That may materialise, but it’s concerning that it hasn’t yet - one watch out for in the new year

That may materialise, but it’s concerning that it hasn’t yet - one watch out for in the new year

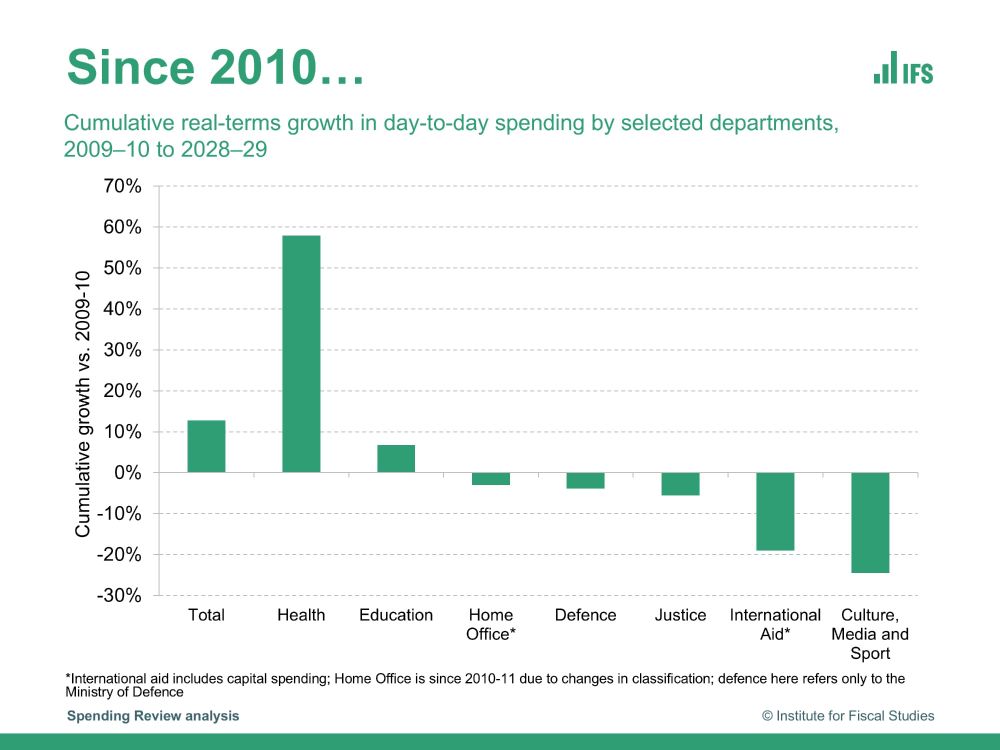

Spending on justice, in contrast, will be lower in 2028–29 than two decades earlier despite recent increases. Spending on overseas aid and culture, media & sport will also be lower than in 2010.

Spending on justice, in contrast, will be lower in 2028–29 than two decades earlier despite recent increases. Spending on overseas aid and culture, media & sport will also be lower than in 2010.

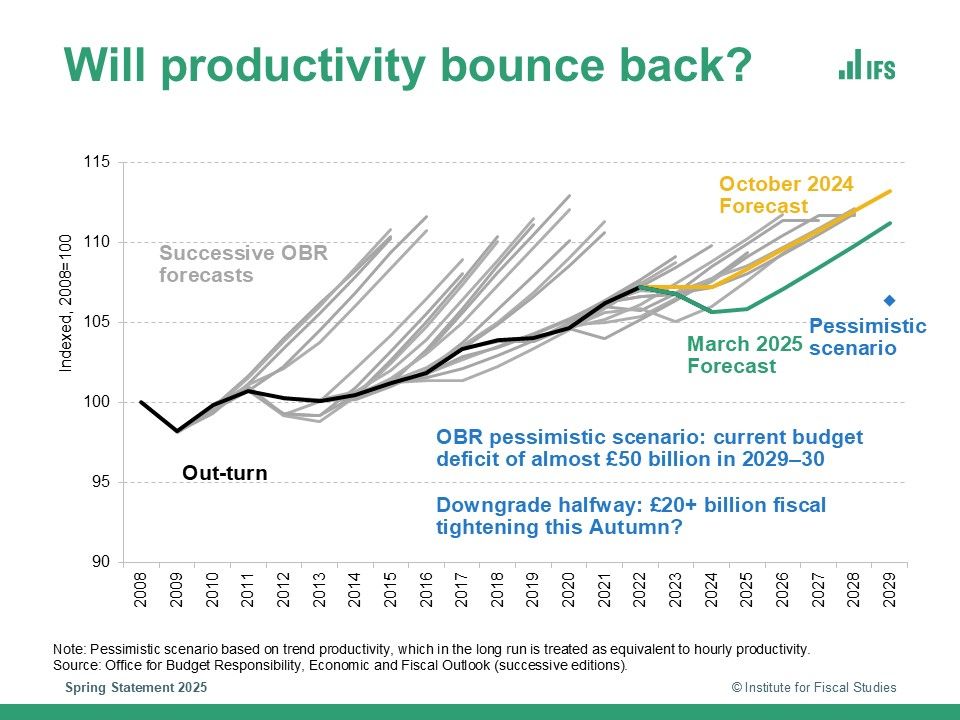

They remain above the productivity growth rates seen since 2008 – a downgrade to the OBR's forecast could cause a real fiscal headache for the Chancellor.

They remain above the productivity growth rates seen since 2008 – a downgrade to the OBR's forecast could cause a real fiscal headache for the Chancellor.