Everyone tracks returns differently some by % gain, others by portfolio value or income flow.

At iOCharts, I focus on realized vs unrealized returns + allocation weight to see what’s really working.

How do you measure performance?

Everyone tracks returns differently some by % gain, others by portfolio value or income flow.

At iOCharts, I focus on realized vs unrealized returns + allocation weight to see what’s really working.

How do you measure performance?

Tech and crypto leading again while energy lags.

Mixed earnings, steady sentiment.

Where are you leaning, offense or defense?

Get your iOCharts portfolio ready for Monday’s open.

Tech and crypto leading again while energy lags.

Mixed earnings, steady sentiment.

Where are you leaning, offense or defense?

Get your iOCharts portfolio ready for Monday’s open.

Nikkei 225 +4.26% after Takaichi’s win, first female PM incoming.

💴 Yen breaks 150

🏭 Tech, real estate & industrials lead

📈 $YASKY +20% $JPSWY +14% $7011.T +13%

Policy: “High-pressure economy” = more investment & BOJ support.

Track Japan movers on iOCharts.

Nikkei 225 +4.26% after Takaichi’s win, first female PM incoming.

💴 Yen breaks 150

🏭 Tech, real estate & industrials lead

📈 $YASKY +20% $JPSWY +14% $7011.T +13%

Policy: “High-pressure economy” = more investment & BOJ support.

Track Japan movers on iOCharts.

FinTech: $HOOD $IBKR $PYPL

Semis: $SNDK $NVTS $WDC $STX $MU

Crypto: $BKKT $MARA $CLSK $RIOT $GLXY $CIFR $WULF $COIN

Autonomy/EV: $BLNK $INVZ $PONY $LYFT

Health/Bio: $GRAL $QURE $EDIT

💡 Build & track your own portfolio on iOCharts.

FinTech: $HOOD $IBKR $PYPL

Semis: $SNDK $NVTS $WDC $STX $MU

Crypto: $BKKT $MARA $CLSK $RIOT $GLXY $CIFR $WULF $COIN

Autonomy/EV: $BLNK $INVZ $PONY $LYFT

Health/Bio: $GRAL $QURE $EDIT

💡 Build & track your own portfolio on iOCharts.

$AAPL +2.25% (top mover)

$TSM 1.57% (highest yield)

$MSFT 19 yrs (longest growth)

The iOCharts Dividend Screener lets you track:

- Dividend yield

- Growth streaks

- Free cash flow payout

- Market caps & sectors

👉 Smarter way to spot income + growth opportunities.

$AAPL +2.25% (top mover)

$TSM 1.57% (highest yield)

$MSFT 19 yrs (longest growth)

The iOCharts Dividend Screener lets you track:

- Dividend yield

- Growth streaks

- Free cash flow payout

- Market caps & sectors

👉 Smarter way to spot income + growth opportunities.

Charts beyond price:

- 20 years of revenue + free cash flow

- Dividend payout ratios

- Growth trends per company

Finally, a tool that treats fundamentals as seriously as traders treat hype.

Explore your companies inside iOCharts.

Charts beyond price:

- 20 years of revenue + free cash flow

- Dividend payout ratios

- Growth trends per company

Finally, a tool that treats fundamentals as seriously as traders treat hype.

Explore your companies inside iOCharts.

💻 Tech: $MSFT, $NVDA, $AAPL

🛡️ Defense: $LMT, $GE, $NOC

💊 Healthcare: $NVO, $PFE, $HCA

🌱 Renewables: $ENPH, $NEE, $RUN

📦 Consumer: $AMZN, $LULU, $WMT

🌊 Sector rotations = opportunity.

👉 Which sector are you overweight in your iOCharts portfolio?

💻 Tech: $MSFT, $NVDA, $AAPL

🛡️ Defense: $LMT, $GE, $NOC

💊 Healthcare: $NVO, $PFE, $HCA

🌱 Renewables: $ENPH, $NEE, $RUN

📦 Consumer: $AMZN, $LULU, $WMT

🌊 Sector rotations = opportunity.

👉 Which sector are you overweight in your iOCharts portfolio?

iOCharts breaks down:

Dividend yield

Payout ratios

Sector weightings

So you can see not just price, but cash flow.

Which matters more to you, growth or yield?

iOCharts breaks down:

Dividend yield

Payout ratios

Sector weightings

So you can see not just price, but cash flow.

Which matters more to you, growth or yield?

$MSFT 509.90 | $AAPL 234.07 | $NVDA 177.82 | $AMZN 230.33

$GOOG 241.38 | $GOOGL 240.80 | $META 755.59

$TSLA 395.94 | $AVGO 359.87 | $TSM 259.33

AI chips to cloud giants — the trillion-dollar club keeps shifting.

👉 Which would you add to your iOCharts portfolio?

$MSFT 509.90 | $AAPL 234.07 | $NVDA 177.82 | $AMZN 230.33

$GOOG 241.38 | $GOOGL 240.80 | $META 755.59

$TSLA 395.94 | $AVGO 359.87 | $TSM 259.33

AI chips to cloud giants — the trillion-dollar club keeps shifting.

👉 Which would you add to your iOCharts portfolio?

$MSFT — 19 yrs div growth | $3.55T

$NVDA — AI giant | $3.51T

$AAPL — +2.25% today | $2.98T

$TSM — 1.57% yield | cheapest P/E

$TSLA — $1.04T | pure growth

$GOOGL / $GOOG — $900B+ each

👉 Track your tech heavyweights in iOCharts portfolio.

$MSFT — 19 yrs div growth | $3.55T

$NVDA — AI giant | $3.51T

$AAPL — +2.25% today | $2.98T

$TSM — 1.57% yield | cheapest P/E

$TSLA — $1.04T | pure growth

$GOOGL / $GOOG — $900B+ each

👉 Track your tech heavyweights in iOCharts portfolio.

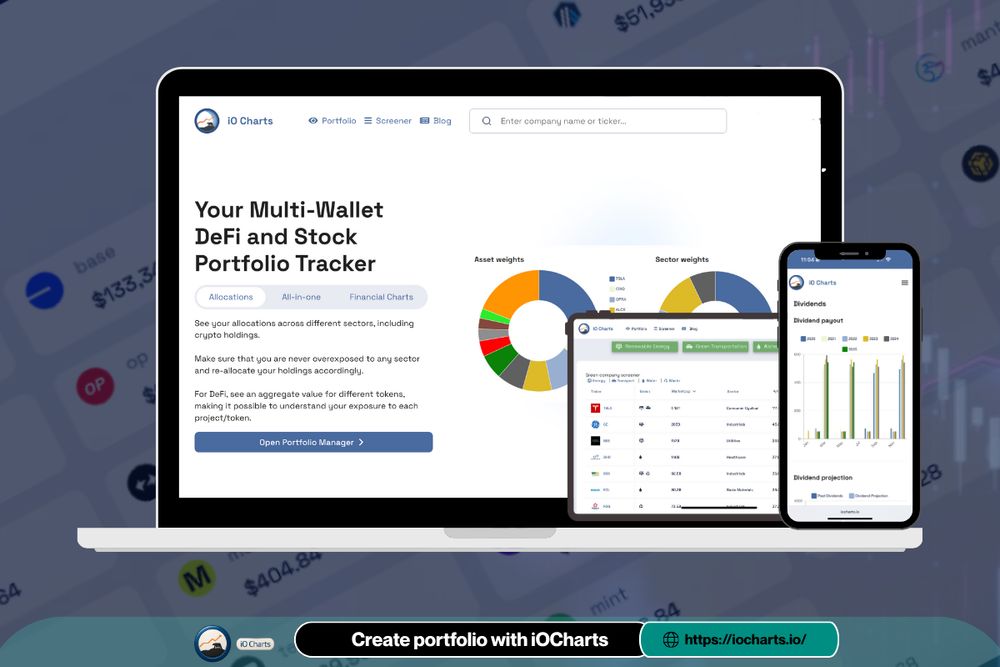

- Track crypto + stocks

- See USD value & performance

- Screen by growth, value, or dividends

- Spot macro impacts (CPI, Fed, etc.)

Stop juggling apps. See the big picture in seconds.

👉 Build your iOCharts portfolio today.

- Track crypto + stocks

- See USD value & performance

- Screen by growth, value, or dividends

- Spot macro impacts (CPI, Fed, etc.)

Stop juggling apps. See the big picture in seconds.

👉 Build your iOCharts portfolio today.

The AI factory powering $NVDA, $AAPL, $AVGO, $AMD.

👉 Build your iOCharts portfolio with $TSM + the chip giants it supplies.

The AI factory powering $NVDA, $AAPL, $AVGO, $AMD.

👉 Build your iOCharts portfolio with $TSM + the chip giants it supplies.

📈 Up +252% in 1 year.

Riding the AI + data center wave with high-speed connectivity tech.

A quiet semi name turning into a big winner.

Add $CRDO to your iOCharts portfolio and see how it stacks against $NVDA + $AMD.

📈 Up +252% in 1 year.

Riding the AI + data center wave with high-speed connectivity tech.

A quiet semi name turning into a big winner.

Add $CRDO to your iOCharts portfolio and see how it stacks against $NVDA + $AMD.

$AAPL → $110B

$GOOGL → $70B

$NVDA → $60B

That’s $1T+ fueling markets. 🚀 or 🛡️?

👉 See how buyback-heavy stocks rank in your iOCharts portfolio.

Clarity > noise.

$AAPL → $110B

$GOOGL → $70B

$NVDA → $60B

That’s $1T+ fueling markets. 🚀 or 🛡️?

👉 See how buyback-heavy stocks rank in your iOCharts portfolio.

Clarity > noise.

Crypto wallets on one app.

Stocks in another.

Dividends in a forgotten sheet.

With iOCharts, everything is unified:

✅ Portfolio breakdowns

✅ Dividend insights

✅ Historical fundamentals

👉 Create your portfolio today and see the full picture.

Crypto wallets on one app.

Stocks in another.

Dividends in a forgotten sheet.

With iOCharts, everything is unified:

✅ Portfolio breakdowns

✅ Dividend insights

✅ Historical fundamentals

👉 Create your portfolio today and see the full picture.

$AAPL → $110B

$GOOGL → $70B

$NVDA → $60B

Nearly $1T fueling stocks this year.

Rocket fuel 🚀 or safety net 🛡️?

👉 Check buyback-heavy names in your iOCharts portfolio.

$AAPL → $110B

$GOOGL → $70B

$NVDA → $60B

Nearly $1T fueling stocks this year.

Rocket fuel 🚀 or safety net 🛡️?

👉 Check buyback-heavy names in your iOCharts portfolio.

$FFTY +1.7% (growth names)

$IGV +0.6% (software)

$SMH -1.1% (semis under pressure)

$XME +2.75% (metals)

$XLE +2.55% (energy)

$XHB -2.6% (homebuilders slump)

Money is rotating, are you?

Create your portfolio in iOCharts today & track sector shifts.

$FFTY +1.7% (growth names)

$IGV +0.6% (software)

$SMH -1.1% (semis under pressure)

$XME +2.75% (metals)

$XLE +2.55% (energy)

$XHB -2.6% (homebuilders slump)

Money is rotating, are you?

Create your portfolio in iOCharts today & track sector shifts.

🚀 $PLTR +108% YTD

⚡ $WW swings hard

📉 $BINI –18% in a day

👉 iOCharts shows both rockets & wipeouts.

Momentum or defense, what’s your move?

🚀 $PLTR +108% YTD

⚡ $WW swings hard

📉 $BINI –18% in a day

👉 iOCharts shows both rockets & wipeouts.

Momentum or defense, what’s your move?

💻 Tech → $NVDA | $MSFT | $AAPL

🛡️ Defense → $LMT | $GE | $NOC

💊 Healthcare → $HCA | $UHS | $DIVISLAB

🌱 Renewables → $DNNGY | $NEE | $GE

👉 Track your pick in iOCharts.

💻 Tech → $NVDA | $MSFT | $AAPL

🛡️ Defense → $LMT | $GE | $NOC

💊 Healthcare → $HCA | $UHS | $DIVISLAB

🌱 Renewables → $DNNGY | $NEE | $GE

👉 Track your pick in iOCharts.

Tech cools, but defense & aviation climb:

• $LMT +22% YTD

• $NOC +18%

• $GE +59% (90d)

• $ACHR emerging outlier

Budgets + aviation demand = strong tailwind.

👉 Track $LMT, $NOC, $GE, $ACHR in iOCharts.

Is defense the next hidden bull market?

Tech cools, but defense & aviation climb:

• $LMT +22% YTD

• $NOC +18%

• $GE +59% (90d)

• $ACHR emerging outlier

Budgets + aviation demand = strong tailwind.

👉 Track $LMT, $NOC, $GE, $ACHR in iOCharts.

Is defense the next hidden bull market?

Cohance Lifesciences popped +5.5% after a Jefferies Buy call with ~30% upside.

Divi’s Labs $DIVISLAB + SAI Life Sciences are climbing too.

While AI hype dominates the West, India’s biotech is quietly breaking out.

Track $COH + healthcare on iOCharts

Cohance Lifesciences popped +5.5% after a Jefferies Buy call with ~30% upside.

Divi’s Labs $DIVISLAB + SAI Life Sciences are climbing too.

While AI hype dominates the West, India’s biotech is quietly breaking out.

Track $COH + healthcare on iOCharts

$WIF up +400% since June

$FET doubled with AI hype

$PEPE retraced -65% in a month

👉 Use iOCharts to track your P&L across all coins.

Are you holding through the volatility or rotating fast?

$WIF up +400% since June

$FET doubled with AI hype

$PEPE retraced -65% in a month

👉 Use iOCharts to track your P&L across all coins.

Are you holding through the volatility or rotating fast?

Breakouts

$WW → $31.89

$GWAV → $6.80

$ATNFW → $0.43

$BINI → $0.262

Mega-Caps Holding Strong

$PLTR → $156.71

$GE → $275.20

$UBER → $93.75

$BABA → $135.00

Build your portfolio now on iOCharts

Which one would you add first?

Breakouts

$WW → $31.89

$GWAV → $6.80

$ATNFW → $0.43

$BINI → $0.262

Mega-Caps Holding Strong

$PLTR → $156.71

$GE → $275.20

$UBER → $93.75

$BABA → $135.00

Build your portfolio now on iOCharts

Which one would you add first?

• Started investing at 11

• Built most wealth after 50

• $350B cash at Berkshire

• Billions in $KO, 5 cans a day

• Edge: patience & discipline

“Money moves from the Active to the Patient.”

👉 Build & track your long-term portfolio in iOCharts.

• Started investing at 11

• Built most wealth after 50

• $350B cash at Berkshire

• Billions in $KO, 5 cans a day

• Edge: patience & discipline

“Money moves from the Active to the Patient.”

👉 Build & track your long-term portfolio in iOCharts.

👉 With iOCharts, you:

Add assets

Track P&L

See allocations

Check valuation

All in one clean dashboard.

Don’t just watch the market , own your portfolio with iOCharts today.

Have you built your iOCharts portfolio yet?

👉 With iOCharts, you:

Add assets

Track P&L

See allocations

Check valuation

All in one clean dashboard.

Don’t just watch the market , own your portfolio with iOCharts today.

Have you built your iOCharts portfolio yet?