Sophie Hale

@sophiehale.bsky.social

2.4K followers

68 following

18 posts

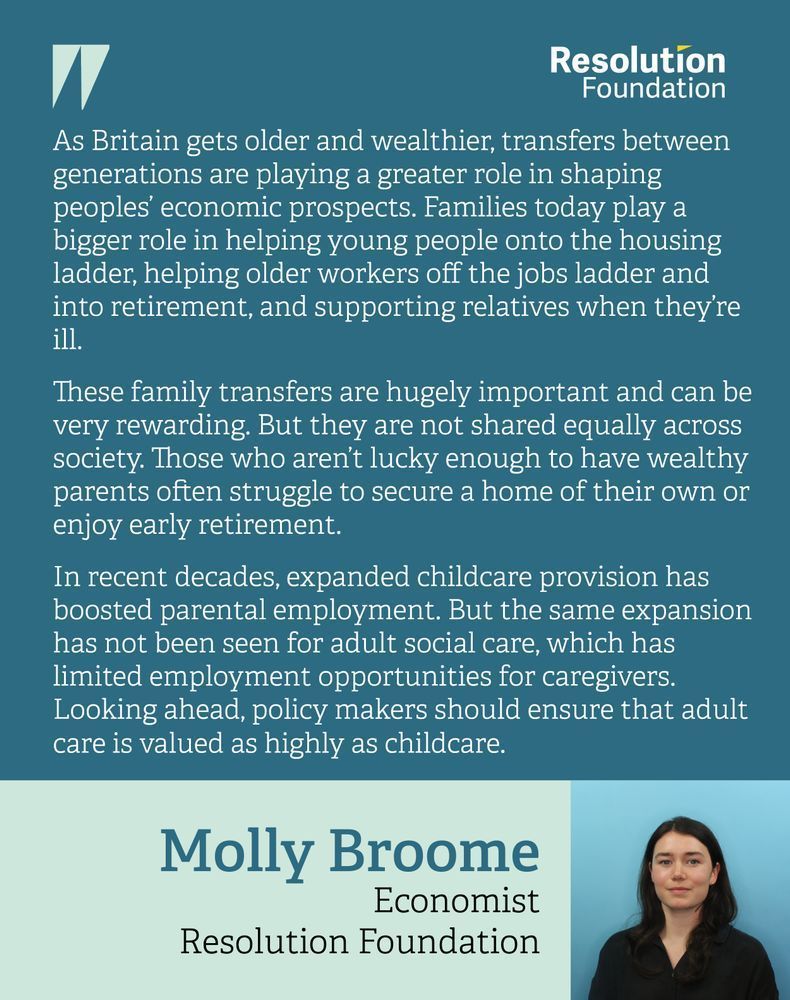

Principal Economist leading on trade and intergenerational fairness at the Resolution Foundation.

Posts

Media

Videos

Starter Packs

Sophie Hale

@sophiehale.bsky.social

· Apr 11

Reposted by Sophie Hale

Reposted by Sophie Hale

Reposted by Sophie Hale

Reposted by Sophie Hale

Jacob Öberg

@profjacob.bsky.social

· Dec 4

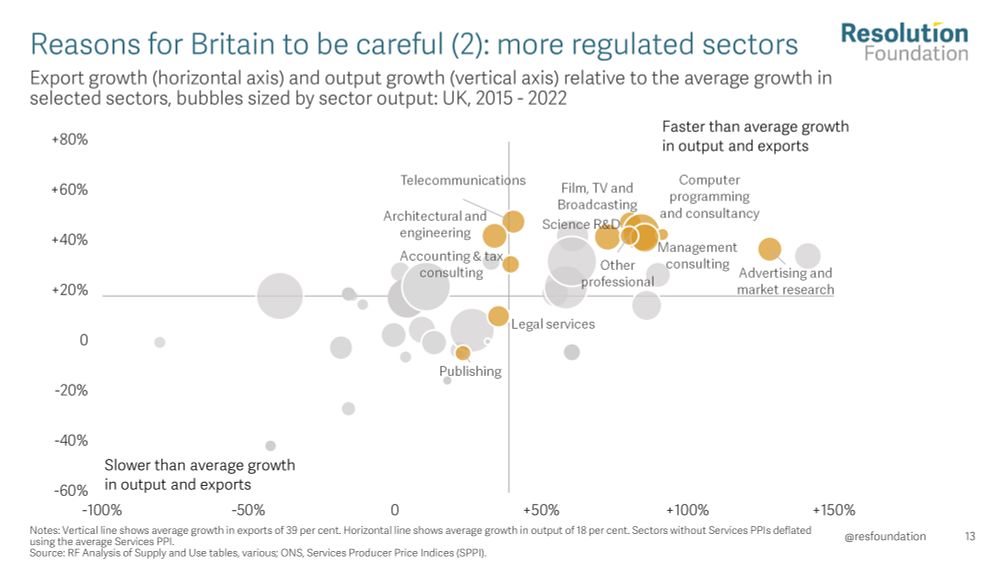

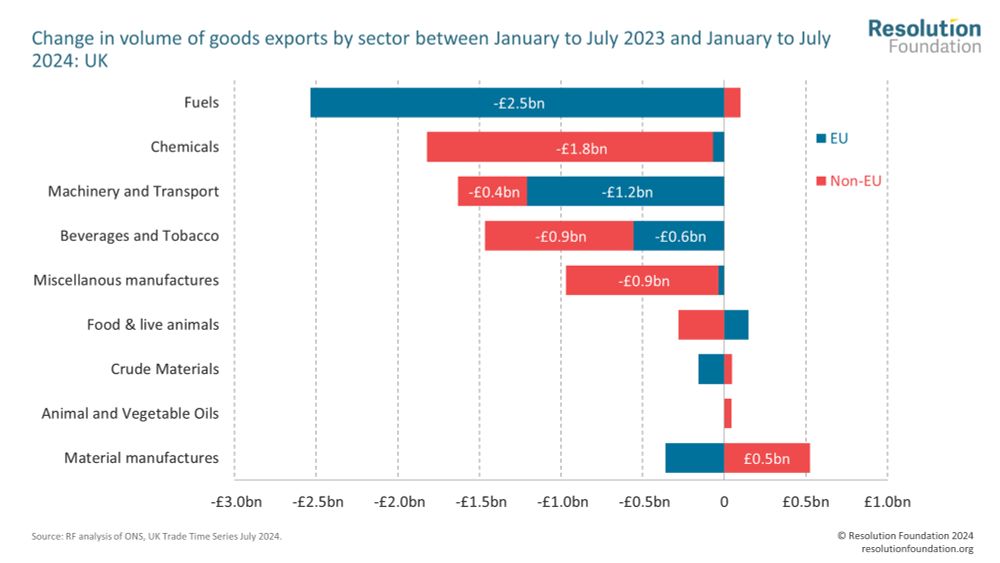

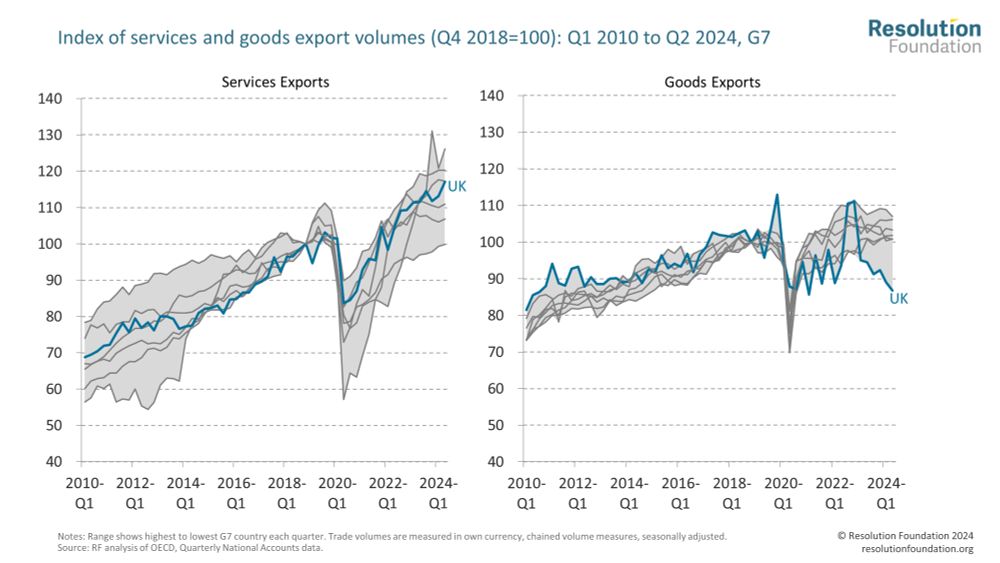

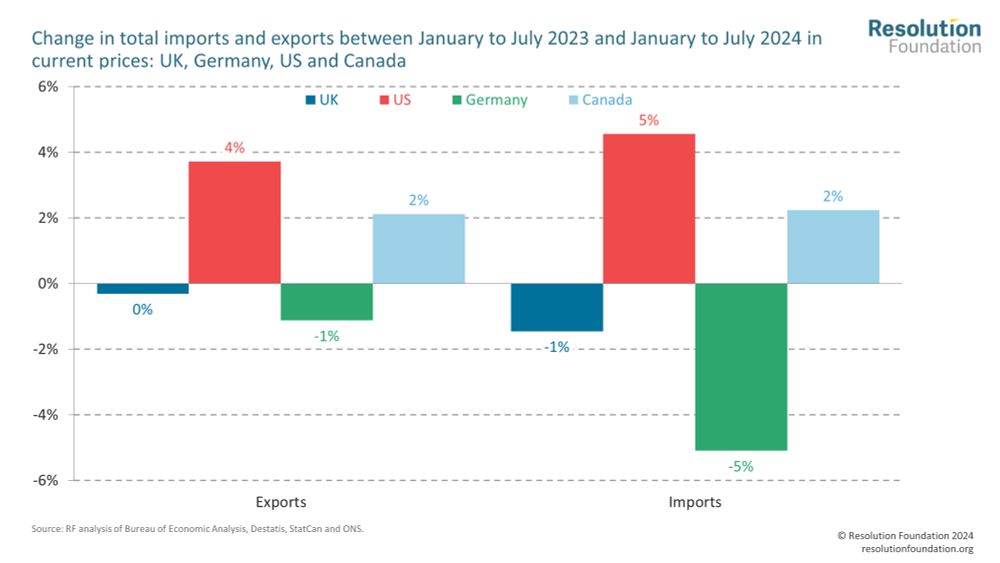

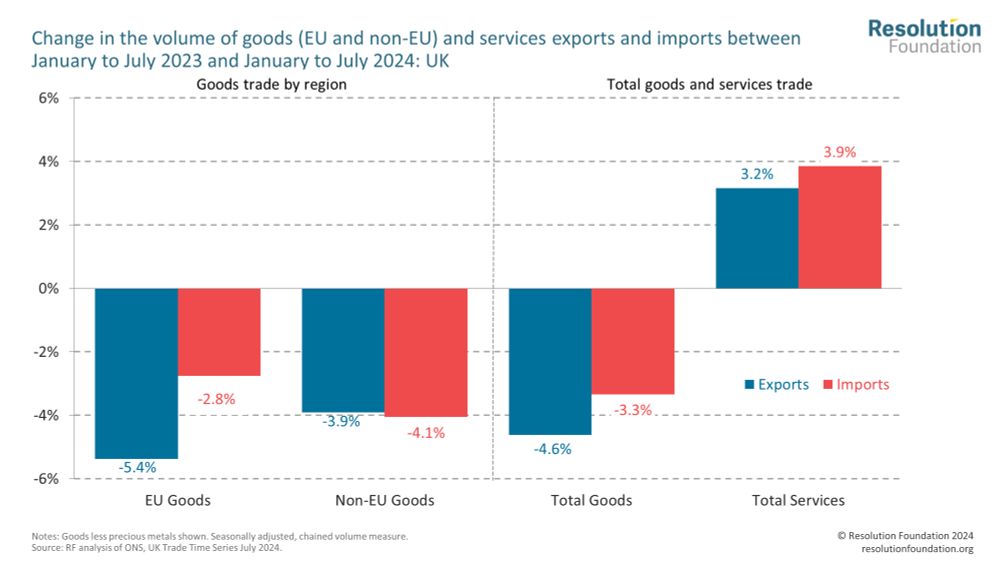

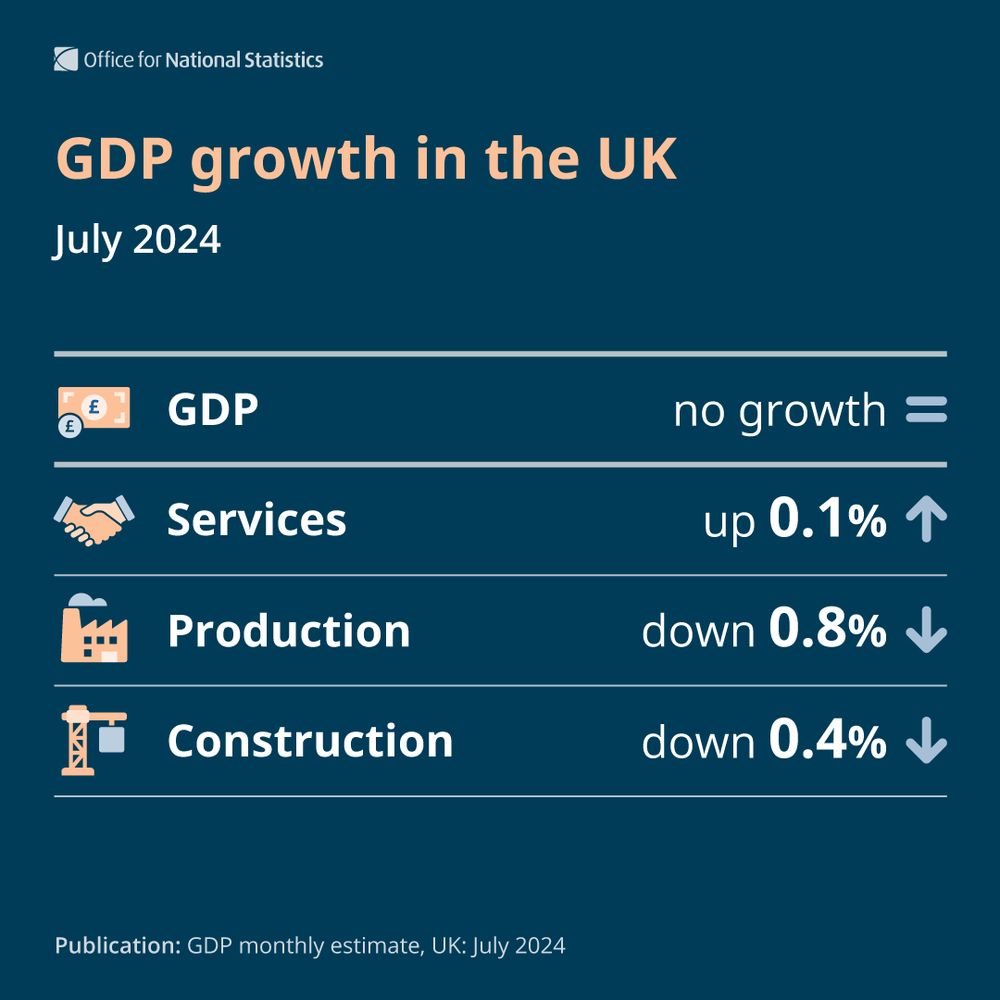

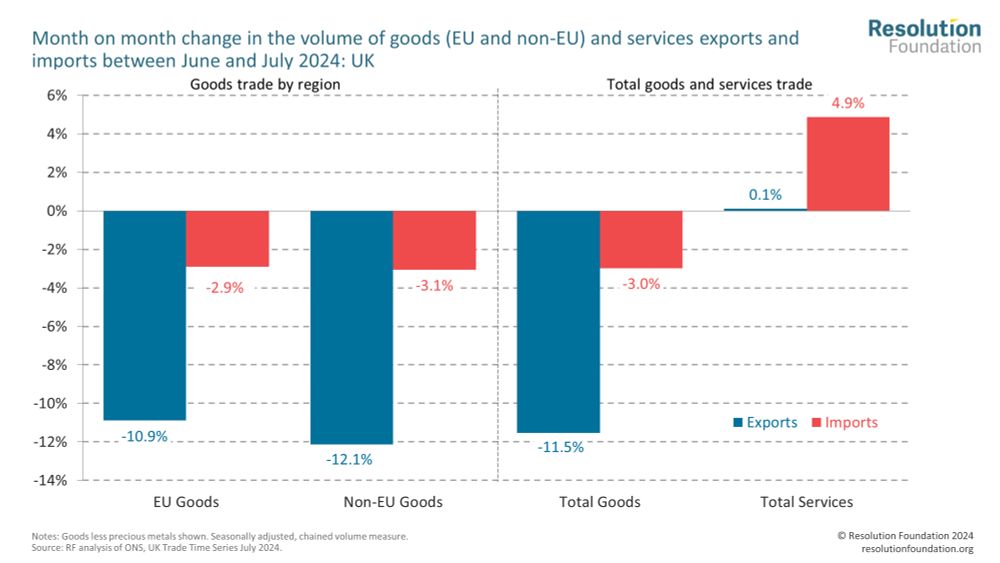

Trading blows • Resolution Foundation

Recently the UK has faced tough times in trade, juggling twin shocks of Brexit and Covid. While service exports have stayed strong, goods trade has struggled. With a possible further disruption to goo...

www.resolutionfoundation.org

Sophie Hale

@sophiehale.bsky.social

· Sep 11

Sophie Hale

@sophiehale.bsky.social

· Sep 11