Riccardo Baioni

@riccardobaioni.bsky.social

49 followers

110 following

7 posts

PhD researcher - Research Fellow SuFi Project @UniWH - political economy green transition

Posts

Media

Videos

Starter Packs

Reposted by Riccardo Baioni

Reposted by Riccardo Baioni

JEPP Journal

@jeppjournal.bsky.social

· Jul 23

Playing the capital market? Sustainable finance and the discursive construction of the Capital Markets Union as a common good

The Capital Markets Union (CMU) project aims to create more integrated capital markets in Europe. However, the project faces resistance, and despite ongoing efforts EU capital markets remain fragme...

www.tandfonline.com

Reposted by Riccardo Baioni

Reposted by Riccardo Baioni

Reposted by Riccardo Baioni

naguila.bsky.social

@naguila.bsky.social

· May 19

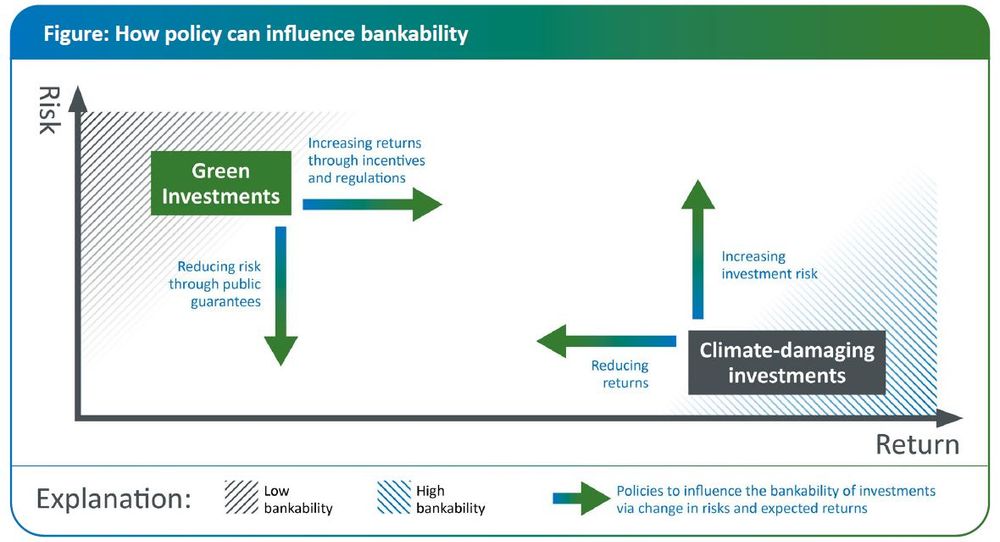

The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation

Banks have been slow to increase green lending while they continue to finance high-GHG-emitting activities, a phenomenon we call the "green banking gap&quo

papers.ssrn.com