Substacking on financial stability topics at www.withoutwarningresearch.com (free)

Could household, corporate, or nonbank financial companies pull this off?

Could household, corporate, or nonbank financial companies pull this off?

When rescuing an individual institution, only "lend freely" survives as good advice:

When rescuing an individual institution, only "lend freely" survives as good advice:

Our recent paper (w/ Vincient Arnold, Greg Feldberg, and Andrew Metrick) is now out as a policy brief with the European Money & Finance Forum:

www.suerf.org/publications...

Our recent paper (w/ Vincient Arnold, Greg Feldberg, and Andrew Metrick) is now out as a policy brief with the European Money & Finance Forum:

www.suerf.org/publications...

As noted below, the resolution included First Republic, which wasn't ultimately closed for another 6 weeks:

As noted below, the resolution included First Republic, which wasn't ultimately closed for another 6 weeks:

But, not to lose any friends, the press release specifically mentions also having access to the Fed's FIMA facility, "which allows the BCB to access US dollars through a repo operation."

Translated:

But, not to lose any friends, the press release specifically mentions also having access to the Fed's FIMA facility, "which allows the BCB to access US dollars through a repo operation."

Translated:

All the largest borrowers (pictured) were the crypto/VC banks highlighted in the paper below: SVB, Signature, First Republic, PacWest, & Western Alliance.

One additional bank sneaks in at the bottom: Customers Bank—another crypto bank.

All the largest borrowers (pictured) were the crypto/VC banks highlighted in the paper below: SVB, Signature, First Republic, PacWest, & Western Alliance.

One additional bank sneaks in at the bottom: Customers Bank—another crypto bank.

At the two-year anniversary of the crisis, Jonathan Rose and I present 7 facts that are overlooked in the standard account of the crisis: www.chicagofed.org/publications...

At the two-year anniversary of the crisis, Jonathan Rose and I present 7 facts that are overlooked in the standard account of the crisis: www.chicagofed.org/publications...

On the left is the web archive, with the right being right now:

On the left is the web archive, with the right being right now:

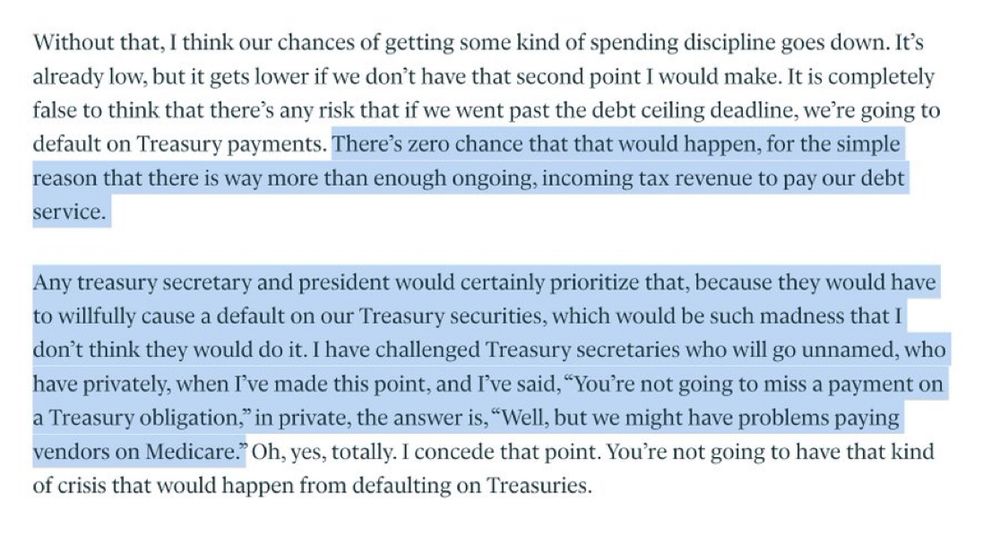

Toomey says that even in the event of the debt ceiling binding, there's "zero chance" of a missed payment on Treasuries.

Toomey says that even in the event of the debt ceiling binding, there's "zero chance" of a missed payment on Treasuries.

Only *contingent* ones like the BoE's new one for pension funds and insurers:

Only *contingent* ones like the BoE's new one for pension funds and insurers:

The exception? When they try to pool their funds: papers.ssrn.com/sol3/papers....

The exception? When they try to pool their funds: papers.ssrn.com/sol3/papers....

Too often, the ratings agencies are considered as an afterthought, rather than a first-order constraint:

Too often, the ratings agencies are considered as an afterthought, rather than a first-order constraint: