From August, Provost, The Queen’s College, Oxford. Previously director, Institute for Fiscal Studies. Author “Follow the Money”

Paul Gavin Johnson is a British economist. Since 2025, he has been the provost of The Queen's College, Oxford. He served as director of the Institute for Fiscal Studies from 2011 until 2025. He is also a columnist for The Times, and a visiting professor in Economics at the Department of Economics, University College London. He is author of the best selling book Follow the Money and a frequent contributor to written and broadcast media. .. more

Reposted by Paul Johnson

In 2021–22, just 8% were higher-rate tax payers.

This is a really fundamental shift in the structure of the tax system.

Reposted by Paul Johnson

In 2021–22, just 8% were higher-rate tax payers.

Reposted by Paul Johnson

Reposted by Paul Johnson

Reposted by Paul Johnson, Paul Nightingale

Reposted by Paul Johnson

(£) www.thetimes.com/business-mon...

By @pjtheeconomist.bsky.social

Reposted by Paul Johnson

✍️ @pjtheeconomist.bsky.social gives his two pence on the government's growth problem

Reposted by Paul Johnson

✍️ @pjtheeconomist.bsky.social argues the solution to the UK's fiscal problems is political not technocratic

ukandeu.ac.uk/what-can-rac...

Reposted by Paul Johnson

Reposted by Paul Johnson

Here's @instituteforgovernment.org.uk take on lessons this Pensions Commission should learn from its predecessor www.instituteforgovernment.org.uk/comment/new-...

Reposted by Paul Johnson

@pjtheeconomist.bsky.social, Stuart Adam and Tim Leunig discuss how certain taxes impact the housing market, affecting affordability, renting, and homeownership.

🎧 Listen here: ifs.org.uk/articles/how...

Reposted by Paul Johnson, Melinda Mills

With birth rates at record lows @pjtheeconomist.bsky.social, @melindacmills.bsky.social and Carl Emmerson discuss the implications for the UK and how it might impact the public finances.

🎧 Listen here: https://buff.ly/3YD8S1P

Reposted by Paul Johnson

Reposted by Paul Johnson

Reposted by Paul Johnson

Reposted by Paul Johnson

Reposted by Paul Johnson

@beeboileau.bsky.social, @maxwarner.bsky.social and @benzaranko.bsky.social's new interactive tool allows you to explore where and how the government spends money, over time and across the UK.

📊 Explore the data: ifs.org.uk/calculators/...

Reposted by Paul Johnson

60 years after its introduction, @pjtheeconomist.bsky.social

is joined by @helenmiller.bsky.social and Deloitte UK's Amanda Tickel to discuss all things corporation tax in our latest podcast.

🎧 Listen here: ifs.org.uk/articles/wha...

Reposted by Paul Johnson

Read @pjtheeconomist.bsky.social's column in @thetimes.com 👇

www.thetimes.com/business-mon...

Reposted by Paul Johnson

@pjtheeconomist.bsky.social summarises what we heard in today's #SpendingReview and what the announcements mean:

Reposted by Paul Johnson

Reposted by Paul Johnson

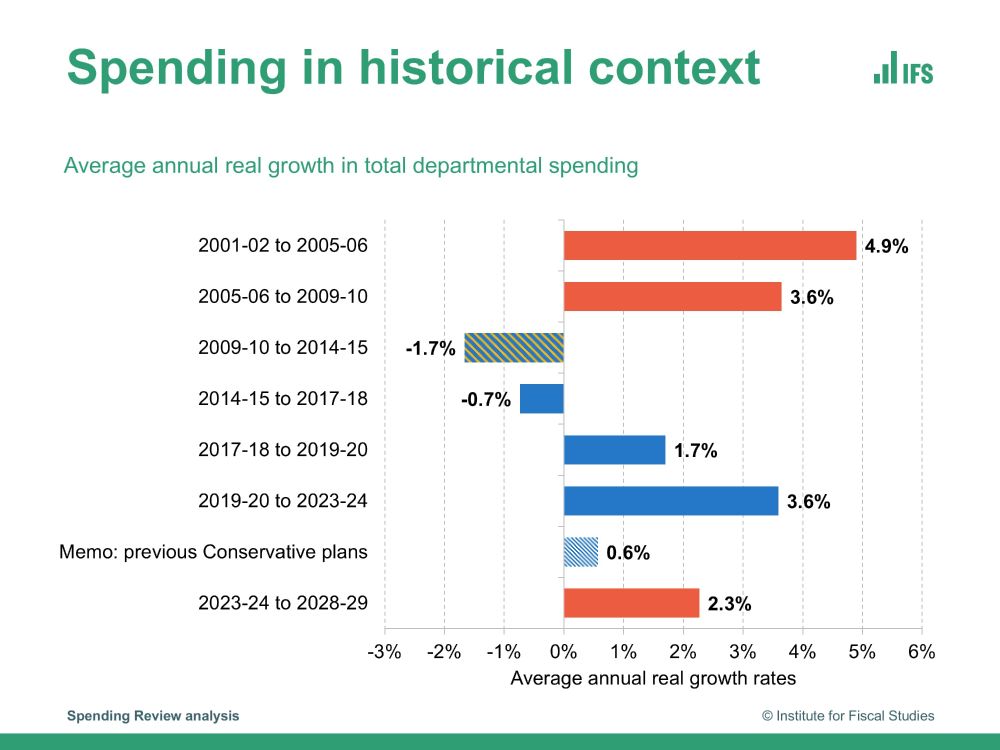

This is below the previous parliament’s average of 3.6%, but higher than the last government had outlined.

@beeboileau.bsky.social on the big picture choices in the Spending Review:

Reposted by Paul Johnson

Read @ckfarquharson.bsky.social’s briefing on what the Spending Review means for childcare entitlements: ifs.org.uk/articles/pop...

Reposted by Paul Johnson

🎙️ @PJTheEconomist.bsky.social, @helenmiller.bsky.social and @benzaranko.bsky.social discuss what the Spending Review means for public services, government investment, and the broader economic outlook: ifs.org.uk/articles/spe...

Reposted by Paul Johnson

Reposted by Paul Johnson