www.fiscalpolicy.org

@zohrankmamdani.bsky.social admin's transition committee:

🏢 Executive Director Nathan Gusdorf on Government Operations

🏘️ Chief Economist Emily Eisner on Housing

🏥 Director of Health Policy Michael Kinnucan

on Health www.cbsnews.com/newyork/news...

@zohrankmamdani.bsky.social admin's transition committee:

🏢 Executive Director Nathan Gusdorf on Government Operations

🏘️ Chief Economist Emily Eisner on Housing

🏥 Director of Health Policy Michael Kinnucan

on Health www.cbsnews.com/newyork/news...

No.

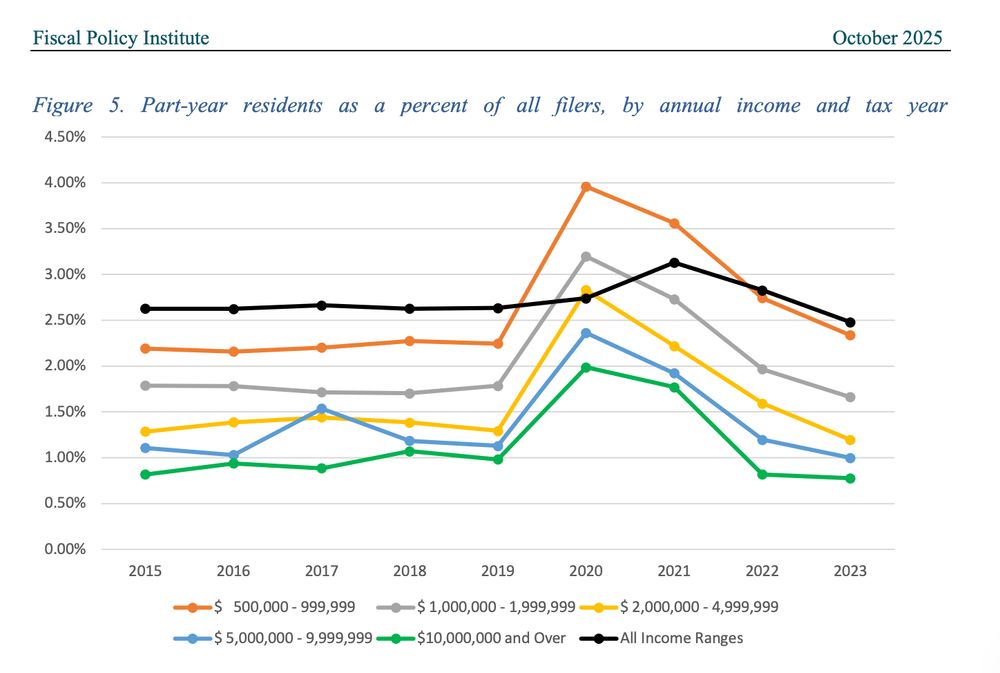

"There was no notable increase in out-migration among high earners following the State’s 2021 increases to the top Personal Income Tax rates. These higher tax rates raise approximately $3.6 billion annually"—

@nyfiscalpolicy.bsky.social

No.

"There was no notable increase in out-migration among high earners following the State’s 2021 increases to the top Personal Income Tax rates. These higher tax rates raise approximately $3.6 billion annually"—

@nyfiscalpolicy.bsky.social

However, on Saturday 3 million New Yorkers, including 1,000,000 children, who rely on SNAP for food security will lose $640M per month in benefits, triggering a hunger crisis in NY. 1/2

However, on Saturday 3 million New Yorkers, including 1,000,000 children, who rely on SNAP for food security will lose $640M per month in benefits, triggering a hunger crisis in NY. 1/2

@cvhaction.bsky.social for a powerful panel on the impact of the federal healthcare cuts.

@cvhaction.bsky.social for a powerful panel on the impact of the federal healthcare cuts.

No, absolutely not, says a new study.

And other links to start your day!

hellgatenyc.com/the-myth-of-...

Analysis of new tax data shows that the 2021 tax increases on high earners raise an estimated $3.6 billion annually, boosting state revenue without triggering increased out-migration among high earners.

fiscalpolicy.org/new-tax-data...

Analysis of new tax data shows that the 2021 tax increases on high earners raise an estimated $3.6 billion annually, boosting state revenue without triggering increased out-migration among high earners.

fiscalpolicy.org/new-tax-data...

www.nytimes.com/2025/09/09/b...

Key points: 1) the cuts amount to over $20bn annually by 2030, 2) 1.5 million NYers will lose healthcare, 3) FPI advises a special session to remedy (1) and (2).

Key points: 1) the cuts amount to over $20bn annually by 2030, 2) 1.5 million NYers will lose healthcare, 3) FPI advises a special session to remedy (1) and (2).

Report 1: fiscalpolicy.org/the-state-is...

Report 2: fiscalpolicy.org/making-sense...

Report 1: fiscalpolicy.org/the-state-is...

Report 2: fiscalpolicy.org/making-sense...

Key points: 1) the cuts amount to over $20bn annually by 2030, 2) 1.5 million NYers will lose healthcare, 3) FPI advises a special session to remedy (1) and (2).

Key points: 1) the cuts amount to over $20bn annually by 2030, 2) 1.5 million NYers will lose healthcare, 3) FPI advises a special session to remedy (1) and (2).

fiscalpolicy.org/new-york-emp...

fiscalpolicy.org/new-york-emp...

us06web.zoom.us/webinar/regi...

us06web.zoom.us/webinar/regi...

Please join if you're interested!

us06web.zoom.us/webinar/regi...

Please join if you're interested!

us06web.zoom.us/webinar/regi...

"Albany Must Prep for Federal Cuts"

NY policymakers must reject tax cuts and the irresponsible "inflation refund" and instead invest in real affordability for New Yorkers.

"Albany Must Prep for Federal Cuts"

NY policymakers must reject tax cuts and the irresponsible "inflation refund" and instead invest in real affordability for New Yorkers.

"Albany Must Prep for Federal Cuts"

NY policymakers must reject tax cuts and the irresponsible "inflation refund" and instead invest in real affordability for New Yorkers.

"Albany Must Prep for Federal Cuts"

NY policymakers must reject tax cuts and the irresponsible "inflation refund" and instead invest in real affordability for New Yorkers.

Cites to FPI's proposal for UI reform in NY.

www.timesunion.com/opinion/arti...

Cites to FPI's proposal for UI reform in NY.

www.timesunion.com/opinion/arti...

We expect to hold these updates on a bi-weekly basis.

Primarily for policymakers, advocates, and labor leaders in New York

Register at the link:

us06web.zoom.us/webinar/regi...

We expect to hold these updates on a bi-weekly basis.

Primarily for policymakers, advocates, and labor leaders in New York

Register at the link:

us06web.zoom.us/webinar/regi...

We expect to hold these updates on a bi-weekly basis.

Primarily for policymakers, advocates, and labor leaders in New York

Register at the link:

us06web.zoom.us/webinar/regi...