MTS Insights

@mtsinsights.bsky.social

Economic commentary, data, and reports with topics ranging from #macro to financial #markets. Tweets are not financial advice.

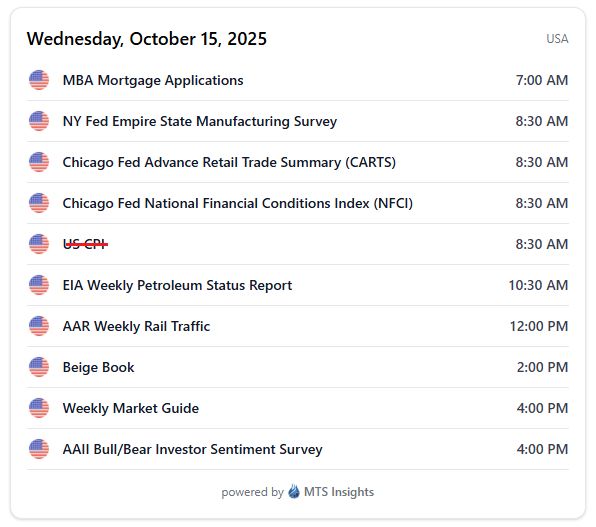

The CPI release that was originally due today has been rescheduled for October 24th, so the morning will be dominated by Fed data instead.

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

October 15, 2025 at 11:07 AM

The CPI release that was originally due today has been rescheduled for October 24th, so the morning will be dominated by Fed data instead.

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

Later this afternoon, the Beige Book will be released, providing a qualitative view of macro conditions.

Full economic calendar: www.mtsinsights.com/calendar/

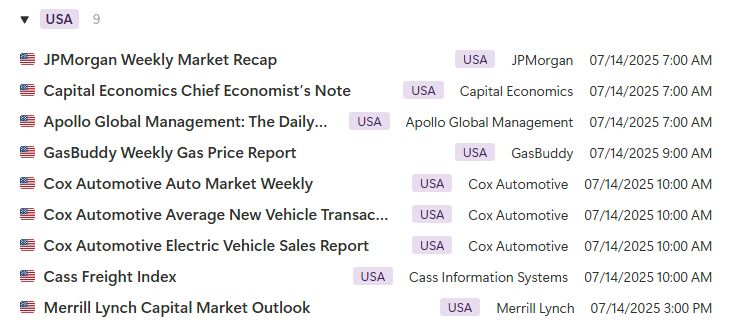

A quiet start to a mid-October week. No major data updates are due today, just some recurring reports.

Full economic calendar here: www.mtsinsights.com/calendar/

Full economic calendar here: www.mtsinsights.com/calendar/

October 13, 2025 at 11:19 AM

A quiet start to a mid-October week. No major data updates are due today, just some recurring reports.

Full economic calendar here: www.mtsinsights.com/calendar/

Full economic calendar here: www.mtsinsights.com/calendar/

The week ends with several private sector reports, including consumer updates from BofA and the National Retail Federation.

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

October 10, 2025 at 11:57 AM

The week ends with several private sector reports, including consumer updates from BofA and the National Retail Federation.

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

The Monthly Treasury Statement is likely to be delayed due to the shutdown.

Full economic calendar: www.mtsinsights.com/calendar/

Another labor market data point will be missed later this morning as the government shutdown continues.

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

October 9, 2025 at 11:09 AM

Another labor market data point will be missed later this morning as the government shutdown continues.

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

That makes for a quiet day with only a few minor reports coming out.

Full economic calendar: www.mtsinsights.com/calendar/

Several macro events are canceled due to the government shutdown. assuming no activity from the Census Bureau, NOAA, and the CBO (though CBO is operating at a limited capacity).

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

October 8, 2025 at 10:46 AM

Several macro events are canceled due to the government shutdown. assuming no activity from the Census Bureau, NOAA, and the CBO (though CBO is operating at a limited capacity).

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

Later in the day, all eyes will be on the FOMC minutes, which document the deliberations behind the September cut.

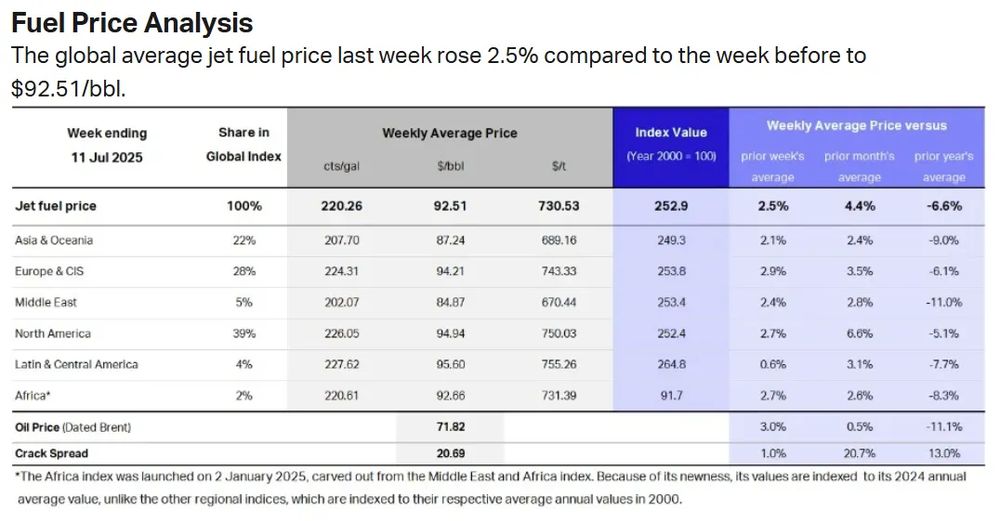

Jet fuel prices increased 2.5% WoW last week and are now up 4.4% from a month ago. On an annual basis, fuel prices are still lower, down -6.6% YoY.

July 14, 2025 at 6:00 PM

Jet fuel prices increased 2.5% WoW last week and are now up 4.4% from a month ago. On an annual basis, fuel prices are still lower, down -6.6% YoY.

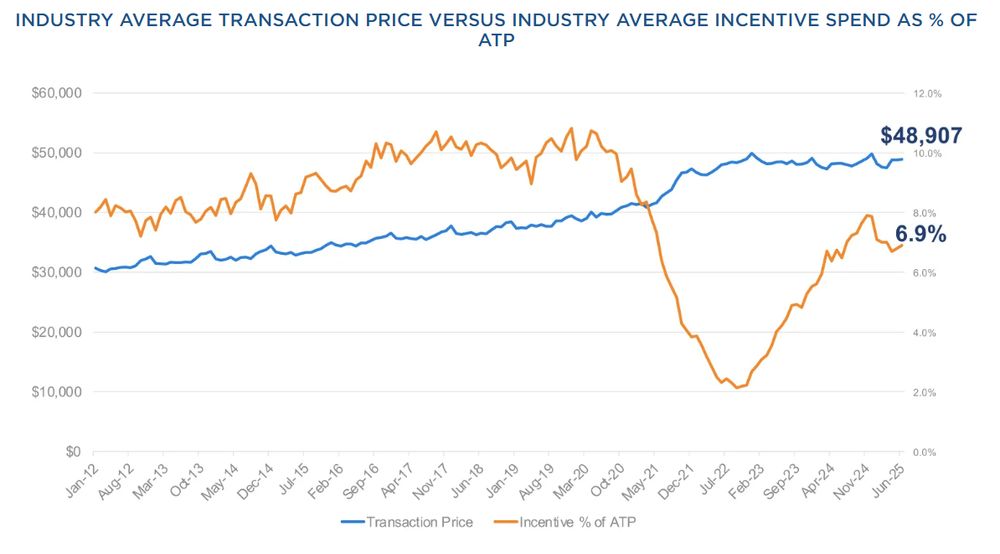

New-vehicle average transaction prices (ATP) rose 0.4% MoM and 1.2% YoY in June 2025 to $48,907, the highest YoY gain this year but still below the 10-year average of 3.9%.

July 14, 2025 at 5:55 PM

New-vehicle average transaction prices (ATP) rose 0.4% MoM and 1.2% YoY in June 2025 to $48,907, the highest YoY gain this year but still below the 10-year average of 3.9%.

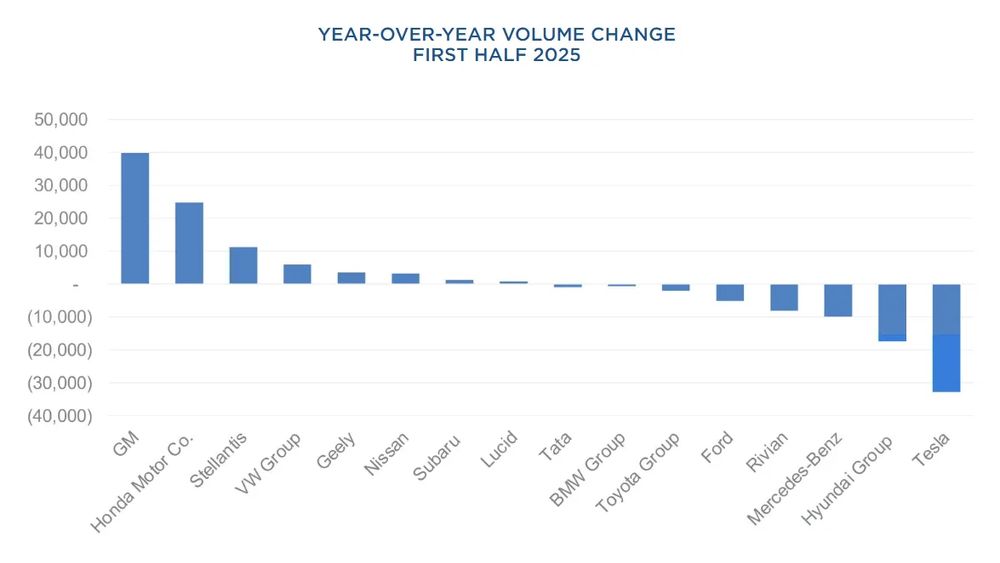

U.S. electric vehicle (EV) sales totaled 310,839 units in Q2 2025, down -6.3% YoY but up 4.9% QoQ, bringing H1 sales to a record 607,089, a modest 1.5% increase YoY.

July 14, 2025 at 5:24 PM

U.S. electric vehicle (EV) sales totaled 310,839 units in Q2 2025, down -6.3% YoY but up 4.9% QoQ, bringing H1 sales to a record 607,089, a modest 1.5% increase YoY.

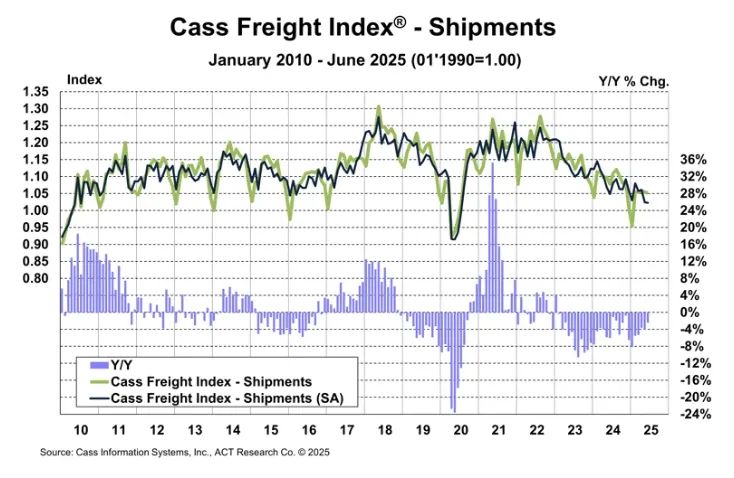

The Cass Freight Shipments Index fell -0.2% MoM (-0.2% SA) and -2.4% YoY in June, continuing its multi-year downtrend in volume despite some stability.

Freight volumes remain soft, and shipment levels are on track for a third straight annual decline, despite rate stabilization.

Freight volumes remain soft, and shipment levels are on track for a third straight annual decline, despite rate stabilization.

July 14, 2025 at 5:19 PM

The Cass Freight Shipments Index fell -0.2% MoM (-0.2% SA) and -2.4% YoY in June, continuing its multi-year downtrend in volume despite some stability.

Freight volumes remain soft, and shipment levels are on track for a third straight annual decline, despite rate stabilization.

Freight volumes remain soft, and shipment levels are on track for a third straight annual decline, despite rate stabilization.

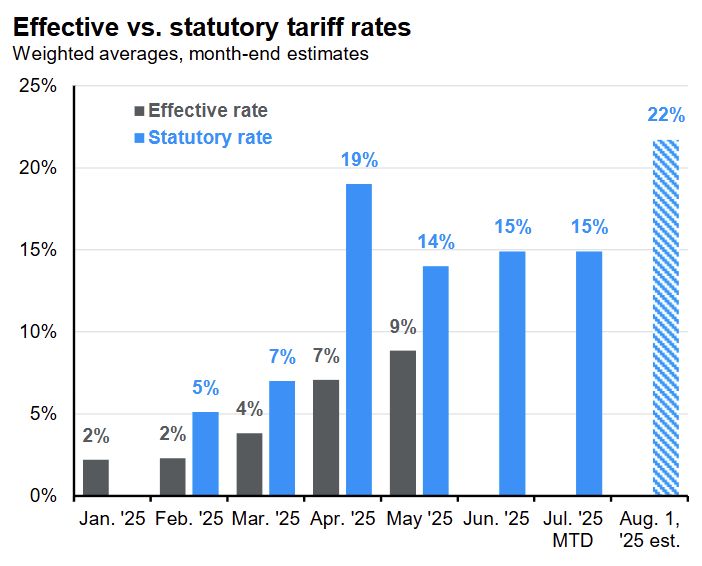

🌮 TACO has been accurate so far, but August 1st will be the most important TACO to date.

(chart via JPMorgan)

(chart via JPMorgan)

July 14, 2025 at 12:47 PM

🌮 TACO has been accurate so far, but August 1st will be the most important TACO to date.

(chart via JPMorgan)

(chart via JPMorgan)

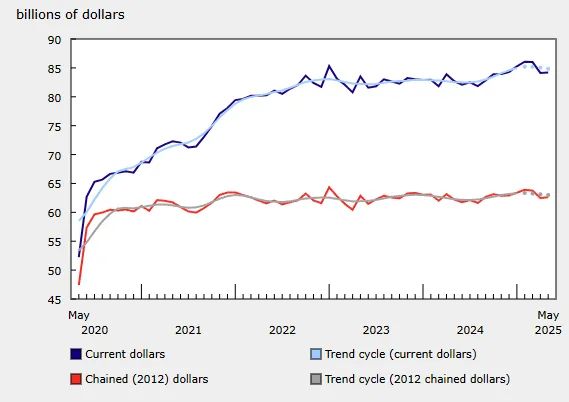

Canadian wholesale sales (excluding petroleum and oilseed/grain) rose 0.1% MoM in May 2025 to $84.2 billion and were up 1.8% YoY, with volume sales also increasing 0.2% MoM.

This was well ahead of the -0.4% MoM decline in the preliminary estimate.

This was well ahead of the -0.4% MoM decline in the preliminary estimate.

July 14, 2025 at 12:42 PM

Canadian wholesale sales (excluding petroleum and oilseed/grain) rose 0.1% MoM in May 2025 to $84.2 billion and were up 1.8% YoY, with volume sales also increasing 0.2% MoM.

This was well ahead of the -0.4% MoM decline in the preliminary estimate.

This was well ahead of the -0.4% MoM decline in the preliminary estimate.

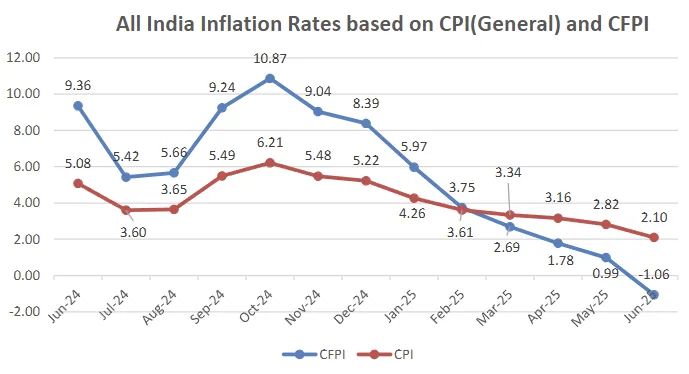

India’s CPI rose 0.06% MoM and 2.10% YoY (vs 2.5% YoY expected) in June 2025, down sharply from 2.82% YoY in May, marking the lowest annual inflation since January 2019.

July 14, 2025 at 12:20 PM

India’s CPI rose 0.06% MoM and 2.10% YoY (vs 2.5% YoY expected) in June 2025, down sharply from 2.82% YoY in May, marking the lowest annual inflation since January 2019.

Germany’s Manufacturing PMI Export Conditions Index edged down to 50.3 in June from 50.4 in May, remaining in modest expansion territory for the fifth straight month.

The New Export Orders Index rose to 52.0 in June from 51.0 in May, the fastest pace since February 2022.

The New Export Orders Index rose to 52.0 in June from 51.0 in May, the fastest pace since February 2022.

July 14, 2025 at 10:49 AM

Germany’s Manufacturing PMI Export Conditions Index edged down to 50.3 in June from 50.4 in May, remaining in modest expansion territory for the fifth straight month.

The New Export Orders Index rose to 52.0 in June from 51.0 in May, the fastest pace since February 2022.

The New Export Orders Index rose to 52.0 in June from 51.0 in May, the fastest pace since February 2022.

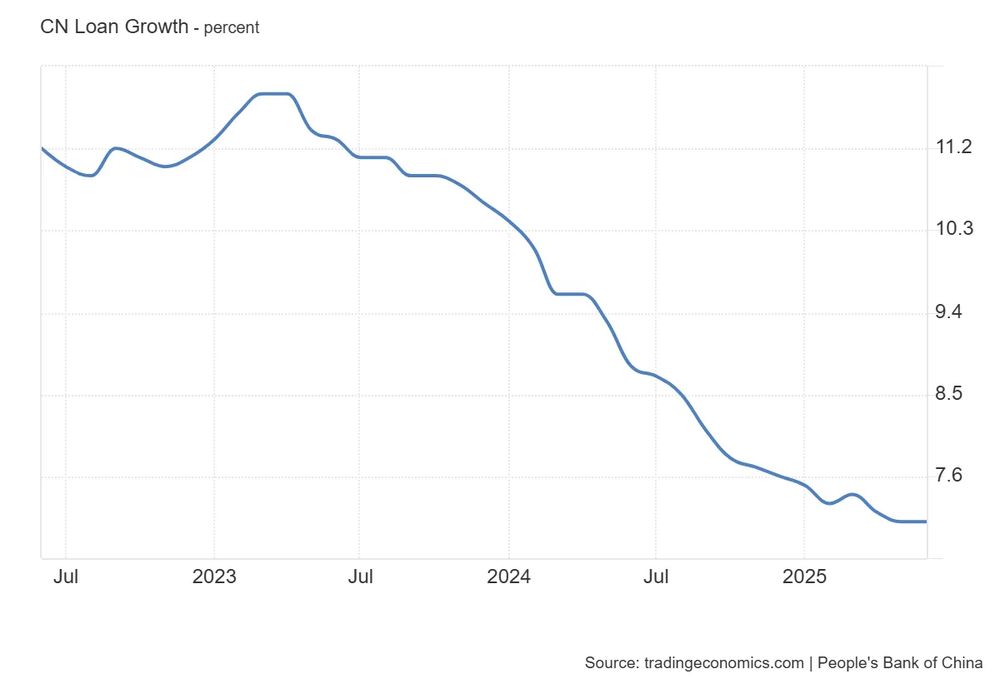

China’s M2 money supply was up 8.3% YoY in June, a significant acceleration from 7.9% YoY in May and above expectations of an 8.1% YoY increase.

- RMB loan growth was 7.1% YoY (vs 7.0% YoY expected) with the total balance of loans up to ¥268.56 trillion.

- RMB loan growth was 7.1% YoY (vs 7.0% YoY expected) with the total balance of loans up to ¥268.56 trillion.

July 14, 2025 at 10:46 AM

China’s M2 money supply was up 8.3% YoY in June, a significant acceleration from 7.9% YoY in May and above expectations of an 8.1% YoY increase.

- RMB loan growth was 7.1% YoY (vs 7.0% YoY expected) with the total balance of loans up to ¥268.56 trillion.

- RMB loan growth was 7.1% YoY (vs 7.0% YoY expected) with the total balance of loans up to ¥268.56 trillion.

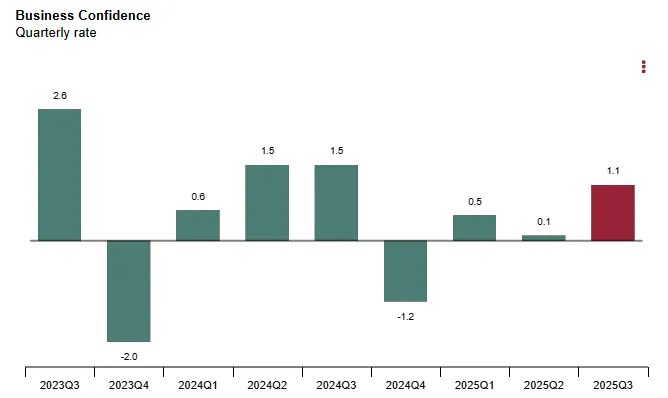

Spain’s Business Confidence Index rose 1.1% QoQ in Q3 2025, rebounding from a -2.0% drop in Q2 & supported by stronger sentiment across most sectors & firm sizes.

A net 9.6% of businesses had optimistic expectations for Q3, down from 11.2% in Q2 but still elevated vs to 2024.

A net 9.6% of businesses had optimistic expectations for Q3, down from 11.2% in Q2 but still elevated vs to 2024.

July 14, 2025 at 10:33 AM

Spain’s Business Confidence Index rose 1.1% QoQ in Q3 2025, rebounding from a -2.0% drop in Q2 & supported by stronger sentiment across most sectors & firm sizes.

A net 9.6% of businesses had optimistic expectations for Q3, down from 11.2% in Q2 but still elevated vs to 2024.

A net 9.6% of businesses had optimistic expectations for Q3, down from 11.2% in Q2 but still elevated vs to 2024.

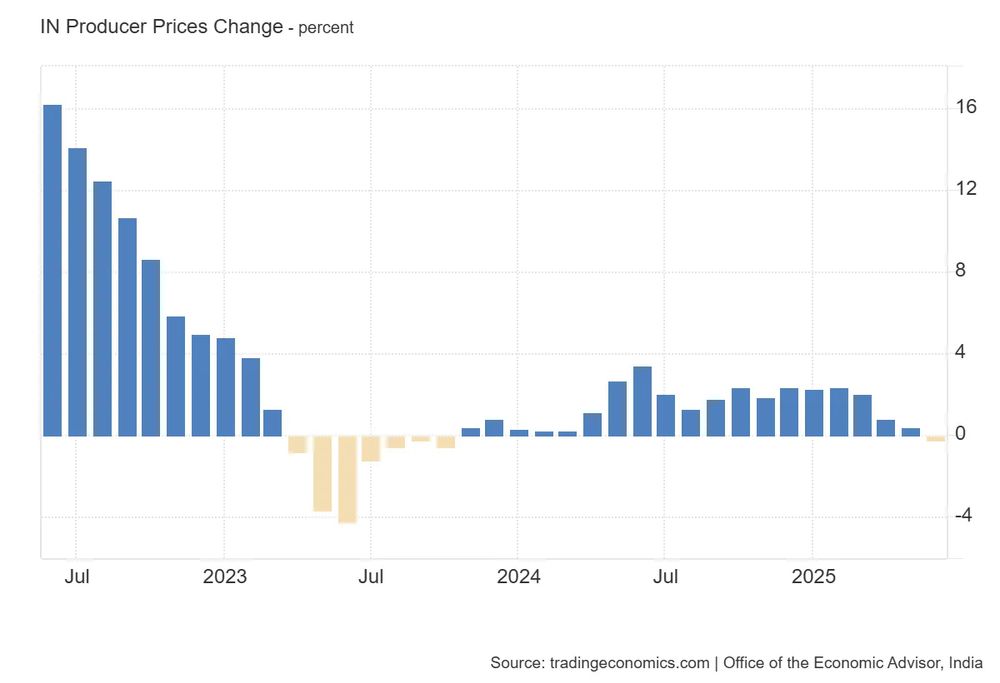

India’s Wholesale Price Index (WPI) declined -0.19% MoM and fell -0.13% YoY (vs 0.52% YoY expected) in June 2025, marking the first negative YoY print since October 2023, led by declines in fuel, food, and metals.

July 14, 2025 at 10:26 AM

India’s Wholesale Price Index (WPI) declined -0.19% MoM and fell -0.13% YoY (vs 0.52% YoY expected) in June 2025, marking the first negative YoY print since October 2023, led by declines in fuel, food, and metals.

Japanese industrial production in May was revised down from 0.5% MoM in the initial estimate to a -0.1% MoM drop. On an annual basis, production is down -2.4% YoY vs the initial estimate of -1.8% YoY.

July 14, 2025 at 10:12 AM

Japanese industrial production in May was revised down from 0.5% MoM in the initial estimate to a -0.1% MoM drop. On an annual basis, production is down -2.4% YoY vs the initial estimate of -1.8% YoY.

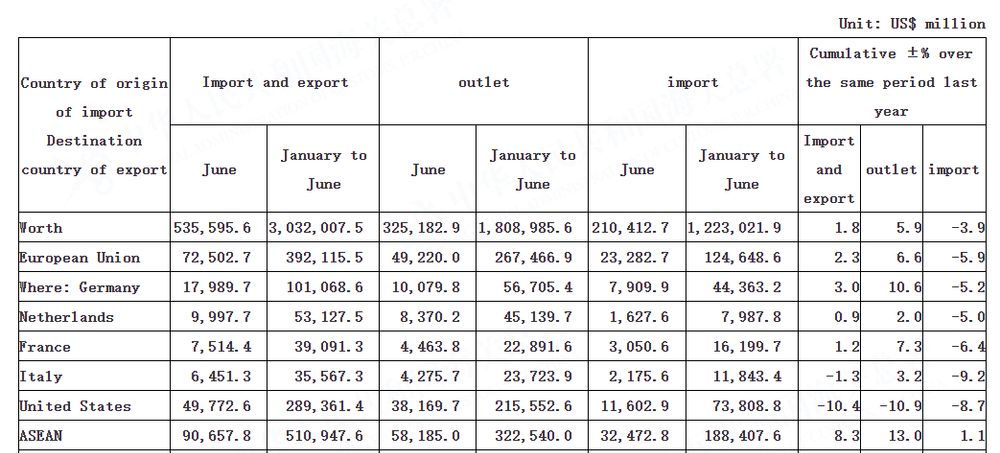

Chinese exports to the US surged 32.4% MoM as early trade deals encouraged trade to bounce back. Imports from the US were up 7.4% MoM.

On a YTD basis, trade between the US and China is down -10.4% YoY with exports down -10.9% YoY and imports down -8.7% YoY.

On a YTD basis, trade between the US and China is down -10.4% YoY with exports down -10.9% YoY and imports down -8.7% YoY.

July 14, 2025 at 9:53 AM

Chinese exports to the US surged 32.4% MoM as early trade deals encouraged trade to bounce back. Imports from the US were up 7.4% MoM.

On a YTD basis, trade between the US and China is down -10.4% YoY with exports down -10.9% YoY and imports down -8.7% YoY.

On a YTD basis, trade between the US and China is down -10.4% YoY with exports down -10.9% YoY and imports down -8.7% YoY.

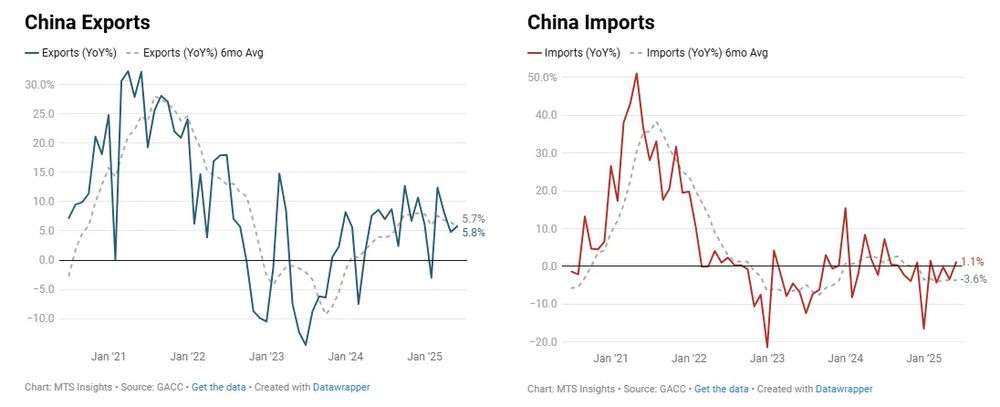

China’s trade balance improved again to $114.8 billion in June from $103.2 billion in May, beating expectations of a $109 billion trade surplus.

Exports increased 2.9% MoM and 5.8% YoY, up from 4.8% YoY in May and above expectations of 5.0% YoY.

Exports increased 2.9% MoM and 5.8% YoY, up from 4.8% YoY in May and above expectations of 5.0% YoY.

July 14, 2025 at 9:45 AM

China’s trade balance improved again to $114.8 billion in June from $103.2 billion in May, beating expectations of a $109 billion trade surplus.

Exports increased 2.9% MoM and 5.8% YoY, up from 4.8% YoY in May and above expectations of 5.0% YoY.

Exports increased 2.9% MoM and 5.8% YoY, up from 4.8% YoY in May and above expectations of 5.0% YoY.

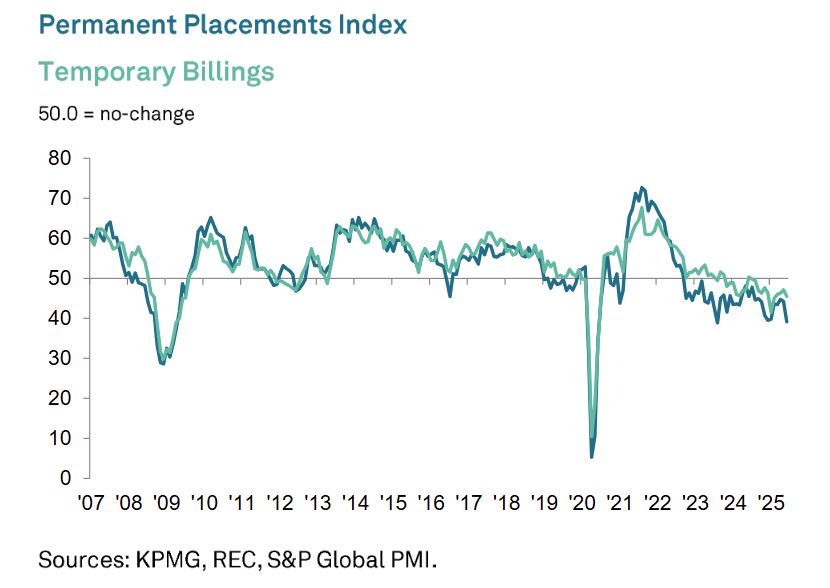

Hiring in the UK weakened further in June, with permanent placements falling at the fastest rate in 22 months.

Candidate supply rose at the steepest pace since November 2020, driven by redundancies and a reduced appetite for hiring.

Candidate supply rose at the steepest pace since November 2020, driven by redundancies and a reduced appetite for hiring.

July 14, 2025 at 9:33 AM

Hiring in the UK weakened further in June, with permanent placements falling at the fastest rate in 22 months.

Candidate supply rose at the steepest pace since November 2020, driven by redundancies and a reduced appetite for hiring.

Candidate supply rose at the steepest pace since November 2020, driven by redundancies and a reduced appetite for hiring.

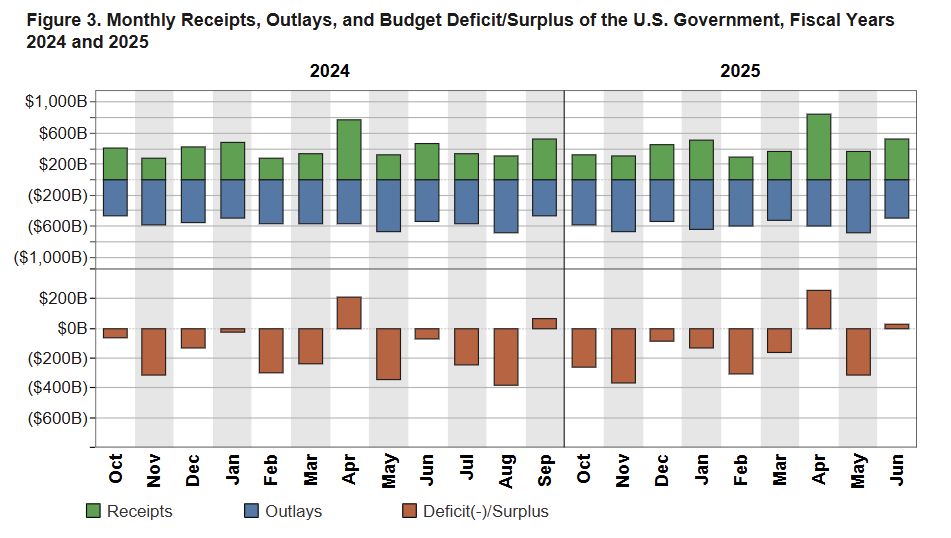

The Monthly Treasury Statement reports a surplus of $27.0 bil (vs -$41.5 bil expected) in June 2025, better than the -$71.0 bil deficit in June 2024.

The Oct-Jun FY25 deficit is now up to $1.34 trillion, a 5.0% YoY increase over the Oct-Jun FY24 deficit of $1.27 trillion.

The Oct-Jun FY25 deficit is now up to $1.34 trillion, a 5.0% YoY increase over the Oct-Jun FY24 deficit of $1.27 trillion.

July 11, 2025 at 6:10 PM

The Monthly Treasury Statement reports a surplus of $27.0 bil (vs -$41.5 bil expected) in June 2025, better than the -$71.0 bil deficit in June 2024.

The Oct-Jun FY25 deficit is now up to $1.34 trillion, a 5.0% YoY increase over the Oct-Jun FY24 deficit of $1.27 trillion.

The Oct-Jun FY25 deficit is now up to $1.34 trillion, a 5.0% YoY increase over the Oct-Jun FY24 deficit of $1.27 trillion.

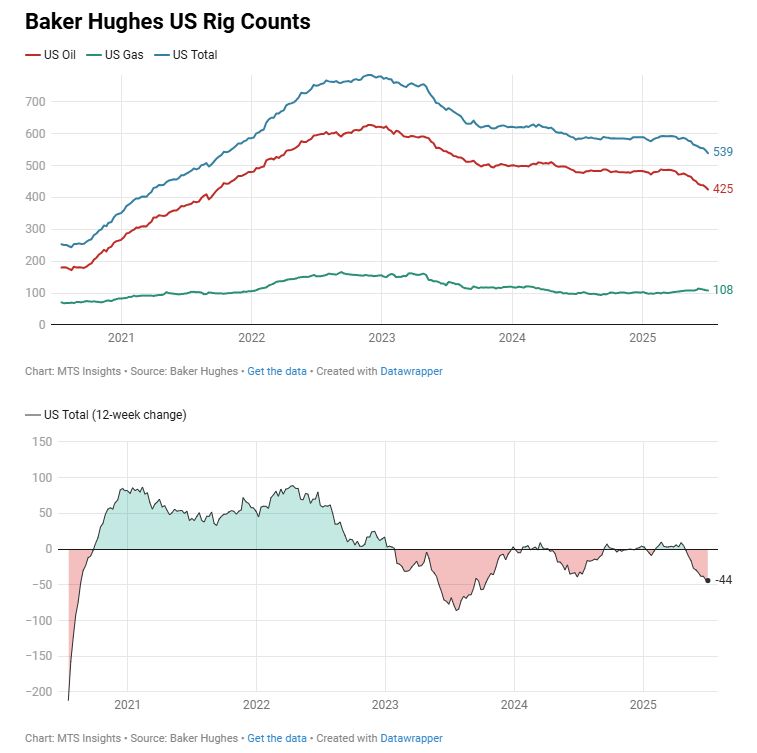

The number of active US oil and gas rigs fell by -2 to 539 last week. Over the last twelve weeks, the total rig count is down by -44 rigs, the largest decline since October 2023.

July 11, 2025 at 5:48 PM

The number of active US oil and gas rigs fell by -2 to 539 last week. Over the last twelve weeks, the total rig count is down by -44 rigs, the largest decline since October 2023.

Cox Automotive: July opened with 2.83 million new vehicles available on dealer lots across the U.S., representing a 14.5% increase from 2.47 million units at the beginning of June, but still 1.4% lower than the same period last year.

July 11, 2025 at 5:45 PM

Cox Automotive: July opened with 2.83 million new vehicles available on dealer lots across the U.S., representing a 14.5% increase from 2.47 million units at the beginning of June, but still 1.4% lower than the same period last year.

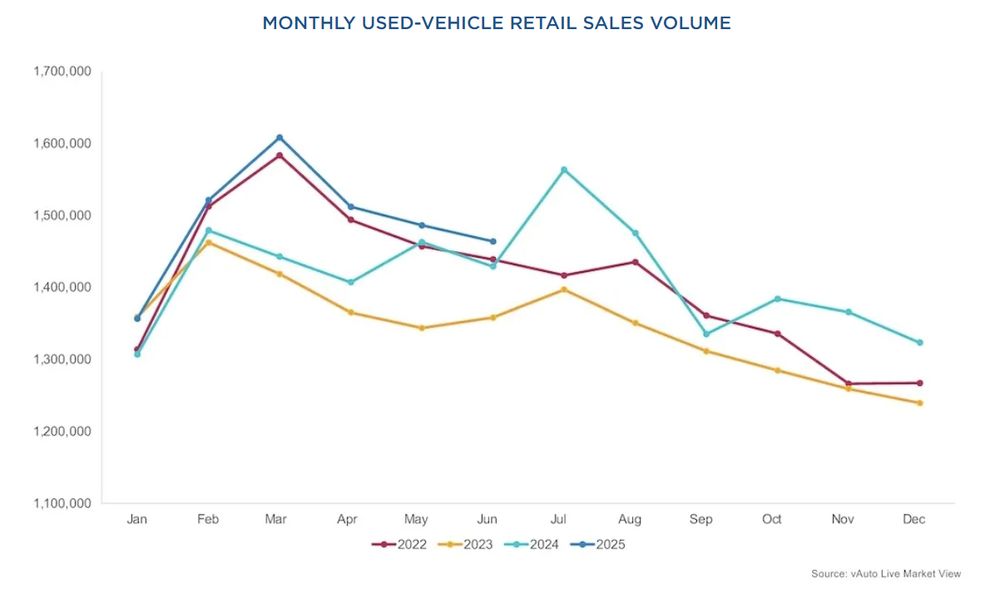

Used-vehicle retail sales totaled 1.46 million in June, down -1.5% MoM but up 2.4% YoY, according to Cox Automotive’s vAuto Live Market View.

Certified pre-owned (CPO) sales dropped -13.1% MoM to 200,950 and were down -3.7% YoY.

Certified pre-owned (CPO) sales dropped -13.1% MoM to 200,950 and were down -3.7% YoY.

July 11, 2025 at 5:42 PM

Used-vehicle retail sales totaled 1.46 million in June, down -1.5% MoM but up 2.4% YoY, according to Cox Automotive’s vAuto Live Market View.

Certified pre-owned (CPO) sales dropped -13.1% MoM to 200,950 and were down -3.7% YoY.

Certified pre-owned (CPO) sales dropped -13.1% MoM to 200,950 and were down -3.7% YoY.