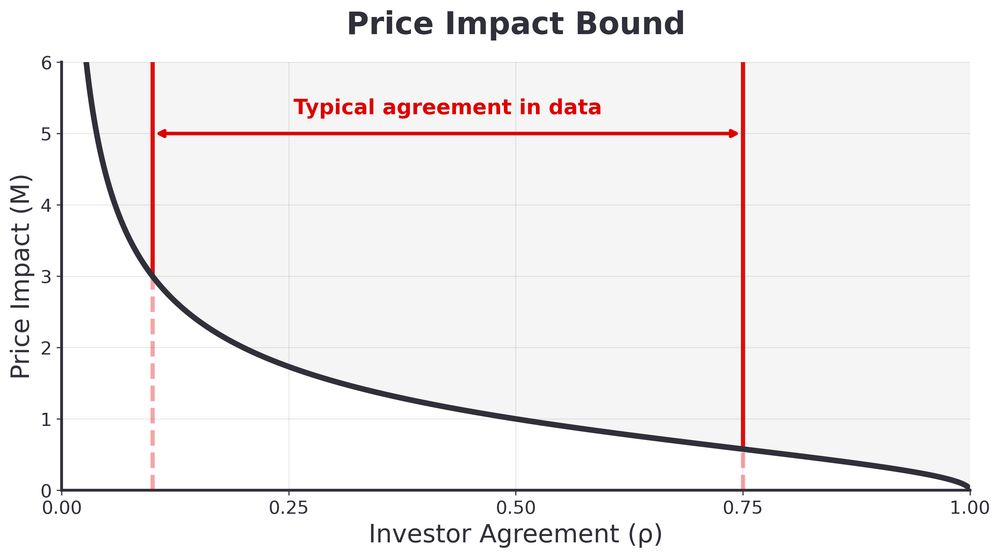

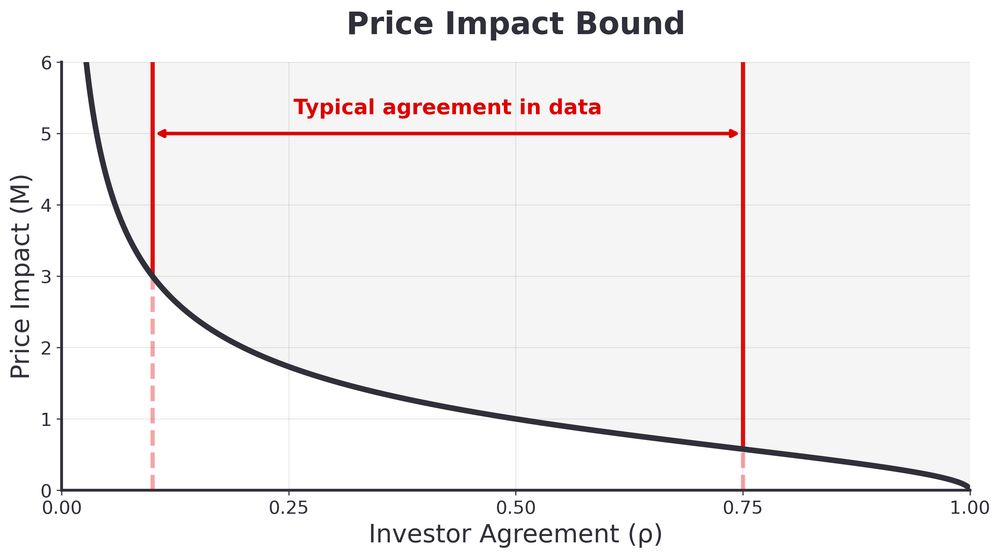

To argue for a price impact less than 0.1, you really need investors to agree with each other for more than 99%!

To argue for a price impact less than 0.1, you really need investors to agree with each other for more than 99%!

To argue for a price impact less than 0.1, you really need investors to agree with each other for more than 99%!

To argue for a price impact less than 0.1, you really need investors to agree with each other for more than 99%!