Light-touch information corrects misperceptions but does not shift deeper identity-based or geopolitical attitudes toward Chinese FDI.

As Germany and the EU adjust their China strategies, public opinion—not just economic fundamentals—will shape the policy space ahead.

Light-touch information corrects misperceptions but does not shift deeper identity-based or geopolitical attitudes toward Chinese FDI.

As Germany and the EU adjust their China strategies, public opinion—not just economic fundamentals—will shape the policy space ahead.

Quantile regressions on WTA measures show that fact-checking and positive narratives reduce the penalty only among respondents already at the favorable end.

Heavy baseline bias → no treatment response

Low baseline bias → clear treatment effect to information and narratives

Quantile regressions on WTA measures show that fact-checking and positive narratives reduce the penalty only among respondents already at the favorable end.

Heavy baseline bias → no treatment response

Low baseline bias → clear treatment effect to information and narratives

To consider a Chinese investor equivalent to an EU/US investor, respondents require more job preservation:

• EU/US investor baseline: 250 jobs saved

• Chinese investor: ~350 jobs saved

This implies a ~50% China-origin penalty built into public preferences.

To consider a Chinese investor equivalent to an EU/US investor, respondents require more job preservation:

• EU/US investor baseline: 250 jobs saved

• Chinese investor: ~350 jobs saved

This implies a ~50% China-origin penalty built into public preferences.

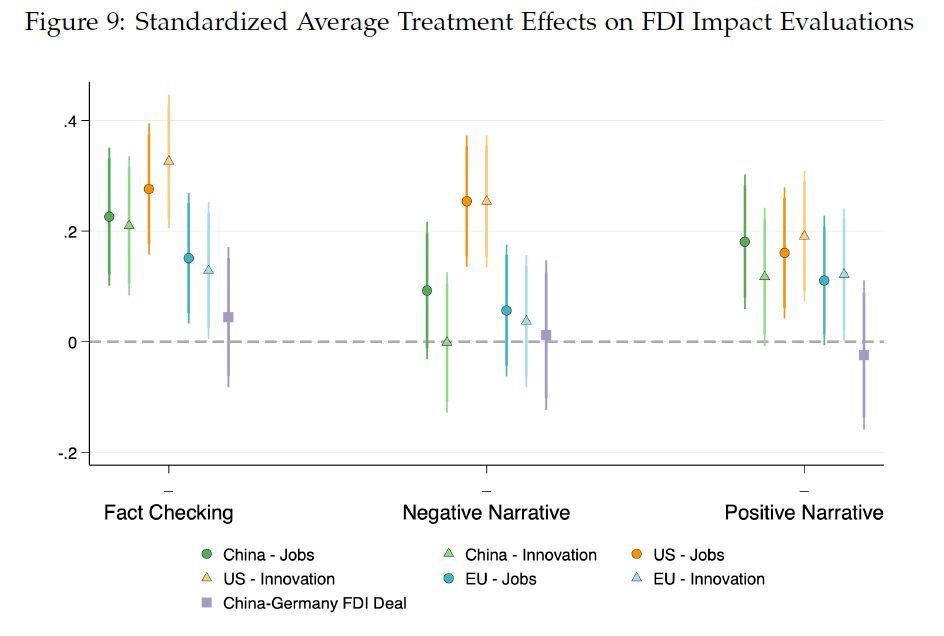

❌ deeper geopolitical or autonomy-related attitudes remain unchanged

❌ support for a Germany–China FDI agreement does not shift

❌ no detectable effects on either conjoint choices or WTA measures

In short, belief updating does not translate into substantive preference updating.

❌ deeper geopolitical or autonomy-related attitudes remain unchanged

❌ support for a Germany–China FDI agreement does not shift

❌ no detectable effects on either conjoint choices or WTA measures

In short, belief updating does not translate into substantive preference updating.

🔵 Positive narrative → modest improvements in economic perceptions

🔴 Negative narrative → little effect on China-specific concerns, but notably increases favorable evaluations of US FDI, consistent with a substitution logic

🔵 Positive narrative → modest improvements in economic perceptions

🔴 Negative narrative → little effect on China-specific concerns, but notably increases favorable evaluations of US FDI, consistent with a substitution logic

Providing accurate information significantly improves perceived economic benefits of FDI (across the board regardless of the country of origin) — by roughly 0.2–0.3 standard deviations

Providing accurate information significantly improves perceived economic benefits of FDI (across the board regardless of the country of origin) — by roughly 0.2–0.3 standard deviations

We implemented three randomized treatments interventions w.r.t. Chinese FDI in Germany:

1️⃣ Fact-checking: true FDI shares

2️⃣ Negative narrative: economic/political risks, dependency, IP

3️⃣ Positive narrative: market access, diversification, competitiveness

We implemented three randomized treatments interventions w.r.t. Chinese FDI in Germany:

1️⃣ Fact-checking: true FDI shares

2️⃣ Negative narrative: economic/political risks, dependency, IP

3️⃣ Positive narrative: market access, diversification, competitiveness

Chinese respondents express overwhelmingly positive evaluations of German FDI, rating it highly on:

✔️ job creation

✔️ technological upgrading

✔️ national economic development

Roughly 80% provide strongly favorable assessments.

The asymmetry in mutual perceptions is striking.

Chinese respondents express overwhelmingly positive evaluations of German FDI, rating it highly on:

✔️ job creation

✔️ technological upgrading

✔️ national economic development

Roughly 80% provide strongly favorable assessments.

The asymmetry in mutual perceptions is striking.

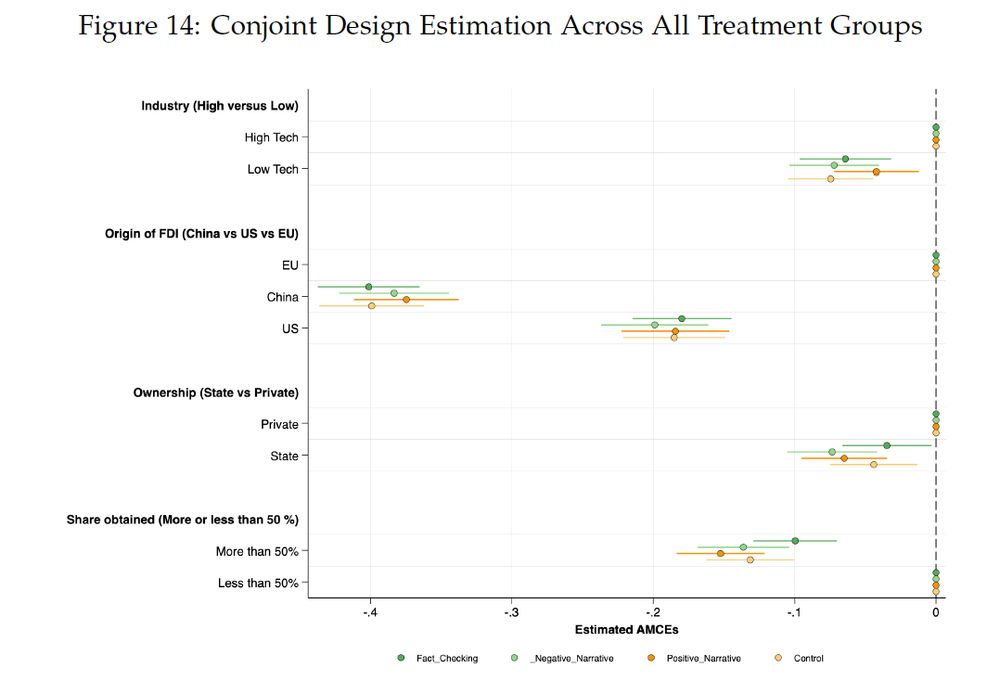

Holding all attributes constant, changing the investor from EU → China reduces selection likelihood by:

➡️ −40 percentage points

Compared with the US:

➡️ −20 points

A substantial origin penalty, independent of project characteristics.

Holding all attributes constant, changing the investor from EU → China reduces selection likelihood by:

➡️ −40 percentage points

Compared with the US:

➡️ −20 points

A substantial origin penalty, independent of project characteristics.

🟧 US FDI

🟥 Chinese FDI

Across every domain we measure —

💼 economic prospects

🏭 employment

🧪 innovation

🏛 political autonomy

a remarkably stable preference hierarchy emerges:

EU > US > China

This structure is consistent and highly robust.

🟧 US FDI

🟥 Chinese FDI

Across every domain we measure —

💼 economic prospects

🏭 employment

🧪 innovation

🏛 political autonomy

a remarkably stable preference hierarchy emerges:

EU > US > China

This structure is consistent and highly robust.

On average, Germans believe that Chinese firms account for 33% of inward FDI.

The actual figure?

👉 ~1% — a roughly 30-fold overestimation. 😬

By contrast:

• EU FDI is systematically underestimated

• US FDI is perceived relatively accurately

On average, Germans believe that Chinese firms account for 33% of inward FDI.

The actual figure?

👉 ~1% — a roughly 30-fold overestimation. 😬

By contrast:

• EU FDI is systematically underestimated

• US FDI is perceived relatively accurately

German respondents substantially overestimate the scale of Chinese FDI in Germany and evaluate it far more negatively than FDI from the EU or the United States.

Attempts to correct these misperceptions produce only modest and fragile shifts in attitudes.

German respondents substantially overestimate the scale of Chinese FDI in Germany and evaluate it far more negatively than FDI from the EU or the United States.

Attempts to correct these misperceptions produce only modest and fragile shifts in attitudes.

Germany and China are economically intertwined through bilateral FDI flows, not just trade.

As Figure 1 shows 👇

🇩🇪 German FDI in China has expanded sharply since 2004—reaching nearly 3% of Germany’s GDP-equivalent.

🇨🇳 Chinese FDI in Germany, by contrast, remains very small.

Germany and China are economically intertwined through bilateral FDI flows, not just trade.

As Figure 1 shows 👇

🇩🇪 German FDI in China has expanded sharply since 2004—reaching nearly 3% of Germany’s GDP-equivalent.

🇨🇳 Chinese FDI in Germany, by contrast, remains very small.