Pawel Adrjan

@paweladrjan.bsky.social

240 followers

640 following

36 posts

Economist at Indeed

Research fellow at Regent's Park College, Oxford

📈 Using data to make the world of work better for all 🌈

https://sites.google.com/site/paweladrjaneconomics/

Sevilla, España

Posts

Media

Videos

Starter Packs

Reposted by Pawel Adrjan

Reposted by Pawel Adrjan

Pawel Adrjan

@paweladrjan.bsky.social

· Jan 28

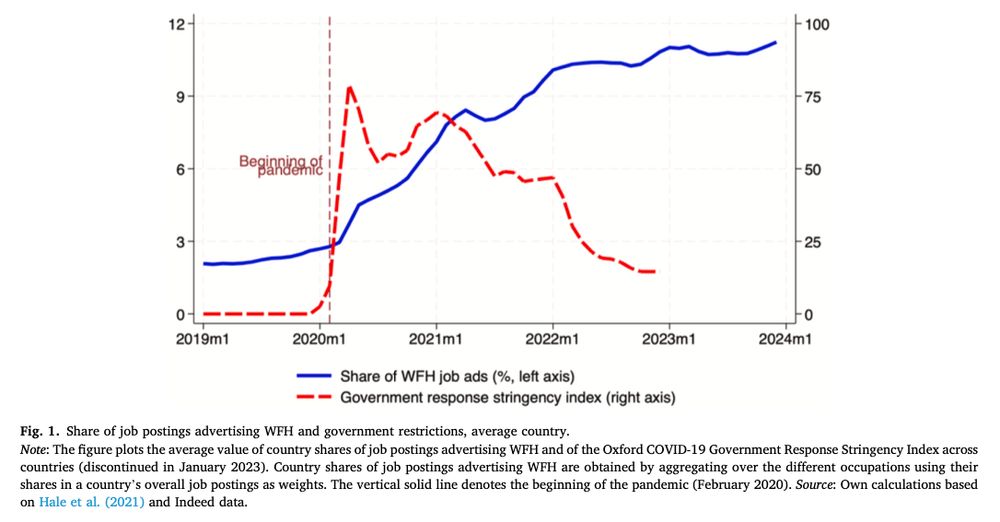

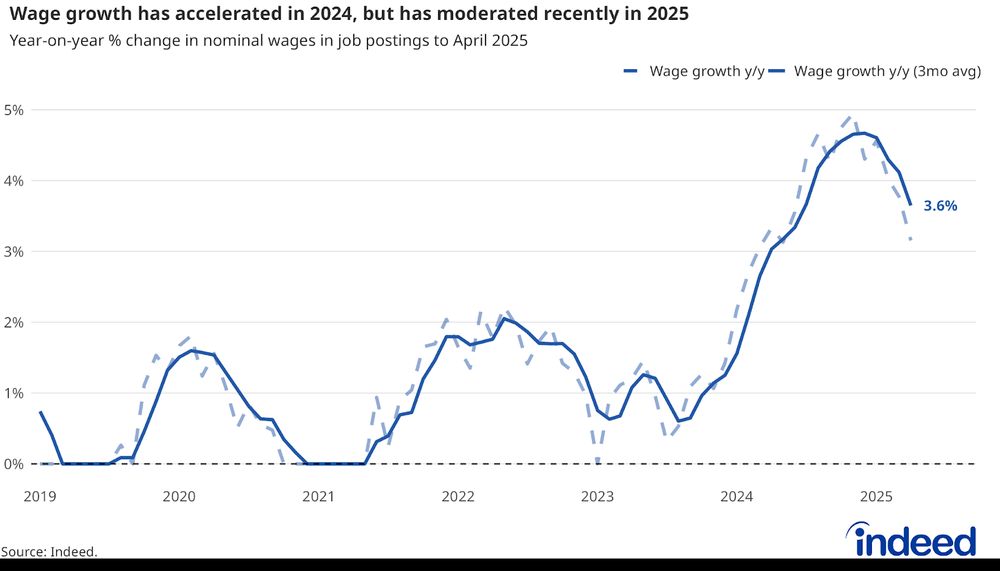

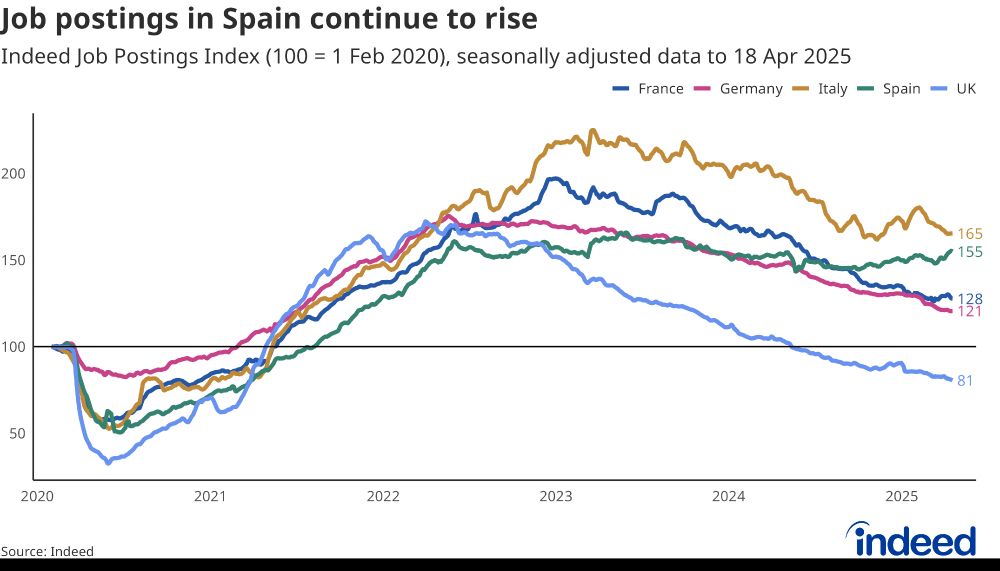

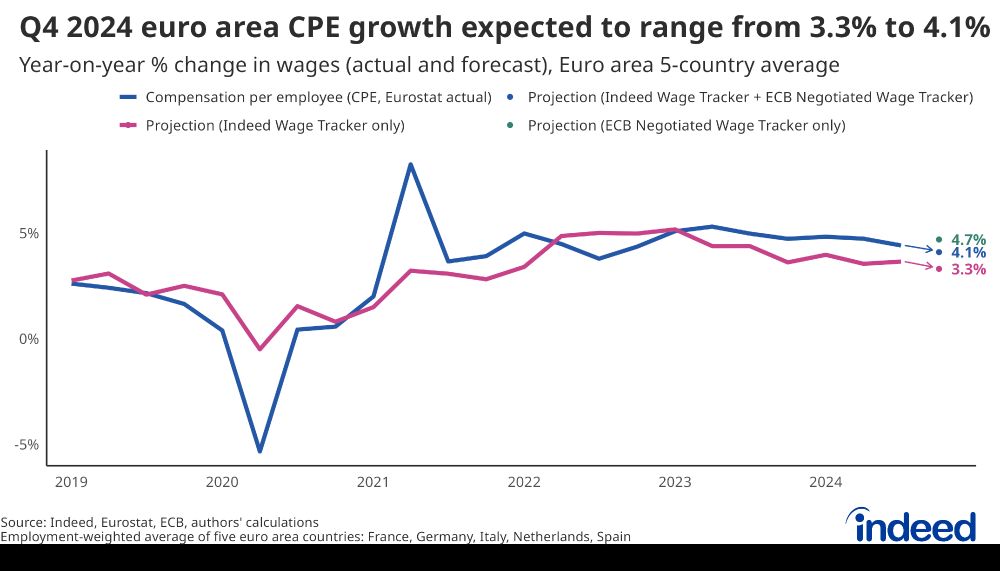

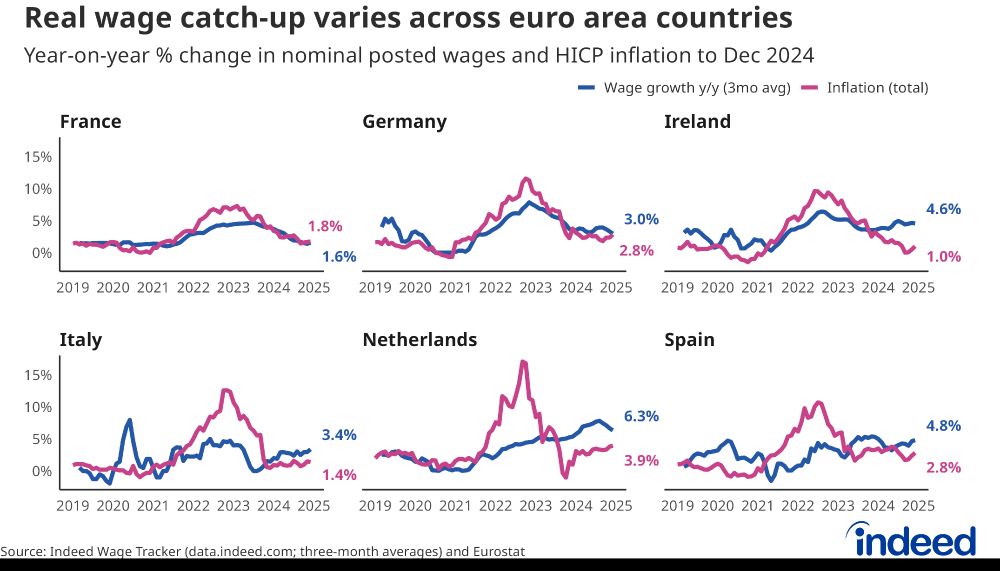

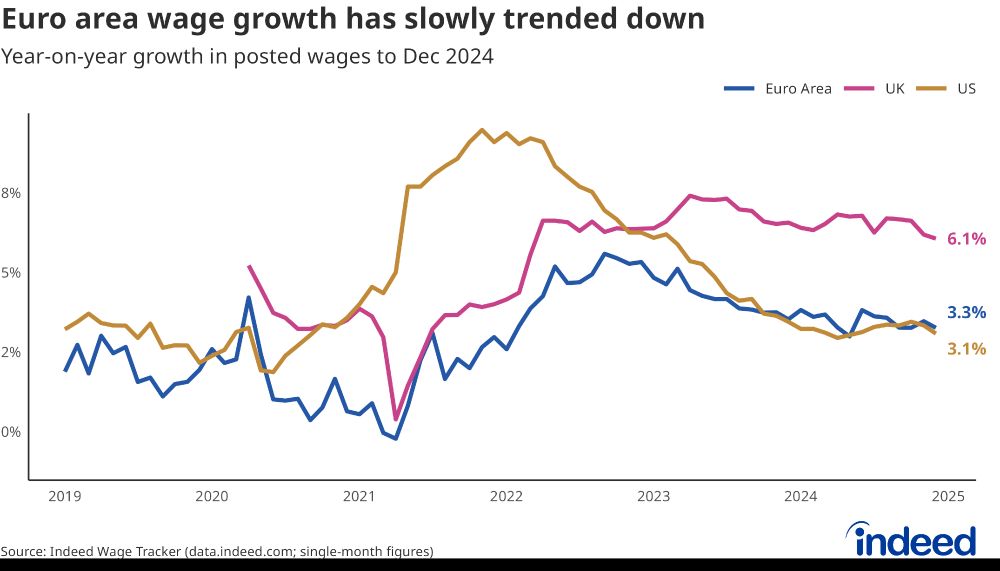

Wage Growth Heading Into 2025: A Gradual Slowdown in the Euro Area - Indeed Hiring Lab UK I Ireland

Growth in advertised wages remains above pre-pandemic levels in several countries, but the latest data through the end of 2024 suggest a steady slowdown in wage growth across the euro area.

hiringlab.org

Pawel Adrjan

@paweladrjan.bsky.social

· Jan 28

Reposted by Pawel Adrjan