Quantile regressions on WTA measures show that fact-checking and positive narratives reduce the penalty only among respondents already at the favorable end.

Heavy baseline bias → no treatment response

Low baseline bias → clear treatment effect to information and narratives

Quantile regressions on WTA measures show that fact-checking and positive narratives reduce the penalty only among respondents already at the favorable end.

Heavy baseline bias → no treatment response

Low baseline bias → clear treatment effect to information and narratives

To consider a Chinese investor equivalent to an EU/US investor, respondents require more job preservation:

• EU/US investor baseline: 250 jobs saved

• Chinese investor: ~350 jobs saved

This implies a ~50% China-origin penalty built into public preferences.

To consider a Chinese investor equivalent to an EU/US investor, respondents require more job preservation:

• EU/US investor baseline: 250 jobs saved

• Chinese investor: ~350 jobs saved

This implies a ~50% China-origin penalty built into public preferences.

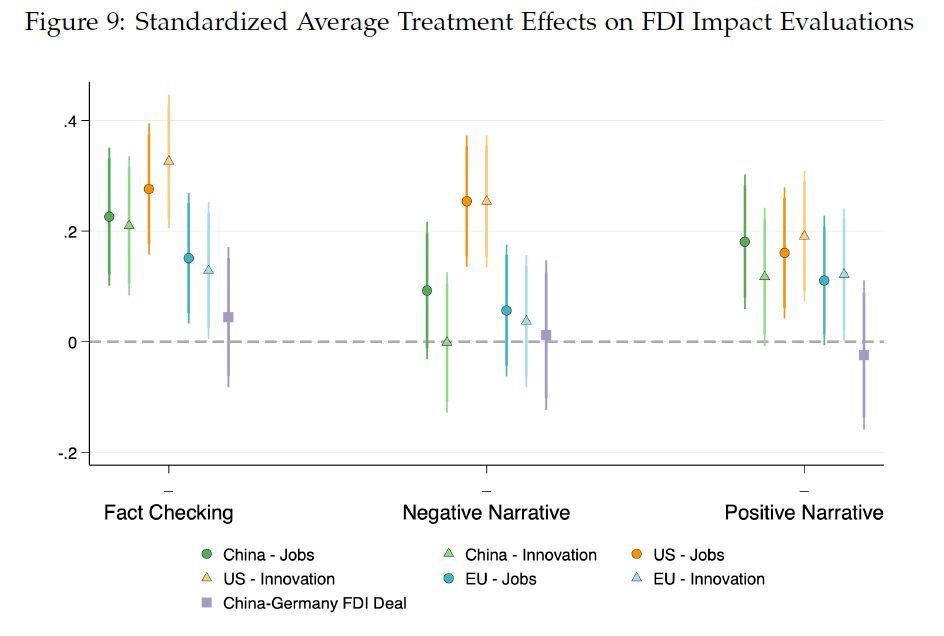

Providing accurate information significantly improves perceived economic benefits of FDI (across the board regardless of the country of origin) — by roughly 0.2–0.3 standard deviations

Providing accurate information significantly improves perceived economic benefits of FDI (across the board regardless of the country of origin) — by roughly 0.2–0.3 standard deviations

Chinese respondents express overwhelmingly positive evaluations of German FDI, rating it highly on:

✔️ job creation

✔️ technological upgrading

✔️ national economic development

Roughly 80% provide strongly favorable assessments.

The asymmetry in mutual perceptions is striking.

Chinese respondents express overwhelmingly positive evaluations of German FDI, rating it highly on:

✔️ job creation

✔️ technological upgrading

✔️ national economic development

Roughly 80% provide strongly favorable assessments.

The asymmetry in mutual perceptions is striking.

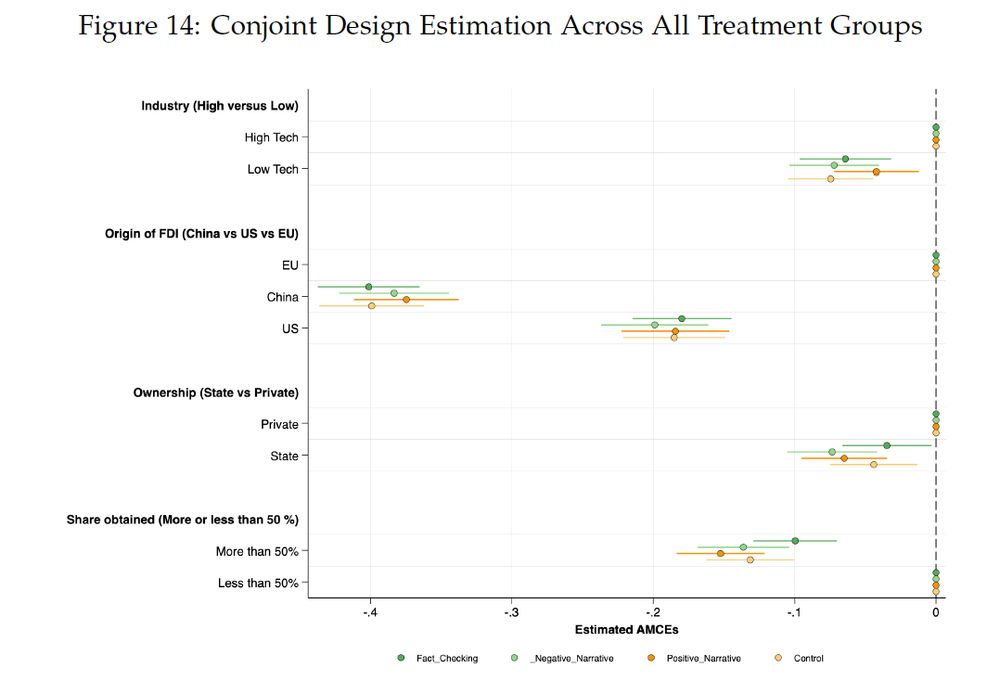

Holding all attributes constant, changing the investor from EU → China reduces selection likelihood by:

➡️ −40 percentage points

Compared with the US:

➡️ −20 points

A substantial origin penalty, independent of project characteristics.

Holding all attributes constant, changing the investor from EU → China reduces selection likelihood by:

➡️ −40 percentage points

Compared with the US:

➡️ −20 points

A substantial origin penalty, independent of project characteristics.

🟧 US FDI

🟥 Chinese FDI

Across every domain we measure —

💼 economic prospects

🏭 employment

🧪 innovation

🏛 political autonomy

a remarkably stable preference hierarchy emerges:

EU > US > China

This structure is consistent and highly robust.

🟧 US FDI

🟥 Chinese FDI

Across every domain we measure —

💼 economic prospects

🏭 employment

🧪 innovation

🏛 political autonomy

a remarkably stable preference hierarchy emerges:

EU > US > China

This structure is consistent and highly robust.

On average, Germans believe that Chinese firms account for 33% of inward FDI.

The actual figure?

👉 ~1% — a roughly 30-fold overestimation. 😬

By contrast:

• EU FDI is systematically underestimated

• US FDI is perceived relatively accurately

On average, Germans believe that Chinese firms account for 33% of inward FDI.

The actual figure?

👉 ~1% — a roughly 30-fold overestimation. 😬

By contrast:

• EU FDI is systematically underestimated

• US FDI is perceived relatively accurately

Germany and China are economically intertwined through bilateral FDI flows, not just trade.

As Figure 1 shows 👇

🇩🇪 German FDI in China has expanded sharply since 2004—reaching nearly 3% of Germany’s GDP-equivalent.

🇨🇳 Chinese FDI in Germany, by contrast, remains very small.

Germany and China are economically intertwined through bilateral FDI flows, not just trade.

As Figure 1 shows 👇

🇩🇪 German FDI in China has expanded sharply since 2004—reaching nearly 3% of Germany’s GDP-equivalent.

🇨🇳 Chinese FDI in Germany, by contrast, remains very small.