Paper: priceimpactbound.github.io/PriceImpactB...

Paper: priceimpactbound.github.io/PriceImpactB...

It's not just a number—it's about whether we can understand asset prices using quantity data.

elastic market → quantities are a sideshow, price data are all you need

inelastic → quantities are CENTRAL for prices

It's not just a number—it's about whether we can understand asset prices using quantity data.

elastic market → quantities are a sideshow, price data are all you need

inelastic → quantities are CENTRAL for prices

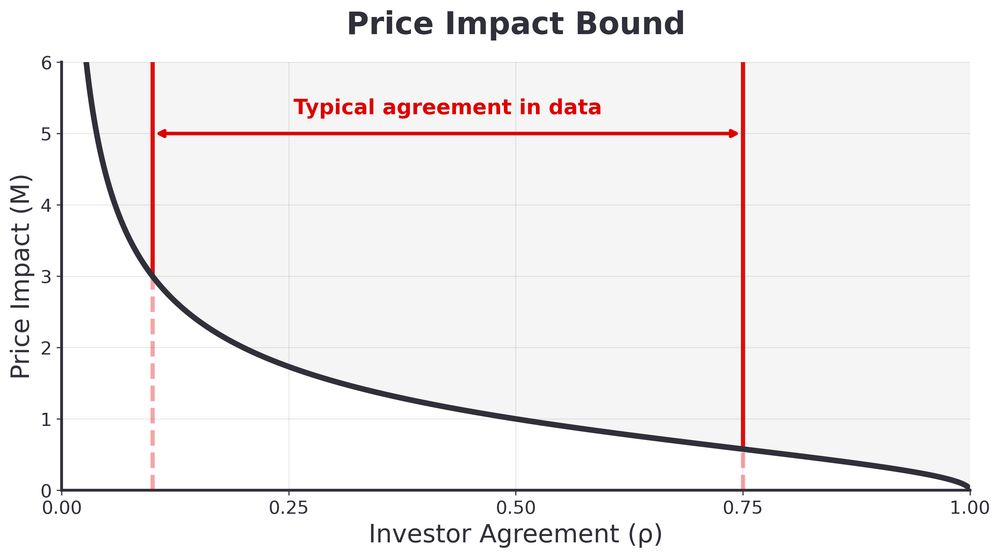

To argue for a price impact less than 0.1, you really need investors to agree with each other for more than 99%!

To argue for a price impact less than 0.1, you really need investors to agree with each other for more than 99%!

Price Impact ≥ (σ_p/σ_q) × √(1/ρ - 1)

where agreement ρ can be loosely understood as avg. corr across investors.

The bound needs few structural assumptions, just like the Hansen–Jagannathan bound for SDF

Price Impact ≥ (σ_p/σ_q) × √(1/ρ - 1)

where agreement ρ can be loosely understood as avg. corr across investors.

The bound needs few structural assumptions, just like the Hansen–Jagannathan bound for SDF

→ A small portfolio flow requires a large price adjustment to clear

→ A small portfolio flow requires a large price adjustment to clear

You can easily generate little trading alongside volatile prices with large agreement.

But with large disagreement and volatile prices, why don't investors trade more?

You can easily generate little trading alongside volatile prices with large agreement.

But with large disagreement and volatile prices, why don't investors trade more?

Paper: priceimpactbound.github.io/PriceImpactB...

Paper: priceimpactbound.github.io/PriceImpactB...

It's not just a number—it's about whether we can understand asset prices using quantity data.

elastic market → quantities are a sideshow, price data are all you need

inelastic → quantities are CENTRAL for prices

It's not just a number—it's about whether we can understand asset prices using quantity data.

elastic market → quantities are a sideshow, price data are all you need

inelastic → quantities are CENTRAL for prices

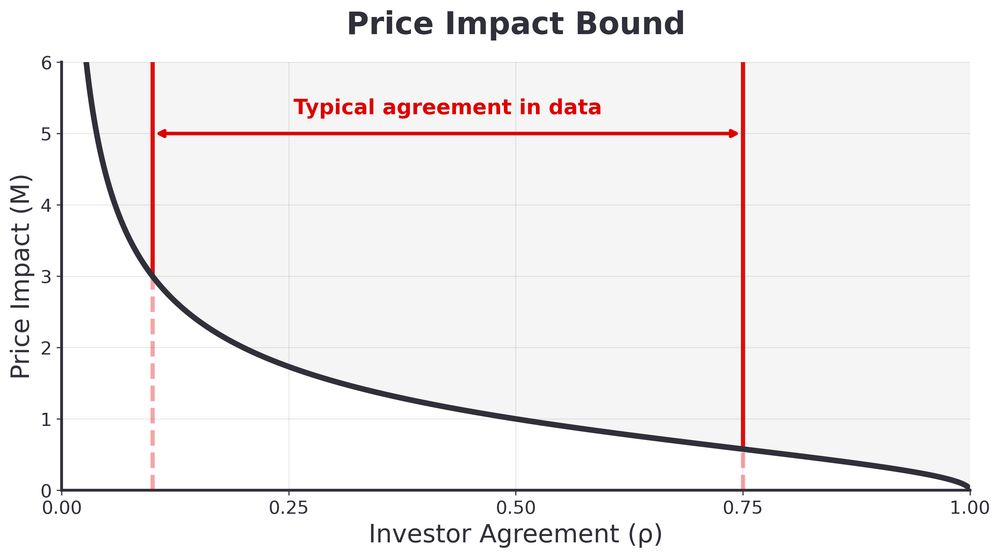

To argue for a price impact less than 0.1, you really need investors to agree with each other for more than 99%!

To argue for a price impact less than 0.1, you really need investors to agree with each other for more than 99%!

Price Impact ≥ (σ_p/σ_q) × √(1/ρ - 1)

where agreement ρ can be loosely understood as avg. corr across investors.

The bound needs few structural assumptions, just like the Hansen–Jagannathan bound for SDF

Price Impact ≥ (σ_p/σ_q) × √(1/ρ - 1)

where agreement ρ can be loosely understood as avg. corr across investors.

The bound needs few structural assumptions, just like the Hansen–Jagannathan bound for SDF

→ A small portfolio flow requires a large price adjustment to clear

→ A small portfolio flow requires a large price adjustment to clear

You can easily generate little trading alongside volatile prices with large agreement.

But with large disagreement and volatile prices, why don't investors trade more?

You can easily generate little trading alongside volatile prices with large agreement.

But with large disagreement and volatile prices, why don't investors trade more?

SSRN: papers.ssrn.com/sol3/papers....

SSRN: papers.ssrn.com/sol3/papers....