Go-to-market efficiency keeps slipping.

Median CAC payback hit 35 months in Q2 2025 - up from 29 two years ago (+21%).

Applovin (4) & Palantir (11) are leading; Zoom (100) & Asana (78) dragging the median higher.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#CACpayback

Median CAC payback hit 35 months in Q2 2025 - up from 29 two years ago (+21%).

Applovin (4) & Palantir (11) are leading; Zoom (100) & Asana (78) dragging the median higher.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#CACpayback

November 4, 2025 at 4:01 AM

Everybody can reply

CAC Payback: Who Spent More Efficiently?

Salesforce: 18 mo avg

HubSpot: 23 mo avg

Only edge for HubSpot?

2020–21 boom.

Want the full breakdown? Click here - https://youtu.be/WnqK4Vd4kFo

#SaaSMetrics #CACPayback #GrowthEfficiency #Salesforce #HubSpot

Salesforce: 18 mo avg

HubSpot: 23 mo avg

Only edge for HubSpot?

2020–21 boom.

Want the full breakdown? Click here - https://youtu.be/WnqK4Vd4kFo

#SaaSMetrics #CACPayback #GrowthEfficiency #Salesforce #HubSpot

July 29, 2025 at 5:01 AM

Everybody can reply

1 likes

Did Salesforce buy its growth?

Spending big is one thing. Doing it efficiently is what matters.

Watch the full breakdown here - https://youtu.be/WnqK4Vd4kFo

#SaaS #StartupMetrics #CACpayback #Salesforce #HubSpot

Spending big is one thing. Doing it efficiently is what matters.

Watch the full breakdown here - https://youtu.be/WnqK4Vd4kFo

#SaaS #StartupMetrics #CACpayback #Salesforce #HubSpot

July 29, 2025 at 2:03 AM

Everybody can reply

1 likes

CAC payback: 70 months.

ARR growth: 9%.

Free cash flow margin: 22%.

#Pegasystems is in a tough spot.

The path back to a premium SaaS multiple?

Start growing - fast.

Watch the full episode for more - https://youtu.be/kKdAXeoRLCg

#SaaS #ARR #CACPayback #SaaSMetrics #TechEarnings

ARR growth: 9%.

Free cash flow margin: 22%.

#Pegasystems is in a tough spot.

The path back to a premium SaaS multiple?

Start growing - fast.

Watch the full episode for more - https://youtu.be/kKdAXeoRLCg

#SaaS #ARR #CACPayback #SaaSMetrics #TechEarnings

August 1, 2025 at 5:03 AM

Everybody can reply

1 likes

Palantir cut CAC payback from 27 to 12 months - while growing to $3.5B ARR.

That’s almost unheard of in SaaS.

For context:

• HubSpot: 20 → 35 months

• CrowdStrike: 13 → 21

• Atlassian: 10 → 15

Full video here - https://youtu.be/kKdAXeoRLCg

#SaaS #Palantir #CACPayback #Tech

That’s almost unheard of in SaaS.

For context:

• HubSpot: 20 → 35 months

• CrowdStrike: 13 → 21

• Atlassian: 10 → 15

Full video here - https://youtu.be/kKdAXeoRLCg

#SaaS #Palantir #CACPayback #Tech

August 9, 2025 at 2:03 AM

Everybody can reply

1 reposts

1 likes

CAC paybacks are up.

Free cash flow is up.

Growth is slowing.

This quarter’s State of SaaS breaks down the numbers - who’s winning and who’s falling behind.

Watch here - https://youtu.be/Y4Jd6o-AGPQ

#SaaS #CACpayback #Q2

Free cash flow is up.

Growth is slowing.

This quarter’s State of SaaS breaks down the numbers - who’s winning and who’s falling behind.

Watch here - https://youtu.be/Y4Jd6o-AGPQ

#SaaS #CACpayback #Q2

CAC Paybacks are exploding for Public SaaS Co’s, Do curricular economics in AI point to a bubble

In Episode 30 of The SaaS Report, host Matt Aird breaks down three key metrics from our Q2 State of SaaS Report - CAC payback, free cash flow margins, and sa...

youtu.be

November 7, 2025 at 4:02 AM

Everybody can reply

Veeva is an incredible business.

They're trading at $40B or 16X ARR right now

#veeva #cacpayback #arr #sales #saas

They're trading at $40B or 16X ARR right now

#veeva #cacpayback #arr #sales #saas

March 28, 2025 at 3:37 AM

Everybody can reply

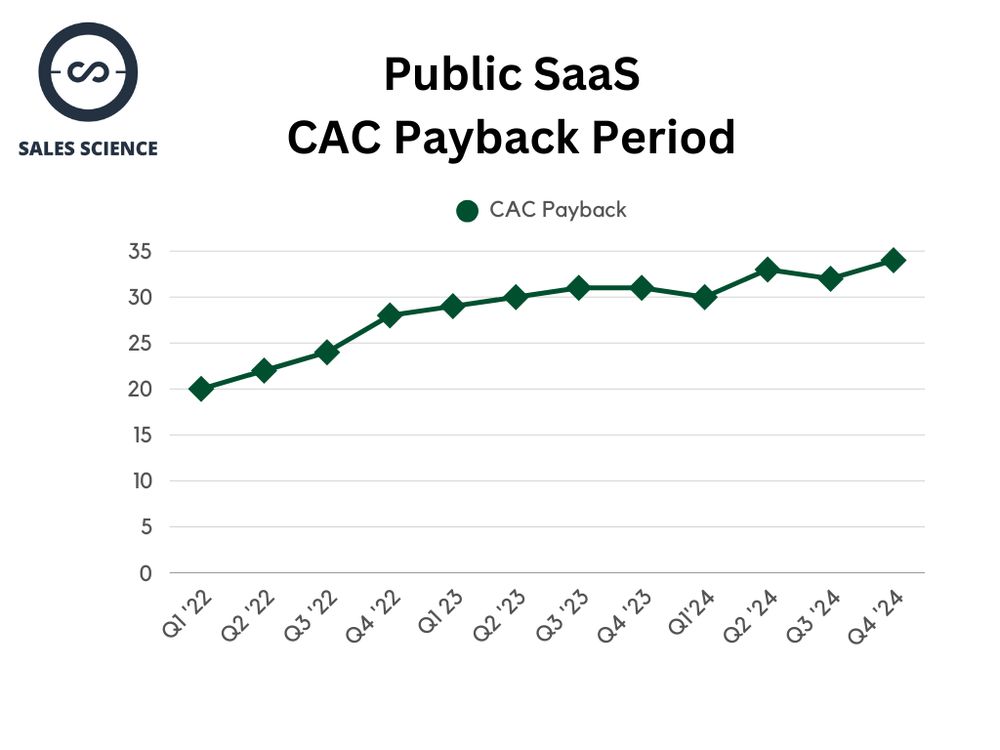

Over the last 12 quarters, we've seen an increase in CAC payback rates from 20 months in Q1 of 22 up to 34 months in Q4 of 24.

That's a 70% increase over the last 12 quarters.

That's crazy.

#SaaS #SalesMetrics #GoToMarket #CACPayback #MagicNumber #ARRGrowth #SaaSMarketing #RevenueGrowth

That's a 70% increase over the last 12 quarters.

That's crazy.

#SaaS #SalesMetrics #GoToMarket #CACPayback #MagicNumber #ARRGrowth #SaaSMarketing #RevenueGrowth

May 8, 2025 at 5:02 AM

Everybody can reply

Want the Q1 State of SaaS Data Sheet?

It’s raw data from 30+ public SaaS companies (#Zoom, #Salesforce, #Snowflake, etc.) - plus calculated metrics like #CACPayback, #ARR growth, #MagicNumber, and Rule of 40.

Comment Q1 and we will send it your way!

It’s raw data from 30+ public SaaS companies (#Zoom, #Salesforce, #Snowflake, etc.) - plus calculated metrics like #CACPayback, #ARR growth, #MagicNumber, and Rule of 40.

Comment Q1 and we will send it your way!

May 26, 2025 at 2:01 AM

Everybody can reply

GTM efficiency continues to decline across B2B SaaS, with CAC Payback periods steadily rising.

Full breakdown of 30 companies across 15 SaaS metrics in the Q4 State of SaaS report. Link in comments.

#B2BSaaS #SaaSmetrics #CACPayback #GTMstrategy #SaaStr #SaaSdata #ARRgrowth #StartupMetrics

Full breakdown of 30 companies across 15 SaaS metrics in the Q4 State of SaaS report. Link in comments.

#B2BSaaS #SaaSmetrics #CACPayback #GTMstrategy #SaaStr #SaaSdata #ARRgrowth #StartupMetrics

April 10, 2025 at 4:45 AM

Everybody can reply

1 likes

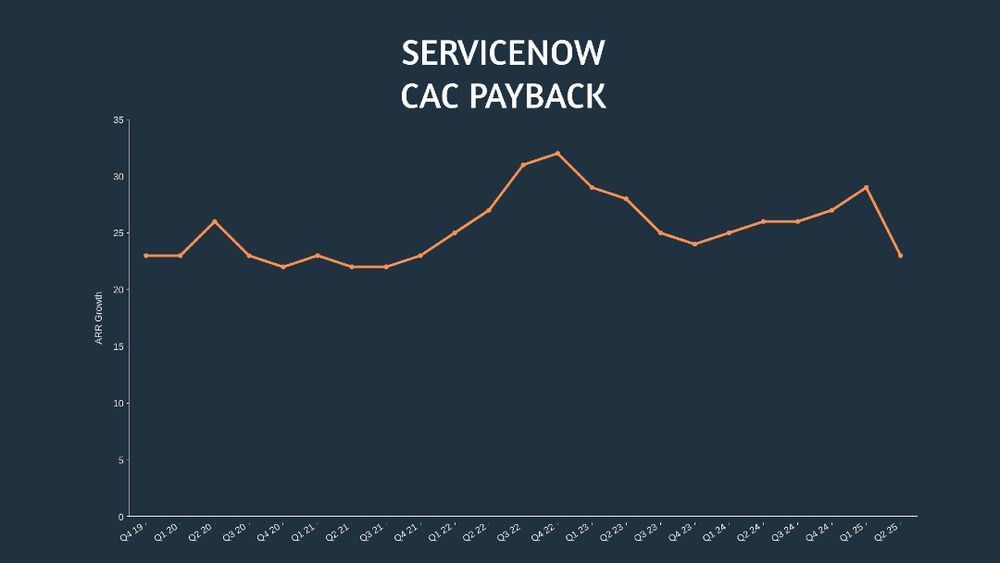

This chart breaks the rule:

ARR ↑ = CAC payback ↑

ServiceNow: 23 months CAC payback at $2.5B and $12.5B ARR

Scaling without bloated S&M spend is rare.

They’re doing it.

Want the full breakdown? Click here - https://youtu.be/kKdAXeoRLCg

#SaaS #ServiceNow #CACPayback #SaaSMetrics

ARR ↑ = CAC payback ↑

ServiceNow: 23 months CAC payback at $2.5B and $12.5B ARR

Scaling without bloated S&M spend is rare.

They’re doing it.

Want the full breakdown? Click here - https://youtu.be/kKdAXeoRLCg

#SaaS #ServiceNow #CACPayback #SaaSMetrics

August 3, 2025 at 2:02 AM

Everybody can reply

1 likes

Go-to-market efficiency is sliding.

Median CAC payback across public SaaS has stretched from 29 → 35 months in just two years - a 21% jump in acquisition cost.

Full episode here - https://youtu.be/Y4Jd6o-AGPQ?si=FBh6E5zdQwzAFquw

#CACpayback #GTM

Median CAC payback across public SaaS has stretched from 29 → 35 months in just two years - a 21% jump in acquisition cost.

Full episode here - https://youtu.be/Y4Jd6o-AGPQ?si=FBh6E5zdQwzAFquw

#CACpayback #GTM

October 29, 2025 at 2:30 AM

Everybody can reply

1 likes

Box just posted a 126-month CAC payback.

$380M in sales + marketing → only $46M in new ARR.

But billings are up 27%, RPO up 21%, and they’re re-investing in growth.

A rough year-but are we seeing early signs of a turnaround?

#Box #CACPayback

$380M in sales + marketing → only $46M in new ARR.

But billings are up 27%, RPO up 21%, and they’re re-investing in growth.

A rough year-but are we seeing early signs of a turnaround?

#Box #CACPayback

June 11, 2025 at 6:33 AM

Everybody can reply

Figma’s CAC payback is elite:

→ Median: 14 months

→ Most peers are well above 20

→ On par with Atlassian, Palantir, and Veeva

→ And still growing 46% YoY

Efficiency + growth = strong IPO setup.

Full breakdown → https://youtu.be/FiXtNHUpKAk

#Figma #SaaS #CACPayback #IPO

→ Median: 14 months

→ Most peers are well above 20

→ On par with Atlassian, Palantir, and Veeva

→ And still growing 46% YoY

Efficiency + growth = strong IPO setup.

Full breakdown → https://youtu.be/FiXtNHUpKAk

#Figma #SaaS #CACPayback #IPO

Enjoy the videos and music that you love, upload original content and share it all with friends, family and the world on YouTube.

youtu.be

July 14, 2025 at 2:02 AM

Everybody can reply

1 likes

🚨 Public SaaS companies have made a big shift in their growth strategy.

Check out the Q4 State of SaaS Metrics report — linked in the comments.

#CACPayback #MagicNumber #GoToMarket #B2BSaaS #SaaSReport #PublicSaaS #Applovin #Atlassian #Rubrik #SentinelOne #Confluent #Asana #GrowthStrategy

Check out the Q4 State of SaaS Metrics report — linked in the comments.

#CACPayback #MagicNumber #GoToMarket #B2BSaaS #SaaSReport #PublicSaaS #Applovin #Atlassian #Rubrik #SentinelOne #Confluent #Asana #GrowthStrategy

April 17, 2025 at 11:15 PM

Everybody can reply

2 likes

Nutanix in Q2:

CAC payback: 142 months

12m view: 37 months

Gross margin: 87%

ARR growth: 19%

FCF margin: 32%

From heavy spenders to efficient operators - big SaaS turnaround.

Click here to watch the full episode - https://youtu.be/GjYmntSFqv4

#Nutanix #SaaS #CACpayback

CAC payback: 142 months

12m view: 37 months

Gross margin: 87%

ARR growth: 19%

FCF margin: 32%

From heavy spenders to efficient operators - big SaaS turnaround.

Click here to watch the full episode - https://youtu.be/GjYmntSFqv4

#Nutanix #SaaS #CACpayback

October 2, 2025 at 1:05 AM

Everybody can reply

3 likes

Workday just posted a 120-month CAC payback period in Q1.

Yep - you read that right.

This is just one of the topics we covered on the latest episode of The SaaS Report, now live!

https://youtu.be/kvbgqQSVdvw?si=kys8SnUMqURJZ9Mv

#SaaS #Workday #CAC #GTM #Startups #CACPayback #Sales

Yep - you read that right.

This is just one of the topics we covered on the latest episode of The SaaS Report, now live!

https://youtu.be/kvbgqQSVdvw?si=kys8SnUMqURJZ9Mv

#SaaS #Workday #CAC #GTM #Startups #CACPayback #Sales

June 1, 2025 at 5:01 AM

Everybody can reply

SaaS go-to-market efficiency is slipping fast.

Median CAC payback → 29mo (Q2 ‘23) → 35mo (Q2 ‘25)

Applovin + Palantir are outliers, but most SaaS names are spending more and growing slower.

Full breakdown here - https://youtu.be/Y4Jd6o-AGPQ

#CACpayback #SaaS #Applovin

Median CAC payback → 29mo (Q2 ‘23) → 35mo (Q2 ‘25)

Applovin + Palantir are outliers, but most SaaS names are spending more and growing slower.

Full breakdown here - https://youtu.be/Y4Jd6o-AGPQ

#CACpayback #SaaS #Applovin

November 6, 2025 at 4:02 AM

Everybody can reply

1 likes

Palantir’s CAC payback dropped from 27 → 12 months.

Control group hit 110 months before recovering.

Most SaaS: less efficient as they grow.

Palantir: bucking the trend.

Watch the full story here - https://youtu.be/kKdAXeoRLCg

#SaaS #CACPayback #Palantir #GoToMarket

Control group hit 110 months before recovering.

Most SaaS: less efficient as they grow.

Palantir: bucking the trend.

Watch the full story here - https://youtu.be/kKdAXeoRLCg

#SaaS #CACPayback #Palantir #GoToMarket

August 9, 2025 at 5:01 AM

Everybody can reply

UiPath’s Q1 wasn’t pretty.

ARR growth down. CAC payback up to 96 months.

Almost every metric worsened YoY.

Watch the new episode here - https://youtu.be/JIJId3J6M1o?si=SGwNTFqSw7kX4z4q

#SaaS #UiPath #Startups #AI #Agentic #CACPayback #Earnings #Automation #EnterpriseTech #ARR

ARR growth down. CAC payback up to 96 months.

Almost every metric worsened YoY.

Watch the new episode here - https://youtu.be/JIJId3J6M1o?si=SGwNTFqSw7kX4z4q

#SaaS #UiPath #Startups #AI #Agentic #CACPayback #Earnings #Automation #EnterpriseTech #ARR

June 9, 2025 at 6:37 AM

Everybody can reply

2 likes

Median CAC payback in SaaS just hit 38 months.

That’s up 27% in 2 years.

It’s now way more expensive to generate new ARR - and it’s hitting everyone.

Chart below. Full breakdown on YouTube - https://youtu.be/RhrSOu-yiak

#saas #gtm #cacpayback #b2b

That’s up 27% in 2 years.

It’s now way more expensive to generate new ARR - and it’s hitting everyone.

Chart below. Full breakdown on YouTube - https://youtu.be/RhrSOu-yiak

#saas #gtm #cacpayback #b2b

July 1, 2025 at 11:01 PM

Everybody can reply

1 likes