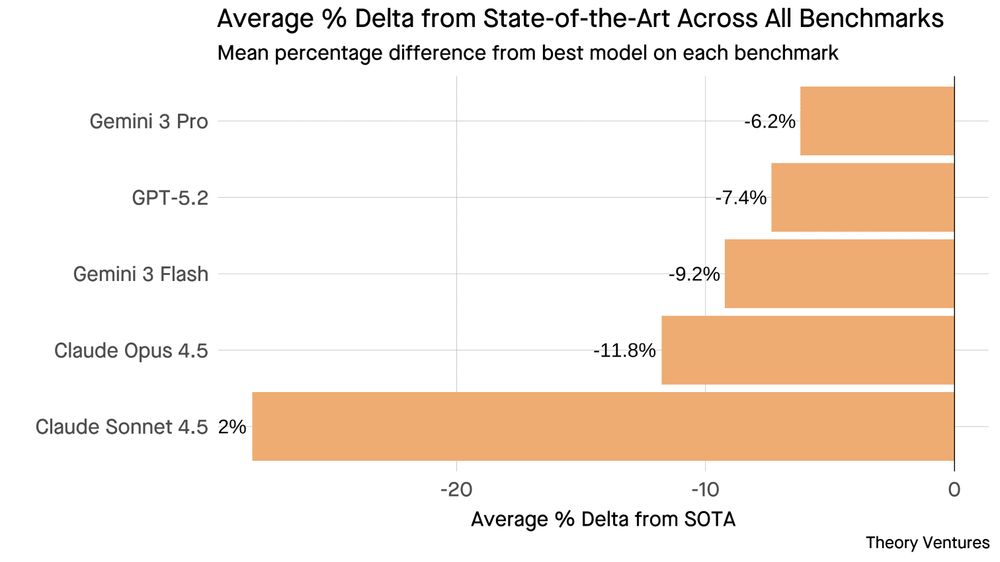

State of the art (SOTA) : the best score achieved by any model on a given benchmark, used as the 100% baseline. Performance score = 100 + average percentage delta from SOTA.

State of the art (SOTA) : the best score achieved by any model on a given benchmark, used as the 100% baseline. Performance score = 100 + average percentage delta from SOTA.

First, performance. Gemini 3 Pro tops this analysis with a 6% deviation from state of the art. Gemini 3 Flash is not far behind at 9%, followed by Opus at 12%.

First, performance. Gemini 3 Pro tops this analysis with a 6% deviation from state of the art. Gemini 3 Flash is not far behind at 9%, followed by Opus at 12%.

The table below shows the top 2 use cases by provider (November 2025). Technology refers to AI assistant tasks like research & summarization.

The table below shows the top 2 use cases by provider (November 2025). Technology refers to AI assistant tasks like research & summarization.

Meta took this even further in October 2025 with Blue Owl Capital :

Meta took this even further in October 2025 with Blue Owl Capital :

Why this structure matters : The 70% debt leverage sits at the fund level, not on Microsoft’s corporate balance sheet.

Why this structure matters : The 70% debt leverage sits at the fund level, not on Microsoft’s corporate balance sheet.

In September 2024, BlackRock, Global Infrastructure Partners (GIP), Microsoft, & MGX launched the AI Infrastructure Partnership with a distinctive financing structure.

In September 2024, BlackRock, Global Infrastructure Partners (GIP), Microsoft, & MGX launched the AI Infrastructure Partnership with a distinctive financing structure.

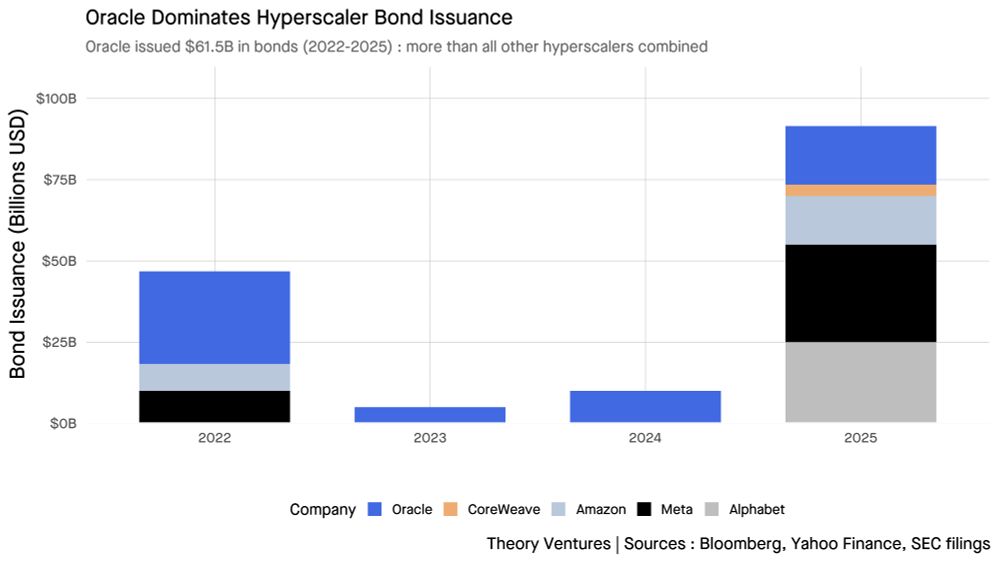

Oracle’s debt-to-equity ratio has ballooned to 500%, dwarfing its cloud computing peers.

Oracle’s debt-to-equity ratio has ballooned to 500%, dwarfing its cloud computing peers.

AI’s capital expenditure in 2025 represents about 1.6% of US GDP. In 2026, that number should top 3% of US GDP according to Goldman Sachs estimates.

AI’s capital expenditure in 2025 represents about 1.6% of US GDP. In 2026, that number should top 3% of US GDP according to Goldman Sachs estimates.