No point in having a European Commission without a Europe

theovershoot.co/p/waking-the...

No point in having a European Commission without a Europe

theovershoot.co/p/waking-the...

- GPU rental business is worse than most nontech retail businesses

- 'big flashy contracts' have terrible economics, but allow Neoclouds to raise money from rubes

- the Bull Case requires Neoclouds to compete effectively with their biggest customers

- GPU rental business is worse than most nontech retail businesses

- 'big flashy contracts' have terrible economics, but allow Neoclouds to raise money from rubes

- the Bull Case requires Neoclouds to compete effectively with their biggest customers

- low barriers to entry

- pricing 85% below hyperscalers

- is there enough enterprise demand for AI workloads

- chip producers (Nvidia) are subsidizing "implicit backstop"

- low barriers to entry

- pricing 85% below hyperscalers

- is there enough enterprise demand for AI workloads

- chip producers (Nvidia) are subsidizing "implicit backstop"

www.caixinglobal.com/2025-11-15/w...

www.caixinglobal.com/2025-11-15/w...

This is actually where Hollywood studios should be leaning in -- Western cultural context is their strength!

This is actually where Hollywood studios should be leaning in -- Western cultural context is their strength!

Trenchant TikTok commentators... are on TikTok! They don't write articles or books!

bsky.app/profile/nosu...

Trenchant TikTok commentators... are on TikTok! They don't write articles or books!

bsky.app/profile/nosu...

The half-life of content is collapsing hence any meaningful conversation about 'cultural impact' is automatically dated

The half-life of content is collapsing hence any meaningful conversation about 'cultural impact' is automatically dated

The economics can be very good

The economics can be very good

US and UK are much more negative with low-income residents in every country much more concerned than high-income residents

US and UK are much more negative with low-income residents in every country much more concerned than high-income residents

50% of Amazon sellers are from China

50% of Amazon sellers are from China

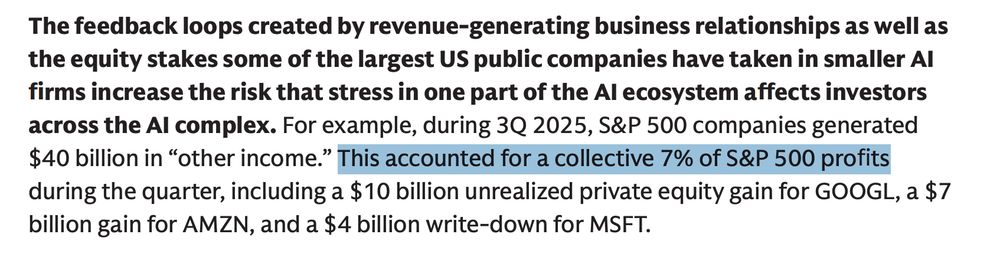

The market is operating in a meta-mode

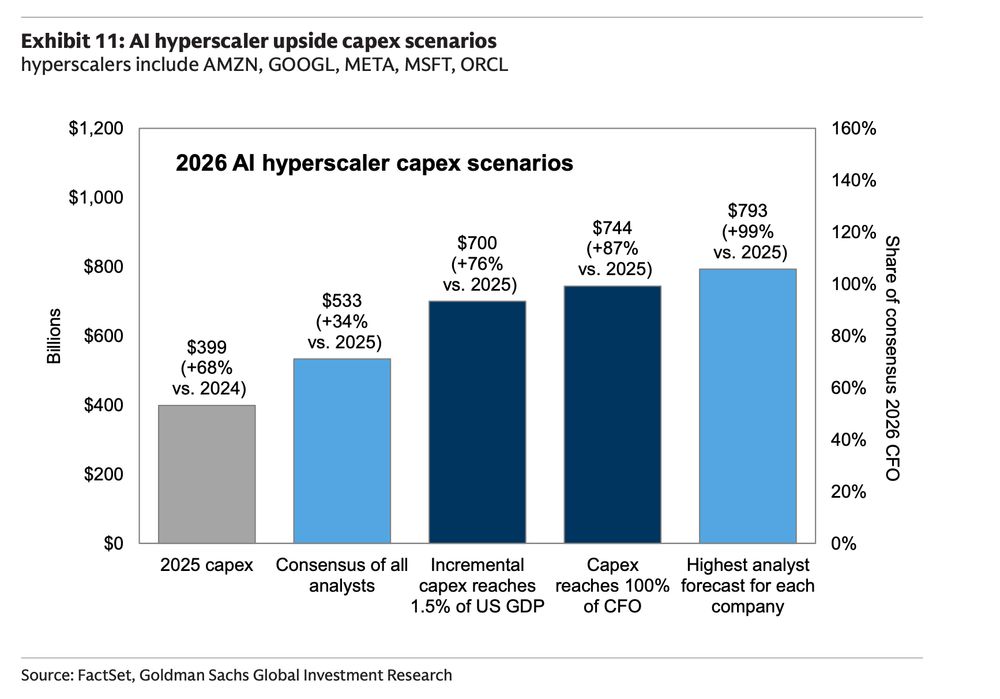

To be fair, the numbers are so mindbogglingly large, that there only conceptual frameworks apply anymore

The market is operating in a meta-mode

To be fair, the numbers are so mindbogglingly large, that there only conceptual frameworks apply anymore