here: www.mtsinsights.com/calendar/

Full economic calendar here: www.mtsinsights.com/calendar/

October 13, 2025 at 11:19 AM

A quiet start to a mid-October week. No major data updates are due today, just some recurring reports.

Full economic calendar here: www.mtsinsights.com/calendar/

Full economic calendar here: www.mtsinsights.com/calendar/

The week ends with several private sector reports, including consumer updates from BofA and the National Retail Federation.

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

October 10, 2025 at 11:57 AM

The week ends with several private sector reports, including consumer updates from BofA and the National Retail Federation.

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

Another labor market data point will be missed later this morning as the government shutdown continues.

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

October 9, 2025 at 11:09 AM

Another labor market data point will be missed later this morning as the government shutdown continues.

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

Several macro events are canceled due to the government shutdown. assuming no activity from the Census Bureau, NOAA, and the CBO (though CBO is operating at a limited capacity).

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

October 8, 2025 at 10:46 AM

Several macro events are canceled due to the government shutdown. assuming no activity from the Census Bureau, NOAA, and the CBO (though CBO is operating at a limited capacity).

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

🇺🇸 Who needs a jobs report?

September labor market data released so far signal a gradual cooling, with ADP reporting unexpected job losses and Challenger showing weak seasonal hiring demand.

seekingalpha.com/article/4827...

September labor market data released so far signal a gradual cooling, with ADP reporting unexpected job losses and Challenger showing weak seasonal hiring demand.

seekingalpha.com/article/4827...

September Labor Market Data: Who Needs A Jobs Report? (SP500)

September labor data shows cooling job market and steady unemployment, impacting stocks and yields. Click here to read what investors need to know.

seekingalpha.com

October 2, 2025 at 5:42 PM

🇺🇸 Who needs a jobs report?

September labor market data released so far signal a gradual cooling, with ADP reporting unexpected job losses and Challenger showing weak seasonal hiring demand.

seekingalpha.com/article/4827...

September labor market data released so far signal a gradual cooling, with ADP reporting unexpected job losses and Challenger showing weak seasonal hiring demand.

seekingalpha.com/article/4827...

🇺🇸 The US government entered its 15th shutdown since 1981, with no clear end in sight as budget negotiations stall.

Investors should watch out for potential federal workforce reductions, delayed data releases, and renewed US debt concerns as key market risks.

seekingalpha.com/article/4827...

Investors should watch out for potential federal workforce reductions, delayed data releases, and renewed US debt concerns as key market risks.

seekingalpha.com/article/4827...

U.S. Government Shuts Down: What Investors Need To Know (SPX)

Track how the US government shutdown may impact markets, gold, and Bitcoin. Learn what investors should watch and how to manage risks.

seekingalpha.com

October 1, 2025 at 3:35 PM

🇺🇸 The US government entered its 15th shutdown since 1981, with no clear end in sight as budget negotiations stall.

Investors should watch out for potential federal workforce reductions, delayed data releases, and renewed US debt concerns as key market risks.

seekingalpha.com/article/4827...

Investors should watch out for potential federal workforce reductions, delayed data releases, and renewed US debt concerns as key market risks.

seekingalpha.com/article/4827...

🇺🇸 Today's personal income and outlays report showed solid spending, slowing incomes, and sticky inflation.

In the end, there weren't too many surprises, but the data generally countered the case for more rate cuts.

seekingalpha.com/article/4826... #inflation

In the end, there weren't too many surprises, but the data generally countered the case for more rate cuts.

seekingalpha.com/article/4826... #inflation

August Personal Income And Outlays: Solid Spending, Slowing Incomes, And Sticky Inflation

Discover how rising wages, persistent inflation, and resilient consumer spending shape market trends.

seekingalpha.com

September 26, 2025 at 5:16 PM

🇺🇸 Today's personal income and outlays report showed solid spending, slowing incomes, and sticky inflation.

In the end, there weren't too many surprises, but the data generally countered the case for more rate cuts.

seekingalpha.com/article/4826... #inflation

In the end, there weren't too many surprises, but the data generally countered the case for more rate cuts.

seekingalpha.com/article/4826... #inflation

⏫ The final Q2 2025 US GDP estimate was revised sharply higher, signaling surprising economic resilience and strong consumer demand.

Investors should stay cautious ahead of October’s Fed decision, as macro data could fuel further volatility.

seekingalpha.com/article/4825... #GDP

Investors should stay cautious ahead of October’s Fed decision, as macro data could fuel further volatility.

seekingalpha.com/article/4825... #GDP

U.S. Q2 GDP, Third Estimate: Upward GDP Revision Counters Slowdown Narrative (SP500)

U.S. Q2 2025 GDP jumps to 3.8%, signaling strong growth.

seekingalpha.com

September 25, 2025 at 6:04 PM

⏫ The final Q2 2025 US GDP estimate was revised sharply higher, signaling surprising economic resilience and strong consumer demand.

Investors should stay cautious ahead of October’s Fed decision, as macro data could fuel further volatility.

seekingalpha.com/article/4825... #GDP

Investors should stay cautious ahead of October’s Fed decision, as macro data could fuel further volatility.

seekingalpha.com/article/4825... #GDP

🇺🇸 Missed the Fed announcement yesterday?

Start your morning with an in-depth review of the press release, the newest projections, and the press conference:

#Fed #FOMC seekingalpha.com/article/4823...

Start your morning with an in-depth review of the press release, the newest projections, and the press conference:

#Fed #FOMC seekingalpha.com/article/4823...

September FOMC: Fed Delivers First Cut Since 2024, But Tone Stays Firm (NDX)

The Fed cut rates to 4.00%-4.25% amid job market risks, but kept a hawkish stance due to inflation concerns. Find out why markets reacted with caution.

seekingalpha.com

September 18, 2025 at 11:25 AM

🇺🇸 Missed the Fed announcement yesterday?

Start your morning with an in-depth review of the press release, the newest projections, and the press conference:

#Fed #FOMC seekingalpha.com/article/4823...

Start your morning with an in-depth review of the press release, the newest projections, and the press conference:

#Fed #FOMC seekingalpha.com/article/4823...

🇺🇸 US macro data showed resilient consumer spending and hotter-than-expected trade prices, but industrial production remained soft

Markets shrugged and largely ignored the data, focusing on the upcoming #Fed rate decision.

seekingalpha.com/article/4823...

Markets shrugged and largely ignored the data, focusing on the upcoming #Fed rate decision.

seekingalpha.com/article/4823...

The Market Shrugs At Solid Macro Data Ahead Of The Fed's Decision (SP500)

Discover key insights on resilient U.S. consumer spending, rising trade prices, and market reactions ahead of the Fed rate decision. Click for more.

seekingalpha.com

September 16, 2025 at 4:40 PM

🇺🇸 US macro data showed resilient consumer spending and hotter-than-expected trade prices, but industrial production remained soft

Markets shrugged and largely ignored the data, focusing on the upcoming #Fed rate decision.

seekingalpha.com/article/4823...

Markets shrugged and largely ignored the data, focusing on the upcoming #Fed rate decision.

seekingalpha.com/article/4823...

📈 August #CPI showed a broad pickup in inflation, with both goods and services fueling the rise, ending the Q1-Q2 disinflationary trend.

If current trends persist, the Fed may face stagflationary conditions, but rates are likely to continue moving lower.

seekingalpha.com/article/4822...

If current trends persist, the Fed may face stagflationary conditions, but rates are likely to continue moving lower.

seekingalpha.com/article/4822...

August CPI: Inflation Momentum Picks Up In Q3 (NDX)

August CPI reveals rising inflation across goods and services. Discover how this impacts Fed rate cuts, stocks, and market outlook.

seekingalpha.com

September 11, 2025 at 3:31 PM

📈 August #CPI showed a broad pickup in inflation, with both goods and services fueling the rise, ending the Q1-Q2 disinflationary trend.

If current trends persist, the Fed may face stagflationary conditions, but rates are likely to continue moving lower.

seekingalpha.com/article/4822...

If current trends persist, the Fed may face stagflationary conditions, but rates are likely to continue moving lower.

seekingalpha.com/article/4822...

❄️ August #PPI cooled more than expected, easing immediate #inflation concerns after July’s hot print.

However, energy and trade services weakness drove the headline decline, while core goods and manufacturing costs continued to rise.

seekingalpha.com/article/4821...

However, energy and trade services weakness drove the headline decline, while core goods and manufacturing costs continued to rise.

seekingalpha.com/article/4821...

August PPI: Headline Weakness Masks Ongoing Cost Pressures (SPX)

August PPI fell more than expected, easing inflation fears. Discover market impacts, Fed considerations, and what investors should watch next.

seekingalpha.com

September 10, 2025 at 5:28 PM

❄️ August #PPI cooled more than expected, easing immediate #inflation concerns after July’s hot print.

However, energy and trade services weakness drove the headline decline, while core goods and manufacturing costs continued to rise.

seekingalpha.com/article/4821...

However, energy and trade services weakness drove the headline decline, while core goods and manufacturing costs continued to rise.

seekingalpha.com/article/4821...

🇺🇸 Today’s macro data adds to the medium-term dovish trend.

With the Fed divided, a broad set of evidence, weakening labor, disinflation in NFIB, and downward jobs revisions, is strengthening the case for rate cuts at upcoming #FOMC meetings.

seekingalpha.com/article/4821...

With the Fed divided, a broad set of evidence, weakening labor, disinflation in NFIB, and downward jobs revisions, is strengthening the case for rate cuts at upcoming #FOMC meetings.

seekingalpha.com/article/4821...

NFIB Optimism, Labor Revisions Feed Into Fed Policy Debate (SPX)

Easing costs, improving small business optimism, and a softening job market could lead to Fed rate cuts. Click here for more information on U.S. Economy.

seekingalpha.com

September 9, 2025 at 6:17 PM

🇺🇸 Today’s macro data adds to the medium-term dovish trend.

With the Fed divided, a broad set of evidence, weakening labor, disinflation in NFIB, and downward jobs revisions, is strengthening the case for rate cuts at upcoming #FOMC meetings.

seekingalpha.com/article/4821...

With the Fed divided, a broad set of evidence, weakening labor, disinflation in NFIB, and downward jobs revisions, is strengthening the case for rate cuts at upcoming #FOMC meetings.

seekingalpha.com/article/4821...

💼 The August jobs report confirms labor market fragility, with hiring momentum slowing and job gains concentrated in 2 industries.

Markets are pricing in Fed rate cuts, with a high probability of 75 bps of easing by year-end as recession fears mount.

seekingalpha.com/article/4820...

Markets are pricing in Fed rate cuts, with a high probability of 75 bps of easing by year-end as recession fears mount.

seekingalpha.com/article/4820...

August Jobs Report: Another Weak Report Heightens Pressure For Rate Cuts

The August jobs report shows a weakening labor market and rising recession risks. Click here to read my most recent analysis of the economy and markets.

seekingalpha.com

September 5, 2025 at 7:31 PM

💼 The August jobs report confirms labor market fragility, with hiring momentum slowing and job gains concentrated in 2 industries.

Markets are pricing in Fed rate cuts, with a high probability of 75 bps of easing by year-end as recession fears mount.

seekingalpha.com/article/4820...

Markets are pricing in Fed rate cuts, with a high probability of 75 bps of easing by year-end as recession fears mount.

seekingalpha.com/article/4820...

🇺🇸 Labor market data shows a continued cooling trend, with job openings and hiring both edging lower, signaling stagnation rather than sharp contraction.

Markets reacted dovishly to the weak JOLTS data, boosting expectations for a September Fed rate cut.

seekingalpha.com/article/4819...

Markets reacted dovishly to the weak JOLTS data, boosting expectations for a September Fed rate cut.

seekingalpha.com/article/4819...

July JOLTS: More Evidence That The Labor Market Weakened This Summer (SPX)

Labor market data shows a continued cooling trend, with job openings and hiring both edging lower, fueling hopes for a Fed rate cut in September. Read more here.

seekingalpha.com

September 3, 2025 at 6:40 PM

🇺🇸 Labor market data shows a continued cooling trend, with job openings and hiring both edging lower, signaling stagnation rather than sharp contraction.

Markets reacted dovishly to the weak JOLTS data, boosting expectations for a September Fed rate cut.

seekingalpha.com/article/4819...

Markets reacted dovishly to the weak JOLTS data, boosting expectations for a September Fed rate cut.

seekingalpha.com/article/4819...

🏭 US manufacturing data is mixed: S&P PMI signals expansion, but ISM remains in contraction, highlighting sector uncertainty.

Tariffs are dampening international demand, driving firms to build inventories & pass costs onto customers, fueling inflation.

seekingalpha.com/article/4818...

Tariffs are dampening international demand, driving firms to build inventories & pass costs onto customers, fueling inflation.

seekingalpha.com/article/4818...

August U.S. Manufacturing PMIs: Tariff Costs Drive Inflation, Hurt Foreign Demand (SPX)

U.S. manufacturing shows mixed signals amid tariffs and inflation. Learn how these trends impact markets and your investments. Click for how this affects markets.

seekingalpha.com

September 2, 2025 at 6:04 PM

🏭 US manufacturing data is mixed: S&P PMI signals expansion, but ISM remains in contraction, highlighting sector uncertainty.

Tariffs are dampening international demand, driving firms to build inventories & pass costs onto customers, fueling inflation.

seekingalpha.com/article/4818...

Tariffs are dampening international demand, driving firms to build inventories & pass costs onto customers, fueling inflation.

seekingalpha.com/article/4818...

🗣️ Powell's Jackson Hole speech signals a dovish shift, highlighting rising downside risks to employment.

I expect a Sept rate cut, followed by a cautious Fed stance for the rest of 2025, barring major economic surprises or shifts in Fed independence. #JacksonHole

seekingalpha.com/article/4816...

I expect a Sept rate cut, followed by a cautious Fed stance for the rest of 2025, barring major economic surprises or shifts in Fed independence. #JacksonHole

seekingalpha.com/article/4816...

Markets Rally As Powell Flags Downside Employment Risks At Jackson Hole (SPX)

Powell's Jackson Hole speech signals a dovish Fed shift, balancing inflation and jobs. Markets rally as rate cut expectations rise for September. Read more here.

seekingalpha.com

August 22, 2025 at 5:41 PM

🗣️ Powell's Jackson Hole speech signals a dovish shift, highlighting rising downside risks to employment.

I expect a Sept rate cut, followed by a cautious Fed stance for the rest of 2025, barring major economic surprises or shifts in Fed independence. #JacksonHole

seekingalpha.com/article/4816...

I expect a Sept rate cut, followed by a cautious Fed stance for the rest of 2025, barring major economic surprises or shifts in Fed independence. #JacksonHole

seekingalpha.com/article/4816...

🇬🇧 UK July CPI surprised to the upside, driven by volatile components like energy and airfares, but underlying inflation pressures remain nuanced.

I expect the BoE to pause in September and likely continue its pattern of cutting rates every other meeting.

seekingalpha.com/article/4815...

I expect the BoE to pause in September and likely continue its pattern of cutting rates every other meeting.

seekingalpha.com/article/4815...

July UK CPI: Inflation Heats Up, But The BoE May Look Through The Noise (BATS:EWUS)

UK inflation rose unexpectedly in July, led by energy and airfares, but core pressures remain nuanced. Markets signal BoE may pause in September.

seekingalpha.com

August 20, 2025 at 2:25 PM

🇬🇧 UK July CPI surprised to the upside, driven by volatile components like energy and airfares, but underlying inflation pressures remain nuanced.

I expect the BoE to pause in September and likely continue its pattern of cutting rates every other meeting.

seekingalpha.com/article/4815...

I expect the BoE to pause in September and likely continue its pattern of cutting rates every other meeting.

seekingalpha.com/article/4815...

🏠 Housing starts data beat expectations, but underlying supply and demand remain weak.

Homebuilder sentiment and forward-looking indicators remain subdued, with incentives rising and commodity prices signaling weak demand.

seekingalpha.com/article/4814... #housing #economy

Homebuilder sentiment and forward-looking indicators remain subdued, with incentives rising and commodity prices signaling weak demand.

seekingalpha.com/article/4814... #housing #economy

U.S. Residential Construction: Signs Of Stabilization But No Clear Breakout (SPX)

Explore how high rates, affordability issues, and macro headwinds shape housing trends. Understand homebuilder sentiment and market outlook for H2 2025.

seekingalpha.com

August 19, 2025 at 6:33 PM

🏠 Housing starts data beat expectations, but underlying supply and demand remain weak.

Homebuilder sentiment and forward-looking indicators remain subdued, with incentives rising and commodity prices signaling weak demand.

seekingalpha.com/article/4814... #housing #economy

Homebuilder sentiment and forward-looking indicators remain subdued, with incentives rising and commodity prices signaling weak demand.

seekingalpha.com/article/4814... #housing #economy

🇺🇸 We end the week with a flurry of data: retail sales, trade prices, industrial production.

Solid consumer demand supports near-term market bullishness, but limits the case for rate cuts, creating a headwind for equities with already high valuations.

seekingalpha.com/article/4814...

Solid consumer demand supports near-term market bullishness, but limits the case for rate cuts, creating a headwind for equities with already high valuations.

seekingalpha.com/article/4814...

July Retail Sales, Trade Prices, Industrial Production: Consumer Spending Holds Up

Discover how resilient US retail sales, consumer demand, and industrial trends shape market outlooks.

seekingalpha.com

August 15, 2025 at 3:51 PM

🇺🇸 We end the week with a flurry of data: retail sales, trade prices, industrial production.

Solid consumer demand supports near-term market bullishness, but limits the case for rate cuts, creating a headwind for equities with already high valuations.

seekingalpha.com/article/4814...

Solid consumer demand supports near-term market bullishness, but limits the case for rate cuts, creating a headwind for equities with already high valuations.

seekingalpha.com/article/4814...

🇺🇸 July PPI surged 0.9% MoM, exceeding forecasts, with goods & services showing their strongest gains in years.

Tariffs are feeding into higher costs across the supply chain, with spikes in food, steel, electronics, and wholesale margins.

seekingalpha.com/article/4813...

Tariffs are feeding into higher costs across the supply chain, with spikes in food, steel, electronics, and wholesale margins.

seekingalpha.com/article/4813...

July PPI: Broad-Based Gains Signal Tariff Impact Across Supply Chain (SPX)

July PPI surged 0.9%, spiking costs across goods & services. Explore tariff impacts, market reactions, and the Fed's potential September rate cut.

seekingalpha.com

August 14, 2025 at 3:58 PM

🇺🇸 July PPI surged 0.9% MoM, exceeding forecasts, with goods & services showing their strongest gains in years.

Tariffs are feeding into higher costs across the supply chain, with spikes in food, steel, electronics, and wholesale margins.

seekingalpha.com/article/4813...

Tariffs are feeding into higher costs across the supply chain, with spikes in food, steel, electronics, and wholesale margins.

seekingalpha.com/article/4813...