Email: [email protected]

Signal: @bencasselman.96

📸: Earl Wilson/NYT

Without CPI value, regulations for TIPS call for a synthetic number “based on last available 12-mo change in CPI”

www.bloomberg.com/news/article...

Without CPI value, regulations for TIPS call for a synthetic number “based on last available 12-mo change in CPI”

www.bloomberg.com/news/article...

www.bls.gov/bls/2025-lap...

www.bls.gov/bls/2025-lap...

www.bls.gov/bls/2025-lap...

#NumbersDay

#NumbersDay

"Effective with the release of January 2026 data, the establishment survey will change the birth-death model by incorporating current sample information each month." #NumbersDay

U.S. employers added 119,000 jobs in September and the unemployment rate ticked up to 4.4 percent.

Data: www.bls.gov/news.release...

Live coverage: www.nytimes.com/live/2025/bu...

#NumbersDay

"Effective with the release of January 2026 data, the establishment survey will change the birth-death model by incorporating current sample information each month." #NumbersDay

U.S. employers added 119,000 jobs in September and the unemployment rate ticked up to 4.4 percent.

Data: www.bls.gov/news.release...

Live coverage: www.nytimes.com/live/2025/bu...

#NumbersDay

U.S. employers added 119,000 jobs in September and the unemployment rate ticked up to 4.4 percent.

Data: www.bls.gov/news.release...

Live coverage: www.nytimes.com/live/2025/bu...

#NumbersDay

New disclosures show trades in individual stocks, like Apple, Southwest Airlines and Cava, many of which took place during the blackout period ahead of policy votes www.nytimes.com/2025/11/15/b...

New disclosures show trades in individual stocks, like Apple, Southwest Airlines and Cava, many of which took place during the blackout period ahead of policy votes www.nytimes.com/2025/11/15/b...

What we know (and mostly don't) about when the data flow will resume, what we'll never get, and what the lasting damage could be:

www.nytimes.com/2025/11/14/b... #EconSky

What we know (and mostly don't) about when the data flow will resume, what we'll never get, and what the lasting damage could be:

www.nytimes.com/2025/11/14/b... #EconSky

Details: events.georgetown.edu/event/35638-...

Details: events.georgetown.edu/event/35638-...

Details: events.georgetown.edu/event/35638-...

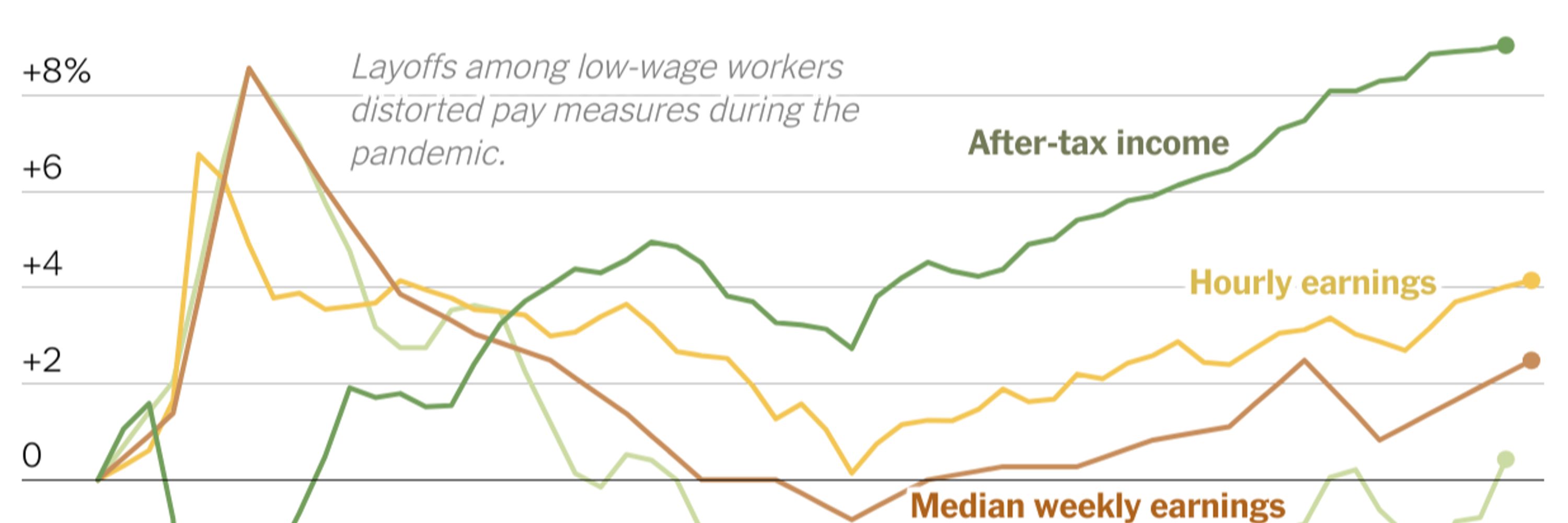

So, what are those sources telling us? A 🧵:

So, what are those sources telling us? A 🧵:

www.nytimes.com/2025/11/01/u...

www.nytimes.com/2025/11/01/u...

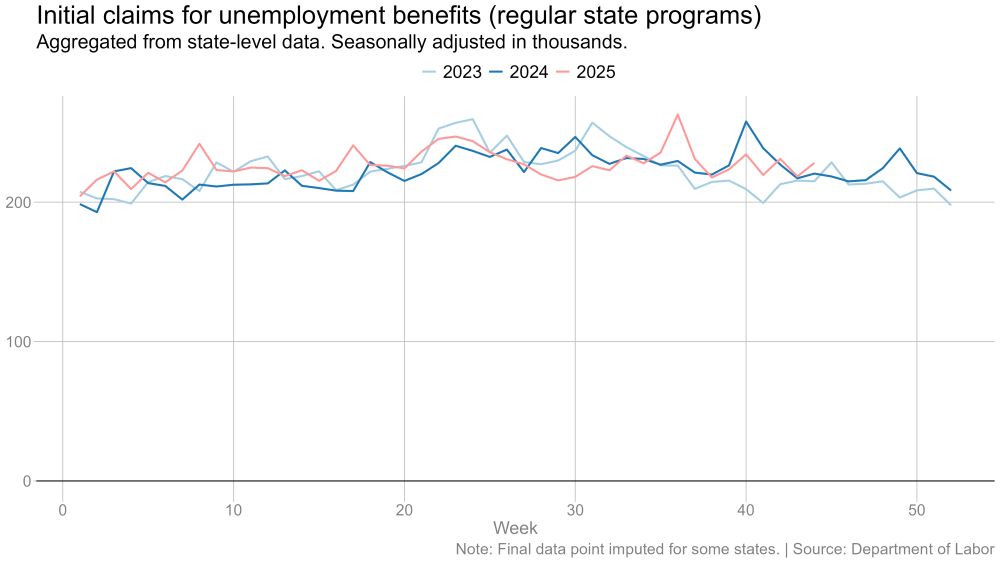

1/ High profile mass layoffs have been the “kid who cried wolf” for the last few years.

Maybe this is changing but we don’t see it, yet, in the data.

1/ High profile mass layoffs have been the “kid who cried wolf” for the last few years.

Maybe this is changing but we don’t see it, yet, in the data.

Statement: www.federalreserve.gov/newsevents/p...

Full coverage: www.nytimes.com/live/2025/10...