Posts

Media

Videos

Starter Packs

Reposted

Reposted

Reposted

Daniel Mertens

@danmertens.bsky.social

· Jun 16

Reposted

CELS

@cels-argentina.bsky.social

· Jun 19

Reposted

Centro Interdisciplinario para el Estudio de Políticas Públicas

@ciepp-argentina.bsky.social

· Jun 14

Home - Open Letter Against the rise of Fascism in 2025

The 2025 letter has been signed by over 400 academics, including 31 Nobel Prize winners. Join them in defending democracy. Our goal The letter is a collective denunciation of the mounting threats to a...

stopreturnfascism.org

Reposted

Reposted

Reposted

Surbhi Kesar

@surbhikesar.bsky.social

· May 19

Reposted

herman mark schwartz

@thunen.bsky.social

· May 19

Decoding Dollar Dominance. The Global Credit View on the Monetary System in International Political Economy

Sovereign Currency View (SCV) and the Global Credit View (GCV) on the international monetary system regarding four crucial assumptions: credit theory of money i

papers.ssrn.com

Reposted

Reposted

Joscha Wullweber

@jwullweber.bsky.social

· May 19

naguila.bsky.social

@naguila.bsky.social

· May 19

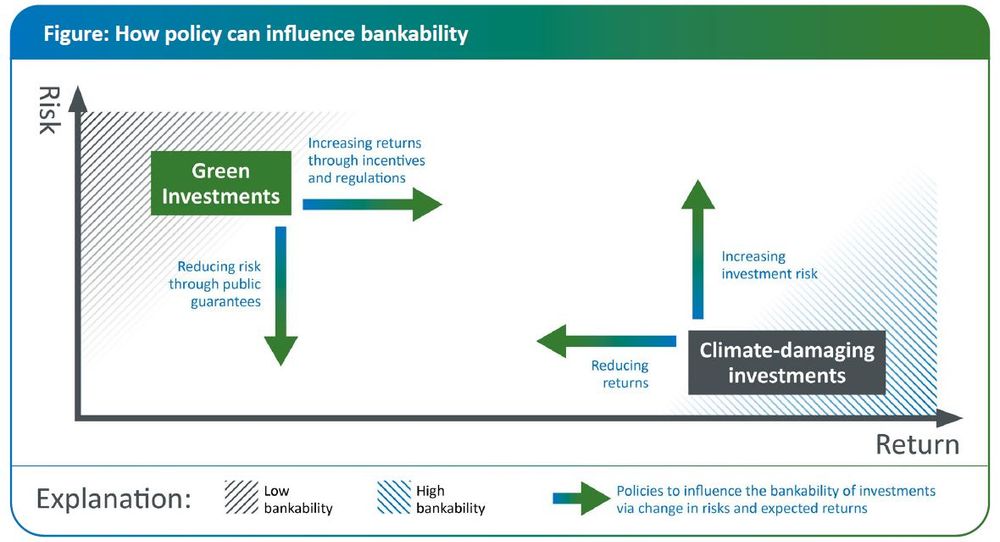

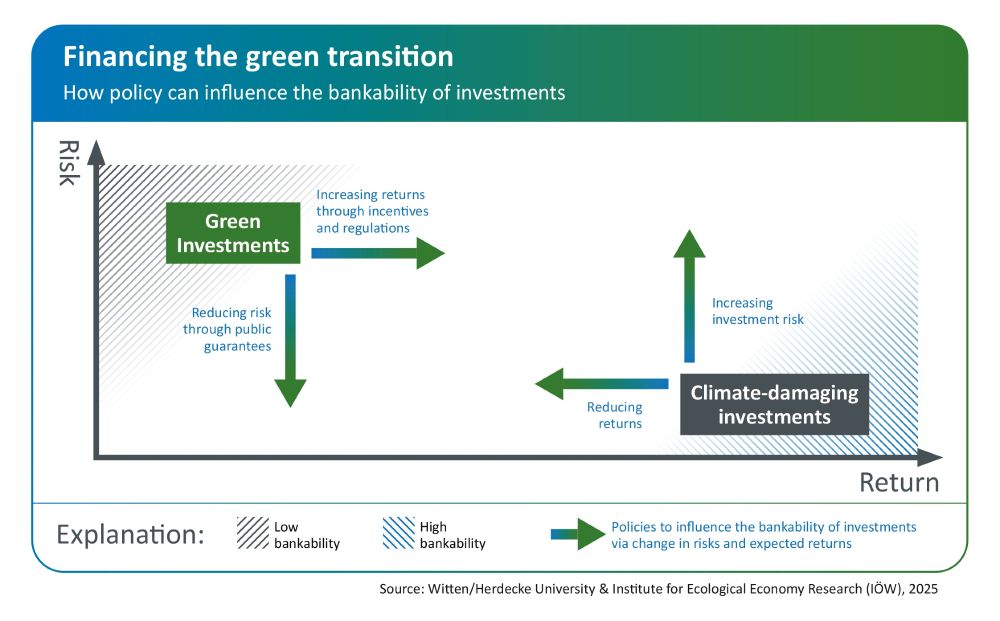

The green banking gap: how bankability, business models, and regulations challenge banks' decarbonisation

Banks have been slow to increase green lending while they continue to finance high-GHG-emitting activities, a phenomenon we call the "green banking gap&quo

papers.ssrn.com

naguila.bsky.social

@naguila.bsky.social

· May 19